Key Metrics: (September 23, 4pm Hong Kong time -> September 30, 4pm Hong Kong time):

-

BTC/USD unchanged ($63,500 -> $63,500), ETH/USD down 1.5% ($2,640 -> $2,600)

-

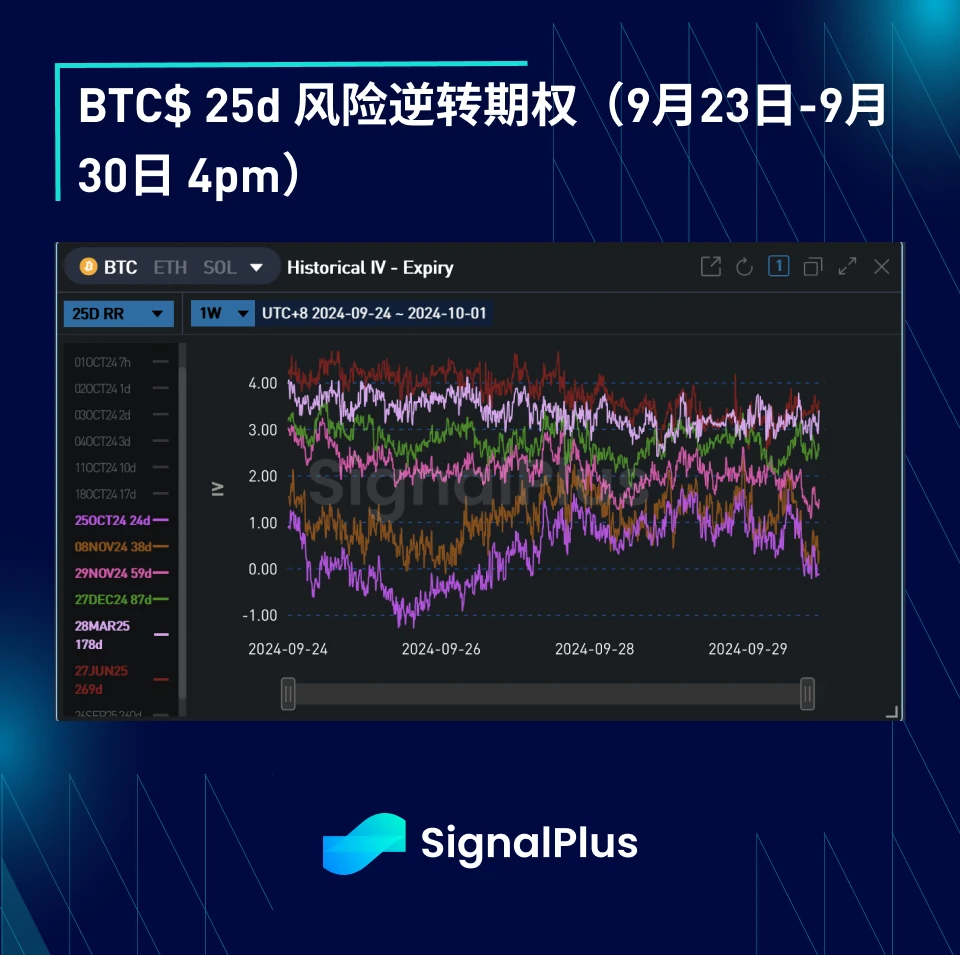

BTC/USD ATM volatility in December (end of the year) decreased by 2.6% (59.4 -> 56.8), and the risk reversal volatility on December 25th decreased by 0.5% (3.2 -> 2.7)

スポットテクニカル指標の概要

-

The market briefly broke through the key resistance level of $65.2-66k, but price action was blocked here again and the first challenge of the long-term flag resistance level has so far failed.

-

The resistance of this range can now be seen as a short-term support and if broken, the price could drop to $62.5k.

-

Long-term structural bullish, but short-term tactics remain neutral; need to wait patiently for a clear signal of breaking through $66k before considering adding new long positions.

市場 イベント:

-

China finally introduced its long-awaited stimulus policy, which has driven a new round of bullishness in regional stock markets and boosted growth expectations. If Chinas stimulus policy is successful, its transmission effect is expected to keep global inflation at a high level, which may lead to lower real interest rates worldwide, especially in the context of most G10 central banks (except Japan) being in a rate cutting cycle. As a result, cryptocurrency prices rose at the beginning of the week, challenging the highs of the local range, but then retreated and ultimately remained generally unchanged during the week.

-

Despite the renewed crypto-friendly rhetoric from the Harris camp last week, the US presidential election polls are back to being close to 50/50. Both camps are expected to continue to make overtures to the crypto community in the run-up to the election, so we need to be cautious with this news, especially with any potential policy shift from Harris/the Democratic Party.

ATMインプライドボラティリティ:

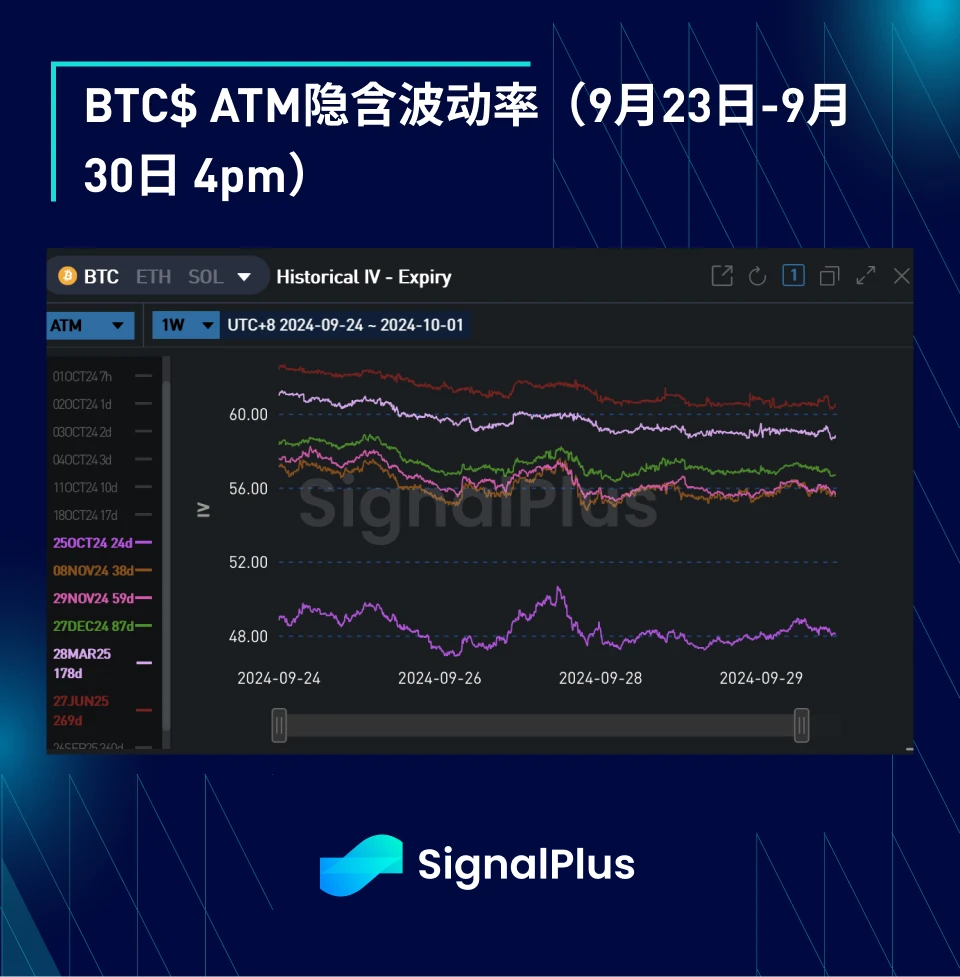

BTC $ATM Implied Volatility (September 23-30, 4 pm, Hong Kong Time)

-

Realized volatility remains extremely low, with spot prices rising from $63.5k to $66k last week, but there is a large sell order ahead of key resistance levels. High frequency trading and fixed-term realized volatility is around 35%, while intraday implied volatility is in the 45% – 50% range.

-

Volatility prices fell sharply across the board this week due to the lack of upward momentum in realized volatility and the absence of new catalysts. Volatility in options expiring in November fell by more than 2 vol. The current risk-friendly macro environment seems to support a buy on dips strategy, but this strategy has a volatility-suppressing effect. A substantial price breakthrough will require more news such as the US election or Trumps support.

-

We expect Gamma (which also drives the front-end implied volatility contracts) to remain weak in the coming weeks as the spot price consolidates in the $62.5-65.5k price range (unsuccessfully breaking out of the overhead resistance).

-

Election event volatility is falling again as markets remove risk premiums from the implied volatility curve; with less than 4 weeks to go until the election, market attention will inevitably turn to the next potential catalyst for this cycle, and we expect event volatility pricing to rise as we approach the election.

歪度/凸度:

-

Despite spot prices rising midweek, skew prices retraced last week’s upward sloping move as both realized and implied volatility moved lower. Covered call strategies and underperformance of volatility as spot prices moved higher drove the liquidation of skew positions.

-

The butterfly spread has risen this week as the market has increased demand for price breakouts on both sides, especially during the election, which has driven the pricing of the November butterfly spread higher. We expect volatility to rebound on either side of the $60-70k range, so this pricing is generally reasonable.

今週も頑張ってください!

t.signalplus.com の SignalPlus トレーディング ベーン機能を使用すると、よりリアルタイムの暗号通貨情報を入手できます。最新情報をすぐに受け取りたい場合は、Twitter アカウント @SignalPlusCN をフォローするか、WeChat グループ (アシスタント WeChat: SignalPlus 123 を追加)、Telegram グループ、Discord コミュニティに参加して、より多くの友人とコミュニケーションを取り、交流してください。SignalPlus 公式ウェブサイト: https://www.signalplus.com

This article is sourced from the internet: BTC Volatility: Week in Review September 23–30, 2024

Related: Interactive Guide: A step ahead to teach you how to play with the Story Protocol ecosystem

Original author: Karen, Foresight News Content is king, IP is supreme. In this era of information explosion and rapid development of generative AI, the power of IP will be everywhere. At the end of August, the on-chain IP protocol Story Protocol launched its first public testnet Iliad, which supports users to mint IP assets on Story Network and transform IP into liquid, programmable and ownable digital assets. Recently, in an exclusive interview with Story Protocol co-founder Jason Zhao by Foresight News ( Exclusive Interview with Story Protocol Co-founder: The Trillion-Dollar IP Market Needs to Be Reshaped ), Jason Zhao elaborated on Story’s vision: “We are not the programmable intellectual property layer of the blockchain, we are the programmable intellectual property layer of the Internet. What is really important is not…