Bitcoin ended August with a drop of 8.6%, and as September began, the market began to discuss seasonal trends. Statistics show that BTC has fallen an average of 4.5% in the past six Septembers. If this trend continues, BTC may fall to $55,000, but strong support is expected around $54,000.

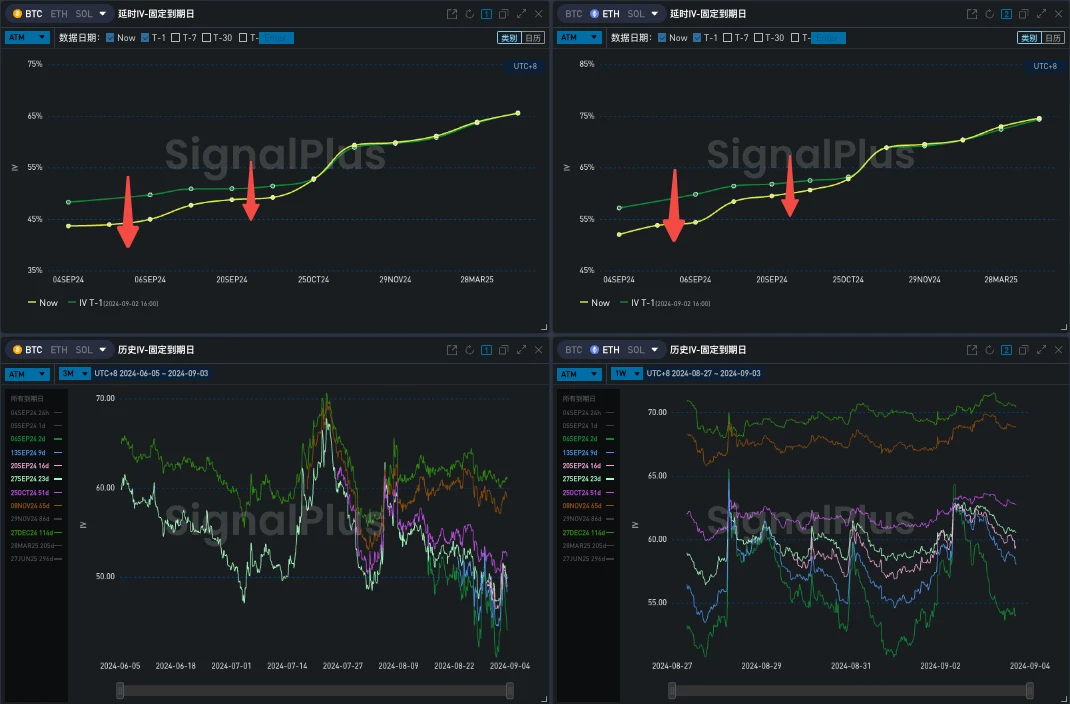

Judging from the local price changes, BTC fell to its lowest point in a week the day before yesterday and was supported around US$57,000. It rebounded to around US$59,000 during the day. The change in implied volatility was negatively correlated with the price. After the price rebounded today, the term structure steepened, and the front end gave up 2-3% of the vol increase, which was slightly lower than the median of the past three months, basically the same as Hourlys RV, and there are not many opportunities in VPR.

Source: Deribit (as of 2 MAY 16: 00 UTC+ 8)

Source: SignalPlus, term structure steepens

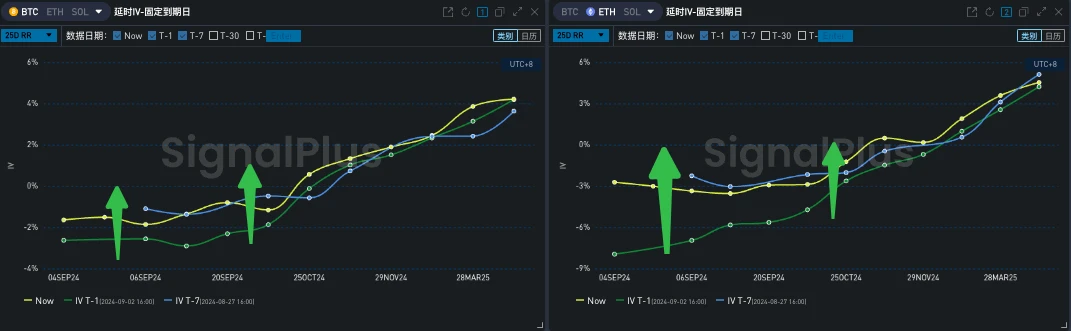

From the perspective of Vol Skew, the long-term bullish sentiment maintained a high level, and the positive correlation trend between the mid-to-front-end Risky and the price was significant. However, it was worth noting that the increase in BTC and ETH yesterday was quite different. From a macro perspective, the massive outflow of funds from BTC ETF, the selling pressure implied by the negative Coinbase premium index, and the dilemma of declining profits faced by miners cast a shadow on the market sentiment. From the perspective of Flow, ETHs short-term bullish demand helped push up the Risky premium. Although there are still long-term bullish buys on BTC, the selling on the front-end Top Side Wing caused by this round of price increases has undoubtedly suppressed the increase in its Skew.

Source: SignalPlus, Risky rebound

Data Source: Deribit, BTC ETH transaction distribution comparison

Source: SignalPlus, Block Trade

t.signalplus.com の SignalPlus トレーディング ベーン機能を使用すると、よりリアルタイムの暗号通貨情報を入手できます。最新情報をすぐに受け取りたい場合は、Twitter アカウント @SignalPlusCN をフォローするか、WeChat グループ (アシスタント WeChat: SignalPlus 123 を追加)、Telegram グループ、Discord コミュニティに参加して、より多くの友人とコミュニケーションおよび交流してください。

シグナルプラス公式サイト: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240903): BTC Stress Resistant Month

Original author: Christine, Galaxy Research Original translation: Ismay, BlockBeats Editors Note: As Ethereum gradually shifts to a Rollup-centric development roadmap, the importance of its protocol changes is gradually diminishing. This article delves into the reasons for this shift and its potential impact on the ecosystem. By analyzing the changing priorities of Ethereum protocol developers, the author reveals that as Rollup matures, the direct impact of protocol-level changes on users will decrease. The article also quotes the views of Aya Miyaguchi, executive director of the Ethereum Foundation, emphasizing the risks and necessity of reducing the roles of protocols and foundations. At the same time, this article points out that the core building blocks of future finance are being built outside of the protocol, and Rollup and other innovative technologies will gradually…