原作者: Howard , Director of Asia Development Relations, TON

原文翻訳: Felix、PANews

The TON ecosystem has been active recently, and applications have emerged within the ecosystem. In response to this situation, Howard, the head of TONs Asian development relations, published an article on the X platform, pointing out the potential application areas worth developing in the current TON ecosystem, and pointing out the direction for developers to build. The following is the full text.

The TON ecosystem has exploded in recent months as applications have proliferated. While many projects are on a similar path (a good sign), TON’s goal remains to maximize your investment, both in time and money, to achieve greater results with less effort.

According to the tried and true 2/8 rule, attention is focused on the top 20% (or fewer) of projects in any field, and traffic and funding will flow to the best projects.

The main value of TON

You may have seen this picture in previous articles: TON is just a part of the whole ecosystem. So, if you have problems with your Telegram account, you can try to solve it through this page: https://telegram.org/support

Wallet handles the financial aspect; Telegram (aka TApps) is the messaging layer that makes accessing content and web pages a breeze; the TON blockchain gives you control over your assets.

Together, these three modules form a powerful ecosystem with unique advantages.

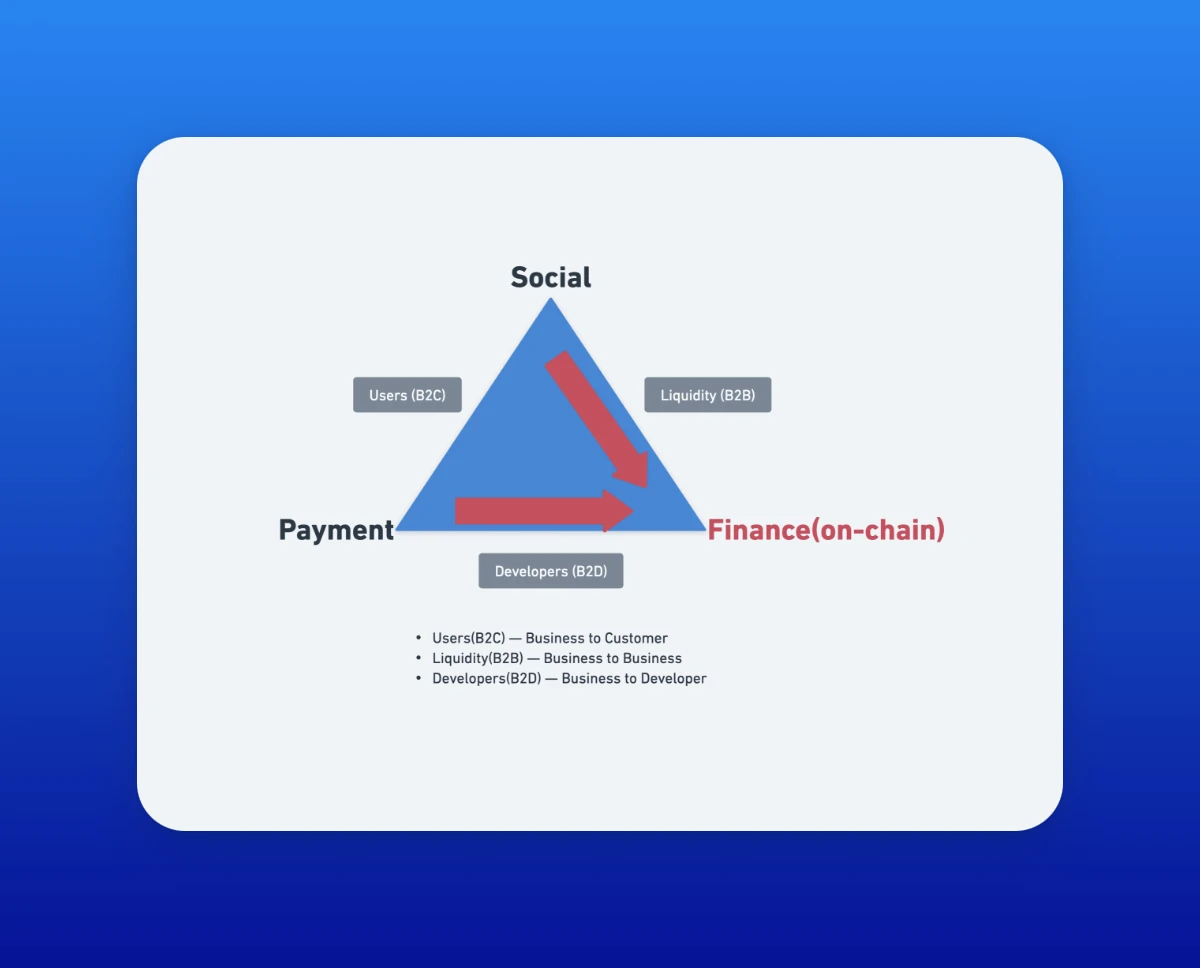

Among L1 blockchains, TON stands out for its unparalleled potential and creative possibilities. The core of TON and Telegram should always revolve around three pillars: social, payment, and finance.

When planning a project, you can filter by the following three dimensions and ask yourself, What problem are you really trying to solve?

ソーシャルコンタクト

Socializing is what Telegram is good at—exchanging valuable information back and forth in real time. But if that value exists on a blockchain, using on-chain assets to highlight your uniqueness or drive your friends to take action. Thats fun, right?

Take Calvin, for example, who recently asked, “If I shared node sales with you, how much would you invest?”

That’s social; that’s referral.

We encounter similar situations every day, from casual questions to heated Telegram group discussions. Our trading habits are largely influenced by the people around us, and most trades are driven by recommendations.

Of course, questions like Calvin’s can be stressful — no one wants to let down a friend by not following through. But this is exactly where prediction market products, Pump.fun, and other platforms that let you place bets with your friends, should be seamlessly integrated into the fabric of social interaction.

Some experts can delve deeper when we talk about the sociology of managing relationships, or how Telegram is closely intertwined with “social”. These are topics worth exploring.

支払い

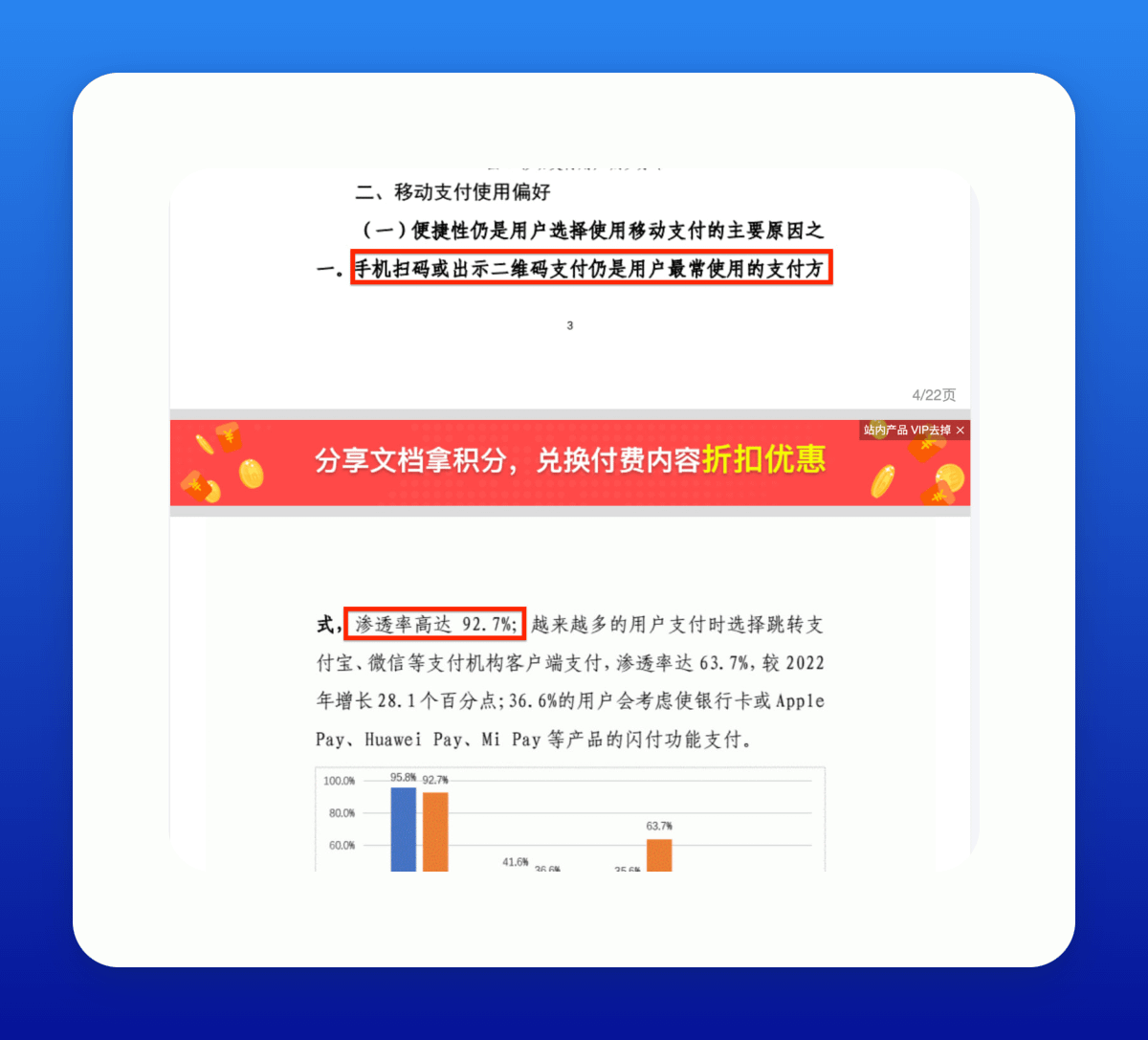

When it comes to payments, the emphasis is on the game-changing business value of seamless transactions – think e-commerce, online shopping and the ubiquitous WeChat QR code payments in China.

The above report shows that currently more than 90% of financial transactions in China are digital.

This digital shift is changing everything. WeChat Pay has not only transformed social interaction, but it has also revolutionized offline transactions, spurred new business models, made payment processes more efficient, and revitalized the economy. It paved the way for e-commerce giants such as Alibaba, Tmall/Temu, and JD.com.

Don’t forget, we already have USDT on the TON blockchain.

-

How to take advantage of it?

-

How to help business owners solve more problems or increase payment conversion rates?

Our goal is to provide a smooth payment user experience for suppliers and consumers. There are about 1 million users on the Ethereum mainnet using cryptocurrency for transactions, and TONs potential market is 1 billion, a difference of 1,000 times in size.

Serving billions of users around the world is an exciting challenge.

Our payment research aims to enable users to use digital payments through custodial or non-custodial wallets. Its market potential is 1,000 times that of Ethereum, and the network effect is amazing.

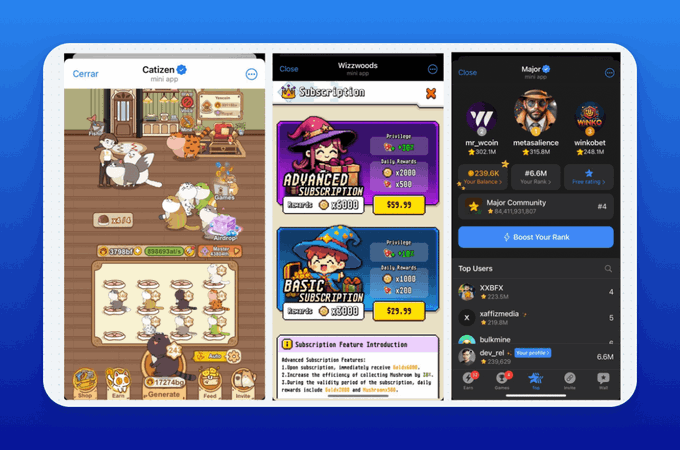

Online shopping is a huge opportunity. Helping merchants transition to Tapps can be a game changer, especially in the gaming and content space. Success stories include:

-

キャティゼン

-

選考科目

-

Wizzwood

Gaming platforms like Catizen thrive with simple payment systems that generate revenue quickly, something that early Web2 games could not do.

finance

The finance discussed here refers to financial management and on-chain aspects, such as bringing more assets to the chain and increasing TVL (Total Value Locked).

There is an urgent need to promote the development of DeFi in the short, medium and long term. The reason is simple: it must be admitted that the TON ecosystem currently lacks various DeFi products, such as yields, profit opportunities and other financial management projects.

You can certainly instinctively move in this direction, but you also have to consider developing smart contracts on the TON blockchain. This represents a portion of the investment risk.

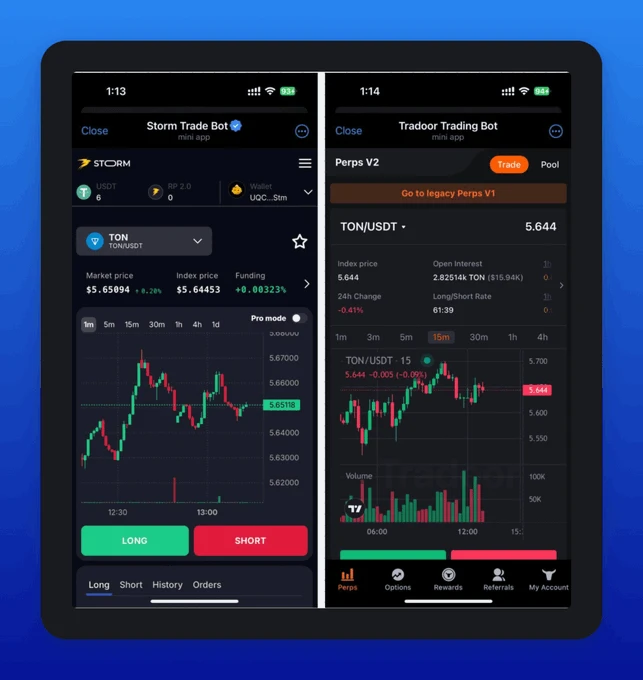

However, there are also opportunities to earn high returns by “trading derivatives”. For example, LP (liquidity provider) returns on derivatives platforms such as StormTrade and Tradoor. These are some opportunities worth exploring.

-

StormTrade

-

Tradoor

方法論

Our goal is to better categorize and discuss projects by outlining these three dimensions.

Currently, the financial sector faces a huge gap. TON lacks DeFi projects and needs more powerful modules to drive on-chain revenue and incentivize assets to stay on the chain. Putting more assets on the chain or on-chaining by increasing TVL is the most direct solution.

But is following Ethereum’s path the best strategy? Will focusing solely on DeFi allow TON to quickly break into the market? After observing the market over the past few months, it seems that this approach alone is not enough.

Telegrams strong user base suggests that the focus should shift to finance to create more on-chain opportunities. I am eager to see more asset tokenization in the future. In addition, I advocate more multi-dimensional or bilingual concepts, integrating social + finance to redefine the traditional product ecosystem.

For example, decentralized exchanges (DEXs) are the foundation of DeFi and are often referred to as the “LEGOs” of the ecosystem. Let’s examine them independently.

Exchanges/DEXs

If we talk about DEXs in isolation, they are financial but lack any significant social aspects.

The current DEX problem is more about market penetration. Uniswap has evolved from v2 to v3 and is aiming for v4, but these updates are mostly just mathematical tweaks. The real problem? They are not exciting at all.

-

Can I spy on my friends portfolios? Not possible

-

Can I easily compare my PnL (profit and loss) with others? It is possible, but only for niche platforms like DeBank or Zapper.

-

Can I send notifications to other traders on Uniswap? Not possible

Trading should be fun and interactive. Imagine a platform where you can dive deep into your trading and enjoy every moment. Find inspiration from our products like PumpFun: https://ton.org/en/memelandia

Trading/Prediction 市場

Even in a field as simple as prediction markets, problems abound. It’s tied to social dynamics, but fails to engage users effectively. Interactions are fragmented, lacking integration with popular platforms like Telegram group chats. Those connected through blockchain finance need more private channels to connect.

Polymarket also faces regulatory hurdles that prevent it from launching features like a mobile app. Poor user experience and lack of convenience. Suppressed growth potential. Who is still using the web in 2024? Mobile is the future, and its dominance is only going to get stronger.

Polymarket’s community participation is limited to commenting on topics or markets, and does not allow for active discussions.

From a financial perspective, the platform is not attractive; AMMs (automated market makers) are neither fair nor attractive considering impermanent loss, gains, and capital exposure.

That’s why I emphasize the close connection between “prediction markets” and “society”, even though I’m cautious about its “financial” angle. We all expect on-chain DeFi to bring breakthrough features to prediction markets. Just look at how Blur.io is reshaping the NFT market, and other innovative DeFi strategies.

Areas of interest/More content

We have focused on the social, payment, and financial sectors within the TON ecosystem to identify early opportunities worth exploring.

We have focused on the social, payment, and financial sectors within the TON ecosystem to identify early opportunities worth exploring.

Curious why proof of work (PoW) is placed under payment? Bitcoin has revolutionized energy efficiency, reduced electricity costs and driven advances in electricity technology. This is payment-driven innovation at its best.

There is still a lot to introduce: DNS domain names, MEME culture, credit cards, cross-chain bridges, etc.

Stay tuned for future in-depth looks at each category.

Vertical Scaling Discussion

Each category opens up a new area to explore. Wondering how to get inspired beyond this list? Of course, there is a way.

User (B2C)

Think vertically to grow your business. There is overlap in the social and payments sectors because both rely on a large user base. Companies like Amazon, which sell products directly to shoppers, are the poster child for B2C transactions. Apps that facilitate social connections or sell digital goods also fall into this category, leveraging user stickiness to expand.

-

Projects that connect society and payments shine here

-

Games are a standout among them, combining social interaction with payment needs, promoting the development of both ecosystems. Take Catizen Mini Program as an example: it has earned more than $6 million through Telegram Stars

-

Advertising business also belongs to this category in my opinion

Developer (B2D)

In the payments and finance space, innovative developers are the catalyst for growth and breakthrough business models. Imagine APIs for blockchain payments or developer-centric DeFi protocols that turn ordinary revenue-generating services into sources of profit.

-

Imagine merging “existing payment channels” with on-chain transactions. This is the next big leap, and the tokenization of Telegram Stars could be a complete game changer.

-

Many projects have stumbled upon the complexity of Telegram Stars, struggling to deal with its strengths and limitations. While it is impossible to cover everything in detail here, it is a gold mine waiting to be explored.

-

What’s really bright? There’s a huge opportunity for developers to address these challenges, sparking a wave of new projects. This is a major pain point just waiting for an innovative solution.

Liquidity (B2B)

Improve liquidity and drive growth through B2B strategic alliances, collaborate with other businesses to form a strong network, expand liquidity, and drive collective success. This strategy creates a strong ecosystem that is critical to decentralized finance (DeFi) and social platforms such as Telegram. In short, it is to turn traffic into profits.

-

The potential here is undeniable, and the synergy of Launchpool, DEXs, and social features is particularly exciting.

-

Emerging “Earn” products combine financial tools with social tools, which promise to revolutionize the market. Alipay’s innovative products demonstrate the power of this combination, especially in China.

結論

Despite the deep dive into various categories, some areas still require more attention, which provides opportunities for innovation teams. Mini-app games have dominated recently, probably due to players’ fatigue with point-earning or invitation-earning models and the competitive environment.

However, it’s exciting to think about the hot topics that are yet to be explored. These could evolve into multi-billion dollar businesses on Telegram mini-programs and the TON blockchain.

Promising areas include credit card cashback and gift card businesses, RWAs, Earn products, Launchpool-type programs, or companies focusing on offline QR code payment solutions. These directions are full of potential and worth exploring.

postscript

Think of the L1 blockchain as a country. TON may not be perfect, but it is full of potential and hope — just like the American Dream. In the 1980s, a new wave of immigrants came to the United States with big dreams.

Today consensus in the EVM ecosystem is breaking down. We have Solana pushing single chain boundaries and Bitcoin L2 gaining traction.

As someone who experienced the summer of DeFi, my choice is clear – I see hope.

-

Would I tell a young graduate to develop on Ethereum? No.

-

Without several million dollars, the chances of success are slim.

-

Would I recommend Web2 game studios to choose the EVM blockchain? No.

They lack users. Look at Black Myth: Wukong – would it have become a hit without Steam? Not likely. Platforms matter.

The TON ecosystem is ripe with real potential for growth. No matter what project you’re working on, you have a chance to succeed. This place is like the American Midwest in the 1980s or Dubai today — you can be whatever you want to be.

With a huge user base, seamless cross-platform functionality, and powerful value transfer, TON/Telegram will help your business reach new heights.

関連記事: Why I am confident about the prospects of TON in the next 6 months?

This article is sourced from the internet: TON Asia Development Relations Director: What should developers build on TON?

Original|Odaily Planet Daily ( @OdailyChina ) Author: Wenser ( @wenser2010 ) In the previous article Counting the Seven Deadly Sins of Ethereum, Who Can Play the Saving Song for It? , we briefly explained the past behavior of the Ethereum Foundation from the perspective of the Seven Deadly Sins. In a nutshell, all the current disputes of Ethereum originated from the poor price performance, and the reason was the various past operations of official forces represented by the Ethereum Foundation . However, the problems mentioned are more superficial phenomena. Odaily Planet Daily will further analyze this in this article and point out the three major problems currently facing the Ethereum ecosystem, mainly involving organizational management, ecological landscape and cyclical chronic diseases. The primary problem of Ethereum ecosystem: centralized decision-making ecosystem…