原作者:Zhang Joy、BlockTempo

After the Bitcoin spot ETF was approved by the SEC in early January this year, it has undergone 7 months of market testing. During this period, Bitcoin once reached $73,000 and then continued to fluctuate as if it had stalled, far from meeting investors original expectations, and it also made people doubt whether institutions had entered the market.

Bloomberg: 701 new funds reported holding Bitcoin spot ETFs

However, according to the latest report from Bloomberg today (16), the just-concluded US 13F institutional holdings report revealed that 701 new funds have increased their holdings of Bitcoin spot ETFs in Q2, bringing the total number of holders to 1,950 funds.

Among them, well-known buyers include hedge fund giant Millennium Management, which has $68 billion in assets under management and is the largest holder of at least five Bitcoin spot ETFs. Other buyers include Capula Investment Management, Schonfeld Strategic Advisors and Steven Cohens Point 72 Asset Management.

Note: The 13F report is a quarterly report required by the U.S. Securities and Exchange Commission (SEC) that investment institutions or consultants with assets under management exceeding US$100 million must submit within 45 days after the end of each quarter, disclosing their common stocks (including ETFs), options, American Depositary Receipts (ADRs), convertible bonds, etc.

Analyst: The large number of funds entering the market is exciting

In this regard, cryptocurrency author Noelle Acheson said that given the current poor price performance of Bitcoin and the fact that few financial advisors are allowed to recommend Bitcoin ETF products to clients, the fact that so many funds are investing in Bitcoin spot ETFs is an exciting thing for investors.

In addition, Acheson added that with Wall Street investment bank Morgan Stanley allowing its financial advisors to recommend Bitcoin spot ETFs to clients last week, more large investment banks may open up this condition in the future, thereby bringing more demand to the Bitcoin market.

US Bitcoin spot ETF scale reaches $53.6 billion

According to Sosovalue data, since the US Bitcoin spot ETF was listed in January this year, as of August 14, the scale of funds has reached US$53.6 billion, accounting for 4.59% of the total market value of Bitcoin.

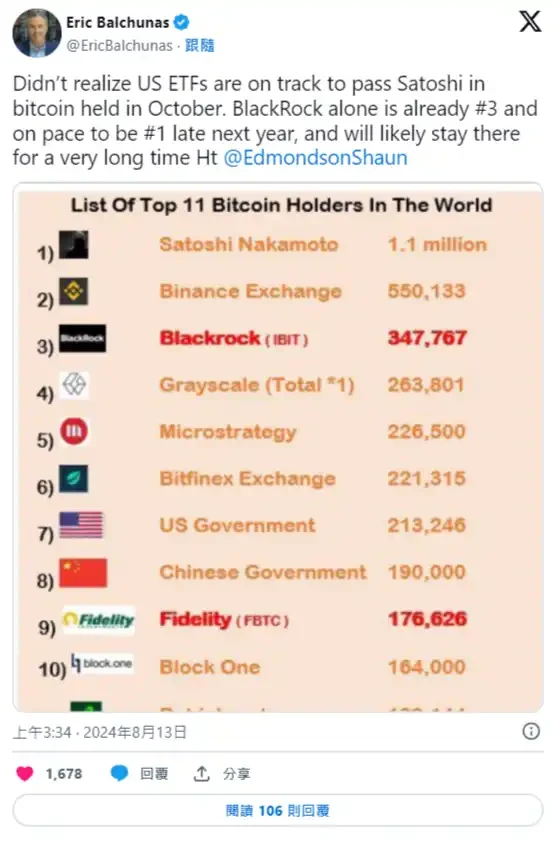

Bloomberg senior ETF analyst Eric Balchunas also wrote this week that BlackRock IBIT now holds 347,767 million bitcoins, second only to the holdings of the exchange Binance and Bitcoin founder Satoshi Nakamoto.

In addition, according to the current growth forecast (currently 900,000 bitcoins), the number of bitcoins held by the US Bitcoin ETF may surpass the 1.1 million bitcoins held by Satoshi Nakamoto in October.

This article is sourced from the internet: 701 institutional funds increase their holdings of Bitcoin ETFs against the trend

Related: Trumps running mate JD Vance: a more pure Crypto supporter

Original | Odaily Planet Daily ( @OdailyChina ) Author: Azuma ( @azuma_eth ) On July 15 local time, former US President Donald Trump announced at the Republican National Convention in Milwaukee, Wisconsin that Ohio Senator James David Vance (J.D. Vance) will run as his vice presidential candidate in the 2024 presidential election. Later, the Republican National Convention formally approved JD Vance as the Republican vice presidential candidate. As JD Vances nomination was approved, many celebrities, including Elon Musk (who had previously stated that he would support the Republican Party), publicly expressed their congratulations. For users in the cryptocurrency industry, JD Vance’s name may be more or less unfamiliar, but compared to Trump, who is still suspected of temporarily currying favor with cryptocurrency users just to win votes, JD Vance seems…