原作者: dt

原文翻訳: リサ

The market conditions this week are still not improving. In this issue of CryptoSnap, let us continue to talk about the development of Tons on-chain ecology. Dr.DODO will take you to understand the development status of Ton Defi and the direction of future efforts, as well as which areas of development retail investors need to pay attention to!

Current Status of Ton Defi

Although Defi is not the main narrative in this cycle, for any public chain, the development of Defi is still a major indicator of whether the on-chain ecology is prosperous, and it is the foundation of the foundation. Of course, Ton is no exception.

As mentioned in the previous Cryptosnap introduction, the most basic Defi applications on the Ton chain, such as DEX, lending, liquidity pledge, etc., the first-layer Defi Lego protocols are already available, which can meet the basic needs of most retail investors. However, there are still many shortcomings for high-end Defi players or whale farmers. Here, the author lists the five most important points that the Ton ecosystem needs to continue to develop:

-

Introduction of mainstream assets BTC and ETH

-

More cross-chain bridge support

-

オラクル

-

Second layer Defi income agreement

-

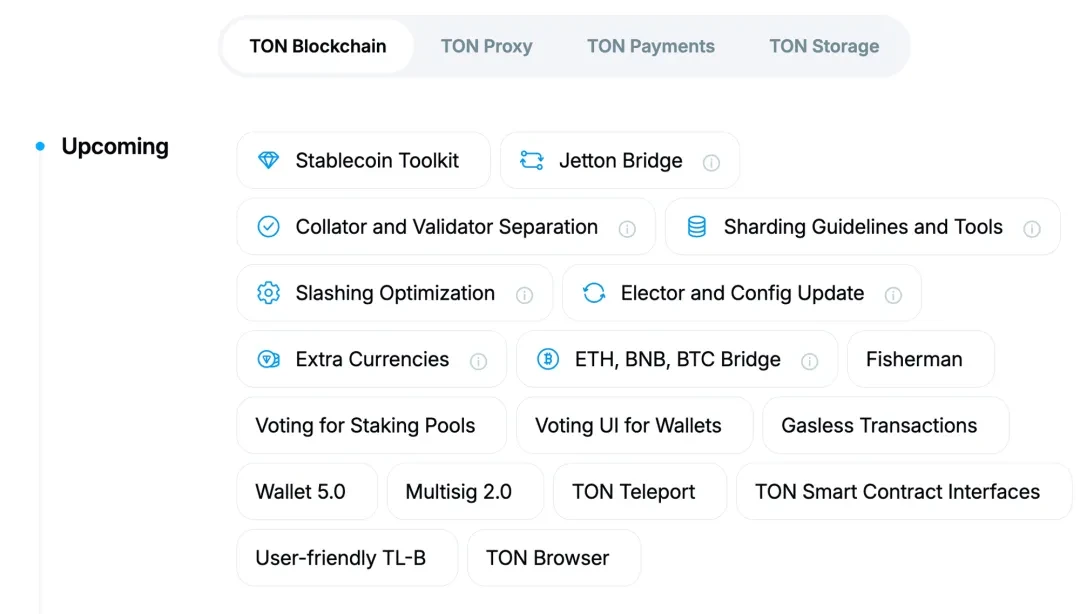

Memecoin Infrastructure

Among them, the first and second points are the most basic cross-chain bridges and the support of other major assets. In the process of explosive growth of TVL on the Ton chain from 100M to 700M in Q2 2024, the support of native USDT is the biggest trigger point. The author believes that the key to breaking through 1B TVL in the next stage is the support of other mainstream assets BTC and ETH , and more third bridges to provide liquidity. This is also the development goal for the next quarter as stated in the current Ton Foundation roadmap.

Source: https://t on.org/en/roadmap

The third point is that oracles determine whether more complex Defi protocols can be implemented. They are also the key for many large players to determine whether they can participate in the project. At present, the mainstream oracle in the Ton ecosystem is the quotation function provided by Redstone, but for many whale players, Redstone still cannot get enough trust foundation. How to introduce oracles such as Chainlink or Pyth with strong capital support is also the key to whether TVL can go to a higher level.

The second-layer Defi income agreement mentioned in the fourth point corresponds to the first-layer Defi Lego agreement in the Ton ecosystem that the author mentioned earlier. However, there are still few second-layer Defi Lego income projects that focus on APR income, such as mortgage stablecoins, packaged interest-bearing assets, income strategy farms, etc.

The last point I think is the general trend of this cycle, the mainstreaming of Memecoin. I think the most successful SOL ecosystem in this cycle is not actually driven by Defi applications, but more by the vigorous development of Memecoin, which has driven the growth of TVL of DEX. Therefore, MemeFi is a key point that I think can be vigorously developed. Although there are many teams that have been working in this direction, such as TON Raffles, Ton UP, Thunder Finance, etc., in my opinion, the promotion of Memecoin requires the official combination of venture capital to ignite the detonation point, just like Solanas $BONK and $WIF. Only with the wealth effect can the subsequent MemeFi ecosystem be ignited.

Mini APP

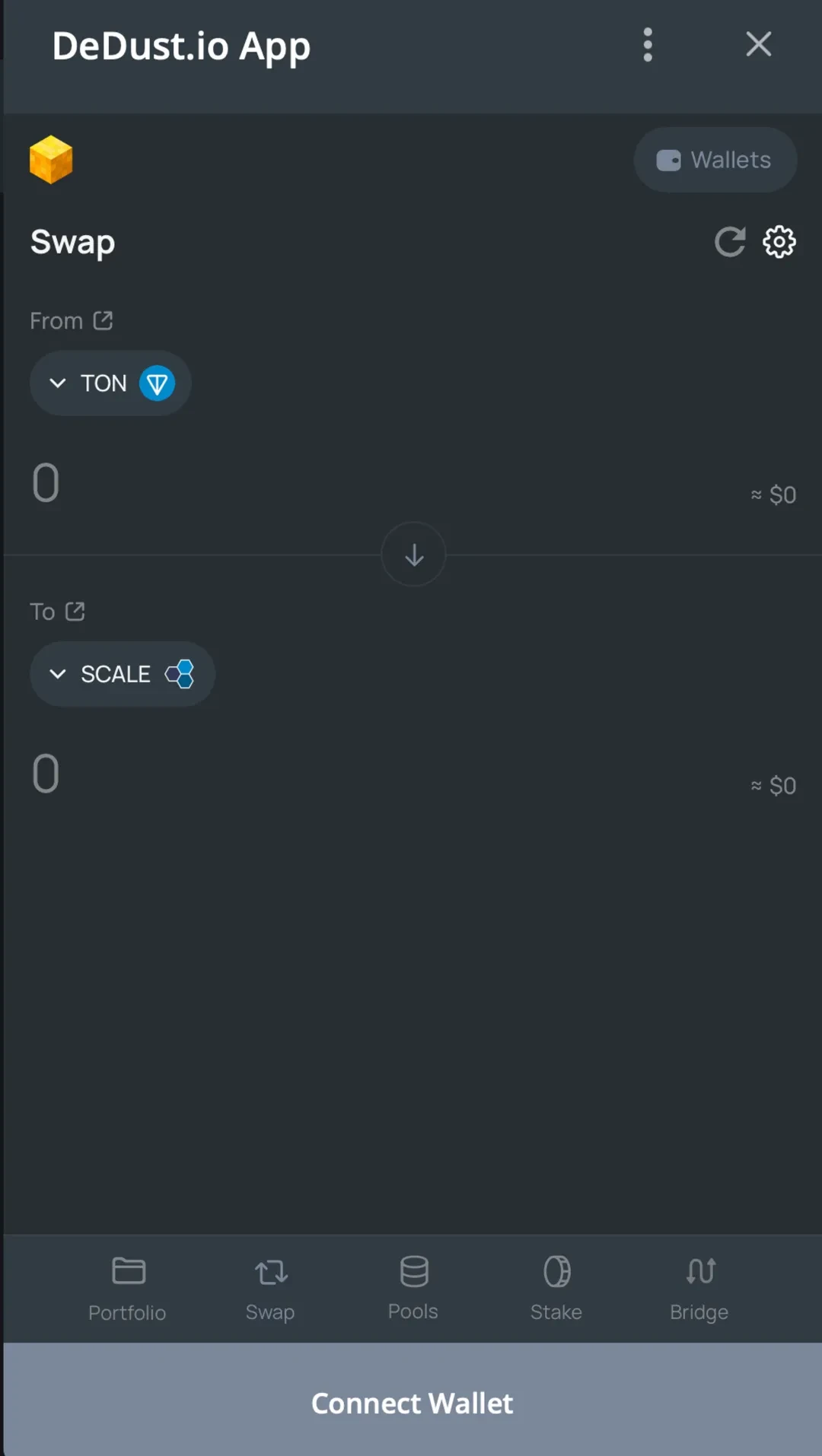

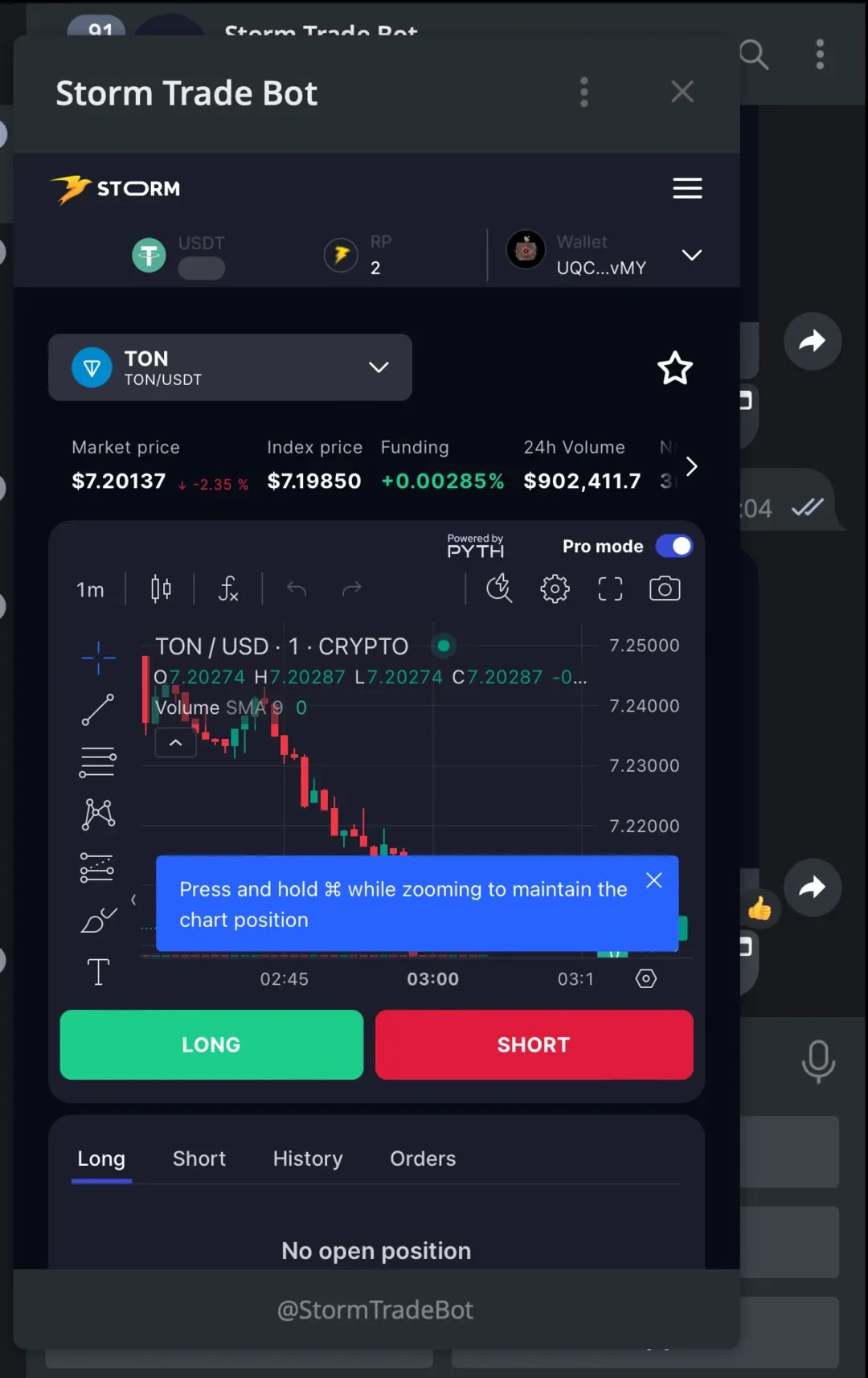

The biggest feature of the Ton ecosystem is the Telegram Mini APP. Although most of the current Ton Mini APPs are game projects, the mainstream Defi applications on Ton almost all have two front-end interfaces, one is the ordinary web-based Dapp and the other is the front-end of the Telegram Mini APP. I believe that the development of the Telegram Mini APP will effectively narrow the gap between TONs DeFi services and Telegram users, and can capture more new mobile users.

But on the other hand, complex Defi applications are not suitable for mobile experience and security. Mini APP or Telegram Chatbot is more suitable for the time-sensitive Memecoin field. Perhaps we need to wait for the appearance of the Golden Dog on Ton to attract a large number of players to become new users of Mini APP.

Source: https://tm e/dedustBot

Source: https://t.me/Storm TradeBot

The Open League Season 5

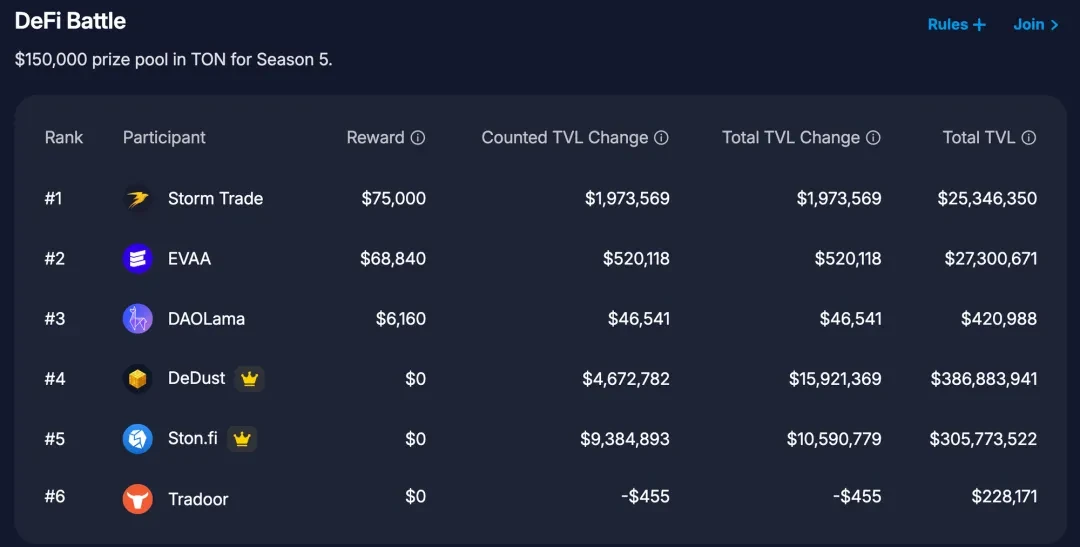

Finally, let鈥檚 talk about the recently started fifth season of The Open League. To be honest, I am a little disappointed with the Ton Defi project so far. There are only six participating protocols and they are exactly the same as those in the fourth season. There are no new projects joining. As for the projects that have already issued coins, only the NFT lending protocol DAOLama token $LLAMA has squeezed into the top ten.

According to the current competition situation, Storm Trade, an on-chain derivatives perpetual contract protocol that ranked third in the previous period, is currently ranked first and its TVL performance has also increased significantly. Tradoor, which is also in the derivatives perpetual contract track, has not made any progress but has regressed. The second place is the lending protocol EVAA, and the third place is the NFT lending protocol DAOLama. The fourth and fifth places are occupied by the two major DEX protocols DeDust and Ston.Fi.

Source: https://ton.org/open-league

ソース: https://ton.org/open-league

著者の意見

This article focuses on the development of Tons Defi. The author believes that there is still a lot of room for development in Defi. One of the problems may be related to the fact that Tons development code is a brand new language, which increases many development barriers. At present, there has been no strong support from venture capital, such as Multicoin and Jump Crypto to Solana, and there have been no representative developers such as AC to the Ethereum Defi ecosystem. Of course, it is still too early to draw conclusions, and the development of Tons Defi still deserves continued attention.

This article is sourced from the internet: Overview of TON Chain DeFi Ecosystem: Current Development and Future Outlook

関連: SEC が再び Consensys を訴える? 今回は Lido と Rocket Pool も関与?

原文|Odaily Planet Daily 執筆者:jk 米国現地時間6月28日金曜日、米国証券取引委員会(SEC)はニューヨーク州ブルックリンの連邦裁判所でコンセンシスを提訴し、同社がMetaMaskと呼ばれるデジタル資産ウォレットを通じて証券の募集と販売に従事し、未登録のブローカーとして活動したと非難した。 SECの取り締まりの範囲 「コンセンシスはブローカーディーラーとして登録せず、特定の証券の募集と販売を登録しなかったことで連邦証券法に違反した」と訴状には記されている。 「コンセンシスは未登録のブローカーディーラーとしての行為を通じて$2億5000万以上の手数料を徴収した」 The Blockによると、SECは、コンセンシスがステーキングプログラムプロバイダーのLidoとRocket Poolを通じて数千の未登録証券を販売し、…