Weekly Editors Picksは、Odaily Planet Dailyの機能的なコラムです。Planet Dailyは毎週大量のリアルタイム情報をカバーするだけでなく、高品質の詳細な分析コンテンツも多数公開していますが、情報の流れやホットなニュースに埋もれて、見逃してしまう可能性があります。

そのため、毎週土曜日、当編集部では過去 7 日間に公開されたコンテンツの中から、時間をかけて読んで収集する価値のある質の高い記事をいくつか選び、データ分析、業界判断、意見出力の観点から、暗号の世界に新たなインスピレーションをもたらします。

さあ、私たちと一緒に読んでください:

投資と起業

Abenomics and Japans long-term negative interest rate environment have made the yen an important global financing and carry asset. Recently, the confrontation between the Bank of Japans forward-looking guidance and the speculative market has officially come to an end, and the yen has ushered in a V-shaped reversal.

The Bank of Japan is a cooperating party in the US-Japan alliance, and the real influence on the future trend is the US dollar. When the United States officially enters the interest rate cut cycle, therefore, with the easing of liquidity again, crypto assets will surely usher in a recovery again.

暗号ベンチャーキャピタルの15年間の進化を振り返る:困難だが全体的には上昇傾向

2019 marked the beginning of the post-ICO boom era; in 2020-2021, financing amounts grew again and surged; in 2022 and 2023, VC investment fell sharply, and the long-term correlation between Bitcoin prices and financing amounts disappeared.

Dialogue with Framework Lianchuang: Can cryptocurrency survive the economic recession?

Regarding regulation: The future legislative framework will affect the market structure of cryptocurrencies.

Concerns about the long-term ambiguity of token attributes: Although some tokens are not considered security tokens, they do not have the characteristics of traditional commodities (such as voting rights or the right to receive dividends from product revenues).

Regarding DeFi governance attacks: Compound’s governance activity has dropped significantly; while the involvement of activist investors may bring short-term benefits, the lack of a legal framework and governance consistency makes the DAO model difficult to sustain.

Regarding coin listing: The market is repairing itself, and low-quality projects will face higher listing thresholds.

トークン移行のケーススタディ: プロジェクト創設者にとって重要な考慮事項は何ですか?

Token migrations or mergers do not guarantee short-term or long-term price increases.

Token migration is not a one-time event; communication, transparency, and governance proposals are an ongoing process.

The article analyzes the inspirations brought to us by five cases in the processing process: MC → BEAM, RBN → AEVO, AGIX+FET+OCEAN → ASI, KLAY+FNSA → PDT, OGV → OGN.

a16z: プロトコルトークンはどのようにしてキャッシュフローを生み出すのでしょうか?

While there are many possible models for protocol tokens, staking pools, if carefully curated, can help address protocol-specific external challenges. By recognizing the intrinsic and external challenges facing a protocol, founders can better design a protocol token model for their project from the ground up.

To make fees traceable, protocols can use a two-step protocol token staking system design – determine which frontend generates fees; and route fees to different pools based on custom logic.

a16z also gives corresponding precautions for L1, L2, application chain, and protocol Rollup.

こちらもおすすめ: The hottest community and misaligned consensus, how does Jupiter find the optimal solution? is worth learning for community builders.

ミーム

Essentials for MEME hunters: What are the tools favored by smart money?

The most common scenario for beginner meme traders is that after seeing a new meme coin in the community, they analyze the token from the aspects of security and chip structure to decide whether to trade. In this scenario, the tools that can help include website tools, trading bots, and monitoring tools based on TGBOT ( if you want speed, you can first enter CA in the group with TGBOT to check the token holdings in real time).

After seeing a meme coin with a good increase, you can look for smart money among three groups of people: early large holders, high-yield traders, and early buyers. The most important thing is to make a judgment based on the time of purchase. If this address is bought before the meme coin rises, then its reference value will be greater.

The advanced gameplay is chain scanning + following orders. Players who pursue being one step ahead compete in speed in three aspects, namely, discovering alpha new coins (chain scanning), discovering the trend of smart money (following orders) and finally buying and selling (trading).

The article also introduces the tools for the corresponding links.

I especially recommend the two parts Psychological Framework and Self-Questioning and Useful Principles.

Multi-ecology and cross-chain

Insight into Solana’s financial report controversy: Real loss or data illusion?

Crypto KOL Bear Biscuit.eth published an article on the X platform saying that Solana may face major risks and that the price of SOL will hardly return to $200. The article pointed out the continuous quarterly losses and unlimited issuance of SOL exposed in Solanas financial report. The article caused a lot of retail investors to have FUD about SOL.

Subsequently, crypto KOL Riyue Xiaochu refuted the views of BearBiscuits.eth. He believed that the inflation of SOL was within a reasonable range and would not hinder the rise in the price of the currency. The loss was just a data illusion caused by the dollar denominated price.

Solana trading bot comparison: a step-by-step guide to trading bots

There are still relatively high risks in using Telegram trading bots. The target users of bots are Degens with higher risk appetite, and security loopholes such as private key theft and hacker attacks still exist.

When using a trading bot, be sure to carefully check the URL of the website and link, and use official sources and avoid clicking on suspicious links. At the same time, treat BONKbot as a hot wallet when trading, transfer transactions, and transfer back to the main wallet after completion.

Arweave の新チェーン AO で注目すべき 10 のプロジェクト

Projects that the author subjectively likes and pays attention to: Autonomous Finance, ArSwap, Astro USDA, LiquidOps, AOX, Outcome, dumdum, WeaveVM, mbd, Cyber Beavers.

Cosmos is often misunderstood as just the Cosmos Hub, which means that as long as the price of ATOM does not perform well, Cosmos has failed. In fact, the Cosmos ecosystem is very diverse and dominates entire verticals, or at least has strong competitors in various fields. Fetch, Cronos, Injective, dYdX, Thorchain, MANTRA, Akash Network, Celestia, Saga, Dymension, Sei, etc. have all received great attention in their respective fields of expertise.

The Interchain Foundation does not play a core role in coordinating marketing, developer onboarding, community initiatives, and development.

The core of Cosmos is that chains are interoperable while maintaining sovereignty, which means there is no one currency to rule them all. This is great for long-term sustainability, but less important for short-term hype.

The author summarizes the solutions that can solve the interoperability of Cross-layer 2: Based-Rollup (representative project Taiko), CrossChain-Rollup (representative project: ZKMs Entangled Rollup Network unified liquidity layer ), Intent-Rollup (representative project: dappOS), Layer 2 Based-layer 3 (representative project: A rbitrum Orbit ), Cosmos IBC Based -Rollup ( representative project: Polymer ), AVS Based -Rollup ( representative project: Altlayer ), Modular-Rollups (representative project: Avail).

CeFi DeFi

テザー10周年:1日あたり$300万近く稼いでいるが、まだ「アウト」のリスクから逃れられない?

The profit of half a year is 5.2 billion US dollars, equivalent to nearly 30 million US dollars a day, which is beyond the reach of many listed companies. But Tether, which has made a lot of money, may not be as glorious as the financial report shows. Circle, which is more compliant and has a surge in on-chain activity, is taking away a significant market share from Tether. After the European regulations came into effect, the trading volume of USDC pairs on centralized exchanges increased by more than 48%.

In June this year, Tether made a strategic investment of $18.75 million in XREX Group, a compliant blockchain financial institution. In addition, Tether is also seeking business growth beyond stablecoins, expanding into multiple fields such as Bitcoin mining, AI and education.

Some market players and investors believe that although Tether and Circle currently occupy almost most of the stablecoin market, the stablecoin landscape is still subject to huge adjustments, providing disruptive opportunities for latecomers in terms of compliance, centralization risks, and how profits are distributed to users.

暗号通貨界で最も優れた固定価格投資である JLP が、なぜ下落に対してそれほど耐性があるのでしょうか?

Since the beginning of this year, Jupiters perpetual contract platform JLP (Jupiter liquidity provider) has become one of the best performing and highest-yielding casinos.

On JLP, the users counterparty is the platform itself. When traders seek to open a leveraged position, they borrow tokens from the pool and are fed prices directly by the oracle. This model is also known as jointly opening a casino, that is, users make money and the platform loses money. Regardless of profit or loss, the opening capital comes from the JLP platform. Therefore, whether long or short, from the moment the position is opened, the trader is in debt to the platform.

For JLP investors: Gains and losses are less than the underlying assets.

The essence of modular lending is not just cross-chain and aggregation, but both play an important role in modular lending;

Modular lending leverages the security, consensus, and data availability provided by the base layer, and focuses on functional modularization at the execution and application layers;

Modular lending breaks down its process into multiple independent modules, such as collateral management, interest rate calculation, risk assessment, and liquidation mechanism, and communicates between the modules through standardized interfaces;

The characteristics of the current modular DeFi protocol are similar to the logic of OP Stacks one-click chain launch. Deployment requires the establishment of a module combination based on its own protocol to create new financial products and services. The article also lists and briefly introduces representative modular lending projects: Morpho Labs and Euler Finance.

ウェブスリー

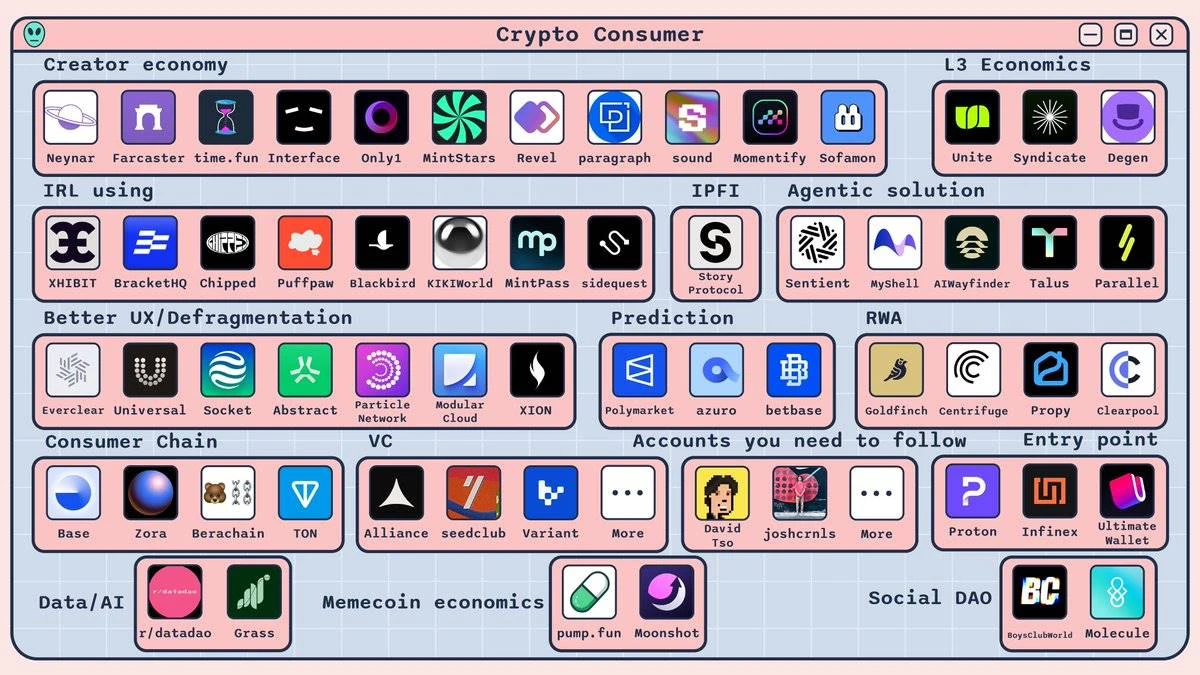

消費者向け暗号アプリケーションが増加しています。注目すべき 4 つのプロジェクトをご紹介します。

The best consumer apps will leverage real-life user behavior to innovatively leverage blockchain and crypto, introducing new financial incentives, gamification elements, and engagement methods that cater to mass-market consumer behavior.

Such as PuffPaw (Vape-to-earn on Berachain), BlackBird (Dine-to-earn on Base), TYB (Engage-to-earn on Avalanche subnet), SkyTrade (airspace rights platform on Solana).

今週のホットトピック

先週、 Jump continued to sell hundreds of millions of dollars of ETH; the global financial market fell into panic and the crypto market plummeted , with the total market value falling below 2 trillion US dollars, and gradually rebounded during the week;

In addition, in terms of policy and macro market, analysis: the number of initial jobless claims in the United States last week hit the largest drop in nearly a year; Putin signed a law to legalize cryptocurrency mining in Russia ; Japans Finance Minister: We are closely watching the dynamics of the volatile stock market, but are not at the stage of taking practical action ; the judge ruled that Ripples sale of XRP to retail investors did not violate federal securities laws and was only fined about $125 million; the judge approved FTX, Alameda and the CFTC s $12.7 billion settlement agreement;

In terms of opinions and voices, トランプ : The US government should not sell cryptocurrencies, but build them; Arthur Hayes: The unwinding of yen carry trades may lead to the collapse of global markets, and crypto investors need to use leverage with caution . The Bitcoin strategic reserve plan is impossible , and the US government will buy gold first; Alex Krüger: The main driving factor for this round of market decline is not the US economic recession, but the missed opportunity for interest rate cuts; 10x Research: Nasdaqs downside risks still exist, and Bitcoin may fall further ; Grayscale: ETHs decline may be due to excessive long positions in perpetual futures , and leveraged traders in the Asian market led this liquidation; Analysis: Jump Tradings selling pressure has subsided , and BTC may not fall below $50,000; Matrixport Investment Research: BTC is in an oversold state, and the dawn of recovery is approaching ; Vitalik: Solving the cross-L2 interoperability problem will bring a smooth user experience to Ethereum; ZKX investors and market makers: They were surprised by the sudden shutdown of ZKX and did not receive any news in advance;

In terms of institutions, large companies and top projects, insiders said: Morgan Stanley will offer BlackRock and Fidelitys Bitcoin ETFs to eligible customers; MicroStrategy seeks to sell $2 billion in shares to buy more Bitcoin ; Grayscale launches two new crypto trusts, SUI and TAO ;

On the security front, $12 million stolen from Ronin Bridge … well, another week of ups and downs.

添付 ポータルです 「週刊編集者のおすすめ」シリーズ。

また次回お会いしましょう〜

This article is sourced from the internet: Weekly Editors Picks (0803-0809)

Written by: Shang2046 The information, opinions and judgments on markets, projects, currencies, etc. mentioned in this report are for reference only and do not constitute any investment advice. Market supply and demand are fragile, and BTC is facing miner liquidation Market summary: The Fed’s interest rate meeting on June 12 and the US CPI data for May have indeed become the dominant factors in BTC’s trend last week. Stimulated by the downward trend of CPI data, BTC once again hit the $70,000 mark, but then fell rapidly due to the Fed’s hawkish remarks. BTC fell 4.32% for the whole week, with an amplitude of 7.44%. The interest rate cut dot plot shows that most market expectations are that the interest rate cut will be postponed to the end of the…