Original author: Aunt Ai (X: @ai_ 9684 xtpa )

I saw the news this morning that Wintermute becomes the third largest holder of $GOAT, holding 1% of the total supply of tokens. But just as airdropping tokens to Vitalik Buterin is a publicity stunt, airdropping tokens to market makers is nothing new.

So here comes the question:

– How to determine whether market makers are truly involved?

– Typical examples of market making

– Examples used only as promotional material

1/ Take GOAT as an example

1. Falsification: It is true that 10 million GOAT are held and the contract address is correct; do not underestimate this step, as many issuers promote market makers under the name of the same token.

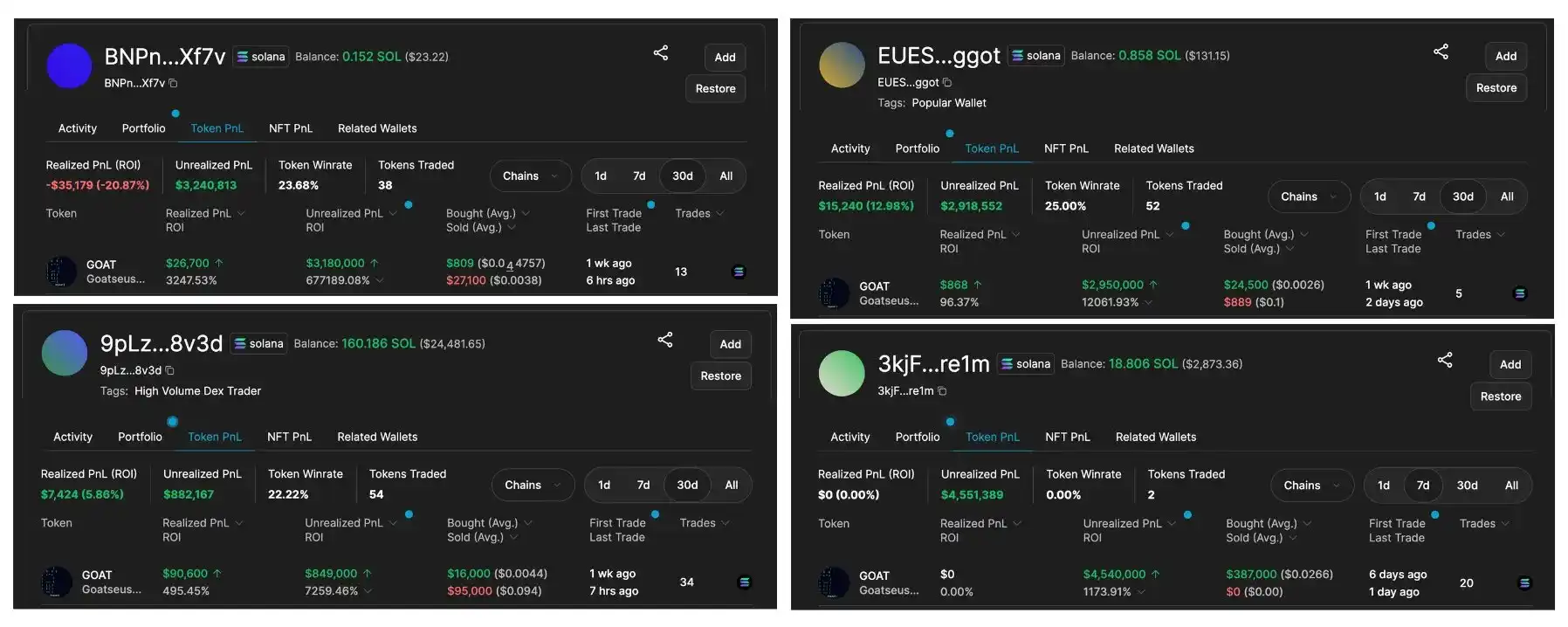

2. Identify the source of funds: Tracing back, it was found that four addresses transferred millions of tokens to 7 GNPT….snUM 1, and all of them were early-stage addresses with extremely high returns, with a cumulative profit of 11.63 million US dollars!

Four early entry addresses for depositing coins to Wintermute:

-

3kjF7ZXfMYo1dqxFNE7WVtQ38zZSciptu1deWYibre1m (the source buying address of CAnS 7…JZT 86)

-

BNPntzDuH7EofLrHGA7gjbeNvJQbEvvrGrCPCTCNXf7v

-

9pLzvD3s5g7nWbMbURPvYQgHp4piosoVLrxiEgr58v3d

-

EUES49UdAkevnREj5YShNXpWjX5DN44uCJQo7yfaggot

3. Check the market makers operation: After receiving the token, it did two things. First, it transferred 1 token to Wintermute 1 and immediately transferred it back. This is an obvious confirmation address action. Second, all tokens were distributed to the Wintermute 3 address after two transfers.

Seeing this, it is basically certain that Wintermute is actively participating in GOAT market making. As for whether it is OTC coin buying/instructed by the project party or a spontaneous behavior, it is unknown.

4. Stay tuned: Ultimately, it depends on whether Wintermute 3 frequently conducts GOAT transactions. If so, it can be confirmed.

2/ Typical examples of market making

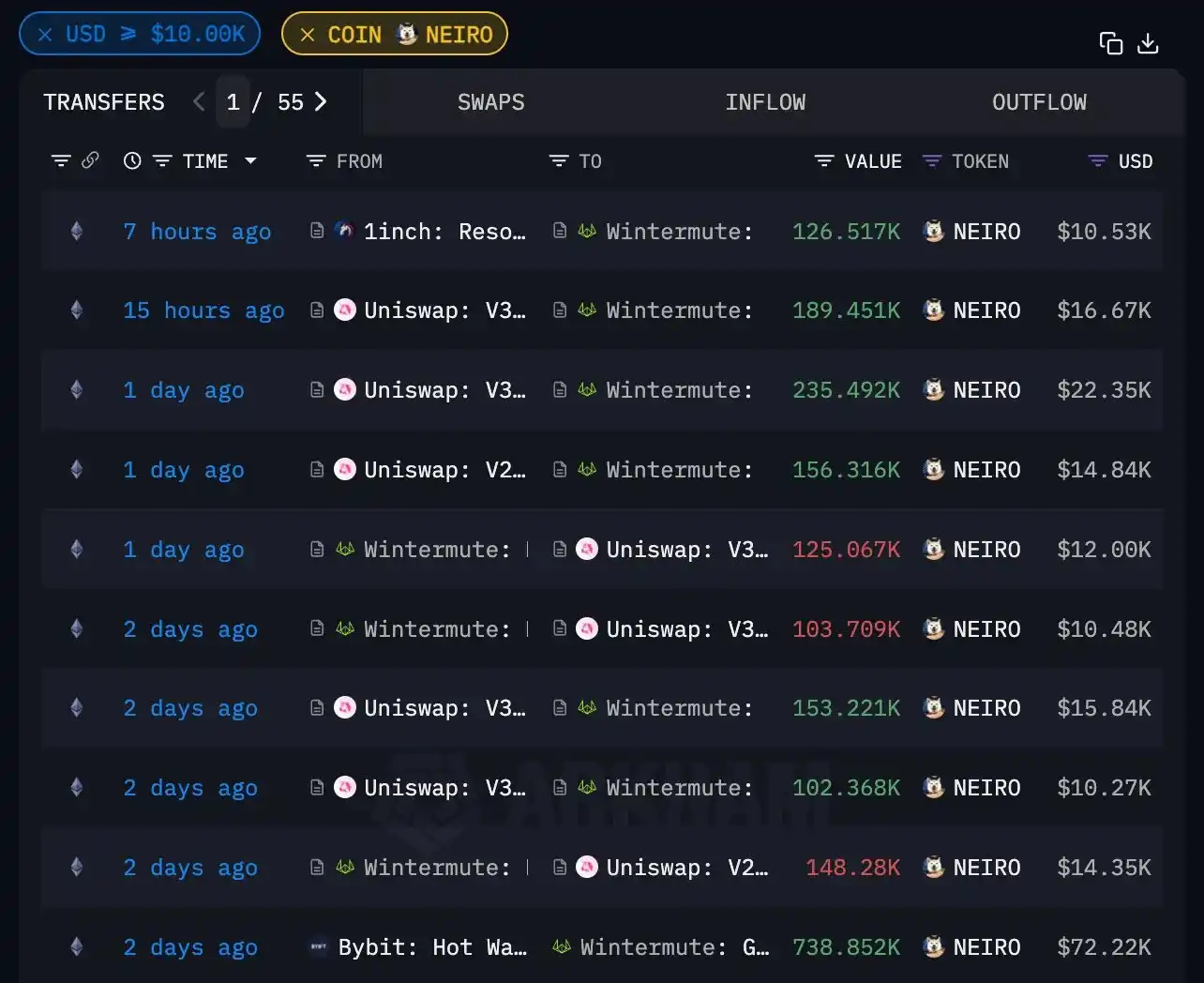

Wintermute participated in market making of capitalized $NEIRO: it once held 4.35% of the total supply of tokens and was once the largest holder. After receiving the tokens, it actively maintained frequent transactions with major exchanges and DEXs.

3/ Typical example of a product that is used only as a promotional tool

This type generally has several characteristics:

-

Direct airdrop by project owner/DEV

-

Usually airdropped to market makers and well-known founders in the 暗号currency circle, such as Vitalik Buterin and Sun Ge.

-

The market maker does not take any action after receiving it (V God may sell it directly)

-

The community has made a high-profile announcement that a certain institution has participated in market making

As for pulling down and stepping down, I won’t give actual examples here. You can check these characteristics yourself.

This article is sourced from the internet: If a market maker holds tokens, does that mean he is participating in market making?

関連: 成長主導型への回帰: VC コインはどのようにして物語のジレンマから逃れられるのか?

原作者:Loki、BeWater Venture Studio TL;DR VCコイン崩壊の本質は、このサイクル中の一次市場での過剰投資と不合理な評価であり、これにより、淘汰されるべきVCやプロジェクトが生き残り、資金を調達し、不合理な評価で二次市場に登場しました。外部からの現金流入がない中で、暗号市場の退化の度合いは極端なレベルにまで上昇し、ピラミッドのような階級構造を形成しています。各レベルの利益は、その下のレベルの搾取と市場からの流動性の撤退から生まれます。このプロセスは、次のレベルでの不信感の高まりにつながり、退化はますます深刻になります。VCに加えて、より上位のレベルが多数あります...