Original author: NingNing (X: @0x Ning 0x )

The core upgrade of the Cancun upgrade, EIP 4844, stores the state data of L2 batch to the Ethereum mainnet in the newly added Blob space.

We know that the design architecture of Rollup is actually reselling Ethereum mainnet block space to developers and consumers.

There are two core business models for Rollup:

-

Build a truly prosperous Rollup ecosystem, and then make money from the interaction between developers and consumers, L1L2 Gas price difference and sequencer MEV income. Companies that adopt this business model include: Arbitrum, Optimism (via Super Chain Ecosystem), Base, etc.

-

Using the expectation of airdrops to continuously engage in Odyssey PUA users, and then earn money from the interaction between developers and consumers, L1L2 Gas price difference and sequencer MEV income. Companies that adopt this business model include: ZkSync, Scroll, Linea, etc.

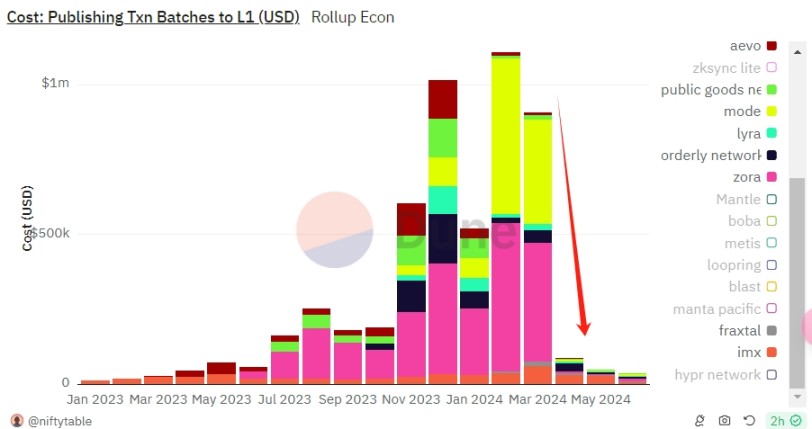

The Cancun upgrade has greatly compressed the data availability fee from L2 to L1, reducing the average gas fee of L2 deployed with the Cancun upgrade by an order of magnitude.

Ethereum is trying to use the Cancun upgrade to strengthen L1s dominance over the current Rollup Centric Ethereum ecosystem and promote explosive growth in the number of Rollups by reducing costs and increasing efficiency.

But intentionally or unintentionally, it destroyed the economic foundation of Rollup, which adopts the second core business model.

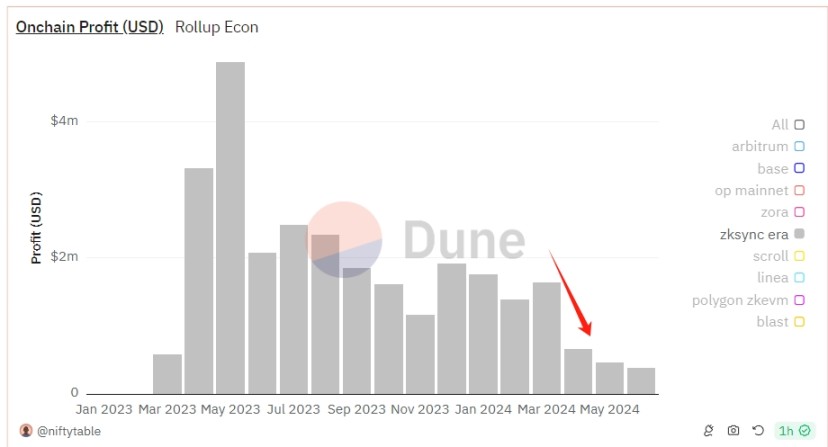

The first to be affected is ZkSync. After the Cancun upgrade, ZkSync immediately supported this new feature, but the effect was poor. The geometric reduction in gas fees did not bring the expected user growth and ecological prosperity, but instead caused the Rollup L1-L2 Gas price difference income to be halved.

Since the ZkSync ecosystem has always been underdeveloped, the growth of MEV revenue cannot make up for the sharp decline in L1-L2 Gas price difference revenue. In desperation, ZkSync had to choose the June rebound time window for airdrops to partially exit by selling tokens in the secondary market.

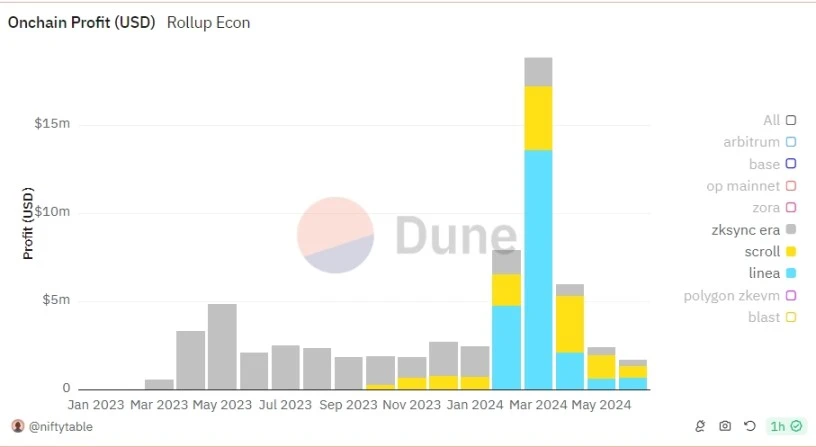

Its competitors Scroll and Linea, on the other hand, resisted community and market pressure by, firstly, delaying the deployment of the Cancun upgrade as much as possible and continuing to maintain the high gas fee of L2 to make a profit from the price difference; secondly, they adhered to the bottom line of not airdropping or issuing coins and continued PUA user interactions.

Judging from the on-chain data, after February, Scroll and Lineas Rollup revenue far surpassed ZkSync.

I think that before the next Ethereum mainnet Pectra upgrade changes the rules of the game, the Scroll and Linea teams will not have any ideas of airdropping coins, and the electronic beggars should be mentally prepared and manage their expectations.

Rollups that adopt the first business model have encountered different challenges, the most important of which is the siphoning effect of the Solana MeMe craze on funds and users in the Ethereum ecosystem.

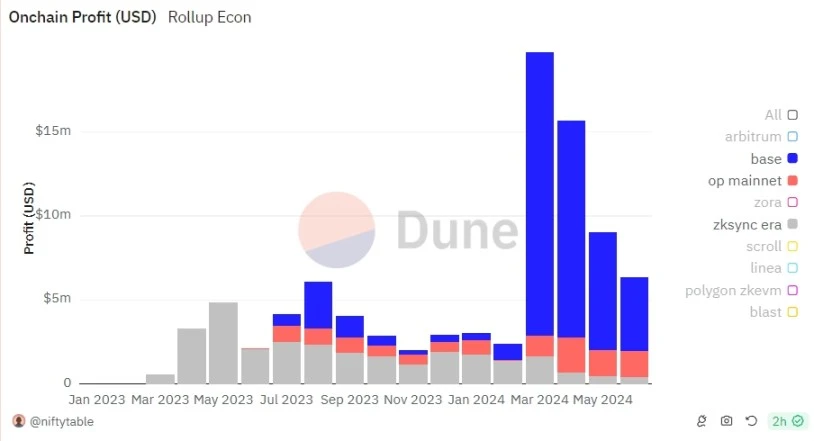

Fortunately, the SocialFi and MeMe sectors of the Base chain have emerged as a dark horse and become the shield for the Ethereum ecosystem to resist the impact of the Solana barbarians. Rollup revenue has also risen sharply, maintaining the first place for four consecutive months.

Since Base is built with OP Stack and is a superchain member of Optimism, Optimisms Rollup revenue also benefits from the positive externalities of Bases ecosystem prosperity and has achieved growth after the Cancun upgrade.

Arbitrum, once the leader, saw its Rollup revenue decline in April and May due to its excessive bets on Web3 games and slow action on its Rollup Stack strategy, but it quickly recovered in July.

Finally, the Cancun upgrade greatly reduced the operating costs of Dapp Rollup, encouraging more Dapps to choose to adopt the Rollup paradigm for reconstruction (such as Frax, Uniswap, AAVE, etc.).

This article is sourced from the internet: How are Rollups doing in the post-Cancun upgrade era?

Related: The art of trading: sharing the application of technical indicators

It is not difficult to know, but it is not easy to do. For investment in the secondary market, everyone knows that you cannot be greedy, nor can you chase the rise and sell the fall, but how many people can control their hands to achieve unity of knowledge and action? In the Tao Te Ching, Lao Tzu mentioned Tao, law, and art. Tao refers to rules, natural laws, and core concepts, law refers to methods, legal principles, and systems, and art refers to behavior and operating methods. Tao, law, and art are combined and regarded as important principles and guidelines for guiding peoples lives and social development. For the secondary market, we can also divide investment into Tao, Fa and Shu, and none of the three can be missing.…