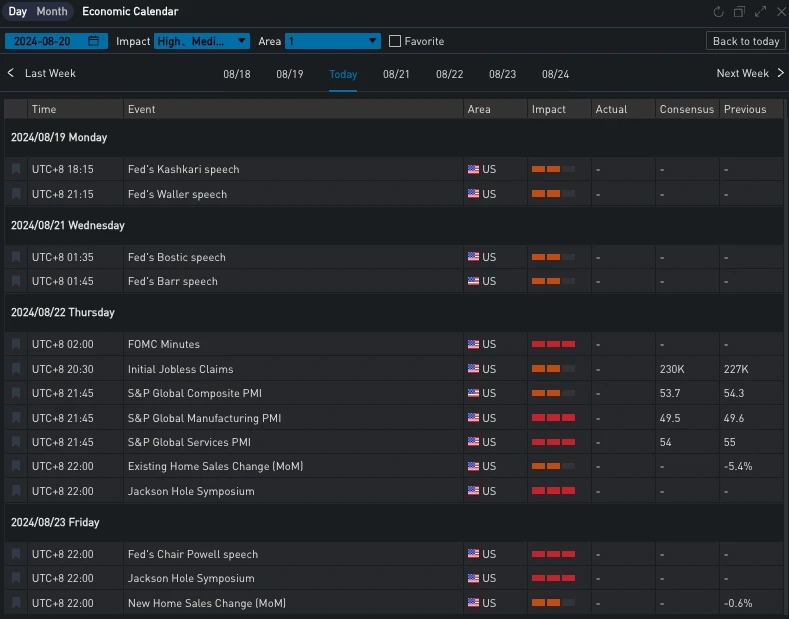

According to the New York Feds July survey on labor market expectations, the proportion of respondents who are worried about losing their jobs in the next four months has increased from 3.9% last year to 4.4%, the proportion of people who expect to change jobs has increased to 11.6%, and the proportion of workers who have been looking for jobs in the past four weeks has increased to 28.4%… A series of indicators in the report have shown cracks in the labor market! This is undoubtedly a worrying phenomenon. Although the number of people applying for unemployment benefits is still relatively low and last weeks retail data performed well, economists continue to issue warnings, pointing out that when the economy is at a turning point, the slowdown in the labor market tends to be relatively early, and the economic growth data cools down later. The focus of the market this week is on Federal Reserve Chairman Powell, who will face a completely different dilemma at the Jackson Hole meeting than the previous year. Considering the recent reassuring inflation data, Powell may remind everyone to pay more attention to employment issues than predicting how much interest rates will be cut in September. The Federal Reserve will receive a revised job growth data on Wednesday, which may show that job growth from last year to the beginning of this year is weaker than before. In addition, the non-farm data at the beginning of next month will inevitably be the focus of attention in determining market sentiment and trends.

Source: Economic Calendar

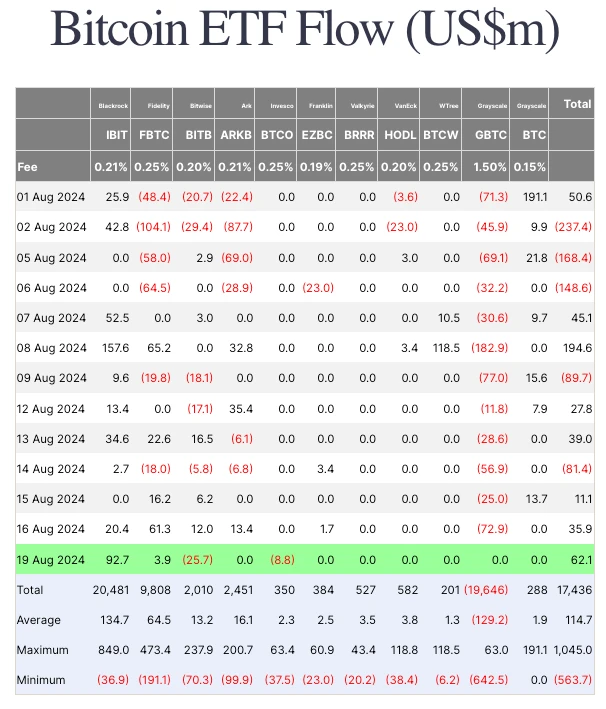

Back to the digital currency, the price of the currency has been rising from the bottom in the past 24 hours. ETH completed delivery at 2674.87 (+ 2.2%), recovering all the lost ground yesterday. BTC is more favored by the market, breaking through the pivot point of 60,000 US dollars and challenging the 61,000 mark, closing at 60901.71, with a daily increase of up to + 3.95%. In addition to the comparison of currency prices, we can see that in the past few days, BTC ETF has continued to have positive capital inflows, while ETH is still losing funds under the shadow of Grayscale ETHEs selling pressure.

出典: ファーサイド・インベスターズ

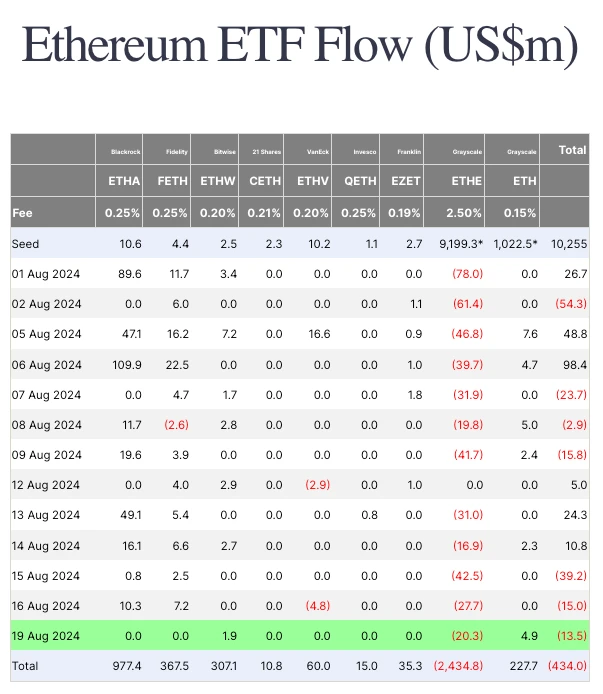

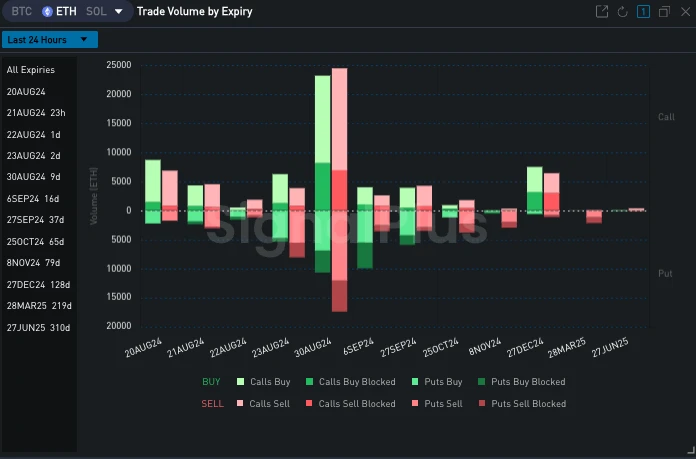

Such market sentiment is also reflected in the options market. From the changes in Vol Skew, we can see that the RR at the front end of BTC has risen sharply back to the positive range, while the curve at the front end of ETH is still tilted towards put options.

Source: SignalPlus, Vol Skew

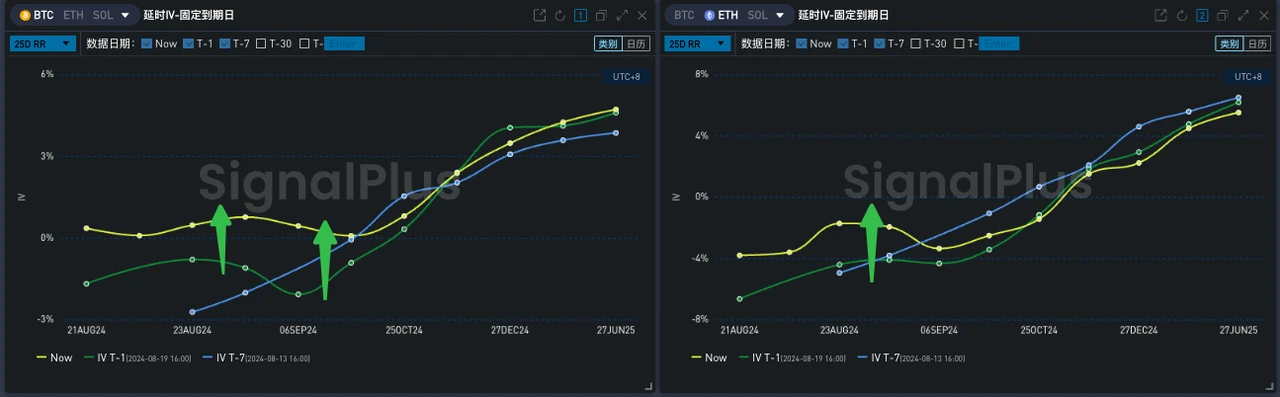

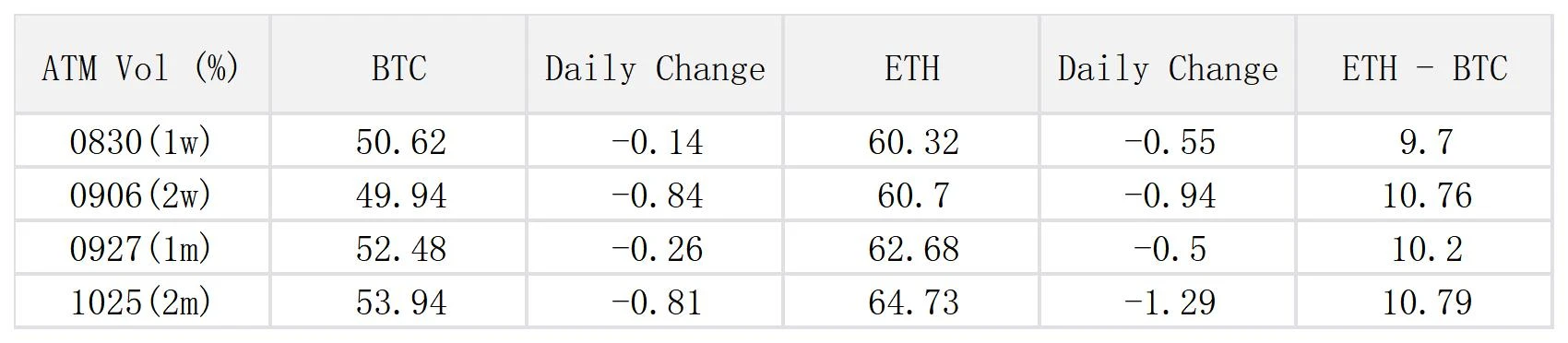

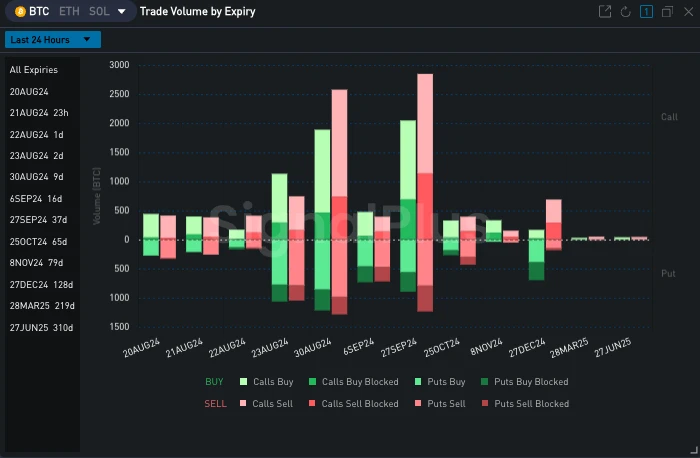

From the overall level of implied volatility, the price increase has led to a slight decline in IV over the past day. BTCs intraday Realized Vol of ~48% is basically the same as the front-end IV, and ETHs RV is about 49%, which is slightly lower than the front-end IV by about 5%-7%. From the transaction, we can see that the sharp rise in BTC price and the return of Skew have attracted traders to sell call options, represented by 29 SEP-70000-C. In the past 24 hours, Deribit sold 800 contracts in bulk, and 938.8 contracts were sold on the option chain, making 25 dRR form a local low on this expiration date; at the same time, 30 aug also showed obvious Sell Risky Flow, with most transactions concentrated on selling 64,000 67,000 Calls vs buying 55,000 Puts.

Source: Deribit (as of 20 AUG 16: 00 UTC+ 8)

出典: SignalPlus

Data Source: SignalPlus, Deribit, BTC ETH overall transaction distribution

t.signalplus.com の SignalPlus トレーディング ベーン機能を使用すると、よりリアルタイムの暗号通貨情報を入手できます。最新情報をすぐに受け取りたい場合は、Twitter アカウント @SignalPlusCN をフォローするか、WeChat グループ (アシスタント WeChat: SignalPlus 123 を追加)、Telegram グループ、Discord コミュニティに参加して、より多くの友人とコミュニケーションを取り、交流してください。SignalPlus 公式ウェブサイト: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240820): BTC! BTC!

関連:Planet Daily | 連邦準備制度理事会が9月に金利を引き下げる確率は89.6%。イーサリアムスポットETF tr

ヘッドライン 9月にFRBが25ベーシスポイントの利下げを行う確率は89.6%です。 CME Fed Watchのデータによると、FRBが8月に金利を据え置く確率は93.3%、25ベーシスポイントの利下げの確率は6.7%です。 9月までにFRBが金利を据え置く確率は0%、25ベーシスポイントの累積利下げの確率は89.6%、50ベーシスポイントの累積利下げの確率は10.2%、75ベーシスポイントの累積利下げの確率は0.3%です。 イーサリアムスポットETFの取引量は2日目に$951万に達しました。 米国市場での取引2日目、イーサリアムETFの累計取引量は…