原作者: 暗号、蒸留

原文翻訳: TechFlow

Coinbase just released a report on how crypto hedge funds generate excess returns.

Here are the most valuable insights.

Report Overview

The report reveals the main strategies used by active crypto hedge funds.

It provides valuable insights for any investor looking to:

-

Better manage risk

-

Capturing excess returns

-

Deepen your understanding of encryption

Provided valuable insights.

Passive or active strategy?

Regardless of your experience level, always compare your performance to $BTC.

If you can’t outperform $BTC for a year or more, consider a passive strategy.

For most investors, DCAing $BTC on a regular basis is usually the best option during a bear market.

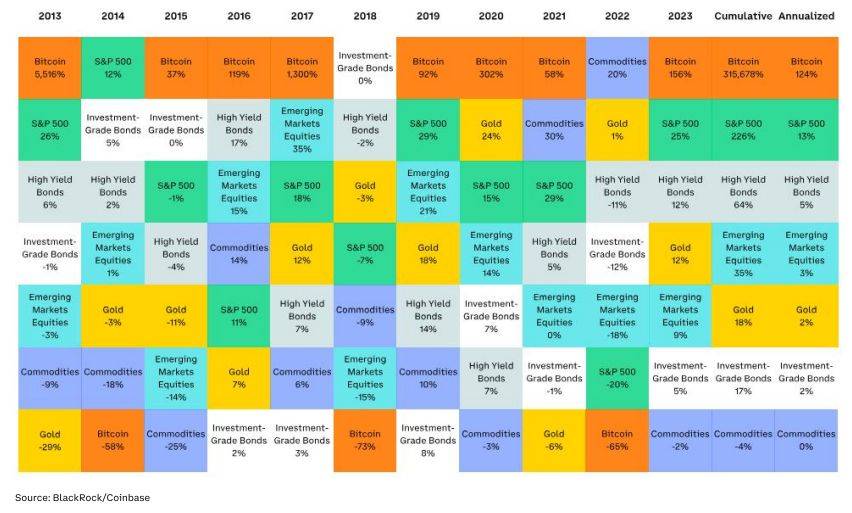

Bitcoin – Benchmark

$BTC is the preferred benchmark for crypto market beta.

Since 2013, $BTC has had an annualized return of 124%.

It has been the best performing asset class in 8 of the past 11 years.

(Source: @coinbase )

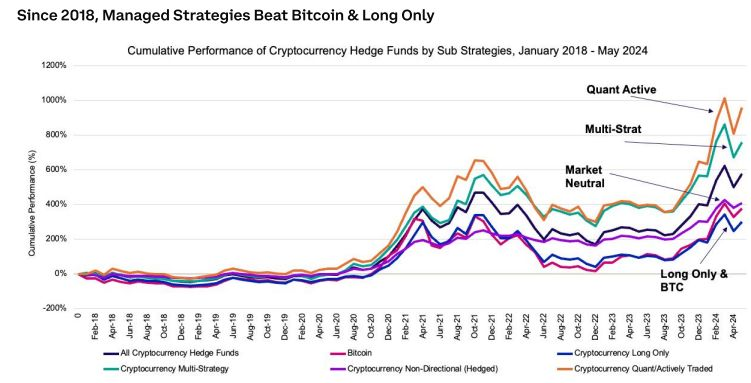

Are Hedge Funds Over $BTC?

In the crypto space, active management can go beyond passive spot $BTC exposure.

The key is risk management and hedging.

On average, actively managed crypto hedge funds outperformed passive spot $BTC positions in 2017, 2018, 2021, and 2022.

Custom Hedge Fund Indices

Coinbase created a custom index using data from more than 50 hedge funds that trade on Coinbase Prime.

The median fund outperformed $BTC amid lower volatility.

However, the dataset has a limited number of funds and may suffer from survivorship bias.

(Thanks @coinbase )

Best Active Management Strategy

Quantitative active and multi-strategy funds offer the best long-term performance potential.

They use advanced data models and diverse methodologies.

Single long fundamental strategies typically lag in performance due to their lack of flexibility.

(Thanks @Preqin )

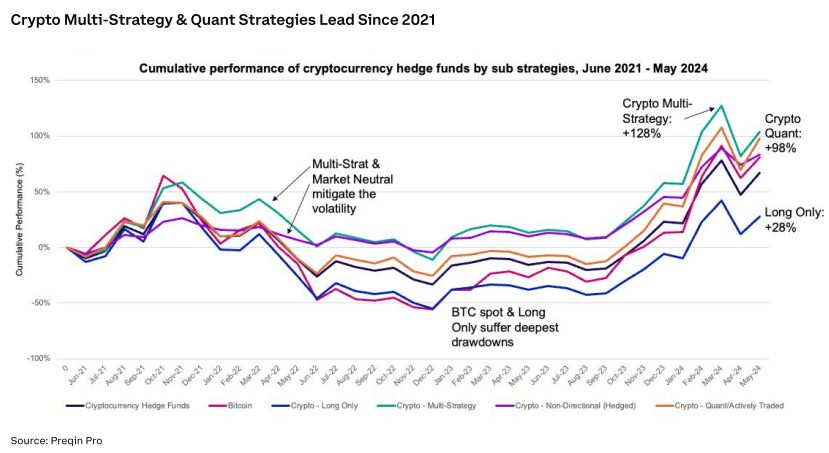

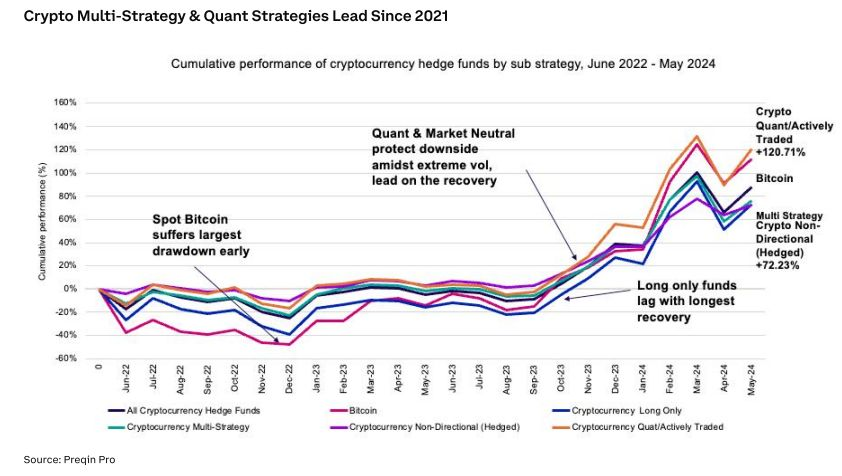

Performance from cycle lows

Since the June 2021 low, multi-strategy funds have led the way with a return of +128%.

Quantitative/active strategies followed closely behind with a return of +98%.

Meanwhile, $BTC and market neutral strategies also performed well.

Single long strategies lagged (+28%).

(Thanks @Preqin )

Bear Market Resilience (June 2022)

During the bear market, only quantitative active strategies outperformed $BTC.

Other strategies performed poorly, highlighting the importance of adaptability.

(Thanks @Preqin )

Why do single longs perform poorly?

Single long strategies generally underperform spot BTC for the following reasons:

-

Limited drawdown risk management

-

Bought underperforming altcoins

-

Poor timing of rebound

Controlling volatility is key:

Crypto hedge funds that manage volatility can offer greater upside potential.

The top quartile long-term performance in crypto is primarily based on:

-

Manage downside risk.

-

Capture huge upside potential.

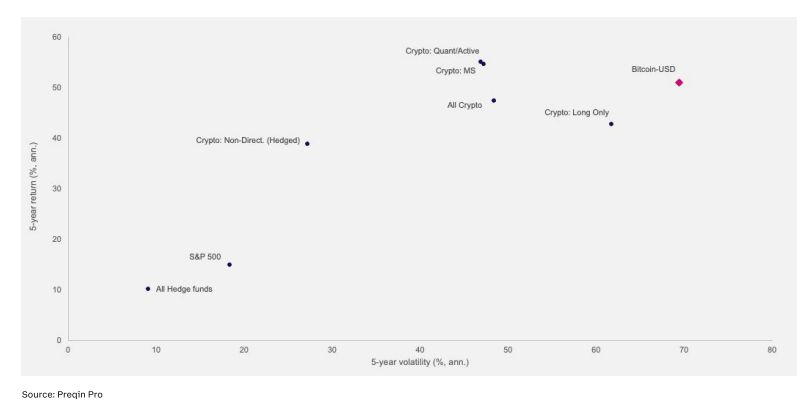

Volatility and Performance

Non-directional funds offer crypto exposure with annualized volatility below 30%.

The volatility of quantitative systems and multi-strategy funds is less than 50%.

These strategies significantly outperform single long and $BTC spot exposure.

(Thanks @Preqin )

Diversification across asset classes

“Structural diversification” is key. Why?

Because crypto markets trade 24/7/365, they are affected by unique factors at different time periods.

Staying diversified outside of crypto can provide a good risk/reward advantage.

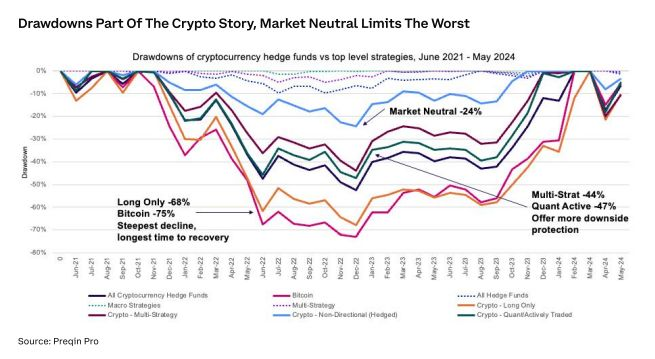

Managing Downside Volatility

Managing downside volatility is key to achieving long-term outperformance.

Market neutral strategies have the lowest volatility and shallowest drawdowns.

Next are multi-strategy, quantitative active strategy and single long strategy.

(Thanks @Preqin )

How to reduce downside exposure

-

Avoid heavy losses: Use stop-loss orders and clear investment thesis invalidation.

-

Stay in the long term: spread your risk through diversification and survive.

-

Long-term growth: Adjust positions based on market conditions to target volatility.

Personalization strategy

While some strategies may not be optimal, they may be the best for you.

Let’s take a deeper look at each strategy.

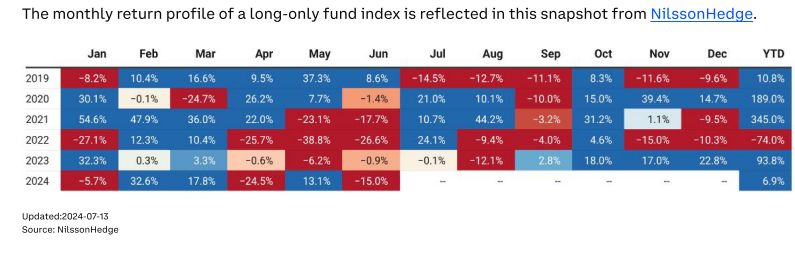

Directional strategy: Single long

Single long strategy targets tomorrows market leader (very easy to follow).

Key metrics to consider: active users, strong fundamentals, large total market value (TAM), value accumulation?

Benefits Summary (courtesy of @nilssonhedge )

Quantitative Systems: Directionality

Systematic (long or short) strategies combine fundamental analysis and automation.

They use structured data and machine learning to control risk and reduce volatility.

Benefits Summary (courtesy of @nilssonhedge )

Hedging strategy: Market neutral

Designed to capture returns in the crypto economy while maintaining low/no directional risk.

They seek positive returns relative to cash and avoid losses in all market environments.

Benefits Summary (courtesy of @nilssonhedge )

Diversification strategy: multiple strategies

These strategies combine specific exposures to achieve diversification, manage risk and capture diversified benefits.

Example: A fund of funds combining crypto hedging strategies of 10-15 managers.

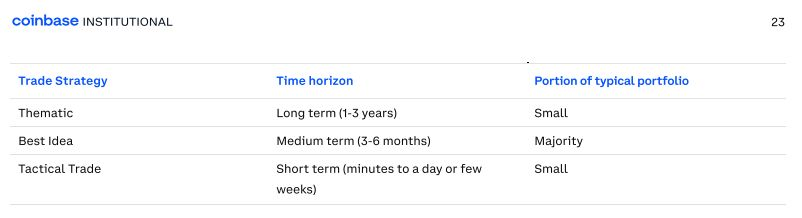

21/ Portfolio Split:

Here’s how a typical portfolio might look like, based on your specific time horizon:

(Courtesy of @coinbase )

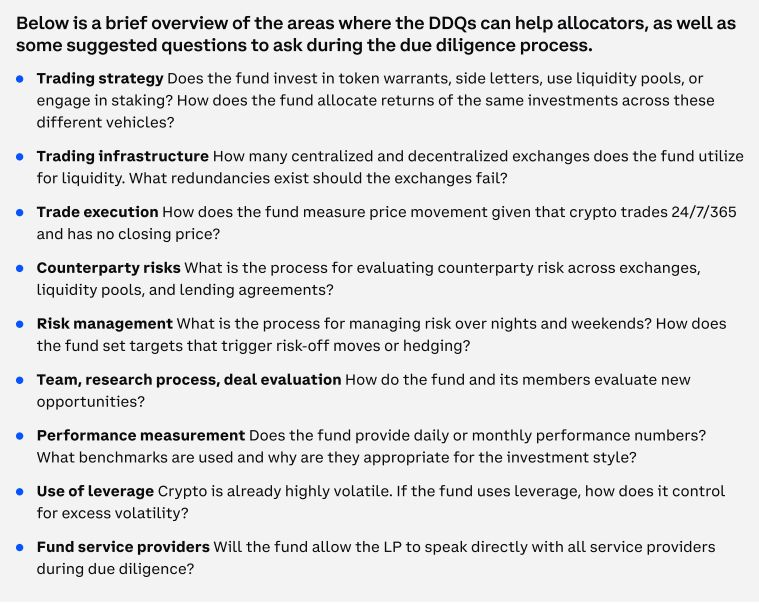

due diligence:

Once your strategy and portfolio are determined, the final step is due diligence.

Consider these key questions:

The following is an overview of areas where a due diligence questionnaire can help allocators of funds, as well as some recommended questions to ask during the due diligence process.

-

Trading strategy: Does the fund invest in token options, add-on protocols, use liquidity pools, or participate in staking? How does the fund allocate returns on the same investment between these different investment vehicles?

-

Trading infrastructure: How many centralized and decentralized exchanges does the fund use for liquidity? What contingency plans are in place if an exchange fails?

-

Trade Execution: Considering that cryptocurrencies trade 24/7/365 and have no closing prices, how does the fund measure price movements without a closing price?

-

Counterparty risk: How does the fund assess counterparty risk across exchanges, liquidity pools, and lending protocols?

-

Risk Management: How does the fund manage risk overnight and on weekends? How does the fund set targets that trigger risk aversion or hedging?

-

Team, research process, deal evaluation: How does the fund and its team evaluate new investment opportunities?

-

Performance measurement: Does the fund provide regular daily or monthly performance data? What benchmarks are used and why are they appropriate for its investment style?

-

Use of leverage: Cryptocurrencies are already highly volatile. If the fund uses leverage, how can excessive volatility be controlled?

-

Fund Service Providers: Does the fund allow limited partners (LPs) to communicate directly with all service providers during due diligence?

(Courtesy of @coinbase )

This article is sourced from the internet: How crypto hedge funds generate excess returns: Actively manage risks and invest in BTC

関連: 暗号ソーシャル ネットワーキングの将来について議論: Friend.tech は消滅、私たちはどこに立つべきか?

原著者: Pzai、Foresight News 序文 Friend.tech の 1 日のアクティブ ユーザー数が 100 未満に減少したことで、暗号ソーシャル ネットワーキングはトレンドから後退しているように見えます。一方では、暗号経済モデルに基づくソーシャル プロジェクトが注目を失っています。他方では、Farcaster や Solana Blinks などの暗号ソーシャル関連アプリケーションがさまざまなエントリ ポイントを使用してソーシャル ネットワーキングを気晴らしの手段にし、エコシステムに新たな成長の可能性をもたらしています。この記事では、各プロジェクトの特性に基づいて暗号ソーシャル ネットワーキングを構築する方法を探ります。Friend.tech に何が起こったのでしょうか。はい、かつて人気があった Friend.tech について言及する人はほとんどいません。初期のエントリの喧騒を懐かしむ人もいれば、キーを売買するときのドーパミンを懐かしむ人もいます。…