Weekly Editors Picksは、Odaily Planet Dailyの機能的なコラムです。Planet Dailyは毎週大量のリアルタイム情報をカバーするだけでなく、高品質の詳細な分析コンテンツも多数公開していますが、情報の流れやホットなニュースに埋もれて、見逃してしまう可能性があります。

そのため、毎週土曜日、私たちの編集部は過去7日間に公開されたコンテンツの中から、時間をかけて読んで収集する価値のある高品質の記事をいくつか選択し、あなたに新しいインスピレーションをもたらします。 暗号 データ分析、業界判断、意見出力の観点から世界を分析します。

さあ、私たちと一緒に読んでください:

投資と起業

A look at crypto VC investing: Who’s performing best?

a16z: How many of the 220 million active addresses are real crypto users?

According to an analysis conducted by a16z using multiple methods, there are currently an estimated 30 to 60 million real monthly active crypto users.

Rather than focusing on active addresses to study blockchain activity, it is better to look at the network fee metric. Fees reflect the total gas consumption of using the protocol, without taking into account the issue of quality users.

Given that users on the PoS chain can also easily receive token issuance rewards, an alternative metric, Real Economic Value (REV), can also be used. REV combines network fees and MEV tips to validators, but does not consider token issuance as a cost. REV is arguably a better metric for assessing real demand for the network and a more comparable revenue metric to traditional finance (TradFi).

ビットコインETFオプションが承認され、ビットコインは爆発的な成長を遂げるでしょうか?

Although there are many crypto options products on the market, most of them lack supervision, which makes institutional investors reluctant to participate due to compliance requirements. In addition, there are no options products that are both compliant and liquid in the market.

The most liquid options product is launched by Deribit, the worlds largest Bitcoin options exchange. Deribit supports 24/7/365 trading of Bitcoin and Ethereum options. Options are European-style and settled in physical underlying cryptocurrencies. However, due to the cryptocurrency-only nature, Deribit users cannot cross margin with assets in traditional portfolios such as ETFs and stocks. And it is not legal in many countries, including the United States.

Without the endorsement of a clearing house, it is impossible to solve the counterparty risk. The market demand for Bitcoin hedging transactions exists. What Bitcoin ETF options can provide the market is an option product that is both compliant and has trading depth.

Options expiration does affect market volatility.

Scam Sniffer charges cause controversy, how to balance the income of security tools?

The 0.25% fee charged by the Scam Sniffer plugin for specific DEX transactions is the same as the fee charged by the Uniswap front-end and does not tamper with user transactions.

However, the community still has obvious differences on Scam Sniffers sudden payment plan. Some users think that it would be better to change the charging model to a recharge method, and to deduct subscription fees based on the number of detections or dates, saying that Scam Sniffer is a security plug-in itself but makes users worry about security. Another user pointed out the monopoly problem behind the charging, believing that such an exaggerated rate can only be charged because of the monopoly position.

However, some users are not sensitive to the fees themselves, but are more concerned about the product improvements and long-term benefits that payment can bring. When issuing coins is no longer the only business model, the projects ability to generate revenue becomes particularly important. Many products that already have PMF have also begun to think about their own monetization paths, and the field of crypto security is one of them.

At present, the security services on the C-end are still fragmented, and users need to integrate different security tools. This fragmentation leads to inconsistent user experience between different services and high integration costs. In the future, security services will be horizontally expanded and unified into an integrated solution. Enterprises only need to refer to this layer of security services to handle all security issues, so as to focus on their core business without having to solve the security needs of users separately.

暗号通貨創業者のための20の教訓: スケールしないことをやれ

Instead of aiming for a massive market from the start, focus on solving a small, specific problem. Starting small allows you to gain a deep understanding of user needs and optimize your product without the noise and complexity of a larger market. Validate your core assumptions with a minimum viable product before investing significant resources, such as money and time. Rapid deployment in 30 days will force you to prioritize core features and avoid the trap of over-planning. Optimize, grow, hone your business model, keep engaging, and keep your team lean.

ミーム

ミームトレーニングマニュアル:再生:ダイヤモンドハンドになりたい(パート2) | 制作:Nanzhi

Ten times in ten days, all thanks to critical hits. Semicolon follow-up and limit the upper limit of single account positions are very necessary. Dont take the initiative to stop profit, stick to diamond hands.

こちらもおすすめ: GOAT、MEMEのスマートマネー購入アドレスの解釈は運よりも取引戦略が重要 a16z talks about GOAT: How did the AI we funded become a multi-millionaire with $50,000?

さまざまなチェーンが「pump.fun」を競う中、Memecoinはピークに達しようとしているのでしょうか?

The rush of various chains to get on pump.fun is just a top signal of the hot-plate gameplay of pump.fun, not even a top signal of the hot plate or even the meme coin itself. Just like after the end of the inscription bull market, the top inscription assets such as ORDI still have a reasonable market value and liquidity, but the assets with inscription as the only consensus point, after the hot spot of its gameplay itself loses attention, there is no consensus to support the long-term value, so it is foreseeable that they will die.

Meme coins are actually the markets best response to VC value technology coins and correction of chaos – perhaps Crypto is not strong enough to become the second US stock. It has convinced people of our generation, but it still needs to attract and convince more young people. Use light-hearted and interesting content to update the publics serious impression of Crypto.

イーサリアム

大企業病、空虚な物語、市場は再びイーサリアムの下落を予測し始めているのでしょうか?

Ethereum is an experiment in Cryptos decentralized governance architecture. It is not controlled by any centralized company or organization. Project developers, researchers, node operators, ETH Holders, etc. from all over the world participate and contribute to it.

In terms of public chain technology, the security, stability, and engineering quality delivery results of Ethereum throughout the upgrade process were all within expectations. However, even if the Cancun upgrade was successful, it did not bring the expected prosperity of Layer 2. Ideally, 10,000 Layer 2 chains would be launched simultaneously, and the user ecosystem would achieve exponential breakthroughs. Ethereum could also achieve deflation by taxation and Gas Burn. But the fact is that the threshold for launching chains has been lowered, the RaaS narrative has also fermented, and the ideal Mass Adoption is still a long way off. To be honest, this has exceeded the constraints of Ethereums pure technical framework.

Narrative is an evolved development context and a derivative product of business thinking superimposed on technology.

マルチエコロジー

大手取引プラットフォームがSOL流動性担保ソリューションを開始し、市場の賢い資金がその選択をしました

In October 2024, leading trading platforms such as Binance, Bybit and Bitget announced the launch of their own SOL liquidity staking tokens, entering the Solana re-staking track.

Bitget is the investment category with the highest interest rate on the market. In terms of application scenarios, there is no big difference in the liquidity pledge tokens of major trading platforms.

DeFi

ArkStream Capital の調査レポート: PayFi が暗号通貨決済の新たな章を開く方法

-

The stablecoin market continues to grow, and crypto payments will not completely replace the traditional fiat currency system;

-

The real significance of PayFi is to promote the application and innovation of crypto assets in real-world scenarios;

-

Solana is not necessarily the only option in PayFi or crypto payment. Ton Network and Sui are likely to catch up with their respective advantages.

-

The PayFi track has huge room for future development. As a composite innovative application in multiple tracks, its potential market value may exceed 10 billion US dollars.

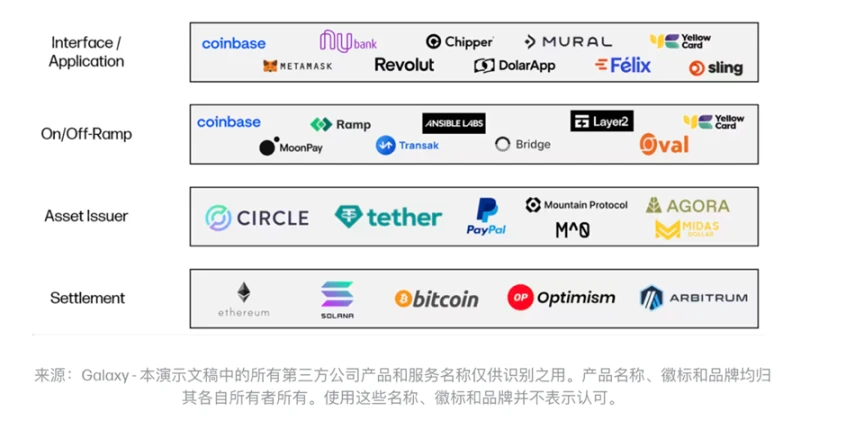

The four-layer architecture of cryptocurrency payments

ネイティブ暗号プロジェクト

PayFi is not an independent concept, but an innovative application that integrates Web3 payment, DeFi, and RWA. RWA tokenizes assets and puts them on the chain to achieve a 1:1 seamless transfer of value on the blockchain, and uses smart contracts to build transaction and settlement processes. DeFi focuses on the on-chain economy and innovating traditional financial products around decentralization. Whether it is automated market makers, flash loans, liquidity mining, etc., its mainstream purpose is trading. Web3 Payment focuses on using cryptocurrencies as payment transaction media, such as cross-border remittances, encrypted payment cards, etc. to improve the efficiency of traditional finance.

PayFi は次の 2 つのコアコンセプトに重点を置いています。 tokenization of real-world assets and releasing the time value of funds.

The projects in PayFi are divided into two application scenarios: cross-border trade and credit finance.

Stablecoin startups go their separate ways: TradFi or DeFi?

Stripe’s $1.1 billion acquisition of Bridge is the largest in cryptocurrency history. The stablecoin ecosystem is much larger than the more common players such as Circle (USDC) and Bitfinex (USDT).

Stripe just makes online payments possible. Bridge enables them to get rid of too many moving parts and integrate their payment process.

The author speculates that Stripes acquisition of Bridge has accelerated the stablecoin strategies of the crypto teams of these large traditional financial/fintech companies.

Web3 AI

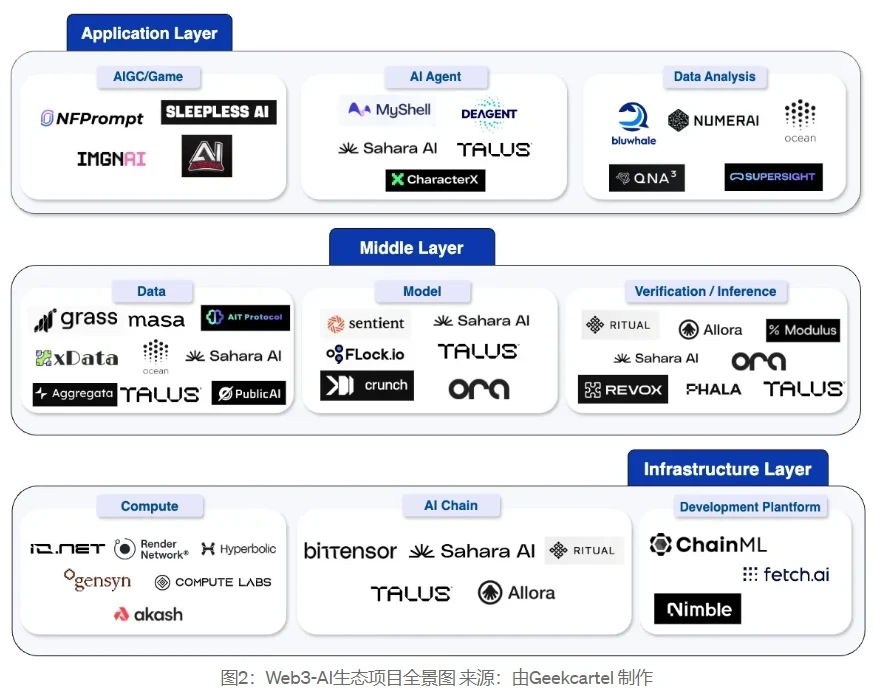

Web3-AIトラックのパノラマレポート:技術ロジック、シナリオアプリケーション、トッププロジェクトの詳細な分析

The article focuses on Sahara AI, an AI blockchain platform dedicated to the collaborative economy; Bittensor, which provides a highly competitive incentive structure for AI commodity producers; Talus, an on-chain AI agent ecosystem based on Move; ORA, an on-chain verifiable AI; Grass, the data layer for AI models; IO.NET, a decentralized computing resource platform; and MyShell, an AI agent platform that connects consumers and creators.

The challenges that need to be urgently addressed in the Web3×AI track include the balance of supply and demand of AI resources, data quality, security, and user experience.

今週のホットトピック

先週、 in terms of policy and macro markets, Elon Musk announced that he would randomly give out $1 million to American voters every day until Election Day;

In terms of opinions and opinions, Fed Governor Waller: DeFi may have a profound impact on financial market transactions ; Fed Schmid : Cryptocurrency is a risky asset, not a currency; Consensys wrote to the future US president , calling for clear supervision and cooperation; Vitalik published an article on the future development of the Ethereum protocol, スカージ , with the goal of minimizing the centralization risk of the Ethereum staking layer; Vitalik published ザ・ヴァージ on the future development of the Ethereum protocol, with the goal of achieving a stateless client; Truth Terminal founder: The 1.25 million GOATs held by individuals will not be sold for the time being , and will be kept in the AI wallet for the time being; Coinbase CEO interacted with Truth Terminal on the topic of encrypted wallets; BlackRock: Trying to trade the US election is stupid;

In terms of institutions, large companies and leading projects, クラーケン plans to launch its own blockchain next year; ポンプ.楽しい launched the advanced trading terminal pump advanced and revealed plans to issue coins in the future; ApeChain : launched the official cross-chain bridge and Top Trader to provide ApeCoin holders with an automatic income model ; スクロール opened airdrop applications;

In terms of data, on October 19, Bitcoins dominance exceeded 65% , the highest level in three years; Polymarkets trading volume in October has exceeded US$1.1 billion, setting a new record; on October 24, GOAT rose above 0.8 USDT, and its market value exceeded US$800 million;

On the security front, Arkham: US government addresses are suspected to have been stolen , with losses of $20 million; Trust Security: LayerZero has a vulnerability similar to Across Protocol… Well, its another week of ups and downs.

添付 ポータルです 「Weekly Editor's Picks」シリーズに登場。

また次回お会いしましょう〜

This article is sourced from the internet: Weekly Editors Picks (1019-1025)

Original | Odaily Planet Daily ( @OdailyChina ) Author锝淣an Zhi ( @Assassin_Malvo ) Yesterday, KDAO, the KRC 20 inscription with the largest total amount on the Kas chain, started minting. The degree of FOMO began to increase rapidly at noon. The total amount of the inscription reached 15 million, but it was still minted within one day. The network fee increased more than ten times during the FOMO period. According to the authors observation, except for a few inscriptions and runes on the Bitcoin mainnet, the inscription ecosystem of each chain is dead in the perception of most users. However, in fact, several inscriptions with a market value of tens of millions of dollars were born on Kas in September, and the market value of KDAO also exceeded tens of…