オリジナル | Odaily Planet Daily ( @OdailyChina )

著者锝淣an Zhi ( アサシン )

On September 30, crypto financial services platform Matrixport announced that it had acquired crypto asset management company Crypto Finance (Asset Management) AG (CFAM) from Deutsche B枚rse Group.

In the fifteenth year since the birth of Bitcoin and cryptocurrency, we have witnessed Bitcoin becoming the worlds eighth largest asset and the approval of the Bitcoin spot ETF. The trend of the crypto market moving towards popularization is unstoppable .

The traditional capital brought by the Bitcoin spot ETF and the third world users entering the market with the TON ecosystem all reflect that the penetration of the crypto industry has been raised to a new level. With the overflow of user groups and funds, it can be foreseen that various types of investment and financial management needs will usher in a new round of explosive growth with this wave .

On the other hand, governments have not fully accepted the encryption industry. Compliance has become a focus of attention in many countries . It is also a difficulty and strategic point in market competition. Therefore, leading institutions are competing for policy opportunities and market share in various regions.

As a licensed and compliant asset management company in Switzerland, the acquisition of CFAM marks Matrixports successful entry into the pan-European crypto asset management market. Matrixport will leverage CFAMs existing pan-European market access and sales network to provide comprehensive compliant crypto services to qualified institutional and individual investors, underwriters, and retail investors.

1. The Popularization of Cryptocurrency and the Rise of Asset Management Demand

BCG data shows that as of the end of 2023, the assets under management (AuM) of the global asset management industry reached approximately US$118.7 trillion, while the global stock market capitalization was US$115.0 trillion during the same period. This shows the high demand for asset management in traditional finance and its stable development.

-

市場 size and allocation ratio increased: The asset size of the crypto market has increased from $1 billion to the current $2 trillion in the past decade. Before the Bitcoin spot ETF was approved, the largest GBTC asset management scale was about $20 billion, and the asset management scales of other companies such as CoinShares, Bitwise, and 21 Shares ranged from hundreds of millions to billions of dollars. Although the Bitcoin spot ETF brought in $19.3 billion in net inflows, compared with the traditional market, there is still much room for improvement in the allocation scale .

-

Changes in asset attributes: As their size increases, the attributes of leading tokens such as Bitcoin and ETH have shifted from Alpha returns to Beta configurations, and characteristics such as anti-inflation and value storage have gradually become prominent and valued by people.

-

Demand overflow caused by the expansion of user groups: On the other hand, the number and structure of the user groups in the crypto market have also changed greatly. Traditional asset management giants such as BlackRock began to deploy on a large scale after the approval of the Bitcoin spot ETF, introducing a large number of US stock users, and a large number of users in the Asia-Pacific and African markets also rushed into the market with the rise of the TON ecosystem. The large-scale increase in the number of users has brought further demand for structured products.

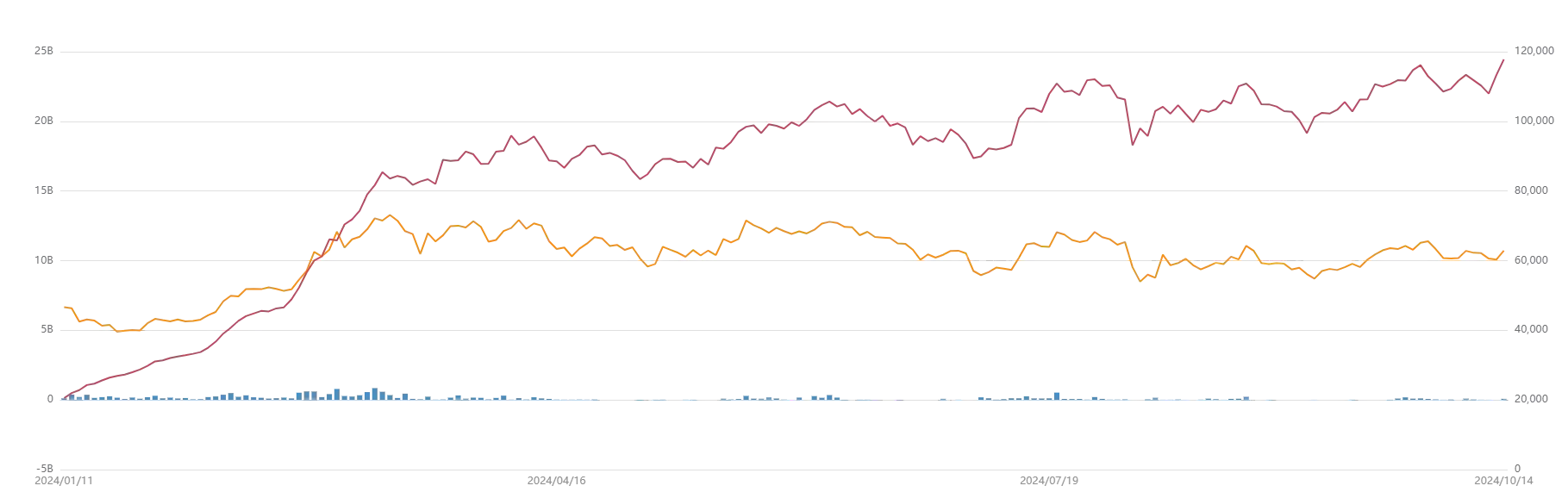

IBIT net assets (left axis), Bitcoin price (right axis)

Although the publics acceptance of cryptocurrencies has made a qualitative leap, there is still a key issue before achieving Massive Adoption – compliance . The US SEC has frequently accused multiple crypto protocols and companies of selling unregistered securities, and various exchanges have flocked to Dubai and Hong Kong to apply for licenses, all of which reflect the trend of compliance and its necessity.

Focusing on the pan-European region, the EU has passed and gradually launched the European Crypto-Asset Market Regulation (MiCA), which has deeply regulated operating licenses, reserves, and risk control. Due to the introduction of MiCA, Coinbase will remove non-compliant stablecoins such as USDT from the European Economic Area in December, Bybit will stop providing services in France 、 そして Binance will disable its copy trading services for European users . It can be seen that if compliance is not completed in time, it will be constrained everywhere . Mica will take full effect in December this year , and compliance is imminent for all units doing business in the relevant regions.

2. Acquisition of CFAM: Entering the Trillion-Dollar Pan-European Market

Leading licenses and external resources

The asset management company CFAM acquired by Matrixport this time was established in 2017. According to official FINMA data , only 31 units have been authorized as securities firms , and CFAM is one of them. CFAM is also the first crypto asset management company to obtain a license from the Swiss Financial Market Supervisory Authority (FINMA) , allowing it to sell crypto-related collective investment plans to qualified institutions and individual investors, underwriting institutions, retail investors, etc.

On January 1, 2020, Switzerland introduced the Financial Institutions Act (FinIA), requiring all asset management companies to obtain a FINMA license to conduct business. According to data disclosed by finalix , there are about 2,400 asset management companies in Switzerland, but only 250 were successfully approved one and a half years after the regulations came into effect, and only three years later, at the end of 2023, a total of 1,187 institutions were approved.

The licenses issued by FINMA to asset management institutions are divided into two categories, EAM License そして Collective Asset Manager License . The former is supervised by regulators outside FINMA, with relatively low process, reporting and audit requirements, and is mainly applicable to simple products . The license obtained by CFAM is the latter, which is directly supervised by FINMA and is the most comprehensive and stringent license for crypto asset management in the Swiss market . It has a wide range of product applications, including complex funds for institutional clients, thereby ensuring comprehensive compliance management of complex fund products.

In addition, CFAM is the first member of the Swiss Asset Management Association (AMAS) to focus on providing crypto asset management services . It also has in-depth cooperation with APEX Group, a financial service provider with an asset management scale of over US$1 trillion, and has the resources and capabilities to quickly create and publish crypto ETPs and AMCs. Among them, ETPs are cryptocurrency exchange-traded products, and AMCs are actively managed certificates, which are non-public excess return investment strategies issued by financial institutions.

ETP is a tool that tracks underlying securities, indices or other financial products. The most well-known subcategory is ETF. Using a shopping analogy, users can select apples, bananas and other fruits individually, or they can directly buy a mixed fruit basket, saving the trouble of selecting. ETF is like such a mixed fruit basket, giving users the ability to buy a basket of cryptocurrencies. For the crypto industry, the most critical feature of ETP is that it lowers the investment threshold for users and increases the potential market size by several orders of magnitude . Native cryptocurrency investment requires creating a crypto wallet, choosing a suitable exchange, and facing potential security risks, while ETP will exempt these problems. The Bitcoin spot ETF approved by the United States in January this year has a cumulative net inflow of US$19.36 billion そして a net asset value of US$61.89 billion, accounting for 4.7% of the total market value of Bitcoin . It can be seen that the ETP product has a wide range of applications and a large volume. The combination of Matrixports high-quality products and the vast pan-European market space is expected to bring a new growth curve for crypto assets.

Global Compliance Strategy

It is reported that Matrixport has obtained compliance licenses in multiple regions, including the Hong Kong Trust License and the US Money Services License. The acquisition of CFAM is an important step in Matrixports global compliance strategy . As the first crypto asset management company authorized by FINMA, the acquisition of CFAM marks Matrixports successful entry into the Swiss and European crypto asset management markets .

First of all, according to data disclosed by the Swiss government in 2021 , the total assets of Swiss pension funds reached 1.159 trillion Swiss francs (about 1.35 trillion US dollars) . With the FINMA license of CFAM, Matrixports products are expected to officially enter this market.

Furthermore, CFAM also has pan-European market access and a corresponding sales network . After the acquisition is completed, Matrixport will be able to provide comprehensive crypto asset management services to qualified institutions, individual investors and underwriting institutions in the relevant regions, and its ETP products can be sold by third parties, further expanding the scope of product promotion.

Resource integration, reaching a new peak

-

Product iteration : CFAM has expanded its product line (6+1 product line) in the past year, covering retail and qualified investors, including the first cryptocurrency mutual fund Crypto Market Index Fund regulated by FINMA, low-risk hedge fund Systematic DLT Fund, CFMOM ETP for users pursuing high growth, etc. In addition, CFAM also cooperates with APEX Group, which has an asset management scale of over one trillion, to design and release customized crypto strategy products for other asset managers, banks and family offices through the white label service provided by the latter.

-

Integration of talents and sales resources : The original CFAM team has more than 20 years of experience in the asset management industry. After the acquisition, the original organization will be renamed and merged into Matrixport Asset Management (MAM). According to the groups plan, Matrixport will complete the asset reorganization of CFAM in the fourth quarter of 2024, and quickly invest in the research and development and testing of new products to realize self-operated Multi-Strategy funds. On the basis of the acquired existing funds, the asset management product line will be further enriched to provide innovative and compliant crypto asset management services and solutions for qualified institutions and individual investors, underwriting institutions, retail investors, etc. in the pan-European market.

3. Matrixport Analysis: A Global One-Stop Crypto Financial Service Platform

Obviously, the acquisition of CFAM is of great strategic significance to Matrixport. So what different investment opportunities and experiences will users or investors gain from it?

Since CFAM has pan-European market access qualifications, for users in the pan-European region, purchasing ETP products through Euronext or national stock exchanges is only a matter of certain regulatory procedures, making it more convenient to access, acquire and invest in various high-quality products under Matrixport.

For Matrixports existing global users, with the entry of incremental funds from the pan-European region, trading activity and capital depth will increase significantly, further improving the liquidity and robustness of Matrixports products. At the same time, after the integration of CFAMs talents, products and resources with Matrixport, the richness of the product matrix and the user experience are expected to improve, providing global users with comprehensive choices and high-quality products.

So specifically, what product systems and services does Matrixport have?

Product and Service Details

Founded in 2019, Matrixport is a global one-stop crypto financial services platform with fund management and custody volume of US$6 billion.

Matrixport provides a wide range of financial products for individuals, institutional investors, and ecological project parties. There are entry-level products such as demand deposits and fixed-income investments, as well as basic financial products such as Shark Fin and Trend Profit, and advanced products such as Dual Currency, Seagull, and Snowball. For users who want to participate in on-chain interest-bearing activities, Matrixport also provides proxy on-chain services such as ETH staking and Restaking. Whether you are a newcomer to the industry, an independent whale, or a large institution, regardless of your risk preference, you can find high-quality, high-capacity financial services that meet your needs at Matrixport.

Matrixport not only meets the needs of the majority of users in terms of product settings, but also actively implements the development strategy of global compliance . For example, in terms of licenses, Matrixport has obtained compliance licenses such as the Hong Kong Trust Company License and Money Lender License, and the US Money Service License. It is also a UK FCA Compliance Authorized Representative Company and a Swiss FINMA SRO-VFQ member.

The following figure shows some examples of Matrixports products, covering the multi-level structured products required by users with different risk preferences. Users with low risk preferences can choose basic products such as demand deposits, shark fins, and trend smart wins, while advanced users can also participate in advanced option-based structured products such as Snowball and Seagull on Matrixport.

Matrixport also launched a more robust Treasury bond yield product through its brand Matrixdock. Through transparent RWA on-chain services, it introduced synthetic assets STBT based on short-term US Treasury bonds, allowing holders to enjoy the risk-free returns of US Treasury bonds. In addition, Matrixdock also launched the gold tokenization product XAUm in September, aiming directly at the next new asset class with a scale of more than 10 trillion US dollars.

Matrixports one-stop platform application is now available for download on multiple platforms. Users can download iOS, Android and other versions through the official link (click to jump). Users can easily find the financial products they need through the home page navigation, complete the deposit and the corresponding level of KYC, and start investing and asset management quickly and conveniently.

In addition to investment products, Matrixport provides a variety of sharing channels for investment insights, aiming to provide users with cutting-edge and professional investment references. At the same time, Matrixport will also regularly output important events, market insights, structured investment strategies and other professional content through the official Telegram channel そして official X account .

Conclusion: Entering a new stage of global compliance and development

The expansion of the crypto industry has become unstoppable, and with the arrival of the US interest rate cut, the scale of capital overflow will continue to rise. In this round of interest rate cuts, the scale of crypto asset management may continue to grow by several orders of magnitude. Through this acquisition of CFAM, Matrixport officially entered the pan-European market, taking a key step in the global compliance strategy, and is expected to gain an advantage in the wave of asset management and start a new round of explosive growth.

This article is sourced from the internet: Matrixport acquires asset management company CFAM: entering the trillion-dollar pan-European market and entering a new stage of global compliance

Related: A look at the top 10 Bitcoin holding entities

Original author: Jamie Redman Original translation: Luffy, Foresight News Over the past decade, a large amount of Bitcoin has flowed into centralized exchanges, public and private companies, governments, exchange-traded funds (ETFs), and derivative token projects such as WBTC. This article will take a closer look at the top ten entities holding the most Bitcoin. Survey of the top ten Bitcoin holders According to Cryptoquant data, currently centralized cryptocurrency exchanges hold about 2,581,607.09 bitcoins. From a trend point of view, the amount of bitcoin held by exchanges has been declining since 2022, but it is still higher than the amount of bitcoin held by exchanges during 2015-2017. On January 1, 2017, Cryptoquant recorded only 1.17 million bitcoins stored on these platforms. In addition to exchanges, the amount of bitcoin held by…