4 Alpha Research Researcher: Stitch, Cloris

Will Trump be elected president? Will the US economy fall into recession? Will the Solana ETF pass this year? When will GPT 5 be released? Will the iPhone 16 have a huge upgrade? There are too many problems in this world that are closely related to life. These problems can be big or small, but they all have one thing in common, that is, search engines can never provide answers to them. Prediction markets provide a supplement to search engines, allowing people to get conclusions instead of analysis. All analysis is hidden behind the winning rate. The views of this article do not represent any investment advice

What is a prediction market?

The prediction market is a trading market. Compared with general betting platforms, the prediction market focuses mainly on events. Users can buy and sell contracts on the outcomes of future events. It is essentially a binary options market. The winners gain profits from the losers betting amounts according to a proportion, while the losers lose all their principal.

By buying and selling contracts, users are actually betting on what they think is the probability of an event, so the price of the contract reflects the markets view on the probability of an event occurring.

The goal of the prediction market is to use the trading behavior of many users to exert the collective wisdom and reflect the accurate assessment of the probability of an event. For example, if the contract price of the event Trump is elected as the US President is 60 yuan, it means that the market believes that there is a 60% probability of this happening.

Disassembling Polymarket, the hottest prediction market

Polymarket is a prediction market built on Polygon, which allows users to purchase USDC for betting directly through Moonpay using traditional payment methods. There is no need for complex operations such as binding a wallet, and it does not involve concepts such as Gas and signatures. It is friendly to non-Web3 users.

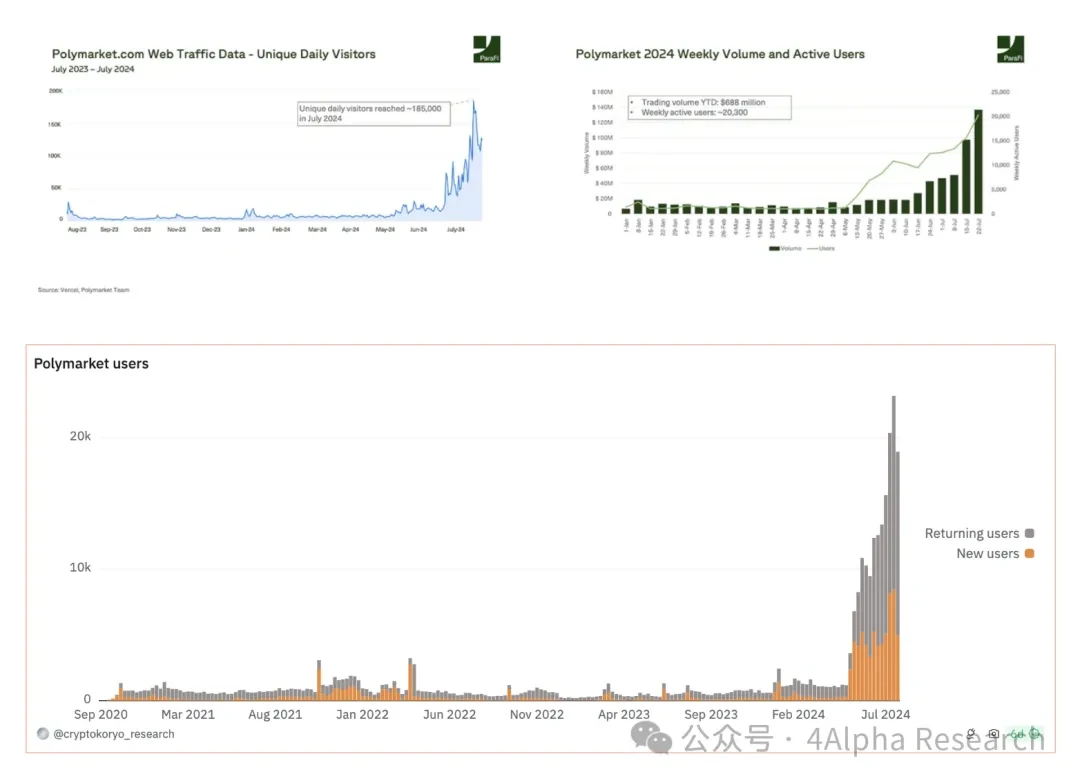

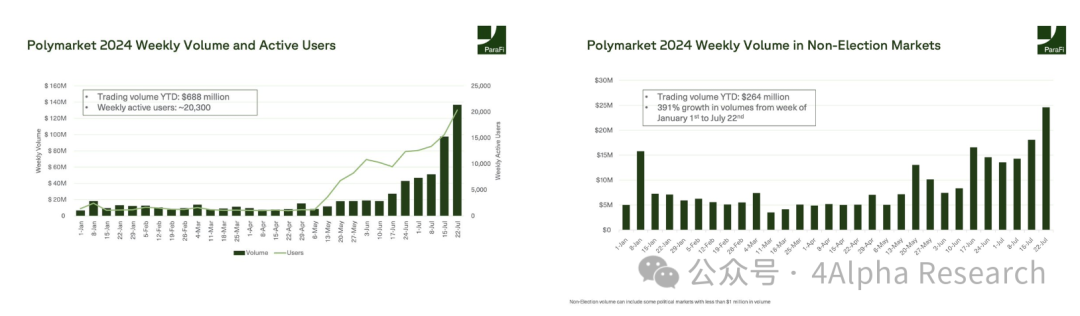

Currently, Polymarkets data is performing well, with bets reaching $387 million in July and daily trading volume reaching millions of dollars. The US presidential candidate alone has more than $550 million in unsettled contracts. According to Dunes data, the number of active users of Polymarket has continued to grow this year, with the highest weekly active users exceeding 23,000. Currently, Polymarket has become an important reference for public opinion in the presidential election, and even Trump himself has repeatedly forwarded data on his leading winning rate on Polymarket.

The rise of Polymarket is inseparable from some favorable conditions, such as:

1) Enough high-quality events: 2024 will always be a hot topic, from Bitcoin and Ethereum ETFs to the US election, the Olympics, etc.

2) The crypto market is more closely connected with policies, regulations, and the economy: In the past one or two years, the biggest factor causing price fluctuations in the crypto market is often not the development of the crypto itself, but changes in external macro factors. This has also led more Crypto Native users and funds to pay attention to macro changes and prediction markets, because prediction markets provide simple conclusions for many macro factor topics.

3) Better infrastructure: When the concept of prediction markets became popular in 2019, custodial wallets, deposit and withdrawal services, and public chains were not perfect, which restricted user access. At that time, many prediction markets were built on Ethereum, and problems such as difficulty in recharging and inability to place bets often occurred.

In addition to the right time and place, Polymarket has also made many product optimizations compared to the prediction markets in previous cycles.

Past prediction markets usually have the following pain points:

-

The entry barrier is too high, the infrastructure is not perfect, and you need to understand the concepts of wallet use, etc.

-

The product is complex and difficult to understand. The prediction market is a combination of casino, options and other models, which is easy to be designed too complicated

-

Insufficient liquidity and counterparty

-

It is difficult to strike a balance between freedom and clear standards in event creation

-

Regulatory risks: Prediction markets have existed since ancient times, but they have always been restricted by centralized power.

-

…

Although Polymarket has not been able to completely solve the above problems, it has still made some innovations or optimizations to address these pain points.

1) Optimize product UIUX as much as possible to lower the threshold for use

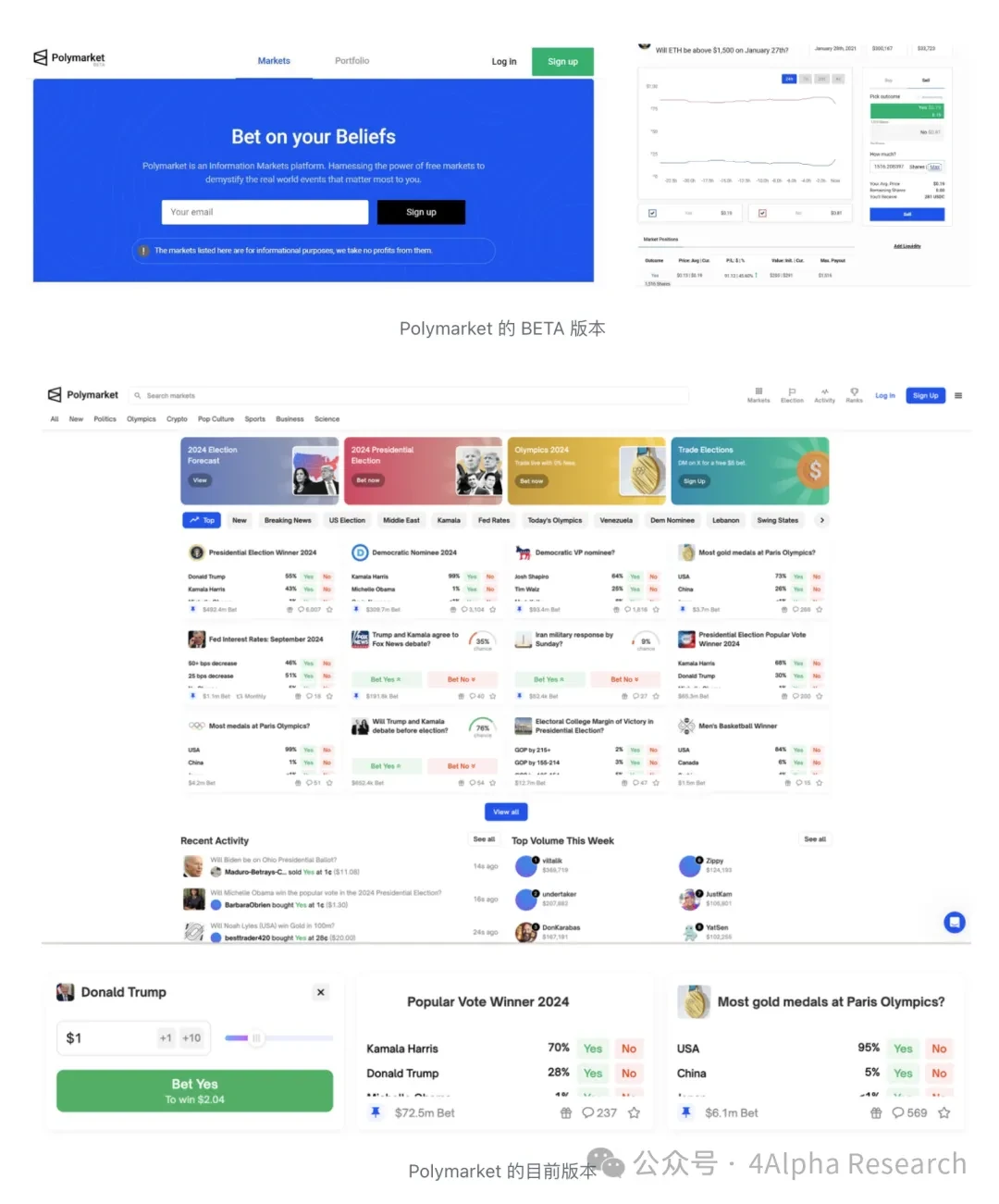

We can collect some data charts to compare the user experience of Polymarket a few years ago and the user experience today.

Comparing the Beta version of Polymarket with the current version, you will find that the current Polymarket is easier to use and has a smoother path. For example, the current homepage directly includes all the most popular events on the platform, and users can place orders directly without entering the secondary page; at the same time, the users participation logic revolves around how much to invest expected returns rather than the cost of each bet; the probability of winning each bet, expected returns, pool size and other data that may need to be referenced before placing an order are also fully displayed. The platform also supports the creation of wallets and deposits using the registration and payment methods of Web2, and there is no need to understand the concepts of blockchain and Gas when using it.

2) Abandon mechanism innovation and provide liquidity through incentives

In some senses, prediction trading and the NFT market are very similar. Any event can be traded on any prediction platform. It can be said that liquidity is one of the decisive factors affecting user choices, because sufficient liquidity not only allows users to profit from correctly predicting the results of events, but also from fluctuations in the markets judgment of events.

Polymarket uses the order book as the mainstream settlement method. Market makers can provide liquidity by placing limit orders to get rewards. The closer the order price is to the market price, the more rewards they will get. Does this model sound like Blur? In fact, all positions held by Polymarket users are in the form of ERC 1155, but the inspiration for this liquidity incentive actually comes from dYdX.

3) Maximize content supply and decentralized settlement

There is a set of special channels in the Polymarket community for community members to provide event suggestions, so that the team can always keep an eye on various events around the world to ensure the continuity of the platforms content supply. At the same time, UMAs oracle is used to decentralizedly solve the settlement problem of events. A rich supply of events is the basis for ensuring the long-term survival of the platform, because popular events such as the US election and the Olympics are not common, and events themselves are content rather than gameplay, and cannot exist for a long time like slot machines and baccarat. Therefore, whether consumable content can be continuously and quickly provided will directly affect user retention.

From these aspects, Polymarket has to some extent solved some of the problems faced by the Crypto trading market in the past, laying the foundation for its explosion; in addition to products, Polymarket has also invested a lot of money in user marketing, including Reddit channels and WallStreetBets.

Even though Polymarket has done so much, it still has some imperfections. Future innovations in the prediction market may also start from these aspects:

1) Insufficient liquidity will be a long-term problem

Events will eventually have clear results and are not completely manipulable. Market making for events relies on understanding the events themselves. If it is just for incentives, blind market making is likely to lead to losses. The requirements of the prediction market for liquidity providers are different from other markets.

2) トークン Utility is difficult to design

Because stablecoins must be used for betting, otherwise the value of the bill will fluctuate, affecting the prediction results. Therefore, when designing tokens, it will be more difficult to empower the tokens and integrate them into the core gameplay of the platform. If the platform tokens are only used as governance tokens or liquidity incentives, they may face a situation where the token price continues to fall and in turn affects the platform traffic.

3) Low conversion rate and difficulty in acquiring customers

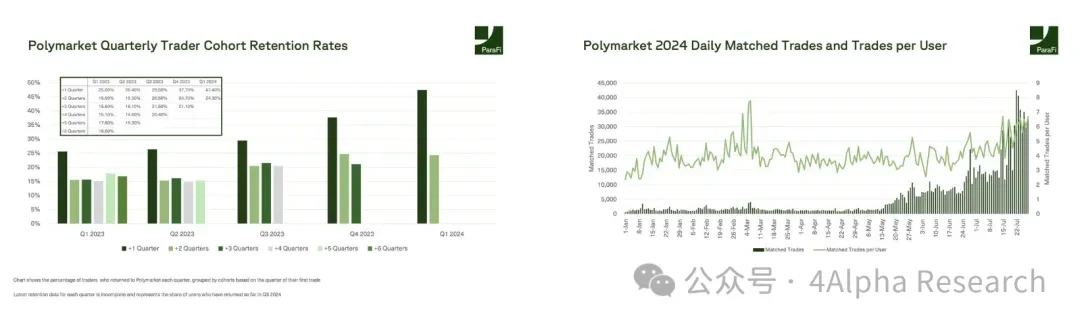

The prediction market category currently does not seem to have a high conversion rate. The left side of the figure below shows the traffic changes of the Polymarket website. The highest number of independent visitors in July was close to 200,000, but the highest number of weekly active users in July was only 20,000. In addition to the low conversion rate from visits to new users, the conversion rate from new users to transactions is also low. The number of active users in May doubled, but the transaction volume did not increase accordingly, which illustrates this point from the side. We speculate that the high threshold for participation in the prediction market and the gameplay close to gambling may be potential reasons.

4) Still far from decentralization and fairness

Polymarket currently uses a settlement mechanism based on the decentralized oracle UMA for fairness. UMA resolves disputes based on token voting and confirms the results of events. This involves certain centralization risks and can only be relatively fair. A famous controversial event was about whether the ETH ETF would be approved. In the end, the community did not foresee that only the 19 b-4 form was approved at the time, not including the S-1. In the end, under the UMA mechanism, it was unanimously agreed that the 19 b-4 was also considered approved. Since events are usually off-chain and sometimes do not have a clear settlement point, similar events will occur repeatedly.

5) Event Gaming is not pure gambling, and it is difficult to increase participation in non-election related events

Data shows that as of the end of July, election-related event transactions on Polymarket accounted for 61.63% of the platforms total transactions this year, and this proportion has recently continued to increase with the influx of new users, reaching a maximum of around 82%. Before May, the platforms election-related event transactions were around 50%, which may mean that a large number of new users are focusing on election-related events.

We believe that the core reason behind this is the high difficulty of event prediction, which leads to a high threshold for participation. Participating in event gaming may even be more difficult than MEME hype, because event gaming is not pure gambling. On the one hand, stable and mature fields such as sports and e-sports already have too many competitors and fixed audiences, and the prediction market has no advantage in competing for these users; on the other hand, events outside of sports and elections are often different from each other, which increases the difficulty for users to participate.

It is inevitable that the popularity will decline after the US election, but the platform has long-term stickiness, and this round of explosion has left a lot of accumulated

Considering the recent election-related event trading volume, which can account for up to 80% of all event trading volume on the entire platform, it is almost inevitable that the prediction market will decline in popularity after the US election. However, even so, the prediction market is by no means a flash in the pan. This category will continue to develop while constantly solving the above problems. The reasons are as follows:

1) Prediction markets have a solid user base. Prediction markets are not new. The earliest modern form originated from the Iowa Electronic Market in the 1980s, which was used to predict the US presidential election. Subsequently, prediction markets gradually attracted the interest of academia and business, and were applied to finance, business decision-making, and public policy. With the development of the Internet, online prediction markets such as Intrade and PredictIt have become more and more popular. There are similar platforms all over the world. However, due to regulatory issues, these platforms are generally either closed or can only be bet with worthless points, which cannot reach their maximum potential. As the Crypto version of the prediction market gradually improves, the golden age of the prediction market is bound to come.

2) The election will end, but political topics will not. Therefore, although the attention to the event will decrease, the supply of events will never be a problem, and prediction markets such as Polymarket have come in cycles. On the other hand, the world is moving forward in instability, and geopolitical conflicts and economic crises are all affecting peoples nerves. In the turbulent and information-exploding era, peoples demand for conclusions will always keep a certain amount of traffic in the prediction market.

3) User stickiness is getting stronger, and 15%-25% of users are converted into long-term users. Since Q3 2023, the long-term retention of new users has increased significantly, indicating that the product logic has been verified before the explosion; in addition, with the influx of a large number of new users, the average number of transactions completed by users has not decreased, and even showed an upward trend in July, which also indirectly shows that the platform has a high retention rate and participation of new users, and the average number of transactions for the overall users has not been lowered due to the increase in the proportion of new users.

The prediction market deserves long-term attention. In our opinion, the prediction market based on Crypto still has three major potentials that have not been fully explored:

1) Everyone can create events and have ample liquidity: Dragonflys Schmidt once said, Polymarkets ultimate secret weapon is that the platform will allow ecosystem participants to independently create new bets, and it will be difficult for competitors in the traditional financial field to replicate this model. Its like YouTube to TV. As of now, this has not been fully implemented on Polymarket. We look forward to the emergence of a platform that can combine the contradictions of event creation and liquidity provision. Perhaps, we have to wait for the intervention of AI.

2) A media where everything is predictable. Prediction markets are still subject to ethical and policy restrictions. In June 2023, a tweet about the disappearance of the Titan submersible went viral, and users on Polymarket bet more than $300,000 on whether the missing submarine would be found before June 23. This triggered ethical criticism of the profit-making nature of prediction markets, and the attack of making money from death forced Polymarket to respond and clarify. This invisible ethical pressure will limit the creation of events, but if you think about it from another perspective, and regard profit-making as the cost of calling on group wisdom, you will be much more tolerant of the range of topics that the prediction market can accommodate. Prediction markets have the potential to become the provider of the richest thematic content, and even evolve into a new social media where discussions and predictions can take place in one place.

3) As a supplement to search engines, prediction markets provide the conclusions most needed in the era of information explosion. Many advocates of prediction markets would say that prediction markets will provide the truth that people need, but this statement somewhat exaggerates the role of prediction markets, because collective wisdom is still far from the truth. However, prediction markets can still provide an important thing, namely, conclusions. In our opinion, win rate is something similar to K-line. It only provides numbers, but contains all the analysis. It is the crystallization of collective wisdom. In many cases, such a clear conclusion with probability is enough to assist people in making judgments.

Other lessons from the popularity of Polymarket

The end of the prediction market has not yet arrived, and it is still unknown whether Polymarket can become the final winner, but its development history can still give market participants a lot of inspiration, such as:

-

Focusing on applications, the imperfection of infrastructure is no longer an excuse for the lack of excellent crypto applications: prediction markets in the past were indeed limited by the price and performance of Ethereum, but now there are enough alternatives, and Polymarket is even built on the previous generation of expansion solutions such as Polygon. Therefore, even if the current infrastructure may still not meet the needs of tens of millions of daily active users, it is enough to create excellent consumer products that can verify the needs of a small range of users.

-

The infrastructure to lower the threshold is basically sufficient, whether it is fiat currency exchange, email registration or gas-free interaction, it is time to look beyond Crypto users

-

Maybe you don鈥檛 need to rush to look at the global market, maybe you can focus on a certain market to verify product demand: Before Polymarket was banned in the United States, more than 80% of its users and traffic came from the United States. The openness of Crypto makes it easy for entrepreneurs to look at global users right away, but in the end, the manpower limitations of startups make it easy for the promotion target to become global on-chain users. This user scale has not increased for many years, and the demand is relatively single and profit-oriented, thus entering an extremely fierce stock competition.

-

For startups, it is important to decide the right time to disclose financing news. The opportunity to gain attention is limited, so keep a low profile until the product is ready.

The content of this article is only for information sharing, and does not promote or endorse any business or investment behavior. Readers are requested to strictly abide by the laws and regulations of their region and not participate in any illegal financial behavior. It does not provide transaction entry, guidance, distribution channel guidance, etc. for the issuance, trading and financing of any virtual currency or digital collections.

4 Alpha Research content is not allowed to be reproduced or copied without permission. Violators will be held accountable for legal liability.

This article is sourced from the internet: 4Alpha Research: In-depth analysis of Polymarket鈥檚 prediction market future development?

Related: Weekly Editors Picks (0831-0906)

Weekly Editors Picks is a functional column of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news, and pass you by. Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days, and bring new inspiration to you in the crypto world from the perspectives of data analysis, industry judgment, and opinion output. Now, come and read with us: Investment and Entrepreneurship Web3 Financing Report 2024: Public sale projects account for more than 80%, retail investors gather together for warmth Projects that take a…