原作者: BitMEX

After the Fed announced a 50 basis point rate cut last Wednesday, the market saw an unexpected rally. For example — $ETH is up over 12% for the week, $BTC is up over 6% for the week, and altcoins like $SUI and $AAVE are up even more significantly.

It appears that risk appetite among traders is growing…creating the conditions for a short-term rally in $ETH in the coming weeks. This week, we’ll revisit our old friend $ETH and explore its potential to outperform the market in the coming weeks.

Why we might be bullish on ETH and how you can put your market view into action by taking advantage of options trading.

Let’s dive in.

ETH Potential Rally: 3 Catalysts

1. EigenLayer’s $EIGEN token will be available for trading soon

On September 30th, EigenLayer, a highly anticipated project in the crypto space, will begin trading its $EIGEN token. This is expected to have a significant impact on the Ethereum ecosystem, given the amount of attention the project has attracted since its launch. The introduction of $EIGEN could be a factor in reinvigorating interest in Ethereum, especially in terms of driving network activity and increased value from $ETH re-staking.

Historical trends show that the issuance of tokens by major projects in the ecosystem is usually correlated with the price appreciation of the native tokens of their underlying blockchains. Therefore, we have reason to believe that the start of trading of $EIGEN will bring buying of Ethereum and become an important catalyst for Ethereums short-term performance.

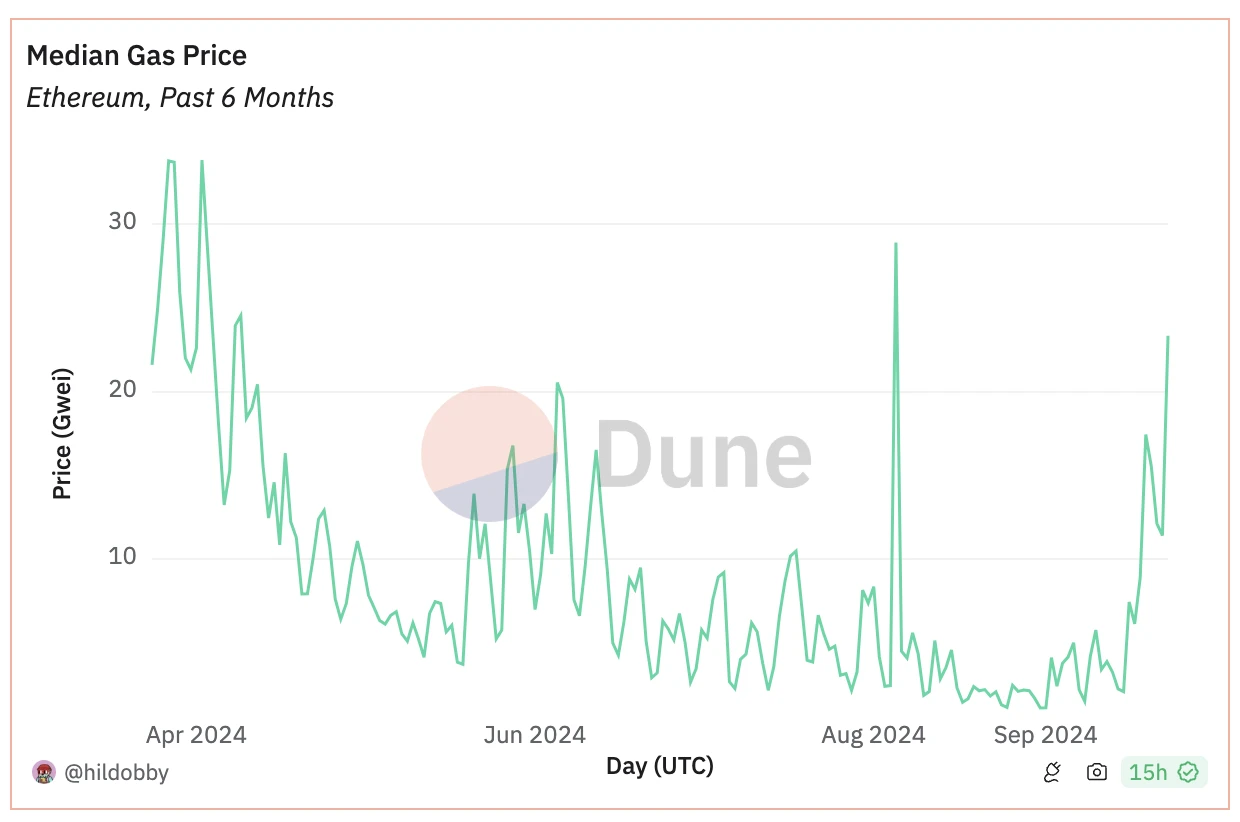

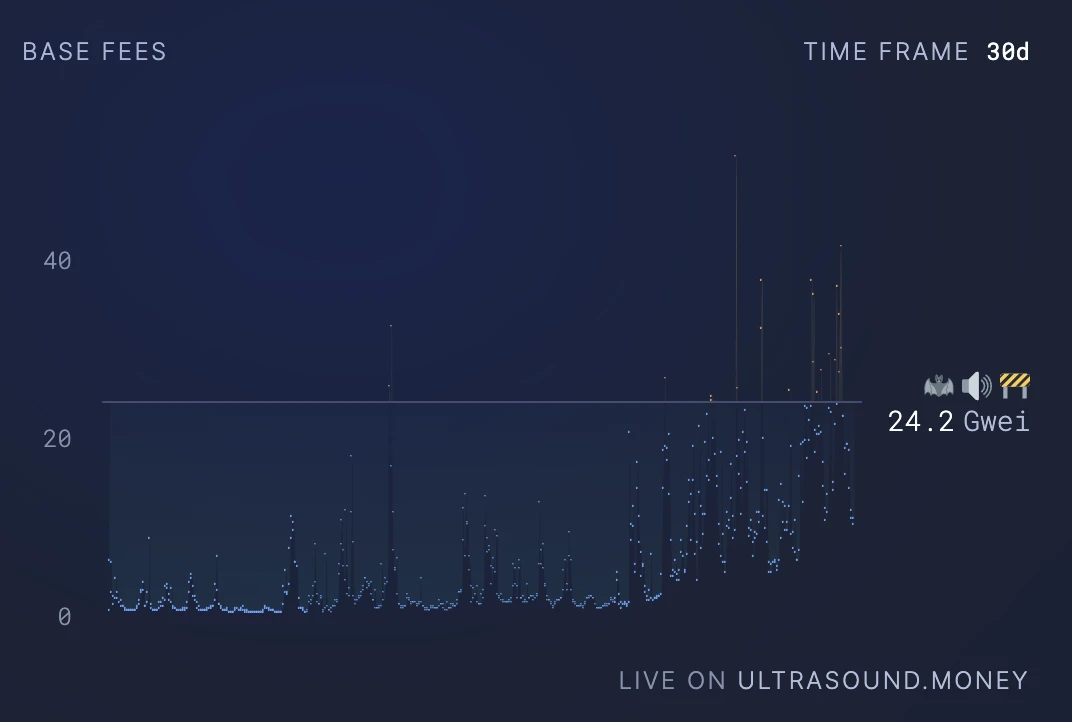

2. Ethereum gas fees hit a 6-month high

Ethereum gas fees have been on a sustained upward trend since September 16. This surge is an important indicator of increased network activity and possible deflationary pressure on ETH supply. Higher gas fees indicate an increase in user activity and smart contract interactions on the Ethereum network, reflecting an increase in demand for blockchain services.

Higher gas fees mean more ETH is destroyed, which could be deflationary for ETH supply. This combination of increased network usage and potential supply reduction could have a positive impact on Ethereum’s short-term value proposition.

3. Vitalik is active again

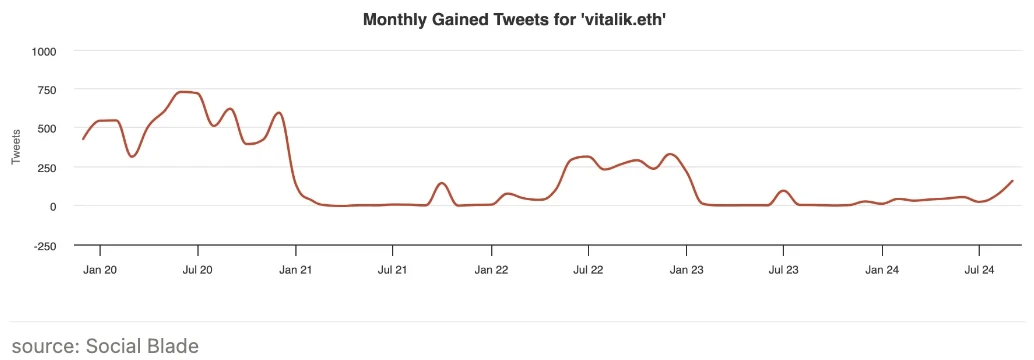

Our research shows that Vitalik “V” has been more active on X than ever since January 2023, indicating his renewed focus and commitment to $ETH. His presence is not limited to social media – it is a sign of his active participation in the crypto community.

Vitalik has been spotted interacting with DeFi founders at TOKEN 2049 and recently met with JJ Lin, one of Asia’s most popular singers.

The latter interactions, in particular, suggest Ethereum’s potential expansion into new populations and markets. Vitalik’s increased involvement not only reinvigorates the Ethereum community, but also signals a potential catalyst for increased interest and development within the ecosystem.

Putting it into practice: Using options trading

Do you think these catalysts are significant enough for $ETH to change the current bearish consensus?

Consider a call spread strategy

A call spread is an options strategy that involves buying a call option and simultaneously selling another call option with a higher strike price, both with the same expiration date. This strategy is suitable for traders who believe that the underlying asset (in this case Ethereum) will experience moderate growth or remain relatively stable.

取引戦略

-

Buy 1 $ETH call option with a strike price of $2,600 and an expiration date of October 4

-

Sell 1 $ETH call option with a strike price of $2,900 and an expiration date of October 4

Potential Benefits

-

Breakeven point: $2689.1

-

Maximum loss: If $ETH falls below $2,600 on the expiration date, a loss of $91.4

-

Max profit: $210.8 if $ETH reaches or exceeds $2900 on expiration date

-

Gain/loss ratio: 228%

利点

-

Limited Risk: Maximum loss is limited to the net premium paid for the spread, providing a clear risk profile.

-

Lower Cost: Selling a higher-strike call option helps offset the cost of buying a lower-strike call option, making it cheaper than buying the call options individually.

-

Profit Potential: You can profit if the underlying asset price rises moderately, with maximum profit realized when the price reaches or exceeds the higher strike price at expiration.

リスク

-

Limited profits: Unlike simply buying a call option, profit potential is capped, which may limit gains in a strong bull market.

-

Breakeven challenge: The underlying asset price needs to exceed the breakeven point for the strategy to be profitable.

-

Time decay: Both options are subject to time decay, which can work against the strategy if prices move more slowly than expected.

This strategy is often used when you expect the underlying asset price to rise modestly but want to limit your risk exposure. It is a more conservative approach than purchasing call options alone and is suitable for traders who want to participate in potential upside while managing downside risk.

This article is sourced from the internet: BitMEX Alpha: Revisiting Ethereum

Original | Odaily Planet Daily ( @OdailyChina ) Author | Asher ( @Asher_0210 ) Against the backdrop of the rapid evolution of blockchain technology, full-stack services such as Op stack and Arbitrum Nova, as well as the recently emerged modular blockchains such as Celestia, Dymension, and Cosmos, have significantly lowered the threshold for developers to create new blockchains. In the foreseeable future, the number of application chains will continue to grow, making the cryptocurrency world more prosperous, but this trend also brings a new problem: the further dispersion of crypto asset liquidity. As Vitalik Buterin said many years ago: Interoperability is the future. The role of cross-chain technology in the cryptocurrency world is becoming increasingly important. It effectively links the data islands between chains in a more efficient, cheap and…