ハッシュ( SHA1 ) of this article: 4a79c3c2fa5456d2d335b08cb26d1bd519063b11

No.: Lianyuan Security Knowledge No.017

This year, the approval and trading of spot exchange-traded funds (ETFs) in the United States has become a major topic of discussion in the cryptocurrency space. The success of the Bitcoin ETF has been particularly remarkable, attracting $16 billion in inflows in just six months after its launch, driving the price of Bitcoin up 46%. As the ETF market has grown rapidly, in addition to major cryptocurrencies such as Bitcoin and Ethereum, more crypto assets such as Solana have gradually entered the market. The Solana blockchain is favored for its high throughput and low transaction costs, capable of processing thousands of transactions per second, and transaction fees are generally less than a few cents. These features make Solana an ideal platform for developing decentralized applications (DApps) and smart contracts. With the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs), Solanas increasingly wide range of applications provides strong support for its expected development of ETFs.

Recently, asset management giant VanEck has submitted an application for Solana ETF (VanEck Solana Trust) to the U.S. Securities and Exchange Commission (SEC), and 21 Shares has also submitted relevant registration documents. However, whether the approval of Solana ETF can be successful depends on a series of complex factors, especially the maturity of technology, in-depth market research and changes in the regulatory environment.

Solana鈥檚 Performance Advantage

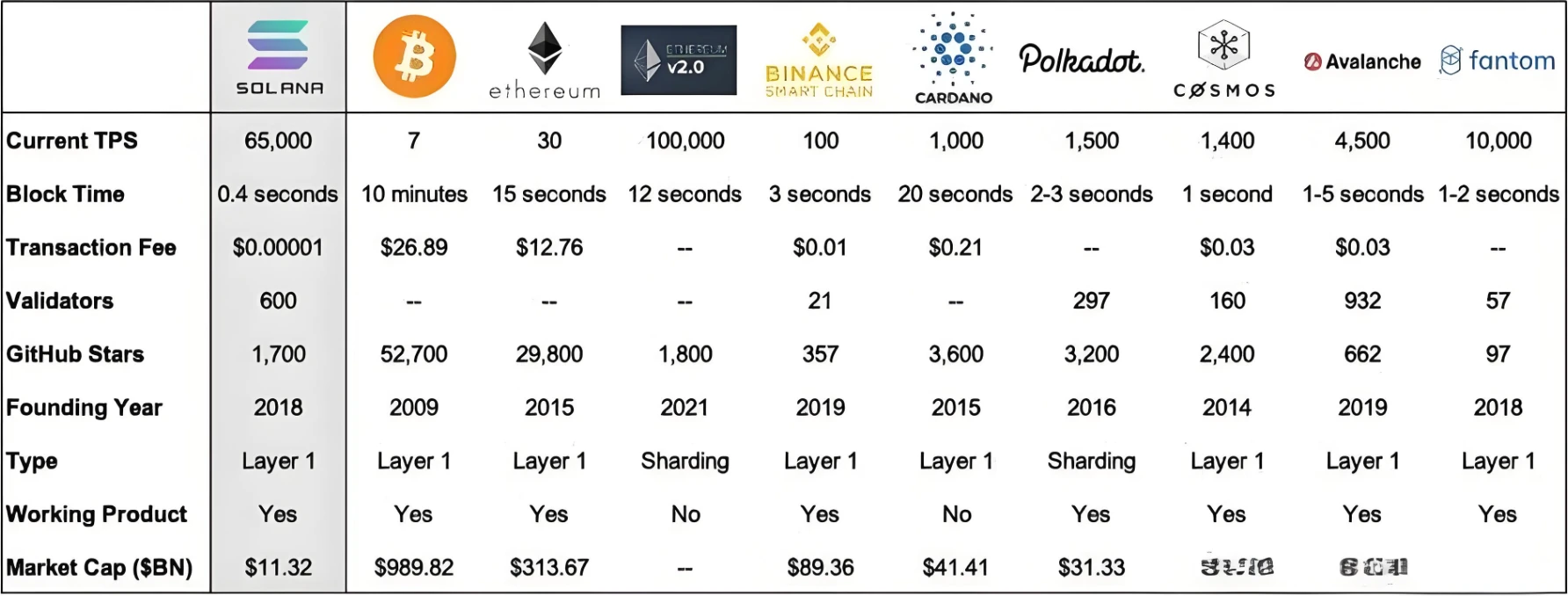

Solana is an open source blockchain designed to handle a variety of applications, including payments, transactions, games, and social interactions. Unlike most blockchains, Solana uses a global single state machine mechanism without relying on sharding or second-layer solutions. This architecture achieves a powerful combination of scalability, speed, and low cost, providing an excellent user experience for many application scenarios. Solana can efficiently process thousands of transactions per second, and its unique Proof of History (PoH) and Proof of Stake (PoS) mechanisms provide strong security guarantees, combined with its high throughput and low fees, making it an ideal ETF choice.

Data shows that Solanas highest daily average real transactions per second (TPS) can reach 1054, far exceeding other blockchain platforms. Its unique PoH mechanism creates a verifiable event order within the network, ensuring that every validator has a fair chance to play a role. Advanced technologies such as the Gulf Stream mechanism, Pipeline technology, Sealevel parallel execution mechanism, Turbine block propagation technology, TowerBFT consensus mechanism and Cloudbreak database enable Solana to efficiently process and propagate blocks, effectively ensuring the high throughput and performance elasticity of the network. The decentralized infrastructure further enhances the security of the system, ensuring that no single entity can monopolize network operations, which also provides solid support for VanEcks belief that Solana is a valuable choice for investors, developers and entrepreneurs.

Market disputes and risks

Although Solanas ETF application has great potential, the market is not entirely optimistic about it. The main potential risks include:

-

Securities Attributes Issue

The SEC has become more cautious in its regulatory stance on crypto assets. Although the number of applications for crypto asset products continues to increase, the SEC will carefully evaluate the transparency, compliance, and investor protection measures of these products when approving them. Solana is classified as a security by the SEC, which means it is subject to strict disclosure regulations and may face higher uncertainty in the ETF application process.

-

The impact of FTX bankruptcy

Although decentralization is one of the core features of blockchain, Solana, as an emerging public chain, still needs to improve its degree of decentralization. The concentration of shares held by exchanges such as FTX in the early days of Solana has raised market doubts about its degree of decentralization, which may affect Solanas performance in regulatory assessments and its market image.

-

Market competition and uncertainty

The cryptocurrency market is generally highly volatile and highly competitive. Although Solana has achieved certain results in technology and the market, it still faces competition from other blockchain projects. At the same time, many factors such as the policy environment, technological progress and market changes will directly affect the application results of the Solana ETF.

Feasibility Analysis of Solana ETF

Solana stands out among many cryptocurrencies and becomes a popular candidate for ETF application thanks to market demand and its unique advantages.

-

Market Cap and Consensus Value

In the cryptocurrency market, market capitalization is an important indicator of project influence and recognition. Solana has long been ranked in the top five in terms of market capitalization, second only to giants such as Bitcoin and Ethereum. This not only reflects its market competitiveness, but also provides a solid foundation for its application for ETFs. In addition, Solana has a large user base and an active community, which are important components of its consensus value.

-

Technical security

Solana combines the two mechanisms of Proof of History (PoH) and Proof of Stake (PoS) to provide a high degree of security and reliability for the network. The PoH mechanism creates a verifiable timestamp record for all transactions on the blockchain, making the order of events tamper-proof. The PoS mechanism allows users to participate in verification by locking a certain amount of Solana coins (SOL), which increases the decentralization of the network and avoids the control of the network by a single entity, which provides a strong guarantee for the security of the Solana ETF.

-

Market demand and expectations

As the cryptocurrency market continues to mature, investors are increasingly demanding diversified investment channels. As a low-threshold, high-liquidity investment tool, ETFs have become the preferred choice for investors. As a representative of emerging blockchain platforms, the launch of Solanas ETF will undoubtedly meet investors demand for emerging assets and further promote the prosperity and development of the market.

結論

Overall, Solana is attracting widespread attention from the investment community with its high-performance blockchain technology and gradually expanding decentralized application scenarios. Despite challenges including market competition, regulatory uncertainty and technological maturity, Solanas technological advantages and good market prospects make it a strong competitor in the ETF market. If it can successfully cope with regulatory and market challenges, Solana ETF is expected to become an important milestone in the field of crypto asset investment, thereby promoting the security and stable development of the entire industry. The ChainSource Security Team recommends that investors can only make wise decisions and maximize investment returns after deeply understanding its technical details and potential risks, and at the same time learn to protect their own funds.

Lianyuan Technology は、ブロックチェーン セキュリティに注力している企業です。当社の主な業務には、ブロックチェーン セキュリティの研究、オンチェーン データ分析、資産および契約の脆弱性の救済が含まれます。当社は、個人や機関の盗難されたデジタル資産を数多く回収してきました。同時に、業界団体に対してプロジェクト セキュリティ分析レポート、オンチェーン トレーサビリティ、技術コンサルティング/サポート サービスの提供に取り組んでいます。

ご一読ありがとうございました。今後もブロックチェーンセキュリティコンテンツに注力し、発信してまいります。

This article is sourced from the internet: Prospects for Solana ETF approval: efficient and low-cost blockchain investment?

関連: セキュリティの最大化: DeFi における MEV 攻撃への対処方法

この記事のハッシュ(SHA 1):b366289db9b21c3e9b6668c274e4a179be57a463 番号:連元セキュリティ知識No.008 過去数年間、ブロックチェーン経済は指数関数的な成長を遂げており、特に2022年には、DeFiエコシステムのロックされた価値が$3000億のピークに達しました。 Web3では、さまざまな攻撃方法と論理的なセキュリティ脆弱性も見られました。 2017年以来、最大抽出可能値(MEV)は、ETHチェーンに損失をもたらす攻撃方法の最前線に立っています。 ChainSourceセキュリティチームは、MEVの基本原則と保護方法について関連する分析と分類を実施し、読者が保護を向上させるのに役立つことを期待しています。 自分の資産の安全を確保する能力。 MEVの基本原則 MEVの正式名称は最大抽出可能値で、マイナーとも呼ばれていました…