原作者: Teng Yan

原文翻訳: TechFlow

I often tell my friends that when we look back on 2022 to 2024, we will find that this was a critical period when human technology accelerated significantly.

AI may be the most transformative technology trend we encounter in our lifetimes—unless we discover a miracle that extends life by hundreds of years.

This means AI is hot right now, and everyone wants to get in on the action.

In the first half of 2024 alone, AI startups attracted $35 billion in investment. And that’s just the private sector—investment is even greater within Big Tech, which is buying massive amounts of GPUs from NVIDIA, driving NVIDIA’s market cap to a staggering $3 trillion.

However, amidst this craze, there is an area of great potential that has been overlooked by many: crypto AI (or decentralized AI).

Back in 2019, there was a forward-thinking cartoon that foreshadowed this.

History shows that every decade presents investment opportunities that seem unlikely or even foolish, but ultimately prove to be extremely visionary.

Social media was once considered just a boring pastime for teenagers with no real business model. However, Meta (formerly Facebook) has become one of the most influential companies in the world, and early investors have received more than 1,000 times the return.

The story of crypto AI is both urgent and compelling. When I explain it to people, most people get it right away.

The essence of AI is to concentrate power. If left unchecked, it could lead to the concentration of power in the hands of a few monopolistic organizations that will inevitably use AI for profit and seek dominance. Therefore, decentralized AI is essential to our future and the key to a brighter and fairer society. I have explored this philosophical question in depth before.

However, skeptics argue that combining crypto with AI is little more than hype buzzwords, pointing out that in the entertainment, gaming, and social media sectors, crypto has yet to have a lasting impact or widespread adoption. I’ve even heard this concern from some smart investors — and it’s a valid concern.

But I believe things will be different this time.

There are several reasons why CryptoAI will take a radically different path. I wrote this article to lay out those reasons.

There is more to discuss than I initially thought, so I decided to break it up into several parts.

In this three-part exposition, I will dive into the technical and investment landscape for crypto AI. I will highlight the most promising areas and show how I am positioning myself to capitalize on this emerging megatrend.

Part 1: Why Crypto AI is a Key Area of Focus

Part II: My thoughts on AI agents, decentralized training, verifiable reasoning, data networks (and other sub-fields of crypto AI)

Part 3: Multiple ways to extract value from this opportunity

As the world grows more AI, we’ll need more encryption to limit it and establish prices and protections for our most precious and irreplaceable resource: time. — Preston Bryne

Standing at the intersection of technological trends

As savvy investors and entrepreneurs, we always hope to ride the wave of change.

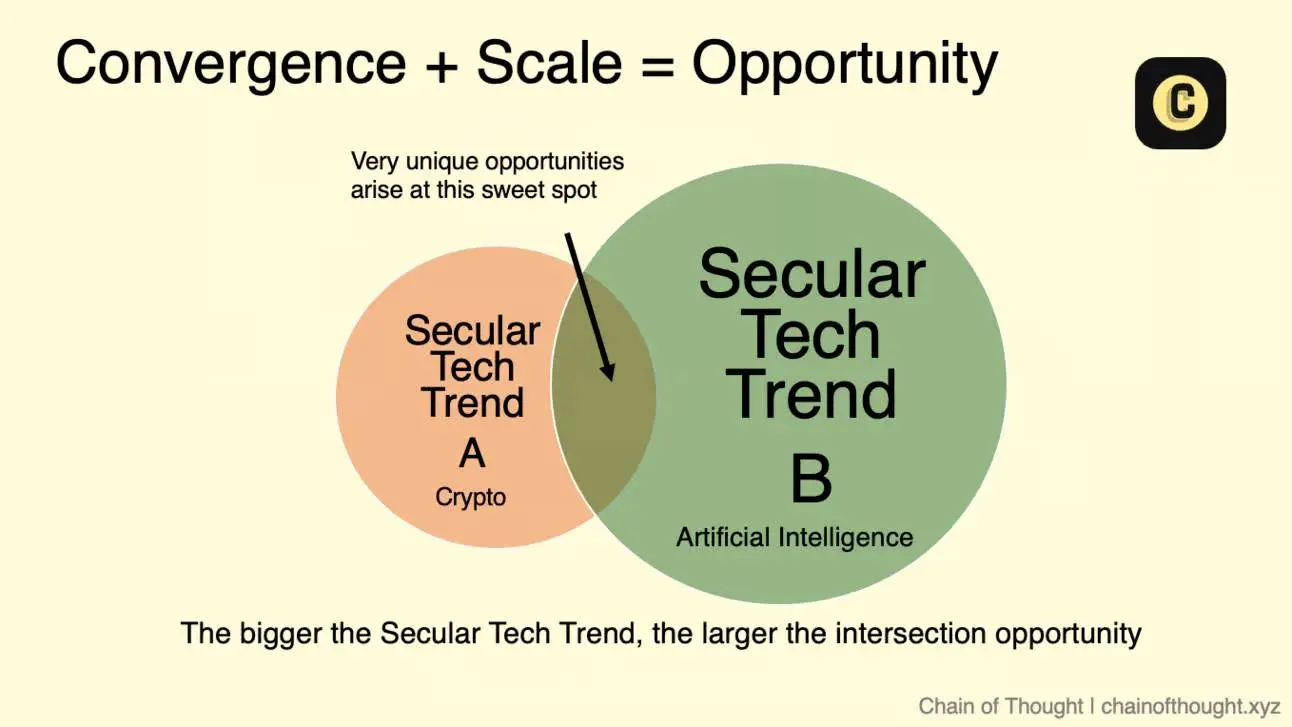

To catch the biggest waves, we need to look for places where 複数 major trends converge and take advantage of them.

This means identifying those long-term technology trends that are driving profound behavioral changes driven by technological advances and have the potential to redefine entire industries.

Crypto is one such tech trend that is changing the way we treat and use money. Other examples include cloud computing, mobile technology, and clean energy.

However, it’s not enough to just follow a tech trend. There are countless others who have seen that trend and made similar investments. To truly stand out, we need to go beyond the superficially obvious.

That’s why spotting the early convergence of two big tech trends is so compelling.

This is where the magic happens.

Convergence + Scale = Opportunity

(1) The power of integration

When two long-term trends converge, it creates the best opportunities for innovation and value in often overlooked places.

-

Multiple Growth Drivers: Companies at the intersection of multiple long-term trends are able to benefit from the growth of each trend.

-

Reduced competition: These companies are able to carve out a unique position in markets with high barriers to entry, due to the need for deep expertise in multiple areas.

-

The intersection of ideas: leading to innovative products and business models.

(2) The power of scale

In investing, market size is crucial.

Think about Amazon in the early 2000s. Its success was not just due to e-commerce, but also because it seized on the emerging cloud computing trend and created Amazon Web Services (AWS). AWS now generates billions of dollars in revenue each year and is the leader in the expanding cloud infrastructure market.

The bigger the long-term technology trends, both in terms of total addressable market and growth potential, the earlier you enter, the more opportunities there are at their intersection.

Megatrends not only provide a cushion against failure, they also greatly amplify potential rewards.

Crypto x AI

CPUs and GPUs have long been the backbone of computing, and now they power AI, which is becoming the worlds supercomputer, harnessing the collective wisdom and creativity of humanity.

Encryption technology makes it possible to create an open, decentralized network, laying the foundation for the next generation of the Internet.

Combined, these supercomputers and supernetworks complement each other.

-

AI improves the user experience of crypto technology. Users can interact with the blockchain through natural language without having to learn how to manage wallets, seed phrases, and sign transactions.

-

Cryptography provides a trustless, permissionless, and secure infrastructure for AI to ensure its openness and censorship resistance. It also serves as a powerful coordination layer for building decentralized networks.

-

This convergence paves the way for entirely new business models.

The combination of crypto and AI will grow exponentially as the two fields progress along separate paths.

The key is to figure out what cryptography can do to enable AI that wasn’t possible before — that’s the secret. Hint: distributed training, data networks, and private data. More on that in Part 2.

Learning from History: The Case for NFTs and DeFi

The reserve price of the Bored Ape Yacht Club NFT has soared. Yuga Labs raised $450 million in funding in 2022 (data source: Coingecko).

The rise and fall of NFTs offer us important lessons.

NFTs have been a hot topic in the crypto community, but they lack the support of another long-term technology trend to develop further. Entertainment and gaming – the main application areas of NFTs – are complex and mature markets dominated by powerful traditional companies, and their development momentum depends not only on technology.

As a result, NFTs have failed to maintain their early growth momentum. Although their use cases are real, it will take longer to realize their potential.

In contrast, DeFi is a successful example of the intersection of long-term technology trends.

DeFi has revolutionized financial services by combining fintech and cryptography, providing alternatives to traditional banking, lending, and asset management, and meeting real-world financial needs. Currently, the total market value of stablecoins has reached an all-time high ($170 billion) and continues to grow, while $82 billion is locked in DeFi protocols.

トークン: Open source AI requires encryption technology

The closed nature of big language models by big tech companies has hindered the realization of AI democracy. Every developer or user should be able to contribute algorithms and data to big language models and get a share of the future benefits of the models. AI should be accessible, relevant, and owned by everyone. —— Catrina Wang (Portal Ventures)

When people ask me why AI needs cryptography, my answer is simple: Tokens.

Traditional software can be expanded at almost no cost. Once the code is written, it can be deployed anywhere.

However, AI is completely different. It requires high capital and marginal costs.

Training and deploying large-scale AI models requires massive computing resources, making efficiency and infrastructure accessibility critical factors for success.

Currently, we live in a world dominated by centralized giants like OpenAI, Anthropic, and Google. These companies have abundant talent, hardware, and capital. But let’s be honest: corporate-owned AI is always driven by the goal of maximizing profits.

While Meta’s contribution to open source AI is invaluable, who’s to say they won’t stop releasing cutting-edge models like Llama 3? These systems cost hundreds of millions of dollars to develop, and if Zuck gets upset one day, the project could be halted.

Expecting the open source movement to compete with these giants based on ideals or good intentions alone is frankly unrealistic. We need a new strategy.

In fact, there is a large amount of underutilized computing resources, research, and talent in the open source world outside of top AI research labs. This includes contributions from universities, research centers, collaborative platforms such as Hugging Face, and individual AI researchers. However, currently these resources are fragmented and lack the necessary coordination to achieve large-scale breakthroughs.

This is where Tokens come into play.

として @long_solitude wrote in Zee Prime, tokens embody crypto’s most powerful feature — permissionless capital formation.

Tokens can achieve things that traditional financing models cannot do:

-

They provide bottom-up funding opportunities for experimental AI projects that might never see the light of day under the traditional venture capital model.

-

They are able to kick-start decentralized networks and transform them into thriving and self-sustaining ecosystems by distributing ownership and value to contributors. Bittensor is an early proof-of-concept example.

-

They create entirely new business models through DePIN-style token economics that significantly reduce costs, for example by shifting the huge upfront infrastructure costs faced by AI startups to the network itself, or by leveraging idle GPU resources in homes around the world through a GPU 市場 to reduce the cost per unit of computing.

Tokens provide ordinary investors with a huge opportunity to participate in the AI wave, which is often underestimated.

Crypto is good at finding new markets that people are willing to trade in. Look at NFTs and cultural assets, social tokens for the creator economy, and viral memecoins.

I believe that the demand for participation from ordinary investors in early-stage AI projects is huge and has not yet been fully tapped.

As AI becomes more deeply integrated into our daily lives and enables us to do things we couldn’t do before, people are starting to realize its scale and real-world implications. While there will be a lot of speculation, this is also about enabling everyone to participate in the biggest technological revolution of our lifetimes — and giving everyone a chance to seize the next big opportunity.

Expect more surprising developments in the future.

So, why now?

Source: Syncracy Capital

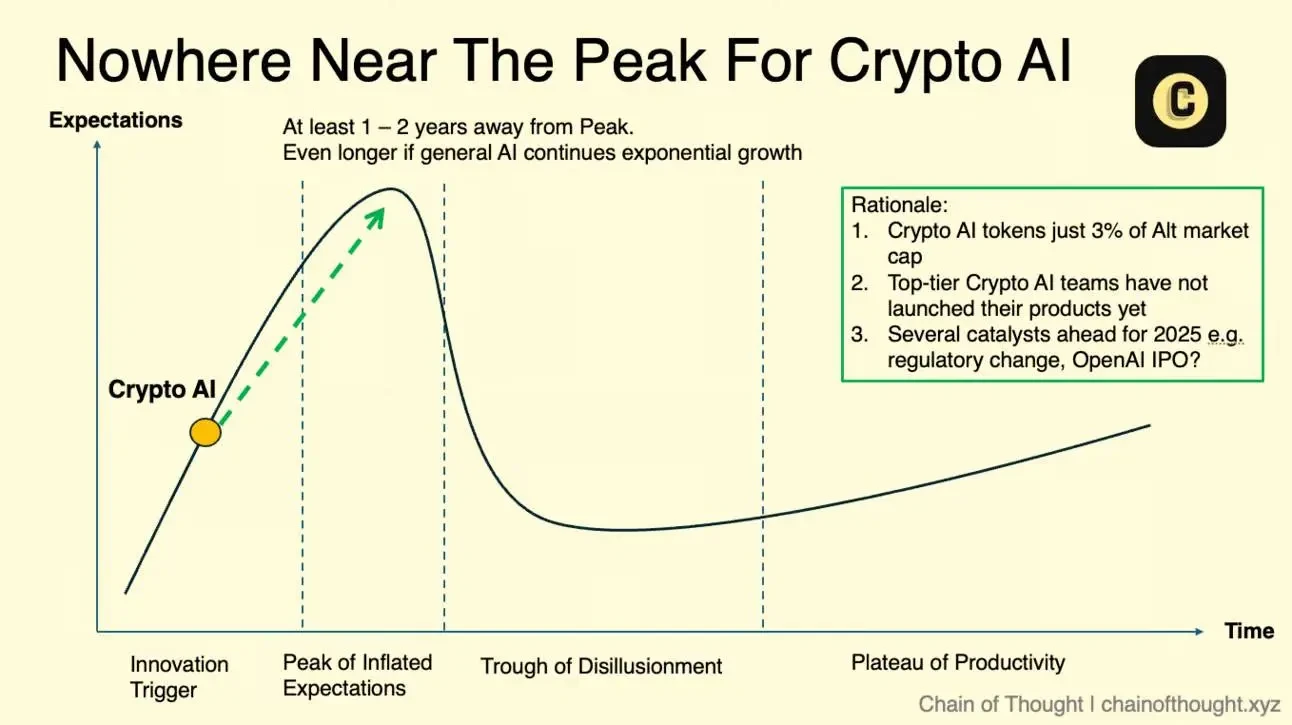

New technologies tend to follow a clear innovation cycle.

One of the most well-known frameworks is the Gartner Hype Cycle, which depicts how innovations move through the hype phase, fall into the trough of disillusionment, and eventually achieve real-world adoption.

For investors, the ideal time to invest is either when you spot the trigger point for new innovation, before the peak of hype, or at the trough of disillusionment, when you can identify startups that are about to mature.

So, here comes the million dollar question: Where are we at in the innovation cycle of Crypto AI?

I like to use this chart from Syncracy Capital to illustrate the current consensus.

The chart shows that decentralized AI is approaching or has already reached the peak of expectations. Crypto AI has had a strong year, with multiple protocols reaching multi-billion dollar valuations.

But I don’t agree with this view. I think the peak of Crypto AI is still far from coming.

The current consensus underestimates the huge potential of this field in the future. We havent even entered the frenzy stage yet. Ask people around you, how many people really understand Bittensor as an indicator of Crypto AI? In fact, I believe it may take another 1 to 2 years to see the real peak.

Here are the reasons:

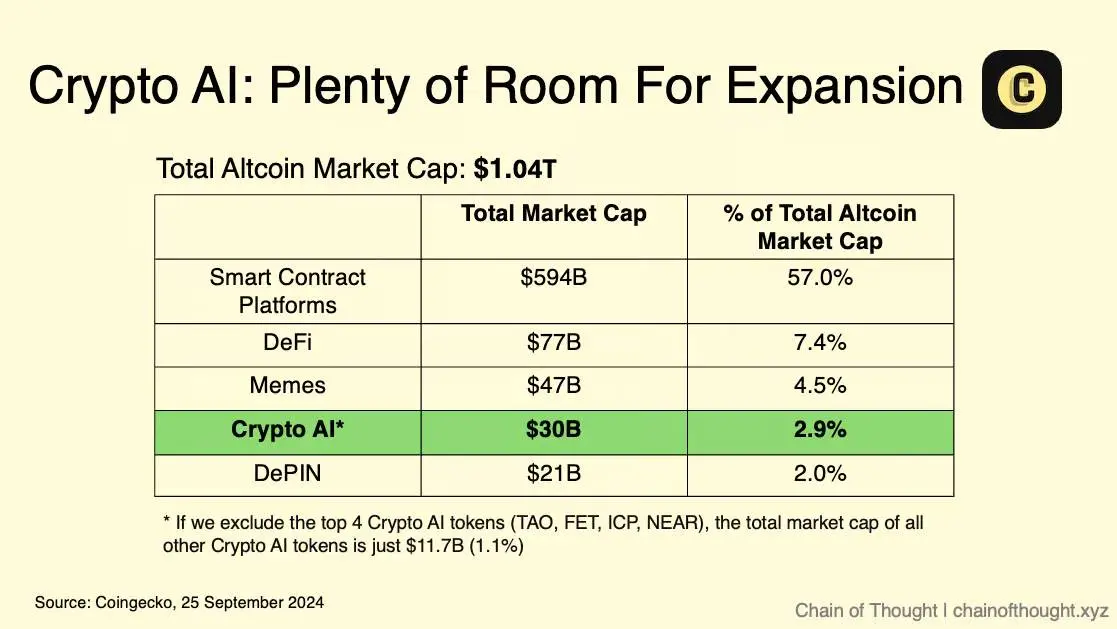

1. The total market value of Crypto AI’s token is $30 billion, accounting for only 2.9% of the total market value of all altcoins (US$1.04 trillion).

There are only four of the largest Crypto AI protocols today — TAO, NEAR, FET, and ICP — with market caps between $5 billion and $10 billion.

Excluding these four, and considering that ICP and NEAR are not dedicated Crypto AI tokens, the total market cap of Crypto AI is only $11.7 billion. This is less than 25% of Memecoin’s market cap.

In addition, only four Crypto AI projects (RENDER, GRT, AKT, AIOZ) are valued between US$500 million and US$5 billion, and most projects have a market value of less than US$100 million to US$200 million.

This market cap is insignificant considering the huge potential of this convergence of trends. Crypto AI covers both infrastructure and applications, including the next generation of smart contract platforms designed for AI.

In comparison, the total market capitalization of smart contract platforms is currently close to $600 billion. There are 8 Layer 1 protocols with a market capitalization of more than $10 billion, and 12 between $1 billion and $10 billion.

How big might the market for Crypto AI be? It’s still early days and no one can accurately predict.

によると Bloomberg Intelligence , the generative AI market is expected to expand at an average annual growth rate of more than 30%, reaching $1.3 trillion by 2032. If decentralized AI can capture 10% of the entire AI market, and taking into account the 3x speculative premium common in the crypto market, this means that the market size will reach $390 billion by 2032 – a 13-fold increase from the current $30 billion.

I intuitively feel that this forecast is too conservative and the time span is too long to be used as a practical reference.

Another way to look at it is to assume that within the next 3 years (by 2027), Crypto AI accounts for 10% of the total market value of the altcoin market, as AI applications and smart contract platforms are launched and gain momentum. If the altcoin market value reaches $2.7 trillion by then (a 50% increase from the peak of $1.8 trillion in 2021), then the market value of Crypto AI will reach $270 billion – about 9 times the current increase. This means that there is $240 billion of potential value waiting to be released.

But these numbers are more illustrative than definitive predictions, as there are so many variables. However, they do show the breadth of the opportunity and provide a rational reference when we consider valuation.

2. Top Crypto AI teams are just getting started

Many high-level teams have been working on research and development for 1 to 2 years, and have not even launched their products on the main network.

Some of these teams have received tens of millions of dollars in venture capital, including Sentient, Sahara, Vana, Story Protocol, Gensyn, Space and Time, Ritual, Nillion, etc. In the next 12 months, we will see the launch of major mainnets and the issuance of tokens – for example, the AO Computer ecosystem is a project worth paying attention to, which I mentioned earlier this year.

3. AI is developing rapidly

For example, OpenAI’s recently launched o1 model has made significant progress in reasoning capabilities. The law of scaling is still valid, and Crypto AI will closely follow the broader AI growth trend.

That said, there is a lot of noise in the market right now, perhaps more than any other area of crypto, and many startups and protocols will inevitably fail even if they achieve some short-term success.

Therefore, selectively identifying potential winners may be more effective than a strategy that casts a wide net.

Positive Catalysts for 2025

I expect that in the coming year, Crypto AI will usher in several favorable factors that will drive the development of the industry and related market expectations.

-

Traditional tech VC funds enter Crypto AI: Although a16z is already involved, major investors like Sequoia, Lightspeed, and Accel have only dipped their toes in the water so far. As they gradually increase their investments in decentralized AI, they will bring more funding and legitimacy to the field.

-

OpenAI IPO : OpenAI has a private valuation of $150 billion and continues to grow revenue. If an initial public offering (IPO) is held in 2025, it may stimulate retail investors enthusiasm for AI investment. Outside of NVIDIA and the hardware sector, retail investors have few opportunities to profit directly from the AI trend. This backlog of demand may shift to Crypto AI Tokens, which can be easily obtained on platforms such as Coinbase.

-

A friendlier U.S. government: If the U.S. government adopts a friendlier policy toward crypto tokens after the November 2024 election, this will provide a huge boost to the Crypto AI industry, provide a clearer regulatory environment, and encourage wider adoption.

-

Breakthroughs in AI: The rapid development of AI technology shows no signs of slowing down. In a recent blog post, Sam Altman describes his vision for a bright future for AI. Advances in AI agents and distributed AI training will unlock new use cases and drive further progress.

Risk Factors of Crypto AI

Although I am optimistic about the huge potential of Crypto AI, I also realize that nothing is absolutely certain. My opinion may change if the following risk factors materialize:

-

Unfriendly regulatory environment: In major markets such as the United States, if the crypto regulatory environment is unfavorable, it may inhibit innovation, limit capital inflows, and push crypto projects into a gray area. Tokens are the core of decentralized networks, and strict restrictions will weaken the key value drivers of crypto. This is less likely to happen if Trump is elected, but more likely if Kamala becomes president.

-

AI fails to deliver on its promise: Despite current market enthusiasm and billions of dollars in investment, AI may fail to deliver on its promise. If progress slows or hits roadblocks, the AI bubble could burst. I think this scenario is unlikely.

-

Failure to find a large market and product-market fit (PMF): No matter how innovative, Crypto AI projects must find a viable business model and product-market fit. If decentralized AI fails to integrate meaningful business applications, the industry may stagnate. In this case, Crypto AI may become a niche field.

-

Talent shortage: There is a limited number of top machine learning scientists and engineers. If Crypto AI cannot attract enough top talent who believe in the vision of an open, democratized AI future, innovation will slow and the industry will struggle to remain competitive.

結論

Ironically, AI may be crypto’s greatest opportunity yet.

It paves the way for true mainstream adoption and real-world use cases, something that games, NFTs, and social apps have been unable to achieve.

We are heading towards a decentralized AI future powered by open and public networks. The most forward-thinking founders and investors have taken notice.

The biggest challenge in the field of Crypto AI is that you can’t just focus on the crypto space, otherwise you will have a very narrow and superficial understanding of future developments. You need to keep up with the latest developments in machine learning, dig into the latest Arxiv papers, and communicate with founders who believe they are creating the next big breakthrough in AI.

Honestly, Ive never been so excited.

This article is sourced from the internet: The peak is far from coming, how much potential does Crypto x AI have?

PIP Labs, the initial core contributor of Story Protocol, announced the completion of a $80 million Series B financing, led by a16z crypto and strategically invested by Polychain. Other well-known investors include Scott Trowbridge, senior vice president and board member of Stability AI, Adrian Cheng, founder of K11, and digital art collector Cozomo de Medici. This round of financing brings PIP Labs total financing to $140 million. Intellectual property (IP) is one of the worlds largest asset classes, including not only Hollywood movies and Billboard charts, but also training data, AI models, memes, UGC videos, game assets, character traits, etc. With the rise of AI, IP is more valuable as the basic input for large-scale model training. In short, without IP, the development of AI may reach a bottleneck. However,…