Trump assassination drives Bitcoin surge

The rising probability of Trumps victory has made risky assets such as Bitcoin popular. In particular, the Republican Party mentioned in its latest campaign platform that if Trump takes office, it will end the suppression of cryptocurrencies, which has greatly boosted confidence in the cryptocurrency market.

The “Trump deal” is a hit.

After Trump was attacked over the weekend, a series of Trump-related assets such as U.S. Treasury yields and Bitcoin soared. This is all thanks to the fact that he survived the assassination attempt, and the American peoples support for Trump has soared.

Among them, Bitcoin rose for six consecutive days, with a total increase of 11.59% this week, reaching a high of US$66,000.

There are about 11 days until the next Fed meeting (August 1, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

市場テクニカルおよび感情環境分析

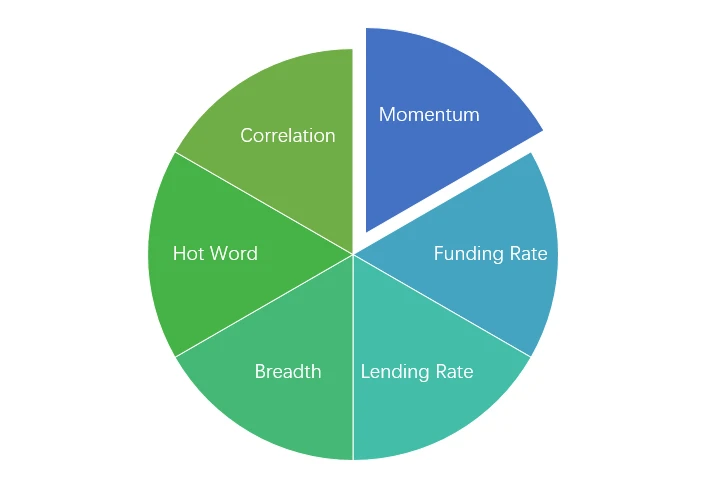

感情分析コンポーネント

テクニカル指標

価格動向

In the past week, BTC prices rose 11.59% and ETH prices rose 10.55%.

上の画像は、過去 1 週間の BTC の価格チャートです。

上の画像は、過去 1 週間の ETH の価格チャートです。

表には過去 1 週間の価格変動率が表示されています。

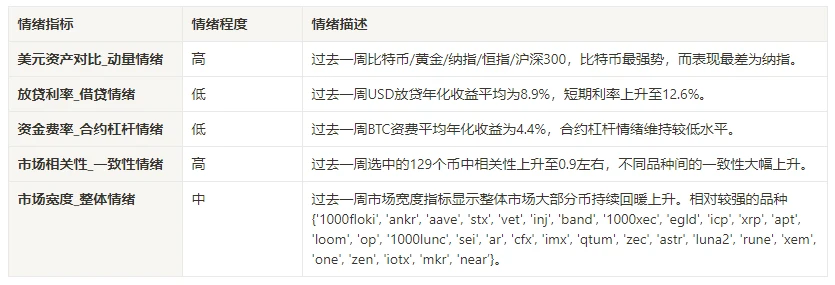

価格ボリューム分布チャート(サポートとレジスタンス)

In the past week, BTC and ETH formed a new intensive trading area as they rose to high levels and increased in volume.

上の図は、過去 1 週間の BTC の取引密度の高いエリアの分布を示しています。

上の図は、過去 1 週間の ETH 密集取引エリアの分布を示しています。

この表は、過去 1 週間の BTC と ETH の週ごとの集中取引範囲を示しています。

取引量と建玉

In the past week, BTC and ETH had the largest trading volume when they rose from July 15 to 16; the open interest of BTC and ETH both fell slightly.

上の図の上はBTCの価格動向、真ん中は取引量、下は未決済建玉、水色は1日平均、オレンジ色は7日平均です。Kラインの色は現在の状態を表し、緑は価格上昇が取引量によって支えられていること、赤はポジションのクローズ、黄色はゆっくりとポジションを蓄積していること、黒は混雑した状態を意味します。

上の図の上はETHの価格動向、真ん中は取引量、下は未決済建玉、水色は1日平均、オレンジ色は7日平均です。Kラインの色は現在の状態を表し、緑は価格上昇が取引量によって支えられていること、赤はポジションをクローズしていること、黄色はゆっくりとポジションを蓄積していること、黒は混雑していることを意味しています。

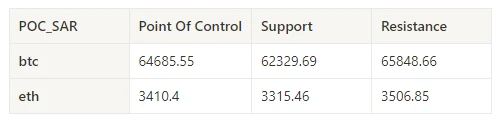

ヒストリカルボラティリティとインプライドボラティリティ

In the past week, the historical volatility of BTC and ETH was the highest when it rose to 7.16; the implied volatility of BTC and ETH rose synchronously.

黄色の線は過去のボラティリティ、青い線はインプライド ボラティリティ、赤い点は 7 日間の平均です。

イベント駆動型

There were no major data releases in the past week.

感情指標

モメンタムセンチメント

In the past week, among Bitcoin/Gold/Nasdaq/Hang Seng Index/SSE 300, Bitcoin was the strongest, while Nasdaq performed the worst.

上の図は、過去 1 週間のさまざまな資産の傾向を示しています。

貸出金利_貸出感情

The average annualized return on USD lending over the past week was 8.9%, and short-term interest rates rose to 12.6%.

黄色の線はUSD金利の最高値、青い線は最高値の75%、赤い線は最高値の75%の7日間平均です。

この表は、過去の異なる保有日における米ドル金利の平均リターンを示している。

資金調達率_契約レバレッジ感情

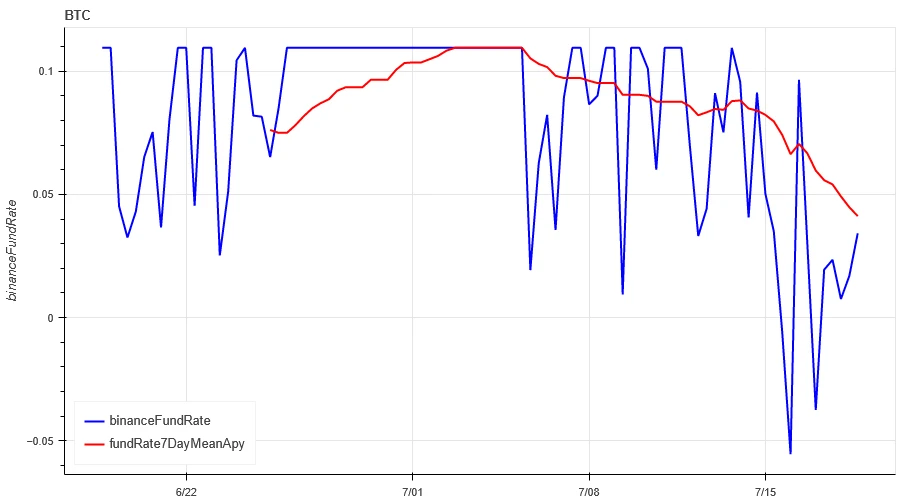

The average annualized return on BTC fees in the past week was 4.4%, and contract leverage sentiment remained at a low level.

青い線はBinanceでのBTCの資金調達率、赤い線は7日間の平均です。

The table shows the average return of BTC fees for different holding days in the past.

市場相関_コンセンサスセンチメント

The correlation among the 129 coins selected in the past week remained at around 0.9, and the consistency between different varieties increased significantly.

In the above picture, the blue line is the price of Bitcoin, and the green line is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx , imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx , sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] overall correlation

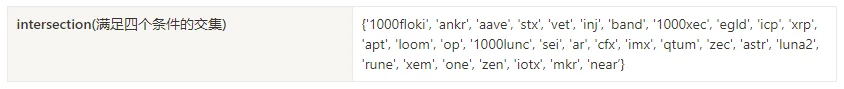

市場の幅_全体的な感情

Among the 129 coins selected in the past week, 78% of the prices were above the 30-day moving average, 37% of the prices were above the 30-day moving average relative to BTC, 33% of the prices were more than 20% away from the lowest price in the past 30 days, and 67.7% of the prices were less than 10% away from the highest price in the past 30 days. The market breadth indicators in the past week showed that most of the coins in the overall market rebounded and rose.

The picture above is [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot , icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, manta, mask, matic, meme, mina, mkr, near, neo, nfp, ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rose, rune, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] 30-day proportion of each width indicator

要約する

In the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) rose for 6 consecutive days, while the volatility and trading volume of these two cryptocurrencies reached the highest level when they rose on July 16. The open interest of Bitcoin and Ethereum is declining. In addition, the implied volatility of Bitcoin and Ethereum has also risen in tandem. Bitcoins funding rate remains at a low level, which may reflect the continued low leverage sentiment of market participants towards Bitcoin. Market breadth indicators show that most cryptocurrencies have rebounded and risen, indicating that the overall market has rebounded from lows in the past week.

ツイッター: @ https://x.com/CTA_ChannelCmt

Webサイト: チャンネルcmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.07.12-07.19): Trumps assassination drives Bitcoin up

Related: Decoding Dar Open Network: The infrastructure layer for the next generation of Web3 games

At Dar Open Network, we firmly believe in the transformative power of blockchain games. Games are not only entertainment, but also empower players, revolutionize the digital economy, and push the boundaries of technological innovation. As the crypto industry grows, we believe that blockchain games will become the cornerstone of a new paradigm in driving adoption, creativity, and digital interaction. Our team is committed to building a gaming platform that serves game developers and players. We are not creating a new chain, but building an ecosystem. Guided by this vision, we developed Dar Open Network as the infrastructure layer for future games. The creation of Dar Open Network has been going on for six months. Starting from the mission of providing a one-stop solution, we have made progress in many aspects…