原作者: TechFlow

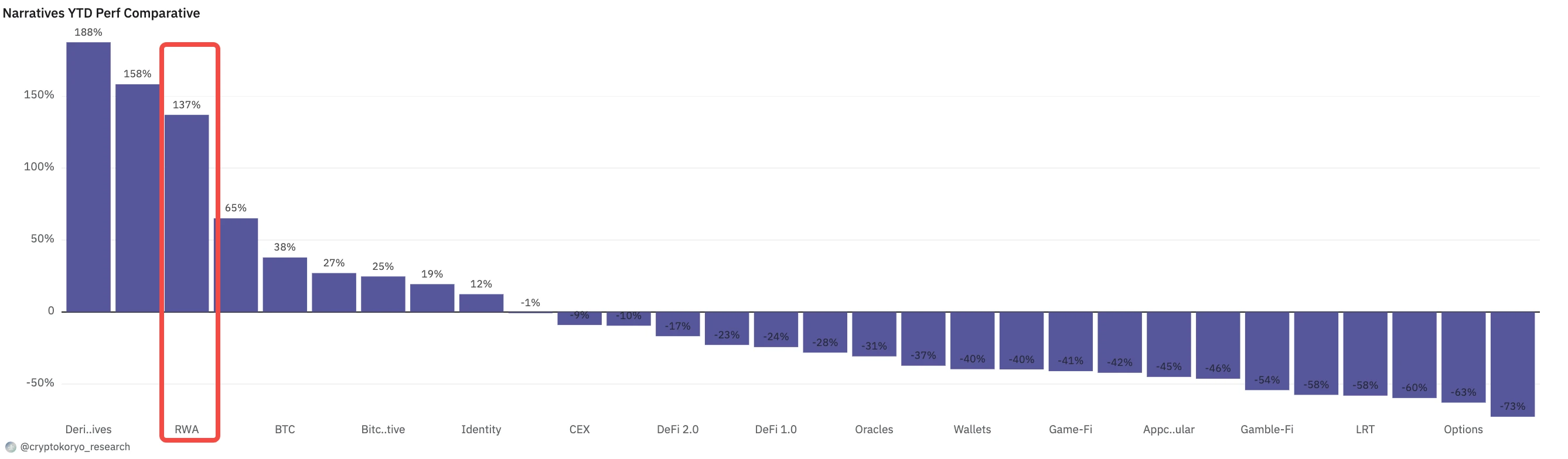

The RWA sector has been making a fortune in silence during this atypical bull market.

When everyones emotions are easily driven by memes, if you look at the data carefully, you will find that the performance of tokens in the RWA track so far this year is probably better than that of tokens in most other tracks.

When U.S. Treasuries become the largest RWA, the trend of the track being affected by the macro economy will become more obvious.

Recently, Binance Research Institute released a long report titled RWA: A safe haven for on-chain returns? , which provides a detailed analysis of the RWA tracks landscape, projects, and revenue performance.

TechFlow interpreted and refined the report, and the key contents are as follows.

重要なポイント

-

The total on-chain RWAs reached $12 billion, not including the $175 billion stablecoin market.

-

Major categories in the RWA space include tokenized U.S. Treasuries, private credit, commodities, equities, real estate, and other non-U.S. bonds. Emerging categories include air rights, carbon credits, and fine art.

-

Institutional and traditional finance (“TradFi”) participation in RWAs is increasing, with BlackRock’s BUIDL tokenized Treasury product being the leader in the category (market cap > $500 million); Franklin Templeton’s FBOXX is the second largest tokenized Treasury product.

-

6 projects highlighted in the report: Ondo (Structured Finance), Open Eden (トークンized Treasury Bonds), Pagge (Tokenized, Structured Credit, Aggregation), Parcl (Synthetic Real Estate), Toucan (Tokenized Carbon Credits), and Jiritsu (Zero-Knowledge Tokenization).

-

Technical risks that cannot be ignored: centralization, third-party dependence (especially for asset custody), the robustness of the oracle, and the complexity of the system design are worth the benefits you get.

-

From a macroeconomic perspective, we are about to begin a historic rate cut cycle in the United States, which may have an impact on many RWA protocols, especially those focused on tokenizing U.S. Treasuries.

RWA Data Fundamentals

Aggregated RWA definition: Tokenized on-chain versions of tangible and intangible non-blockchain assets, e.g., currencies, real estate, bonds, commodities, etc. A broader asset class that includes stablecoins, government debt (dominated by U.S. government bonds, i.e., Treasuries), stocks, and commodities.

Total on-chain RWAs reached an all-time high of over $12 billion (excluding the $175 billion+ stablecoin market)

Key Category 1: Tokenized Treasury Bonds

-

2024 has seen explosive growth, from $769 million at the start of the year to $2.2 billion by September.

-

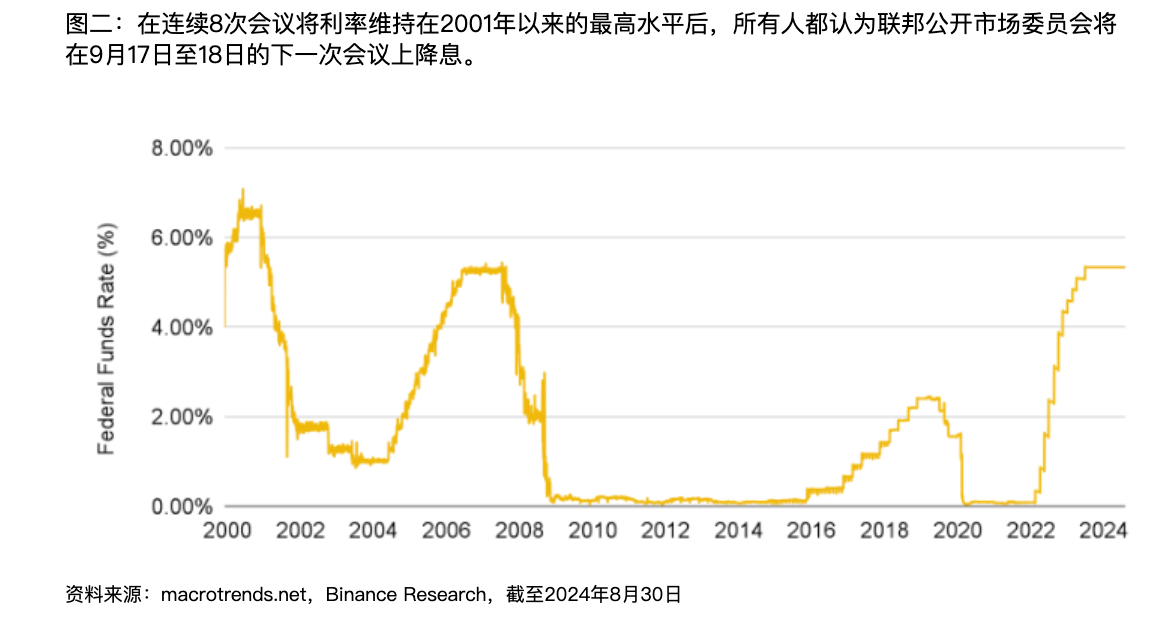

Growth could be hurt by U.S. interest rates at 23-year highs, with the federal funds target rate held steady at 5.25-5.5% since July 2023. That makes the yield on U.S. government-backed Treasury bonds a desirable investment vehicle for many investors.

-

Government backing – U.S. Treasuries are widely considered to be one of the safest yield-earning assets on the market and are often referred to as risk-free.

-

The Fed will kick off a rate-cutting cycle later this month at the September FOMC meeting, so it will be important to watch how RWA yields evolve as they begin to decline.

Key Category 2: On-chain Private Credit

-

Definition: Debt financing provided by non-bank financial institutions, usually to small and medium-sized companies.

-

The IMF estimates that the market size will exceed US$2.1 trillion in 2023, while the on-chain will only account for about 0.4%, or approximately US$9 billion.

-

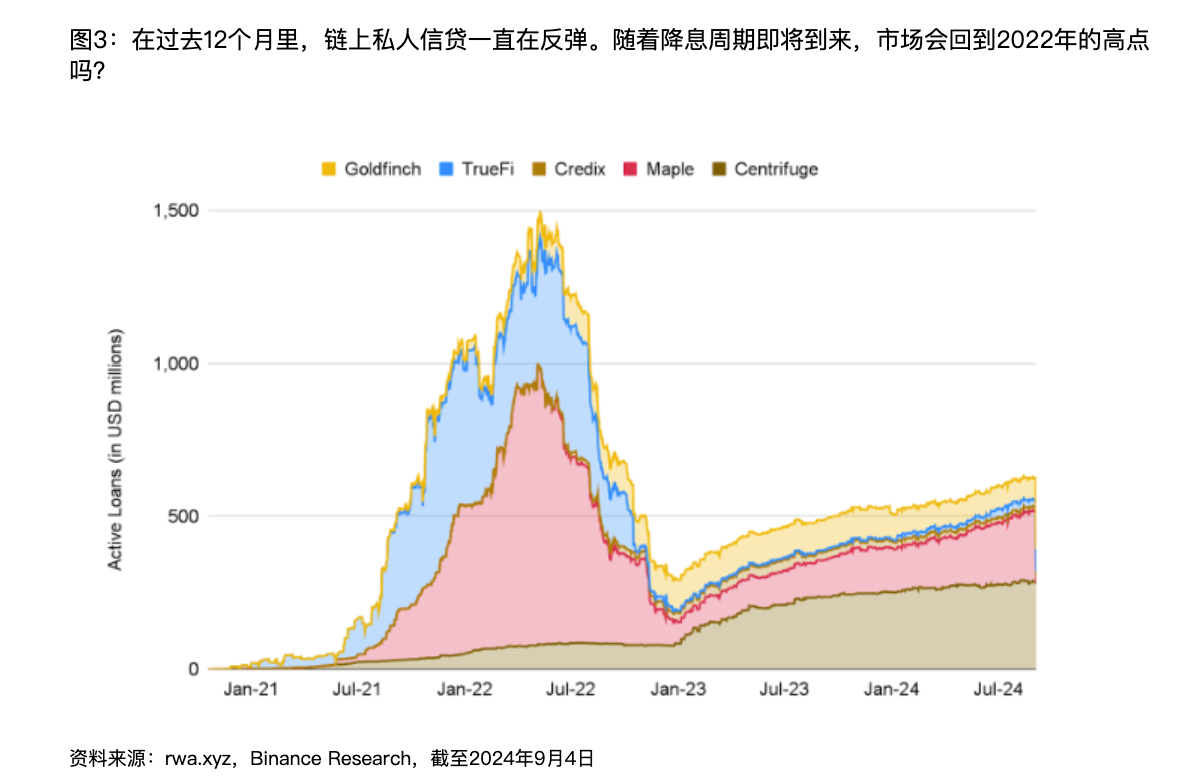

On-chain private credit is growing extremely fast, with active loans increasing by approximately 56% over the past year.

-

The bulk of the growth came from Figure, a program that provides lines of credit secured by home equity.

-

Other major players in the on-chain private credit market include Mongolge, Maple, and Goldfinch.

-

Despite the recent gains, total active loans are still down about 57% from a year ago. This coincides with the Federal Reserves aggressive rate hikes, which have impacted many borrowers (especially those with floating rate agreements for private credit loans) with higher interest payments, leading to a corresponding decline in active loans.

Key Category 3: Commodities (Gold)

-

The leading two tokens, Paxos Gold ($PAXG) and Tether Gold ($XAUT), have a combined market share of approximately 98% of the ~$970 million market.

-

But gold ETFs are very successful, with a market cap of over $110 billion. Investors are still reluctant to move their gold holdings further on-chain.

Key Category 4: Bonds and Stocks

-

The market is relatively small, with a market capitalization of approximately $80 million.

-

Popular tokenized stocks include Coinbase, NVIDIA, and an SP 500 tracker (all issued by Backed).

Key Category 5: Real estate, clean air rights, etc.

-

While it hasn’t reached the point of mass adoption yet, the category still exists.

-

The concept of renewable finance (ReFi) accompanies this, attempting to combine financial incentives with eco-friendly and sustainable outcomes, such as tokenizing carbon emissions.

Key Components of RWA

Smart Contracts:

-

Leverage token standards such as ERC 20, ERC 721, or ERC 1155 to create digital representations of off-chain assets.

-

The key feature is the automatic revenue accumulation mechanism , which distributes off-chain revenue to the chain. This is achieved through rebase tokens (such as stETH) or non-rebase tokens (such as wstETH).

Oracle:

-

Key Trend: RWA-specific Oracles. Legal compliance, accurate valuation, and regulatory oversight are all issues that generalized oracles may not be able to fully address.

-

For example, in private lending, a lender might issue an RWA mortgage on-chain. Without a high-quality oracle to communicate how the funds are being used, the borrower might not abide by the loan agreement, taking on risk and possibly even defaulting.

(Source: original report, compiled and edited by TechFlow)

-

Projects working on dedicated oracles: Chronicle Protocol, Chainlink, DIA and Tellor

Identity/Compliance

-

Emerging technologies for identity authentication such as soul-bound tokens (“SBTs”) and zero-knowledge SBTs (“zkSBTs”) offer a promising approach to verify identity while protecting sensitive user information.

Asset Custody

-

A combination of on-chain and off-chain solutions to manage:

-

On-chain: Secure multi-signature wallets or multi-party computation (“MPC”) wallets are used to manage digital assets. Off-chain: Traditional custodians holding physical assets follow legal integration to ensure proper ownership and transfer mechanisms.

Traditional financial institutions enter the game

BlackRock (asset management scale: US$10.5 trillion)

-

The USD Institutional Digital Liquidity Fund (“BUIDL”) is the market leader at over $510 million.

-

It only launched in late March and has quickly become the biggest product in its space.

-

Securitize is a key partner of BlackRock in BUIDL and serves as transfer agent, tokenization platform and placement agent.

-

Meanwhile, BlackRock is the largest issuer of spot Bitcoin and spot Ethereum ETFs.

Franklin Templeton (asset management scale: US$1.5 trillion)

-

Their on-chain U.S. Government Money Fund (“FOBXX”) is currently the second largest tokenized Treasury product with a market cap of over $440 million.

-

BlackRock’s BUIDL runs on Ethereum, but FOBXX is active on Stellar, Polygon, and Arbitrum

-

Benji, a blockchain-integrated investment platform, has added more functionality to FOBXX, allowing users to browse tokenized securities while also investing in FOBXX.

WisdomTree Investments (AUM: $110 billion)

-

Originally a global ETF giant and asset management company, it has gone a step further and launched multiple “digital funds.” The total AUM of all these RWA products is more than $23 million.

プロジェクト分析

-

The projects analyzed in the report are Ondo (structured finance), Open Eden (tokenized treasury bonds), Pagge (tokenization, structured credit, aggregation), Parcl (synthetic real estate), Toucan (tokenized carbon credits), and Jiritsu (zero-knowledge tokenization).

-

The business model and technical implementation of each project are described in detail in the report, which will not be elaborated here due to space limitations.

-

The comprehensive comparison and characteristics of each project are as follows:

(Source: original report, compiled and edited by TechFlow)

Overall results and outlook

-

RWA can bring benefits, but whether the technical risks VS the benefits are worth it is a matter of opinion. The technical risks are as follows:

Centralization: Smart contracts or the overall architecture exhibit a higher degree of centralization, which is inevitable considering regulatory requirements

Third-party dependence: high reliance on off-chain intermediaries, especially asset custody

-

Some new technology trends:

The emergence of RWA-specific oracle protocols. Established companies like Chainlink are also increasingly focusing on tokenized assets.

Zero-knowledge technology is emerging as a potential solution for balancing regulatory compliance with user privacy and autonomy.

-

Does RWA need its own chain?

Benefits: It is easier to launch new protocols on these chains without having to build their own KYC frameworks and cross regulatory hurdles, thus promoting the growth of more RWA protocols; traditional institutions or Web2 companies that want to adopt certain blockchain features can ensure that all their users are KYC/meet necessary regulatory requirements.

Disadvantages: Faces “cold start” problem; difficult to bootstrap new chains with liquidity and ensure sufficient economic security; higher entry barriers, users may need to set up new wallets, learn new workflows, and familiarize themselves with new products

-

Outlook for the next rate cut expectations

With the Fed expected to begin a rate-cutting cycle at its next meeting on Sept. 18, what does that mean for RWA programs, which thrive in a high-interest rate environment?

While yields on some RWA products may decline, they will continue to offer unique benefits such as diversification, transparency, and accessibility, which may continue to position them as attractive options in a low-rate environment.

-

Concerns about the legal environment

Many protocols still remain significantly centralized, and various technologies, including zk, have a lot of room for improvement.

Decentralize authority while still maintaining regulatory compliance; this may also require some changes to traditional compliance systems to recognize new forms of verification.

Most RWA protocols still have some way to go before they can truly preserve financial products for professional investors and also enable permissionless access.

This article is sourced from the internet: Binance RWA report interpretation: Traditional institutions actively enter the market, and asset returns may decline under the expectation of interest rate cuts

Related: Is Telegram really an encrypted app?

Original author: Matthew Green Original translation: Block unicorn About the author, Matthew Green is a cryptographer and professor at Johns Hopkins University. I design and analyze cryptographic systems used in wireless networks, payment systems, and digital content protection platforms. In my research, I study various ways to use cryptography to protect user privacy. This post was inspired by the recent worrying news that Telegram CEO Pavel Durov was arrested by French authorities for failing to adequately police content. While I don’t know the specifics, the use of criminal charges to coerce social media companies is a rather worrying escalation in the fact that there seems to be more to the story than meets the eye. But I dont want to talk about this arrest today. I want to talk about…