Bitcoin falls as Fed remains on hold

Since inflation has fallen less quickly than expected, the Federal Reserve has kept its interest rate target range between 5.25% and 5.5% since the end of July last year, the highest level in 23 years. After the interest rate meeting, Bitcoin fell to as low as $62,300 and then rebounded.

As the third quarter draws to a close, most market participants expect the Federal Reserve to cut interest rates. If the fight against inflation continues to make good progress, a rate cut could be announced as early as this years September meeting. This could be a positive factor for risk assets such as Bitcoin.

Historically, a lower interest rate environment is good for cryptocurrencies as investors tend to seek higher-yielding assets. Despite the uncertain economic outlook, the prospect of looser monetary policy has boosted positive sentiment toward Bitcoin. However, investors need to be mindful of the risk of price volatility in the short term.

There are about 47 days until the next Federal Reserve interest rate meeting (September 19, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

市場テクニカルおよび感情環境分析

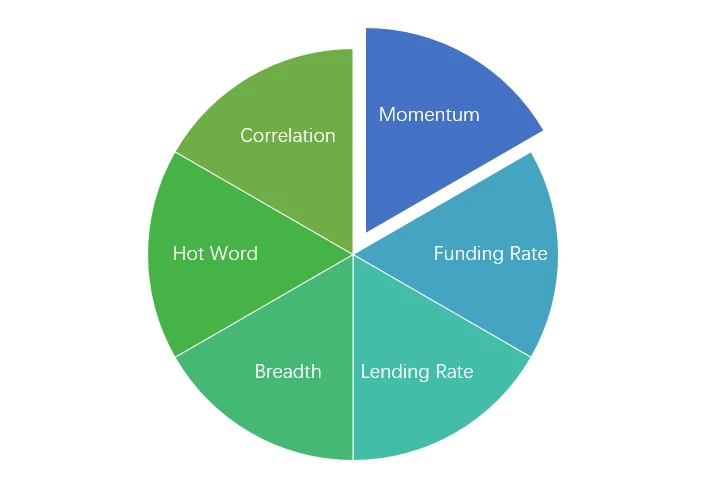

感情分析コンポーネント

テクニカル指標

価格動向

BTC price rose -0.68% and ETH price rose 0.88% over the past week.

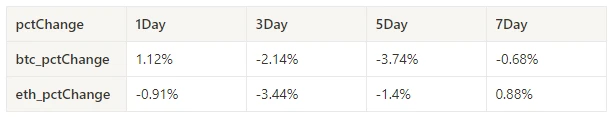

上の画像は、過去 1 週間の BTC の価格チャートです。

上の画像は、過去 1 週間の ETH の価格チャートです。

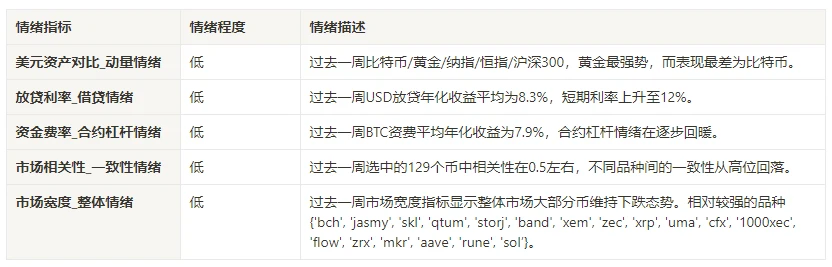

表には過去 1 週間の価格変動率が表示されています。

pctChange1Day3Day5Day7Daybtc_pctChange1.12% -2.14% -3.74% -0.68% eth_pctChange-0.91% -3.44% -1.4% 0.88%

価格ボリューム分布チャート(サポートとレジスタンス)

In the past week, BTC and ETH broke down from the concentrated trading area and then rebounded.

上の図は、過去 1 週間の BTC の取引密度の高いエリアの分布を示しています。

上の図は、過去 1 週間の ETH 密集取引エリアの分布を示しています。

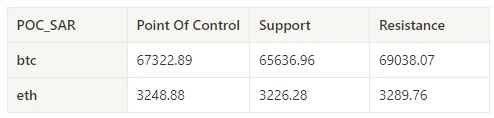

この表は、過去 1 週間の BTC と ETH の週ごとの集中取引範囲を示しています。

取引量と建玉

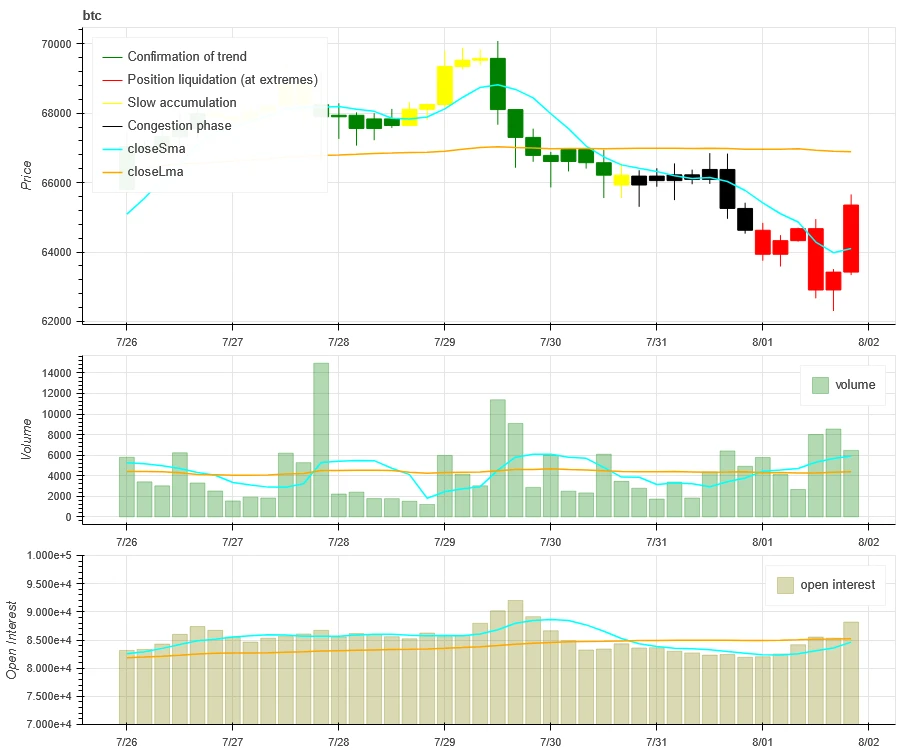

In the past week, the trading volumes of both BTC and ETH increased after the August 1 interest rate meeting; the open interest of both BTC and ETH increased slightly.

上の図の上はBTCの価格動向、真ん中は取引量、下は未決済建玉、水色は1日平均、オレンジ色は7日平均です。Kラインの色は現在の状態を表し、緑は価格上昇が取引量によって支えられていること、赤はポジションのクローズ、黄色はゆっくりとポジションを蓄積していること、黒は混雑した状態を意味します。

上の図の上はETHの価格動向、真ん中は取引量、下は未決済建玉、水色は1日平均、オレンジ色は7日平均です。Kラインの色は現在の状態を表し、緑は価格上昇が取引量によって支えられていること、赤はポジションをクローズしていること、黄色はゆっくりとポジションを蓄積していること、黒は混雑していることを意味しています。

ヒストリカルボラティリティとインプライドボラティリティ

Historical volatility for BTC and ETH was highest this past week at 8.1; implied volatility for both BTC and ETH fell.

黄色の線は過去のボラティリティ、青い線はインプライド ボラティリティ、赤い点は 7 日間の平均です。

イベント駆動型

The Federal Reserve kept interest rates unchanged this past week, and after the interest rate meeting, Bitcoin fell to a low of 62,300.

Emotional indicators

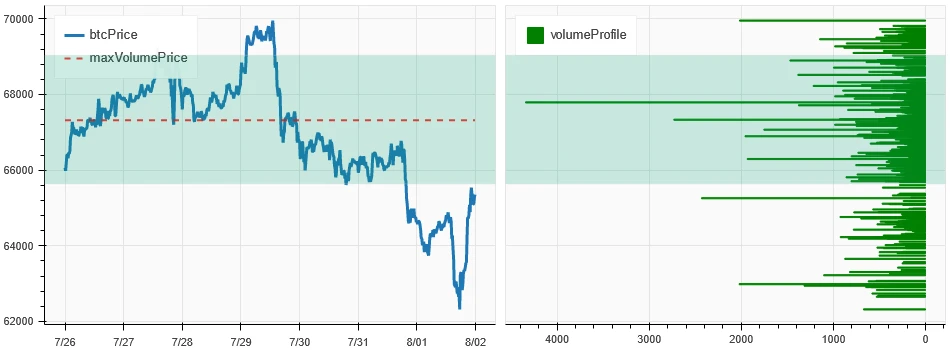

モメンタムセンチメント

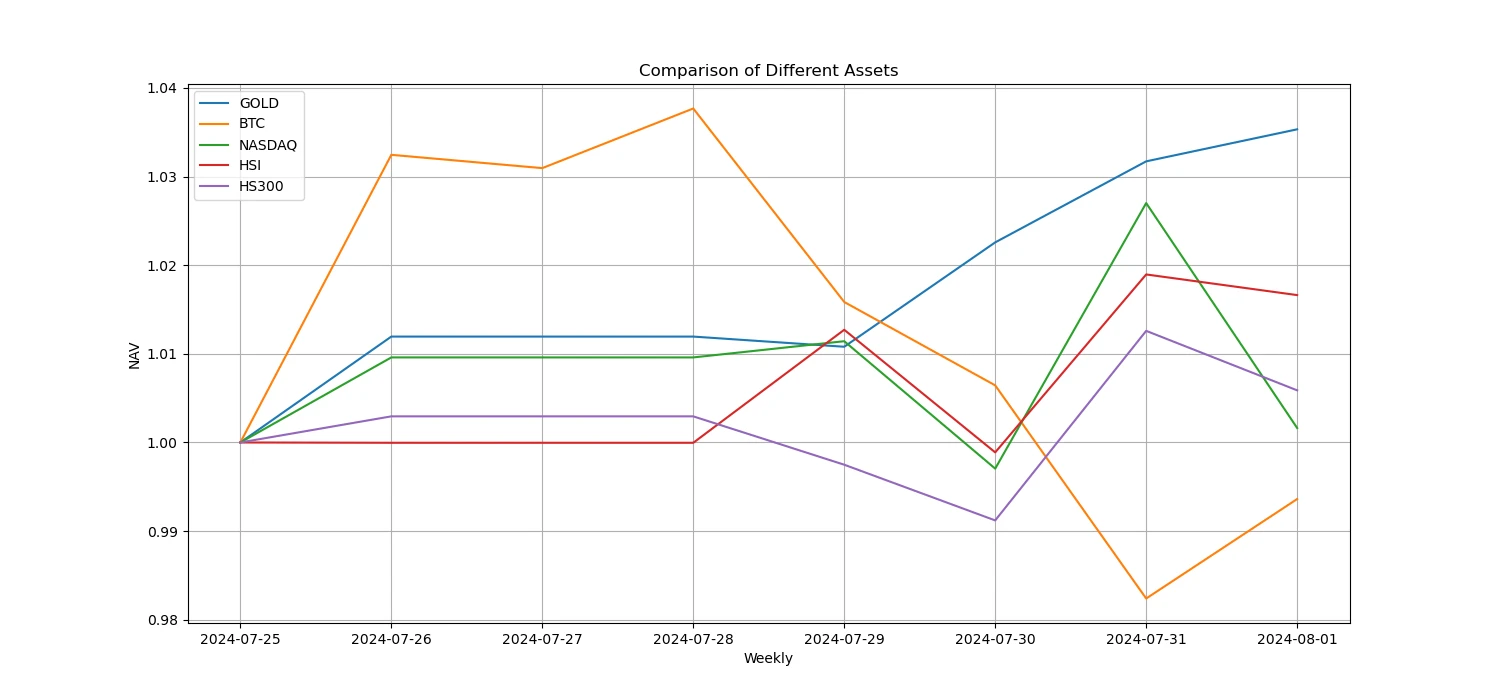

In the past week, among Bitcoin/Gold/Nasdaq/Hang Seng Index/SSE 300, gold was the strongest, while Bitcoin performed the worst.

上の図は、過去 1 週間のさまざまな資産の傾向を示しています。

貸出金利_貸出感情

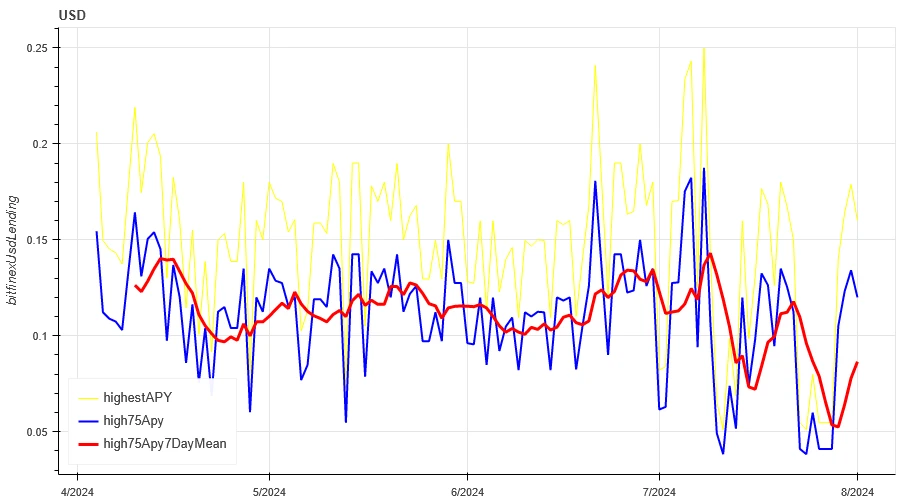

The average annualized return on USD lending over the past week was 8.3%, and short-term interest rates rose to 12%.

黄色の線はUSD金利の最高値、青い線は最高値の75%、赤い線は最高値の75%の7日間平均です。

この表は、過去の異なる保有日における米ドル金利の平均リターンを示している。

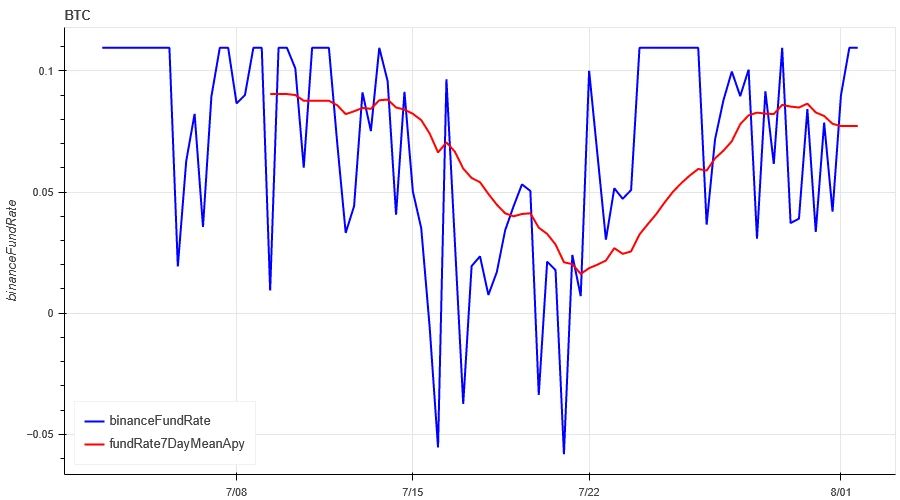

資金調達率_契約レバレッジ感情

The average annualized return on BTC fees in the past week was 7.9%, and contract leverage sentiment is gradually recovering.

青い線はBinanceでのBTCの資金調達率、赤い線は7日間の平均です。

この表は、過去のさまざまな保有日における BTC 手数料の平均リターンを示しています。

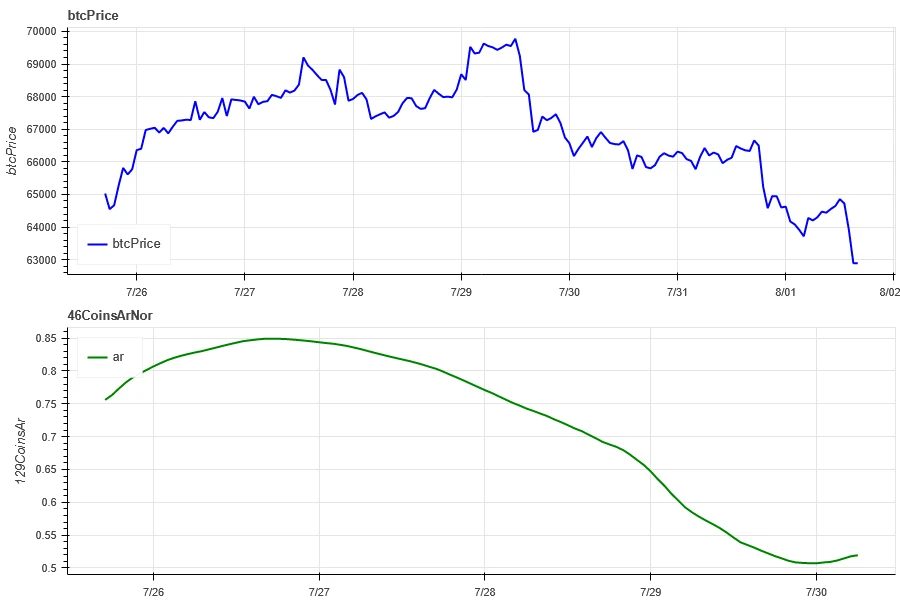

市場相関_コンセンサスセンチメント

The correlation among the 129 coins selected in the past week was around 0.5, and the consistency between different varieties fell from a high level.

In the above picture, the blue line is the price of Bitcoin, and the green line is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx , imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx , sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] overall correlation

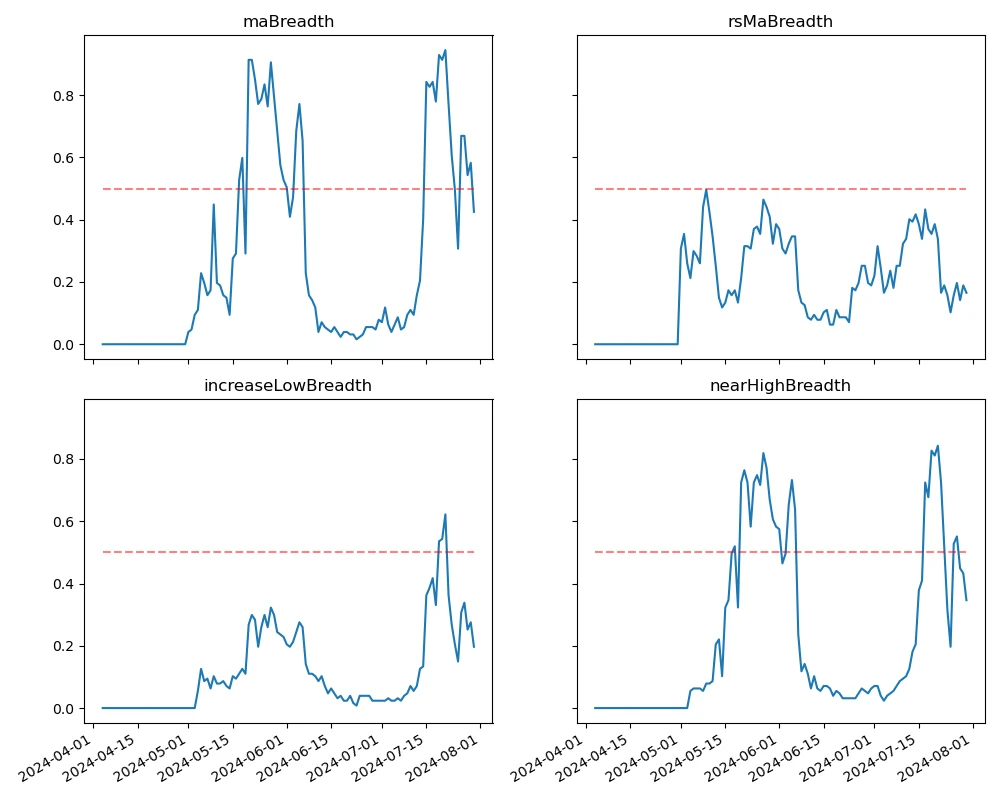

市場の幅_全体的な感情

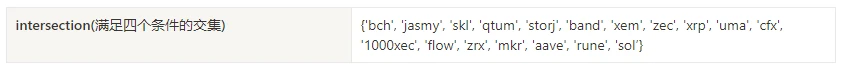

Among the 129 coins selected in the past week, 42.5% of the coins were priced above the 30-day moving average, 16.5% of the coins were priced above the 30-day moving average relative to BTC, 20% of the coins were more than 20% away from the lowest price in the past 30 days, and 35% of the coins were less than 10% away from the highest price in the past 30 days. The market breadth indicator in the past week showed that most coins in the overall market maintained a downward trend.

The picture above is [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot , icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, manta, mask, matic, meme, mina, mkr, near, neo, nfp, ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rose, rune, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] 30-day proportion of each width indicator

要約する

In the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) fell after the interest rate meeting, while the volatility and trading volume of these two cryptocurrencies increased after the interest rate meeting on August 1. The open interest of Bitcoin and Ethereum has increased slightly. In addition, the implied volatility of Bitcoin and Ethereum has decreased simultaneously. Bitcoins funding rate has rebounded slightly from a low level, which may reflect the gradual recovery of market participants leverage sentiment towards Bitcoin. Market breadth indicators show that most cryptocurrencies have retreated, indicating that the overall market has continued to fall in the past week.

ツイッター: @ https://x.com/CTA_ChannelCmt

Webサイト: チャンネルcmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.07.26-08.02): Bitcoin Falls as Fed Keeps Steering

Related: Hack VC: A hacker who invests in hackers, an infrastructure maniac in crypto VC

Original author: TechFlow In the crypto market of 2024, there is one crypto VC that you cannot ignore. Prefers lead investors, with 50% of the projects invested this year being lead investors, including the familiar io.net, Initia, AltLayer, imgnAI, etc. Prefer infrastructure, with one-third of the projects invested being infrastructure, including Berachain, EigenLayer, Movement, Babylon, SUI, Eclipse, etc. In addition to funds, they also have technology and developer communities that can empower the projects they invest in for the long term; The name of this VC is Hack VC . As the name suggests, they are a group of tech geeks invested in hacking. This article will give you an inside look at the story behind Hack VC and its founding partner Alexander Pack. Starting from Hong Kong, connecting the…