原作者 | On Chain Times

Compiled by Nan Zhi ( アサシン )

導入

Points, points, points.

Since Friend.tech launched the points system last August, awarding off-chain points to early adopters of the protocol has become an industry standard. It can be said that this round of airdrops has been triggered, and many projects have begun to issue tokens in the past year. As with many trends in the crypto space, everyone rushed into this gold rush and eventually the entire industry became too frothy and gradually lost its appeal.

Is the airdrop craze over, or are we just taking a breather?

Conclusion at a Glance

In this article, the author summarizes the token trends of 47 of the most watched airdrop projects in the past two years, and analyzes several top-level projects that have not yet issued tokens. The main conclusions include:

-

Only 23% of the projects rose after the airdrop; (it is more cost-effective to sell them directly after receiving them)

-

Among the 47 airdropped tokens, only AI, Meme, and Modular airdrops had significant gains;

-

Looking at different networks, only Solana’s airdrop has seen a positive increase since TGE, while Ethereum-based airdrops performed the worst.

-

12.7% of airdrop projects outperformed the same ecosystem tokens this year; (If you want to buy, buy old coins for a higher chance of winning)

-

After the airdrop, all Layer 2 data declined, except for Starknet.

-

Linea is expected to airdrop $251 per address, which the author believes is underestimated; (After the Linea co-founder resigned yesterday, it is good to be able to issue coins)

-

The general airdrop value of Scroll is about $27, and the expected return of 16.9% of users is $1,350. The author believes that unless large funds participate in Scroll to cooperate with other projects to kill two birds with one stone, there is little value in participating;

-

Restaking performance is poor, and the author believes it is difficult to achieve excellent performance;

-

Berachain could try to collect a variety of (expensive) NFTs and participate in testnets regularly.

エアドロップ Performance

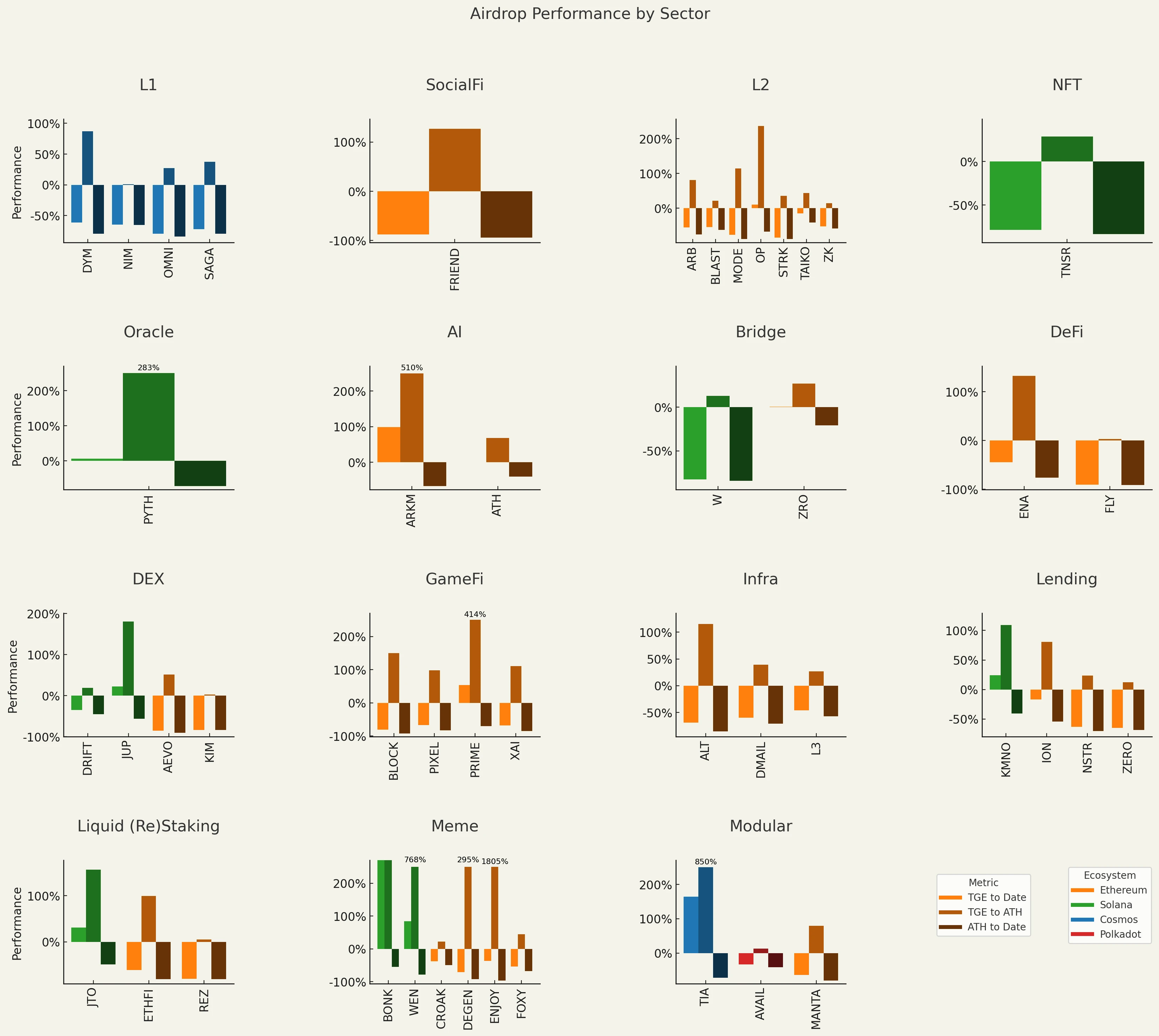

Airdrop tokens are notorious for their “only falling but not rising” performance. The chart below includes 47 of the most watched airdrop projects . As of August 25, 2024, only 11 of them have seen price increases since TGE, with an average return of 49.56% (excluding BONK). Meanwhile, 36 airdrop projects with falling prices have lost an average of 62.15% since TGE.

Some tokens did rise after the TGE, with an average gain of 162.23% (excluding those projects that fell from start to finish and BONK). However, the average retracement rate of these tokens from their all-time high (ATH) was -70.89%.

(Odaily Note: Each token in the figure below has three columns. The first column is the increase or decrease since the opening, the second column is the historical maximum increase after the opening, and the third column is the increase or decrease from the highest point to the present)

Source: CoinMarketCap CoinGecko, as of August 25, 2024.

The trend is clear, except for certain tracks that are popular in this cycle (such as Meme and AI), airdrops since 2023 have mostly been in free fall (even if some of them have risen at certain stages).

Average airdrop token performance from TGE to current, TGE to ATH, and ATH to current. Outlier bars are truncated and highlighted in red. Source: CoinMarketCap CoinGecko as of August 25, 2024.

On average, only AI, Meme, and Modular airdrops have seen significant gains since TGE, with other airdrops underperforming. Meme is the strongest performing sector, up 2,300% on average since TGE, with BONK contributing the most.

In fact, BONK in my opinion saved Solana, or “Soylana” two years ago, from the post-FTX despair. Many Pump.fun users should thank this cartoon puppy.

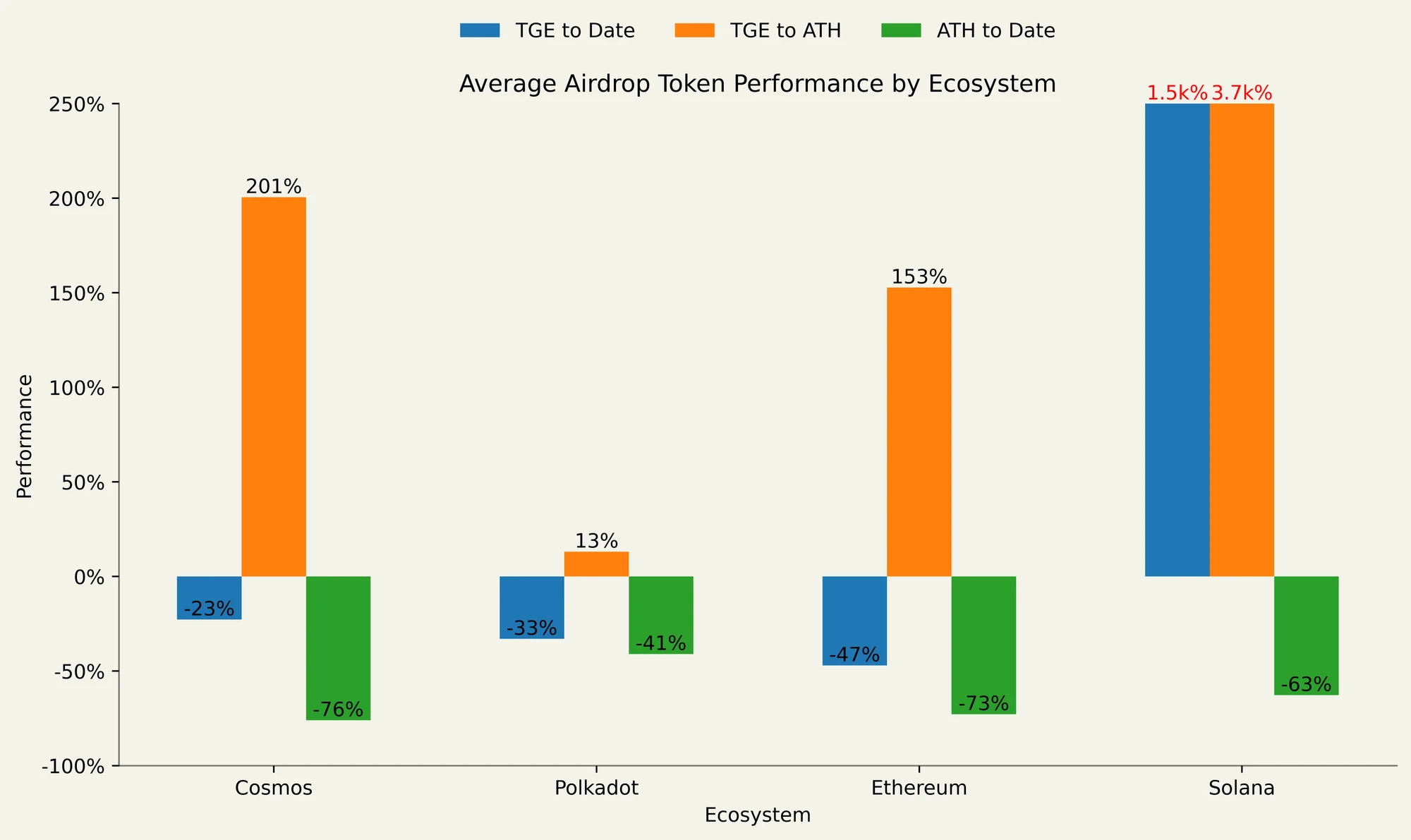

Average performance of airdropped tokens by ecosystem, from TGE to current, TGE to ATH, and ATH to current. Outlier bars are truncated and highlighted in red. Source: CoinMarketCap CoinGecko, as of August 25, 2024.

By ecosystem classification, only Solanas airdrop has increased from TGE to now, which is mainly due to the contribution of BONK . Ethereum-based airdrops performed the worst , while Cosmos-based airdrops fluctuated the most.

Cosmos’ TGE to ATH average gain is 201% (TIA’s 850% gain pushes this higher), and airdrops based on Cosmos were all the rage in Q4 2023. The Cosmos staking airdrop sparked a short-lived secondary trend of “stake airdrops to get more airdrops”, but that trend died as quickly as it started, and with the exception of DYM (down 61.1% post-TGE), there have been no significant airdrops awarded to stakers.

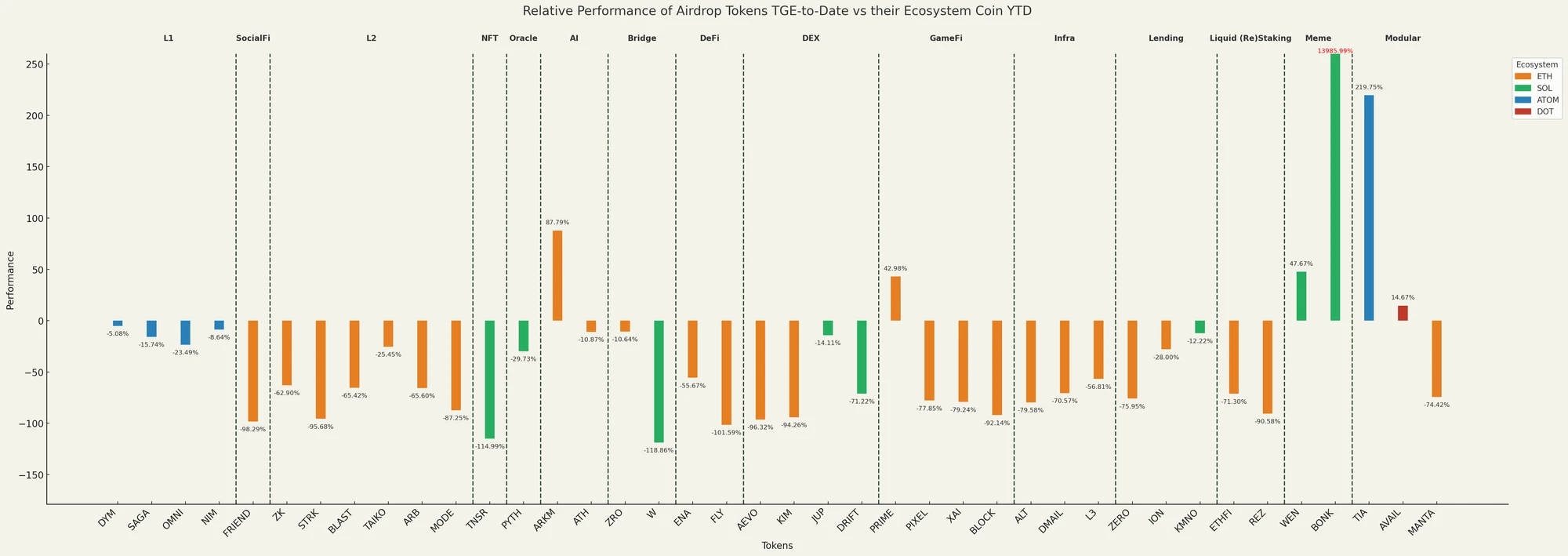

One could argue that the performance so far and the pullback from ATH is due to the overall altcoin market environment rather than an airdrop-specific phenomenon, but when comparing the year-to-date performance of their ecosystem tokens, only 6 of the 47 tokens (half of which are memes or AI) have outperformed their ecosystem tokens.

Relative performance of airdropped tokens from TGE to current year-to-date relative to their ecosystem tokens. Outlier bars are truncated and highlighted in red. Source: CoinMarketCap CoinGecko as of August 25, 2024.

The crypto community (CT) attributes this phenomenon to low circulation, high FDV token economics, complaining that these tokens are only designed as a vehicle for VC exits and are therefore almost destined to go down and not up. While there is some truth to this argument, especially considering that most of the functionality of these tokens is limited to governance rights and their value is unclear, there seems to be a deeper and more worrying problem. Projects that rely on user volume and usage, whether measured by TVL, transaction volume or other indicators, have presented a disturbing picture after TGE.

Layer 2

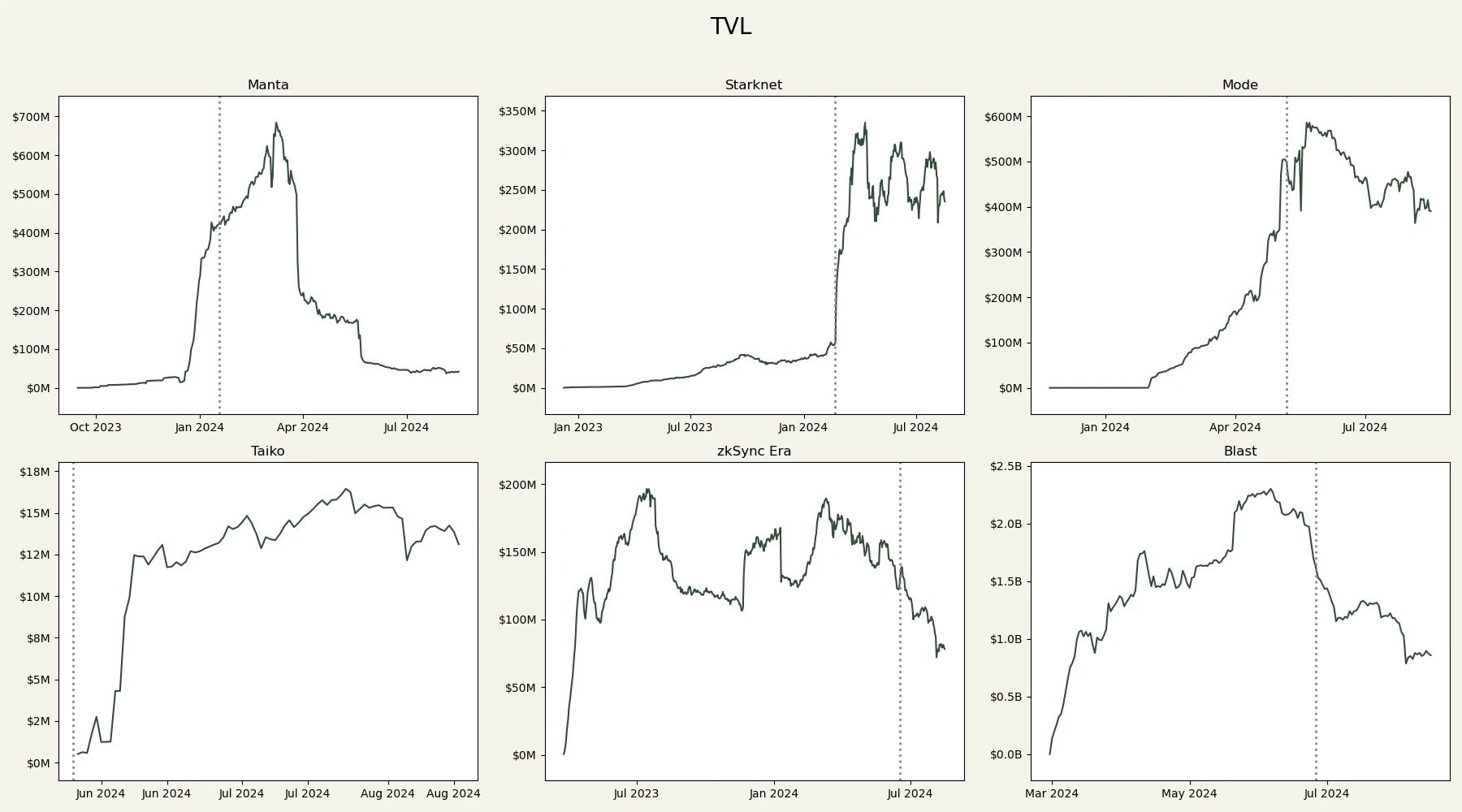

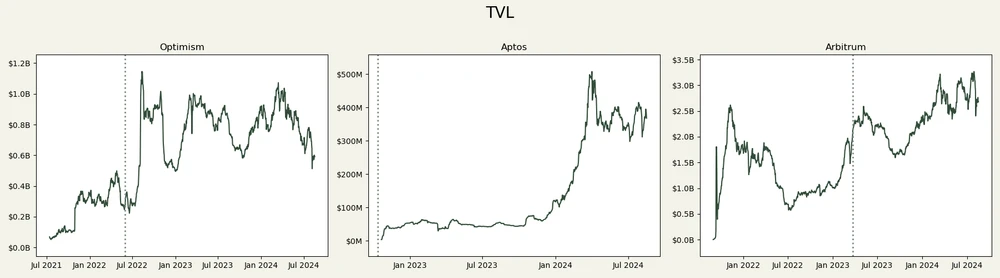

TVL of 2024 airdropped L2 over time, as of August 16, 2024. Dotted line indicates TGE date. Source: DefiLlama.

The much-anticipated new L2 projects have performed poorly in terms of TVL growth, or have shown a trend of “only falling but not rising”.

-

Blast and zkSync Era are the most obvious examples. These two airdrop projects that were once heavily farmed seem to have lost market attention after TGE.

-

Manta Pacific’s initial strong performance can be attributed to their “new paradigm” marketing campaign, which only allowed funds to cross from Manta after March 26, 2024, and since then the chain’s TVL has seen a significant decline, down 94% from its ATH. A similar situation may be happening with Mode, which delayed the 50% distribution to the first 2,000 wallets by 3 months and stipulated that no cross-chain outflows could occur during this period. In addition to this, Mode’s relative strength may also be attributed to its second season points program (which Manta does not have) and its inclusion in Optimism’s Superfest.

-

Taiko chose to conduct TGE when the mainnet was launched, giving the illusion that TGE had a positive impact on TVL, however, its TVL was only $14 million, indicating that the market had little interest in it.

-

It’s important to note that Starknet’s TVL clearly did not follow this trend, and instead surged after the TGE. While this is certainly an impressive performance, its disconnect from market sentiment raises questions. Did Starknet’s last 8 users resurrect Starknet? Before Starknet supporters criticize me, it’s important to note that the data on that Dune dashboard is inaccurate; the number of daily active users on June 4, 2024 was actually 21,200, a 94% decrease from the ATH two months earlier. Starknet raised $282.5 million at an $8 billion valuation, which means its TVL is still 18% less than the amount raised. In contrast, Blast only raised $20 million, but its TVL is 190% higher than the amount raised.

クロスチェーン

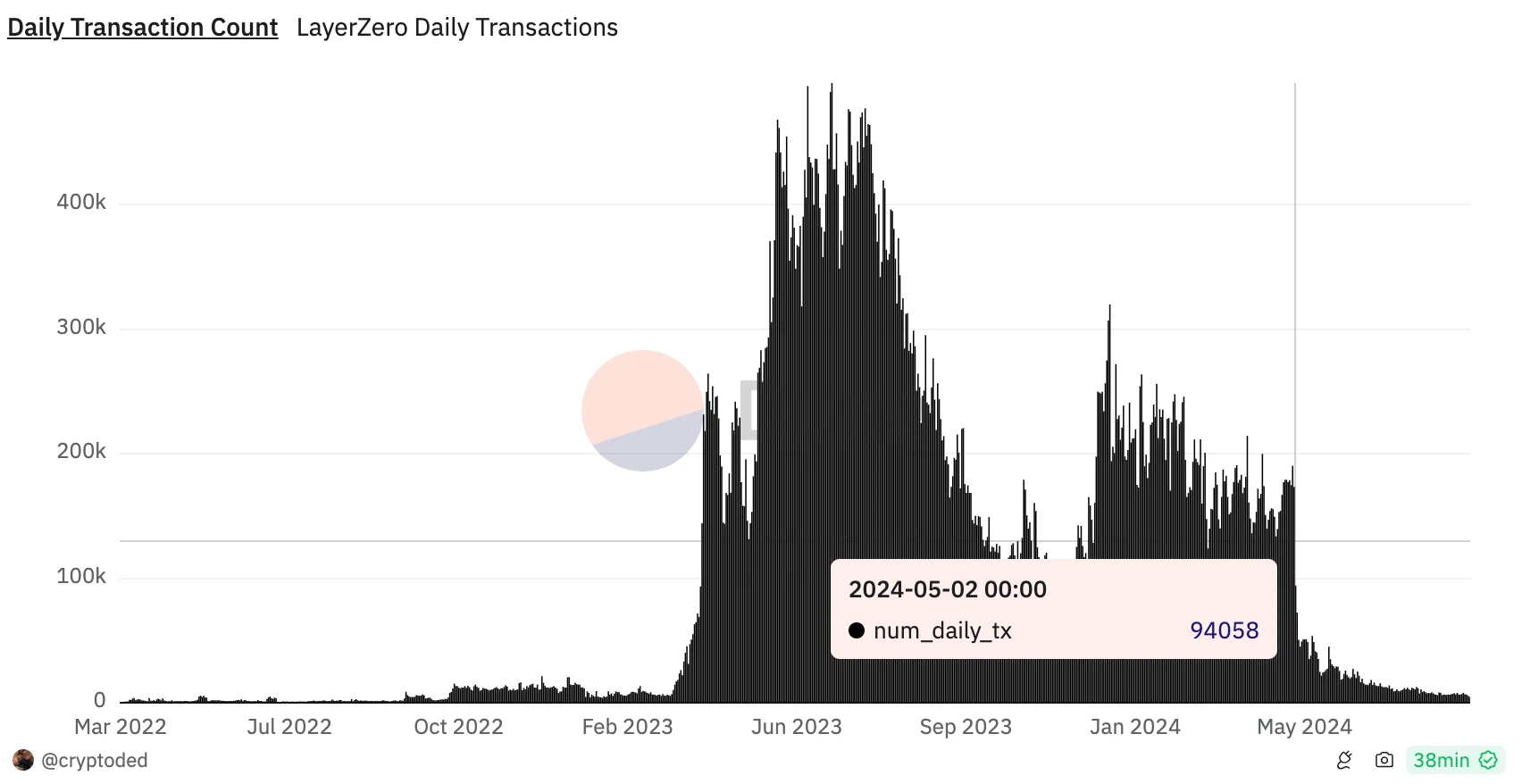

Looking at LayerZero’s daily transaction volume, the picture becomes clearer.

After the first ZRO airdrop snapshot was announced on May 1, 2024, daily transaction volume dropped 52% to about 45,000. Currently, there are less than 7,000 transactions, a 92% drop from May 1.

Farmers, Sybils (whatever you want to call them) have been the driving force behind cryptocurrency adoption in this cycle, or at least creating the illusion of it. While LayerZero is “old school” in that it has no points program, it has long hinted at issuing tokens, so users acted accordingly, trading as much as possible to maximize the airdrop.

These volumes were the inflated numbers LayerZero presented to VCs during its $12M Series B round in April 2023 (Source: CryptoRank).

Comparing the airdrops before August 2023 (which can be said to belong to the previous cycle) presents a completely different picture (of course, here we are discussing the performance of the project, not the performance of the token). Except for Aptos, which must conduct a TGE when the mainnet is launched because its APT is a gas token, Optimism and Arbitrum have been online for more than a year before the release of governance tokens and have developed quite steadily.

This is in stark contrast to the opportunistic environment in this cycle, where many projects accelerated their mainnet and TGE processes in order to get their funding back as soon as possible. At that time, the L2 space was still in its infancy, and it was a far cry from the current situation where there seems to be an L2 launch every month.

Points should be withdrawn

Looking back at some of the largest airdrops of all time (ranked by all-time high value), at least 7 of them were unexpected surprises for those who received them, and this positive sentiment likely contributed to the rapid rise of these tokens after the TGE.

The 10 Biggest Airdrops in Crypto History

Source: Coingecko Research https://www.coingecko.com/research/publications/biggest-crypto-airdrops

In the last cycle, most airdrops were popular because they were seen as “free money”. Intentional airdrop farming became more popular at the end of the cycle, but it is far from becoming a mainstream mindset like this cycle. While Friend.tech’s points system initially sparked market interest, this innovation became a tired old routine in just a few months after every project waiting for the bear market to end so that they could conduct a TGE launched their own points program.

Farming points season after season has become more and more time- and capital-intensive, weakening the appeal of airdrops. Airdrops are no longer free money and now require real costs, which has caused almost every recent airdrop to be questioned at the TGE and fall into a death spiral.

It’s time to let the Points Universe go. If projects can stop explicitly using points and leaderboards to extract all value from “farmers” and the overall market sentiment turns bullish, farmers may benefit again.

Are these top projects still worth participating in?

There are many projects on the way to TGE, so we will only discuss a few (king-level projects) here.

Linea and Scroll

Linea and Scroll are the last two large L2s without tokens (assuming Base does not issue a token), Scroll raised $80 million with a valuation of $1.8 billion, while Linea’s parent company Consensys has raised a total of $725 million with a valuation of $7 billion.

While Consensys has a lot of other projects (including MetaMask), it is certain that Linea has strong financial backing. Compared to zkSync and Starknet, which have raised $458 million and $282.5 million respectively, and are both valued at $8 billion, Linea has at least the potential to deliver a good performance. STRK briefly reached $50 billion in FDV within minutes of the TGE, more than 6 times its valuation, while ZK listed at about $4.7 billion in FDV, becoming a lucrative airdrop for zkSync farmers and developers who accidentally participated in the Starknet hackathon.

Therefore, I think those who participated in Linea Surge or before the launch of Scroll Mark can look forward to a Christmas gift in Q4. If you are a latecomer, you need a lot of funds to catch up, but if you farm on multiple protocols at the same time (for example, providing WRSETH/ETH liquidity on Ambient to farm Kelp, Scroll and Ambient at the same time), it may be worth it.

(Odaily Note: Scroll Mark is a points system launched by Odaily.)

Linea Math Problems

Whales Market data shows that the current valuations of LXP and LXP-L are $0.11 and $0.003 respectively, which means that the average airdrop associated with LXP-L is only $109, and the overall airdrop of LXP-L is approximately $234 million.

OpenBlock Linea Surge Dashboard as of September 2, 2024.

According to @nvthao’s Dune dashboard, most users have 1000-1499 LXP, which means the airdrop is only worth $137 for most users.

Additionally, there’s the Linea Voyage testnet NFT, the Delta version of which is currently priced at 0.00187 ETH (~$5) on Element.

If the expected value is true, the average Linea Farmer can only earn $251 from the testnet voyage, a few mainnet voyages, and 6 surges, which may be close to $150 after deducting gas fees. I personally think that the expected value is too pessimistic, probably due to the trauma of the L2 airdrop. If market sentiment picks up, LXP should be worth at least $0.50.

Still, I think most regular users will be disappointed with Linea because driving transactions isn’t as profitable as it used to be and projects are more focused on TVL.

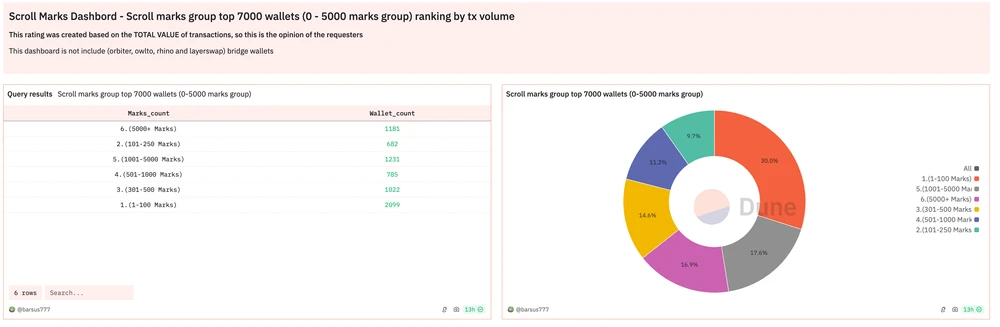

Scroll Math Problem

The math for Scroll is even simpler. According to Whales Market (but with very low volume), the Scroll Mark is currently worth about $0.27, so most wallets with 0-100 Marks are worth about $27, but we are only in the first phase and this number will continue to increase. The number of wallets with more than 5000 Marks is quite significant, reaching 16.9%, with an expected return of about $1350.

@barsus 777 Scroll as of Sep 2, 2024 Tags Dune Dashboard.

Additionally, there is the Scroll Canvas, which is a transaction-based NFT badge. While the project has moved away from allocating large amounts of tokens to transaction-based activities, I find it hard to believe that these badges are not related to the airdrop distribution. Since it is separate from the points program, they may be considered a multiplier for points.

Overall, unless you start interacting with Mark before its released, I think there are better places to put your money. If you can do Mark with a few tens of thousands of dollars, it might be worth a try.

再ステーキング

Of the 7 largest ETH liquid staking protocols, only 2 have airdropped: EtherFi and Renzo. Despite their tokens’ disappointing performance, down 60.4% and 79.7% respectively from the TGE, EtherFi showed considerable strength and solidified its position as the LRT of choice. Meanwhile, Renzo’s TVL stagnated after the TGE and began to decline sharply a few months later. This is likely because withdrawals were not allowed until June, leaving many farmers stranded when ezETH depegged on the open market.

The other major LRTs haven’t seen much growth since the airdrop craze died down, so I doubt there will still be good performance.

We are still waiting for EIGENs TGE, but with the pre-market price on Whales Market at $3.62, most farmers would earn less than $400 even with an extra 100 EIGEN. We may see Karak and Symbiotic TGE before EIGEN, but it would take a lot of capital to exchange these projects.

Berachain and Monad

Finally, two of the most mysterious and anticipated projects we’ve seen: Berachain and Monad. CT has been very involved with both of these projects over the past 6 months, but it’s unclear how exactly they will interact, and there’s no mainnet launch date in sight. Considering they raised $142 million and $244 million respectively, with the former valuing the project at $420.69 million (haha), it’s sure to be a treat for those who got their airdrops.

Starting with the relatively less mysterious Berachain, collecting various (expensive) Bera NFTs and gaining exclusive Discord characters will likely yield the biggest rewards. If you don’t like trading NFTs, your best bet is to regularly interact with the major DApps on the testnet (BEX, BEND, BERPS, etc.). Collecting badges through TheHoneyJar’s missions is a good way to do this, although they are not directly affiliated with Berachain. That being said, testnet interactions may end up being fruitless (always remember the lesson of Sui).

Monad is basically a cult, and at least for now the only way to interact is to build reputation on its social platform because there is no testnet yet.

This article is sourced from the internet: Digging deep into airdrop data: Should you sell or keep the coins after receiving them? What is the interactive value of the king-level projects that have not yet issued coins?

Original author: Nancy, PANews Ethereum’s 10th anniversary has ushered in a milestone, with 9 spot ETFs finally “passing customs” and being approved, and 8 issuers have won the victory of mainstreaming Ethereum after years of regulatory resistance. On the first day of listing on July 23, the trading volume of Ethereum spot ETF exceeded $1 billion, which is 23% of the $4.6 billion trading volume of Bitcoin spot ETF on the first day in January this year. Although the rise in market demand will drive up the price of crypto ETFs, the competition between homogeneous products is bound to be fierce, which has been reflected in the market structure of Bitcoin spot ETFs. Among these issuers, the crypto-native institution Bitwise does not have the appeal of traditional giants such as…