Original title: Introducing the Crypto Market Map

Original author: Electric Capital

原文翻訳:Peisen、BlockBeats

編集者注:

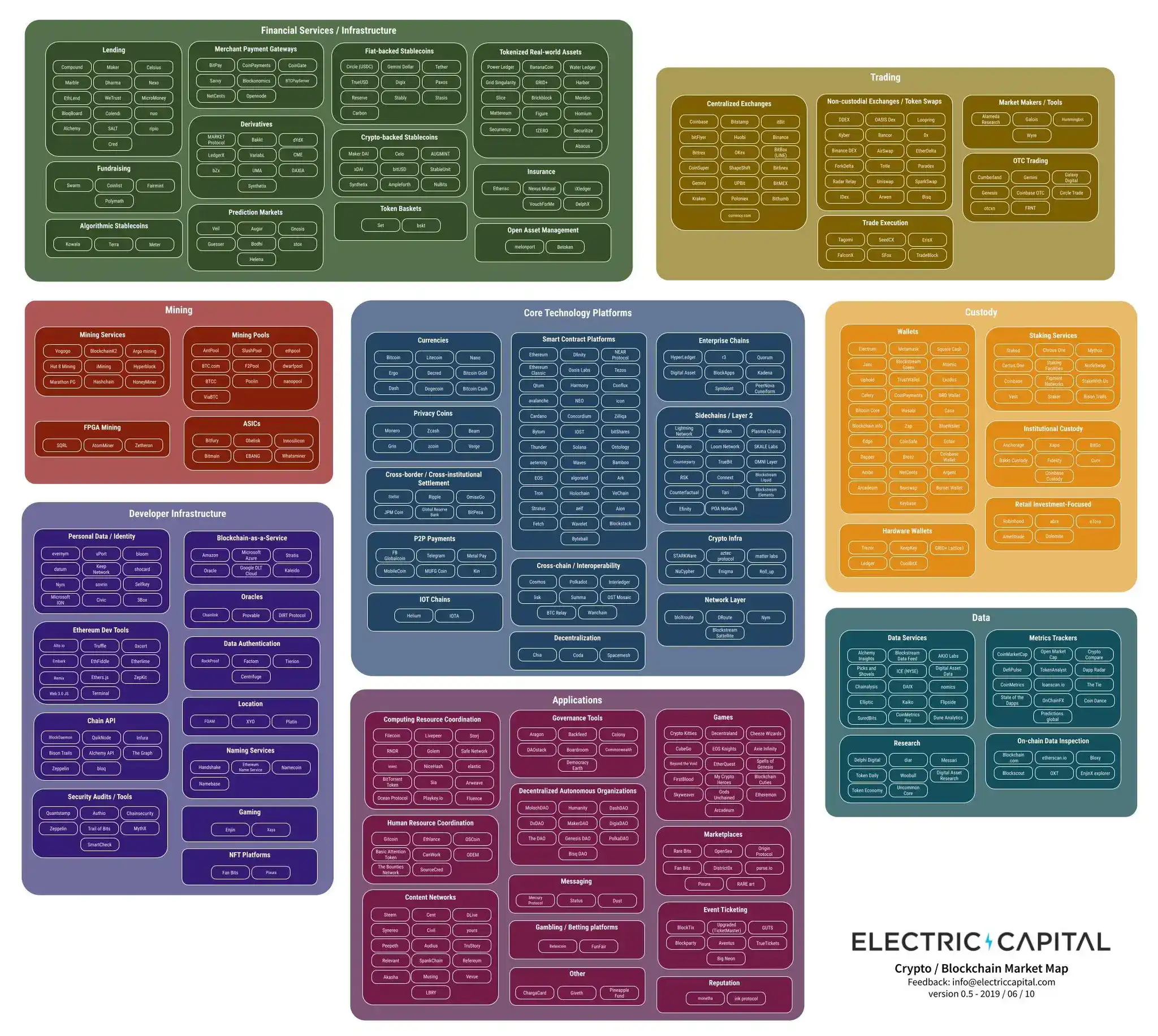

After tracking more than 1,500 projects in the entire crypto field, Electric Capital drew a crypto market map, dividing crypto projects into six technical levels, including core infrastructure, expansion, interoperability, developer tools and services, protocols and applications. The analysis shows that DeFi has now become the main category of crypto; NFT now supports the entire crypto application; scalability and interoperability projects are maturing; consumer-oriented applications and protocols are growing; innovative technologies have moved from the theoretical stage to the practical stage.

The Crypto Market Map tracks over 1,500 projects across the crypto space. The goal of the Crypto Market Map is to help people understand and put projects into context within the crypto environment. It provides a clear picture of the industry structure and the roles played by different companies and projects.

The site is an important place for the community to stay on top of the ever-expanding crypto space.

The Crypto Market Map is the first tool to put each major projects role in the ecosystem into context. The Crypto Market Map is divided into six technical layers, from infrastructure projects at the bottom to end-user-facing projects at the top. These layers reflect the progression of crypto infrastructure maturity.

The six technical layers of the crypto market map include:

Core Infrastructure: This base layer includes Bitcoin and other Layer 1 blockchain projects that expand upon Bitcoin’s initial design, offering improvements and different trade-offs. Mining services, hardware manufacturers, and other infrastructure-level projects are included in this layer.

Scaling: As the use of Bitcoin, Ethereum, and other Layer 1s increases, projects emerge to address scalability issues. This layer includes Layer 2, Layer 3, and modular blockchain projects.

Interoperability: As the number of chains increases, the ability to transfer information across chains becomes critical. Projects at this layer focus on achieving cross-chain communication, data sharing, and asset transfer.

Developer Tools and Services: This layer lists the tools, services, and data providers that are critical to developers and users. It covers everything from development frameworks to data analysis tools.

Protocols: These projects are characterized by most of the rules being executed on-chain. Many different front ends can be created on top of these protocols to serve different user groups. These projects cover a variety of use cases such as DeFi, NFT and gaming, social, identity and data sovereignty, privacy, etc.

Applications: These projects are characterized by the fact that most of the rules are not executed on the chain. These projects cover a variety of use cases such as centralized finance, creator platforms, NFTs and games, social, identity and data management and sovereignty, privacy, etc.

The line between protocols and applications is not always clear, and many projects can be considered both. This is because many applications in crypto have both off-chain and on-chain components.

In the Crypto Market Map, 138 projects are listed in multiple categories.

The crypto market map aims to visually show where most projects in the crypto space are headed. The height of each level shows the number of projects. The highest level has the most projects. Within each level, categories with more projects are on the left, and categories with fewer projects are on the right.

As crypto technology matures, it becomes more specialized and complex. We created the Crypto Market Map to provide an overview of the rapidly expanding crypto industry.

As of June 2019, the Electric Capital market map has included 500+ projects. Although only significant projects are taken into account, the 2024 crypto market map includes 1,500+ projects.

Since the first edition of the market map was published in 2019, the crypto space has changed significantly:

DeFi is now a major category in crypto. In 2019, the DeFi category was not on the market map because it was not separate enough from non-protocol financial applications. Projects like Uniswap and Compound were launched less than a year ago. DAI, the third largest stablecoin with a circulating supply of $34 billion today, was not yet launched. The total value locked (TVL) of DeFi as a whole was less than $500 million at the time. Today, DeFi has a TVL of $85 billion and is the largest category on the crypto market map, covering 394 projects and covering 14 subcategories, including brand new specialized subcategories such as yield, liquid staking, liquid re-hypothecation, etc.

NFTs now underpin the entire crypto landscape. In 2019, the most well-known NFT collectibles like Cryptokitties were lumped into the “Games” category. Almost no standalone collectibles existed. Most applications don’t use NFTs. Today, NFTs have become the standard for assets across multiple sectors, including gaming, creator platforms, music, art, loyalty, finance, identity, and more. Protocols that allow for lending, borrowing, and derivatives on NFT assets have become an entirely new category, spanning 49 projects.

Scaling and interoperability projects are maturing. In 2019, there were 17 Layer 2 projects. Cross-chain and interoperability projects had 8. Today, scalability and interoperability exist as separate “technology layers” in the crypto market map, covering many categories and subcategories. There are now 73 significant Layer 2 projects. Layer 3 projects have emerged. Modular blockchains are a new category within scalability, with over 60 significant projects, more than all Layer 2 and cross-chain projects combined in 2019. Intent and account abstraction is a new category within the interoperability layer, with 11 projects.

Consumer-facing applications and protocols are growing. Gaming, social, and other consumer-facing applications are expanding rapidly. In 2019, there were only 30 major gaming projects; today, there are 121 projects in the games, gaming platforms, and metaverse space. Social applications and protocols now have 110 projects.

Innovative technologies have moved from the theoretical stage to the practical stage. Innovations that were still in the theoretical stage in 2019 now have active projects. For example, zero-knowledge technology has developed from a few pioneer projects such as Zcash to being used by 159 projects in the crypto market map.

As categories mature, some have experienced consolidation. Smart contract platforms and exchanges were the two largest categories of crypto projects in 2019. The number of projects in these two categories has not grown significantly as users and developers have consolidated onto fewer platforms. As categories mature, we expect the same consolidation effect to affect other categories as well.

Specialization has become essential in the cryptocurrency space in order to keep up with progress in different categories. Each field requires unique expertise. As cryptocurrency expands, it becomes increasingly challenging to fully understand all verticals. The Crypto Market Map aims to address this by providing an overview of the entire industry.

The Crypto Market Map intends to include only major projects and underestimates the number of all projects in the cryptocurrency space. The Crypto Market Map intends to include projects with significant industry or cultural impact and longevity.

The projects in this market map are drawn from a pool of thousands of crypto projects. To be included in the market map, a project must have at least one of the following characteristics:

Raised over $2 million since 2019 and has active updates since March 2024

Raised over $50 million since 2019 and has been active since March 2024

More than 50 developers involved in 2024

Top 100 by market capitalization on Coingecko

Major DeFi projects on their chains on DefiLlama

Individual projects with significant community support with over 10k Twitter followers

Individual projects that play a leading or prominent role in a chain’s ecosystem

Even if the above criteria are met, projects participating in hackathons are excluded as well as projects that do not show an intention to ship their initially announced products or whose shipping timeline may be too far away.

The Crypto Market Map is not yet complete and is in beta. Please help us improve it! This map is still in beta and is far from complete.

We have reviewed thousands of crypto projects for inclusion in the market map, but we expect there will still be gaps. Some projects may be absent due to missing data sources. Classification can be subjective, so projects may be missing from certain categories.

Additionally, as time goes on and new projects become more important, keeping the map up to date will be a community effort.

By building the Crypto Market Map publicly, we aim to provide a valuable and community-driven tool for everyone in the crypto industry.

Missing project? Miscategorized? General feedback? Please contribute here to improve and expand the Crypto Market Map.

This article is sourced from the internet: Electric Capital: What did we find after studying more than 1,500 projects?

Next weeks highlights ZK Nation: ZK airdrop will be available on June 17th ; LayerZero will release an updated list of witches on Monday ; Nostra will conduct a TGE and airdrop on June 17 ; Renzo Co-founder: It is expected that users can request withdrawals on June 17/18 ; Lista DAO: TGE and airdrop will start on June 20 ; Starknet Foundation: The STRK airdrop claim window will close on June 20th . From June 17 to June 23, more noteworthy events in the industry are previewed below. June 17 Tether CEO: Plans to launch new types of digital asset products on June 17 Odaily Planet Daily News: Tether CEO Paolo Ardoino announced on the X platform that after a year of hard work, Tether will launch a new…