オリジナル | Odaily Planet Daily ( @OdailyChina )

著者 | フー・ハウ( @ヴィンセント 31515173 )

The TON ecosystem has experienced rapid development in 2024, with the total value locked (TVL) in the ecosystem rising continuously, among which the growth rate of the liquidity staking track is in the leading position. Liquidity staking is a method that allows users to stake crypto assets for returns while still maintaining the liquidity of these assets, and can trade, lend or other DeFi operations through derivative tokens.

In the TON network, the potential for liquidity staking is huge. By converting staked TON tokens into liquidity tokens, users can participate in the governance and security maintenance of the TON network while still maintaining the liquidity of their assets. Liquidity staking can not only improve the decentralization of the network, but also attract more funds to flow into the TON ecosystem, further enhancing the security and vitality of TON.

At present, the TON ecosystem liquidity pledge track is in a relatively early stage. According to DeFiLlama data , the total TVL of the TON ecosystem liquidity pledge track is 303 million US dollars. However, when the author counted, he believed that Ton Whales could also be counted as a liquidity pledge track. According to its TVL of 105 million US dollars, the TON ecosystem liquidity pledge track was updated to 408 million US dollars.

At the same time, according to Tonscan data , the total staked volume of the entire network is 646 million TONs. Combined with the Toncoin price of $5.5 at the time of posting, the TVL of the entire liquidity staked track accounts for about 11.5% of the total staked volume of the TON network. This ratio is relatively low compared to other networks.

Odaily Planet Daily compiled five representative projects in the TON ecosystem liquidity staking track: Tonstakers, Bemo, Stakee, Ton Whales and Hipo, and deeply analyzed the advantages and disadvantages of each project.

Analysis of TON Liquidity Staking Representative Projects

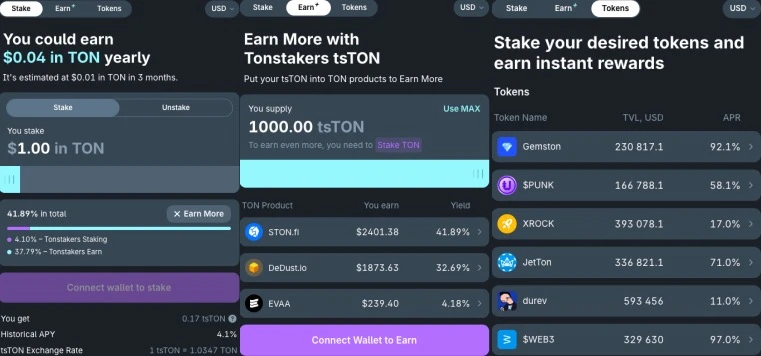

Tonstakers ( tsTON )

トンステーカーズ is a non-custodial liquidity staking protocol on the TON network. It mainly provides users with a low threshold to participate in staking. Users can stake as little as 1 TON. At the same time, there is no lock-up period, deposits and withdrawals are available at any time, and income is obtained every 18 hours. Tonstakers has also passed the CertiK security audit with a score of 94.5/100, ensuring the safety of user funds. And its code is open source, so anyone can review and verify the fairness of the protocol.

At present, the total locked value (TVL) of Tonstakers has reached 197 million US dollars, ranking first in the liquidity staking track. In 2024, the TVL increased by about 511%. The number of pledgers is 69,358, and the APY is 4.1%.

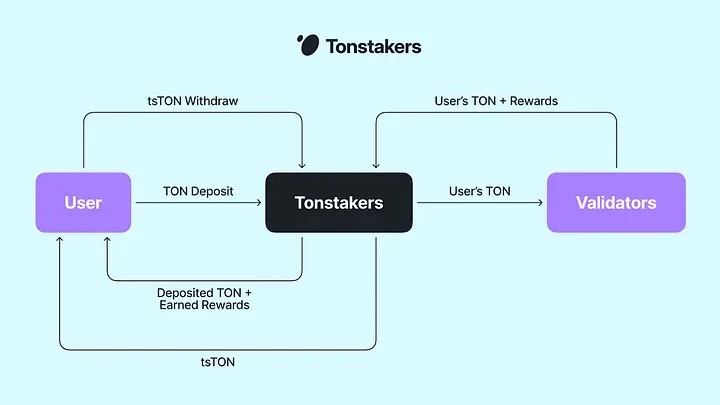

How Tonstakers works: Users deposit TON into the Tonstakers staking pool, and Tonstakers delegates these tokens to cooperating validators for staking. Validators process transactions and generate blocks, and the rewards they receive are returned to the Tonstakers staking pool, after which users can redeem them at any time and receive more TON than they initially invested. This liquidity staking mechanism allows users to obtain tsTON tokens, which represent their share in the staking pool, and users can also use tsTON tokens in other DeFi protocols.

In addition, Tonstakers is integrated with the TON ecosystem DEX to provide one-click tsTON LP returns, and also provides a section for staking new coins.

In order to prevent validators from being sanctioned by the TON network due to illegal operations, Tonstakers protect users from losses through the following measures.

-

Tonstakers select validators with a good operational record and infrastructure to reduce the risk of being slashed.

-

Tonstakers has set up a liquidity staking mechanism that requires validators to return staked tokens and rewards, even in slashing events.

Bemo ( stTON )

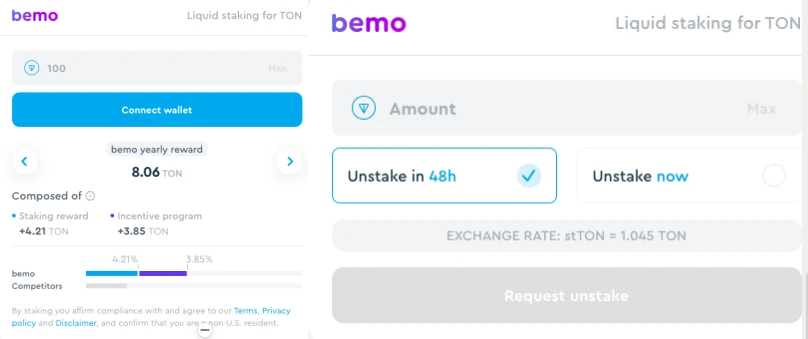

Bemo is a decentralized liquidity staking protocol based on the TON network launched by DWF Labs and Bemo. After staking TON tokens, users will receive stTON tokens. The minimum staking amount of Bemo is 0.1 TON, and Bemo charges a 20% staking reward fee (10% for validators and 10% for Bemo for maintenance and development).

Currently, Bemos TVL has reached 71.01 million US dollars, ranking second in the liquidity staking track. The TVL will increase by about 280% in 2024, and the current APY is 4.21%.

The Bemo protocol manages the deposit and withdrawal of TON tokens, the minting and destruction of stTON tokens, the token allocation of staking nodes, and the collection and allocation of handling fees through smart contracts. The staking process is simple. Users deposit TON through the Stake function of the Bemo application, and the system will generate a corresponding number of stTON tokens for users according to the stTON/Ton exchange rate, representing the users share in the staking pool.

The staked TON will be distributed to the nodes participating in the verification, which are responsible for processing transactions on the TON blockchain and receiving network rewards after each round of verification. After the system automatically deducts the service fee, the reward will be directly injected into the Bemo staking pool, thereby increasing the value of the TON staking pool. This means that the price of stTON will increase as the value of the staking pool grows.

Users can initiate a request to withdraw TON tokens through the Unstake function. There will be a 48-hour cooling-off period after initiation. After the cooling-off period, stTON will be converted into TON tokens at the current exchange rate, and users can withdraw these TONs at any time (mostly above 1). Or withdraw directly, but only 1: 1 exchange for Toncoin.

stTON represents a users share in the Bemo staking pool, and its value grows with staking rewards, while the number of tokens remains constant. The smart contract in the Bemo protocol calculates the price of stTON to TON based on the total amount staked, rewards, and fees, so there is no need to rely on external oracles. stTON is fully backed by the staking pool, ensuring that there is no risk of decoupling within the application.

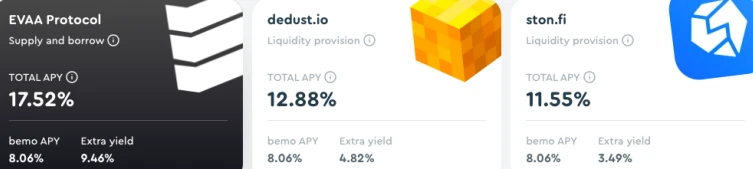

In addition, Bemo also provides DEX LP pool income, but unlike Tonsakers, it is not directly integrated into the DApp. It provides a web API portal where users can first predict the income and then choose a suitable platform.

Finally, Bemo also provides a novel way to play.

stXP is a staking experience token launched by the Bemo platform as part of a user participation incentive program. Users earn stXP by performing actions using stTON tokens, such as minting, holding, providing liquidity for DEX, and lending.

stXP will be converted to the platforms $BMO token in Q4 2024. stXP holders BMO shares are proportional to the amount of stXP they hold, the more stXP they hold, the larger their BMO token share. Bemo will distribute 20% of the total BMO supply to stXP holders, and 10%/15%/20% when the platforms TVL reaches 10m/30m/50m TON respectively.

Users can redeem stXP for $BMO after one of the following two conditions is met:

-

Complete the 12-month stXP accumulation period.

-

The TVL of the Bemo platform reached 50 million TON.

If Bemos TVL reaches the threshold of 50 million TON, the conversion of stXP to $BMO will be completed in 12 months or less, and the proportion of the reward pool will be distributed according to the total stXP pool. Currently, Bemos TVL is 12.79 million TON.

Stakee ( STAKED )

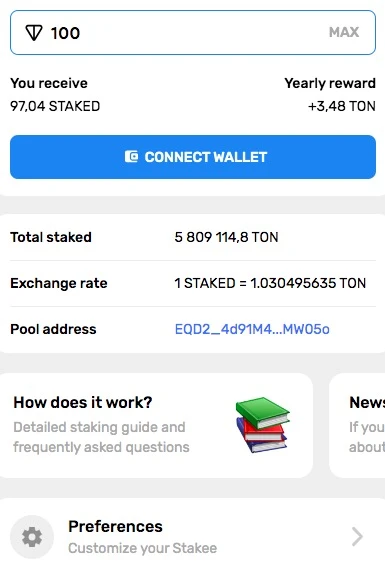

ステーキー is a liquidity staking platform based on smart contracts developed by the TON Foundation. It provides a novel liquidity staking model, where the total staking volume of the platform determines the price trend of its STAKED tokens, and TON staking rewards can also be obtained. The Stakee platform mainly stakes on Telegram. Through the Stakee bot, the wallet can be directly connected, which is more convenient and easier to obtain traffic.

Currently, Stakees TVL has reached 32.24 million US dollars, ranking second in the liquidity staking track. The TVL will increase by about 593% in 2024, and the current APY is 3.48%.

Staking with Stakee is very convenient. Users first need to connect to the TON wallet, enter the amount of TON they want to stake, and then confirm the transaction. After the stake is completed, the user will receive an equivalent amount of STAKED tokens, and the value of the tokens will continue to grow with the staking rewards on the blockchain. The entire process is completed through smart contracts to ensure the security of funds.

However, it is worth noting that its official introduction document does not explain how to delegate TON tokens to validators, and no security company has conducted an audit.

STAKED tokens can not only be used to track users staked shares, but can also be traded on decentralized exchanges (DEX) or used in other DeFi applications. This allows users to maintain liquidity while staking. In addition, users can redeem STAKED tokens back to TON tokens at any time through the Stakee platform and receive accumulated rewards during the staking period.

However, the current price of staked tokens cannot be calculated. STAKED tokens are not seen in most mainstream TON DEX or cryptocurrency market platforms, and it is very likely that they cannot be exchanged for other tokens.

Ton Whales ( wsTON )

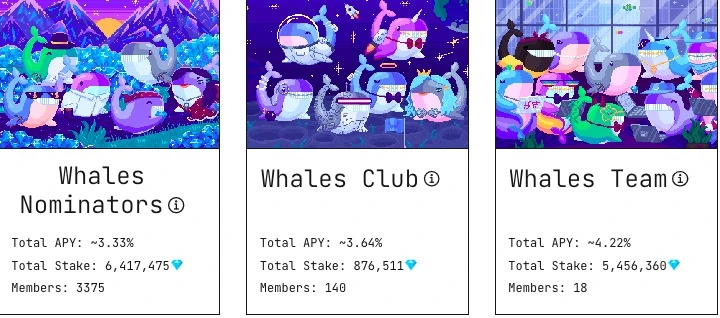

Ton Whales is a deep participant in the TON ecosystem, dedicated to providing users with one-stop blockchain tools and services. Its core products include Whales Stake staking service, Tonhub mobile wallet, blockchain browser, and exclusive club – The Whales Club. Through these products, Ton Whales plays an important role in the TON ecosystem, attracting the attention and participation of a large number of users.

The Whales Club by Ton Whales is a club designed for community members, offering a range of exclusive privileges. To join the club, you must hold a Whales Club NFT, which is limited to 10,000 units. Members holding Whales Club NFTs can participate in the exclusive TON staking pool, enter the clubs private chat room, and receive more benefits from Ton Whales in the future. Currently, the market floor price of Whales Club NFT is approximately 37 Toncoins.

The whales staking service provided by Ton Whales is one of its most important products. Users can deposit TON tokens into the staking pool, and the funds in the pool will be used for blockchain verification. In return, users can receive corresponding rewards based on the staking amount and duration. According to the official website of Ton Whales, the current TVL is 105 million US dollars, and the APY is roughly between 3.33% and 4.22% depending on the different verification pools. And the minimum staking amount is 50 Toncoin.

Ton Whales staking pool manages and distributes funds through smart contracts, ensuring that users tokens are only used for verification operations and that no one can access these funds. During the staking process, TON tokens will be locked for 34 hours, during which time they will be sent to the validator node to participate in verification work and generate income.

The smart contracts used by Ton Whales were developed by the TON Foundation team and have been audited multiple times. In addition, Ton Whales has also launched a bug bounty program, where users who can find bugs in the system that may lead to financial losses will receive generous rewards.

However, Ton Whales also reminds users to avoid staking from custodial wallets (such as exchanges or Telegram wallets) because the special nature of these wallets makes it impossible for smart contracts to return funds. This is the only risk in staking, and users need to pay special attention when operating.

Hipo ( hTON )

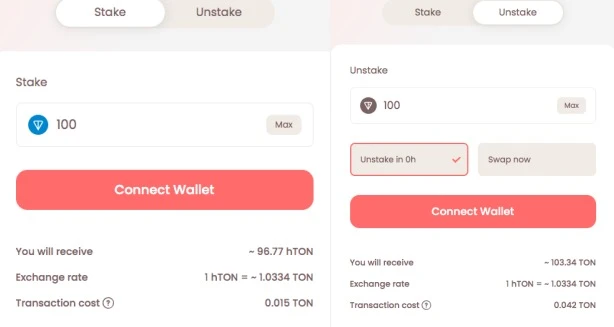

Hipo is an open-source decentralized liquidity staking platform. Through Hipo, users can stake their native Toncoin (TON) and receive Hipo Staked TON (hTON) tokens representing their staked shares. Users can stake as little as 1 TON. The governance and development of Hipo is jointly driven by the community, with users, developers, and validators participating in decision-making. The annualized yield (APY) optimization provided by Hipo is to select the best validators through auctions to ensure that stakers get the highest returns.

Currently, Hipos TVL has reached 3.32 million US dollars. In 2024, the TVL will increase by about 22%, and the current APY is 4.07%.

hTON price dynamics: The number of hTON tokens is fixed, representing the number of staked TONs, but its price increases as the staking rewards are distributed. For example, if you stake 10 TONs and get 10 hTONs, if the rewards increase by 20%, the hTON price will rise to 1.2 TONs, which means your 10 hTONs will be worth 12 TONs.

Hipo adopts a decentralized and permissionless validator model, allowing staked TON to be loaned to validators for verification. Validators participate in the auction by submitting their return on investment (ROI), and the Hipo protocol selects validators with the best ROI, ensuring the best rate of return for stakers and validators.

Users can unlock staked TON at any time through the Hipo app. Users can choose to wait for the cool-down period for unlocking, or trade hTON tokens instantly on DEX. Currently supported trading platforms include DeDust and STON.fi.

The token HPO is the governance token of Hipo. Holders can participate in the governance and decision-making of the protocol. It has not yet been launched.

Hipo Stats is a public dashboard that provides users with key statistics, including hTON price, Hipos TVL (total locked value), etc., to help users make more informed decisions. Users can view hTON price, number of holders, staking APY and other data through this dashboard.

Tonstakers has the largest market share, Bemo offers rich incentives, and Stakee has a novel but risky model.

The above introduces the basic principles and general gameplay of the five major projects. The advantages and disadvantages of each project are summarized as follows:

-

Tonstakers’ DApp products have better user experience, such as revenue prediction and revenue expansion through integration with other DeFi. The perfect risk mechanism is also the reason why it is highly sought after.

-

Bemo has more incentives, especially the design of stXP, which is eye-catching, and the introduction and details of related materials are ahead of other projects;

-

Stakee is mainly based on Telegram mini-programs, and its TVL growth is the fastest, but there is very little information, only one article introducing it, and no relevant mechanism description has been disclosed yet;

-

Ton Whales is a community-based liquidity staking project, but there is a risk of validator penalties.

-

Hipo has excellent documentation and functional components, but the user experience is relatively simple.

Compared with Ethereum and other mainstream blockchain networks, TONs liquidity staking market is still in its early stages of development. Ethereums liquidity staking track is already very mature, and many projects such as Lido and Rocket Pool have already occupied an important position in the market. In contrast, although the number of TONs liquidity staking projects is small, precisely because of its early development stage, users can participate in it in a relatively low-competition environment and enjoy potential high returns.

TONs liquidity pledge is expected to make great progress in terms of capital inflow, user growth, and governance mechanism optimization in the future. For those investors who participated early, this is undoubtedly a good time to seize growth opportunities.

This article is sourced from the internet: Detailed explanation of TON ecosystem LSD track: Tonstakers ranks first in market share, Bemo has rich incentives

関連:良いニュースと悪いニュースが入り混じる:8月の暗号通貨市場を解釈する11のチャート

原著者:The Blockの研究責任者、Lars 原文翻訳:PANewsのJordan 1. 8月、ビットコインとイーサリアムチェーンの調整済み総取引量は15.3%減少して$3770億となり、そのうちビットコインの調整済み取引量は12.1%減少し、イーサリアムは20.2%減少した。 2. 8月、ステーブルコインの調整済みオンチェーン取引量は20.5%増加して$1.2兆米ドルとなり、発行済みステーブルコインの供給量は2.9%増加して$1484億米ドルとなり、そのうちUSDTとUSDCの市場シェアはそれぞれ78.7%と17.4%であった。 3. ビットコインマイナーの収益は8月に$851.4百万に達し、10.4%減少しました。さらに、イーサリアムのステーキング収益も19.3%減少し、$218.2百万になりました。4. 8月に、イーサリアムネットワークは合計13,467 ETHを破壊しました。これは$34.9百万に相当します。データ…