Yesterday, the US employment data was significantly lowered as expected, but BTC did not react to it at the beginning of the US market, indicating that the market has already digested this information. The current focus is still on the speech delivered by Federal Reserve Chairman Powell at the global central bank conference held in Jackson Hole, Wyoming on Friday. Economists believe that the theme word this time may be gradual, and Powell may only give the green light for future interest rate cuts in a relatively cautious and general manner. According to Jinshi, Carl Tannenbaum, chief economist of Northern Trust, believes that Powell will convey another message to investors, telling them not to overreact to the data. The non-agricultural report at the beginning of this month shook the global financial markets, but he believes that the reaction to the employment report is one of the worst market overreactions I have seen in a long time. The market rushed to accept the idea that the economy is in recession, and this is just based on one data point. They are just looking for a narrative, and then they create one based on a job data. For Powell, the current Fed is in the final stage of fighting inflation against the backdrop of the US election. To reduce inflation and complete a soft landing without a recession, the next few months will be crucial, so he will be extremely cautious.

出典: TradingView

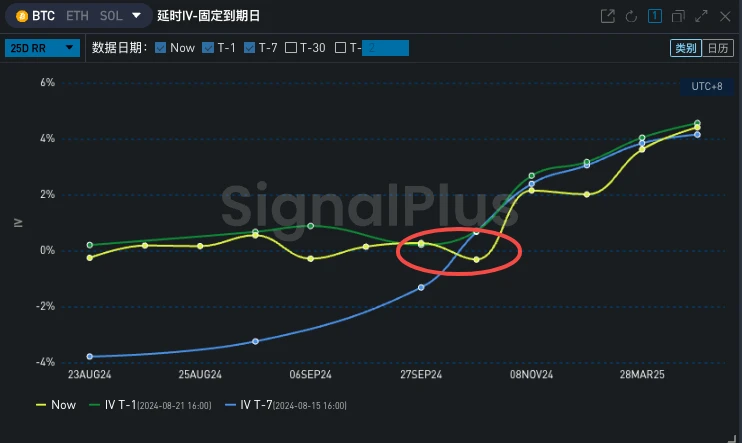

Back to digital currency, BTC formed a V-shaped trend during the day. At 3 a.m., liquidity collapsed and triggered a spike, falling below 6 w. In terms of options, the IV of 25 Aug formed a local high on the surface under the uncertainty brought by the upcoming global central bank annual meeting, but because most economists expected Powell to take a relatively cautious stance, there was no excessive risk premium.

Source: Deribit (as of 22 AUG 16: 00 UTC+ 8)

出典: SignalPlus

In the past two days of transactions, the demand on the bearish side in September and late October continued to rise, concentrated on the two support levels of 55000/56000, causing the local Skew to tilt to the bearish side. In August, there were large-scale bearish selling on Wing, which may be the markets positive response to the recent price increase and the sharp return of the front-end RR.

Source: SignalPlus, BTC Skew and Transaction Distribution

t.signalplus.com の SignalPlus トレーディング ベーン機能を使用すると、よりリアルタイムの暗号通貨情報を入手できます。最新情報をすぐに受け取りたい場合は、Twitter アカウント @SignalPlusCN をフォローするか、WeChat グループ (アシスタント WeChat: SignalPlus 123 を追加)、Telegram グループ、Discord コミュニティに参加して、より多くの友人とコミュニケーションを取り、交流してください。SignalPlus 公式ウェブサイト: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240822): Playing Tai Chi

Original author | Arthur Hayes (BitMEX co-founder) Compiled by Odaily Planet Daily ( @OdailyChine ) Translator| Azuma ( @azuma_eth ) Editors note: This article is a new article Water, Water, Every Where published by BitMEX co-founder Arthur Hayes this morning. In the article, Arthur outlines the tendency of US Treasury Secretary Yellen to use Treasury bonds to withdraw the Federal Reserves reverse repurchase funds and bank reserves, and explains how the flow of these funds will improve the market liquidity situation. Arthur also mentioned the impact of this trend on the cryptocurrency market and predicted the markets next trend and the price performance of mainstream tokens such as BTC, ETH, and SOL. The following is Arthurs original text, translated by Odaily. Because Arthurs writing style is too free and easy,…