Following Trumps speech in support of digital currency at the Bitcoin 2024 Summit on Sunday, news came out the next day that the US government had transferred a large amount of Bitcoin. The potential selling pressure caused investors to feel risk averse. BTC fell from a high of $70,000 to the familiar level of around $66,000. The inflow of funds into BTC ETFs also declined. However, from the ETH side, we saw that ETF products led by Blackrock ETHA resisted the selling pressure from Grayscale ETHE with higher positive capital inflows. The Flow on JUL 30 successfully turned positive, providing confidence for stabilizing prices.

出典: ファーサイド・インベスターズ

Today, investors are most concerned about the FOMC meeting at 2 a.m., and the end-of-day options have already priced in the uncertainty with a high premium. But the uncertainty of this meeting does not come from the decision-making. In fact, according to foreign media surveys and statistics, almost all economists expect that there will be no change in interest rates this time. We should pay more attention to Powells subsequent press conference. The market expects that the Fed may first make subtle changes in the wording in the statement and acknowledge the recent improvement in inflation and the balance between inflation and the labor market. People do not expect Fed officials to show great enthusiasm for rate cuts at this meeting, but they may provide initial hints of a rate cut in September and information on what indicators to pay attention to next. For investors who want more and clearer signals, they may have to wait until the Jackson Hole Central Bank Annual Meeting in August, when the Fed Chairman will give a speech at the meeting and announce some important information.

ソース: SignalPlus, Economic Calendar

出典: SignalPlus

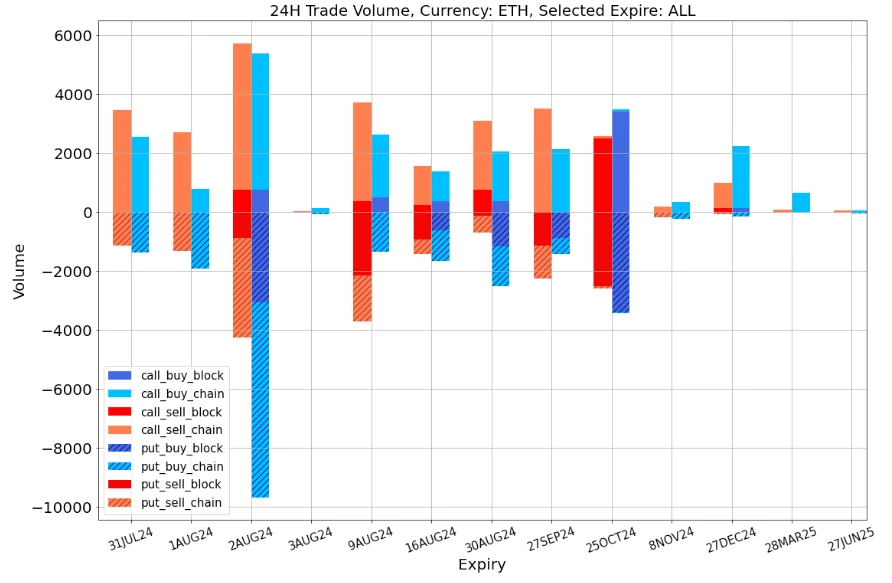

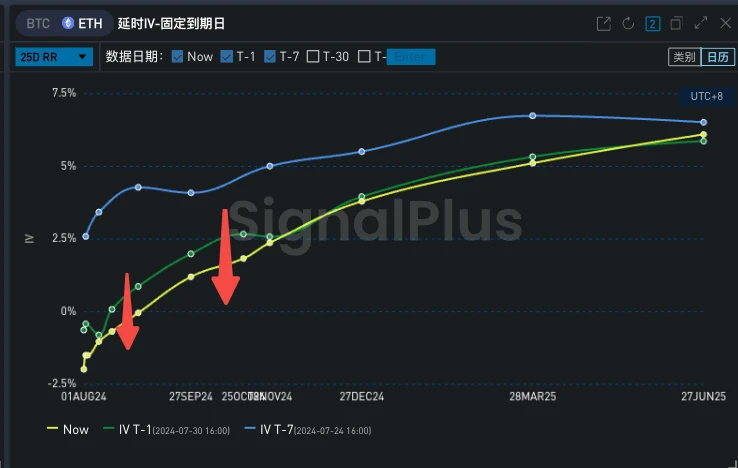

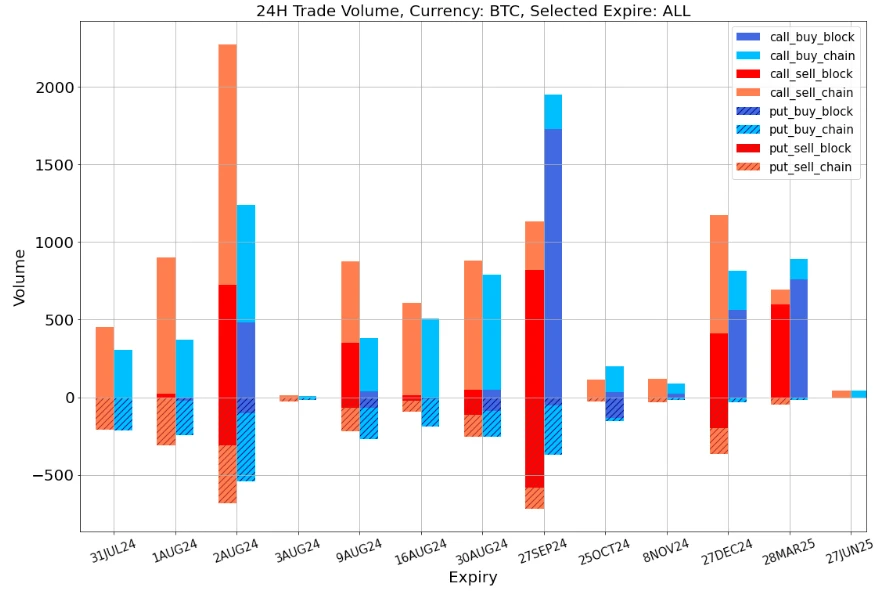

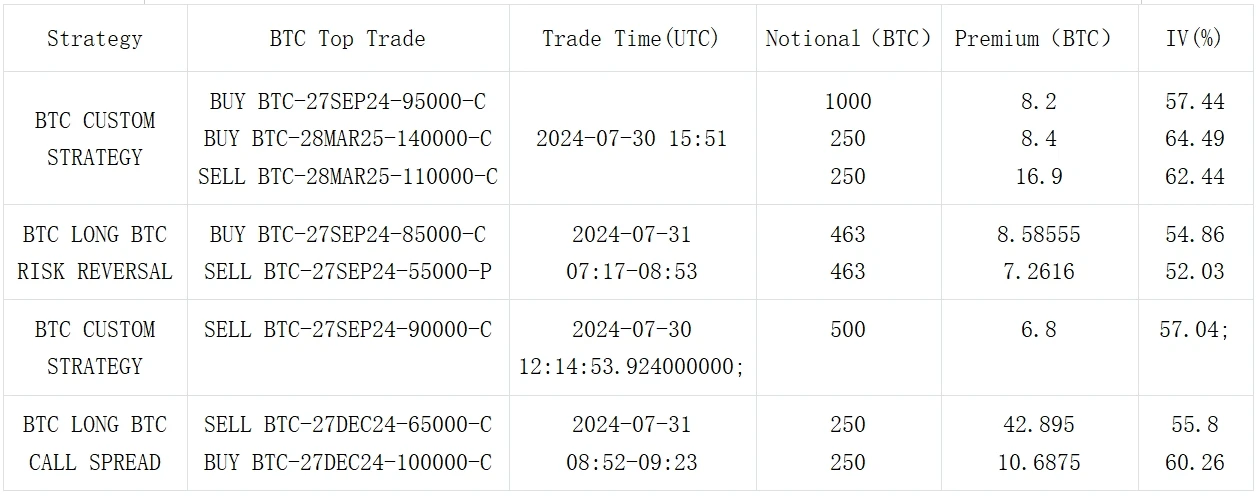

In terms of trading, investors bought a large number of put options on ETH 2 AUG for protection, and sold a large number of call options in the middle and front ends, causing the Vol Skew to fall in this range; in terms of BTC, the market sold call options on 2 AUG to eat the premium brought by the uncertainty of FOMC. At the same time, there was still sufficient supply on the far top side. The more representative ones were 1,000 September 95,000-C call purchases, 85,000 vs 55,000 Long Risky, and December 65,000 vs 100,000 call rolls, which pushed up the premium on the topside wing and tilted the far Vol Skew towards call options.

Source: Deribit (as of 31 JUL 16: 00 UTC+ 8)

Data Source: Deribit ETH transaction overall distribution; SignalPlus 25 dRR

Data Source: Deribit BTC transaction overall distribution; SignalPlus 25 dRR

出典: Deribit ブロック取引

出典: Deribit ブロック取引

t.signalplus.com の SignalPlus トレーディング ベーン機能を使用すると、よりリアルタイムの暗号通貨情報を入手できます。最新情報をすぐに受け取りたい場合は、Twitter アカウント @SignalPlusCN をフォローするか、WeChat グループ (アシスタント WeChat: SignalPlus 123 を追加)、Telegram グループ、Discord コミュニティに参加して、より多くの友人とコミュニケーションを取り、交流してください。SignalPlus 公式ウェブサイト: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240731): FOMC Outlook

関連:新たな世界的コンセンサス?「仮想通貨大統領」の数が増加中

原著者:Huo Huo 2024年はスーパー選挙の年であり、世界中の数十の国と地域で重要な選挙が行われ、総人口は40億人を超えます。米国の選挙は間違いなく最大の焦点です。しかし、過去とは異なり、2024年の米国選挙に参加するすべてのスーパーPACの中で、暗号通貨の話題は人気ランキングで3位にランクされています。4年前、大統領候補が選挙活動中にビットコインについて議論することはまれだったことを今でも覚えています。3年前、エルサルバドルがビットコインを法定通貨として初めて採用したとき、誰もがまだ注目していました。しかし、昨年の予備選挙で状況は変わり始め、暗号化が政治で疎外されていた時代は永遠に終わったように思えました。一方で、トランプ前大統領は…