Recently, with the influence of macro data and government agencies selling coins, the crypto market seems to be very turbulent, but the more in such a period, the more we need to calm down and find good targets and continue to pay attention. Although memes are dominant in this cycle, there are also many outstanding projects in tracks such as DeFi and games. Aerodrome Finance, the largest DEX in the Base ecosystem, and Notcoin in the Ton ecosystem are both excellent cases.

After Notcoin went online and became popular, many ecosystems have Tap-to-Earn imitations, but few have achieved significant results. Aptos ecosystem game Tapos is one of the best. According to data from Artemis, an on-chain analysis agency, on May 25, Aptoss daily transaction volume reached 115.4 million, exceeding Solanas 31.7 million, breaking the historical record of L1 public chains daily transaction volume, which is more than 50% higher than the previous record held by Sui.

The main reason for the surge in activity on the Aptos network is the Tap-to-Earn game called Tapos. During the popularity of the game, the Aptos network had nearly 2,000 transactions per second. In addition to the addictive game mechanism, the most important thing is the high performance of Aptos as a basic support, which made it possible to create history.

The future market is undoubtedly a bull market cycle with more abundant liquidity. From Solana to Ton, the narrative of new public chains still holds true in this cycle. Through recent observations, Aptos may become the next wealth-making chain. This integrator born from Meta and Move languages, what magic does Aptos have from the bear market to the present? We may be able to get a glimpse of it from its recent ecological dynamics.

Aptos recent developments at a glance

In the first half of this year, Aptos TVL growth has been visibly strong. According to DeFillama data, as of the time of writing, Aptos TVL reached $366 million. Among them, in the first quarter, TVL increased from $130 million to a maximum of $493 million, an increase of nearly 500%.

Focus on DeFi

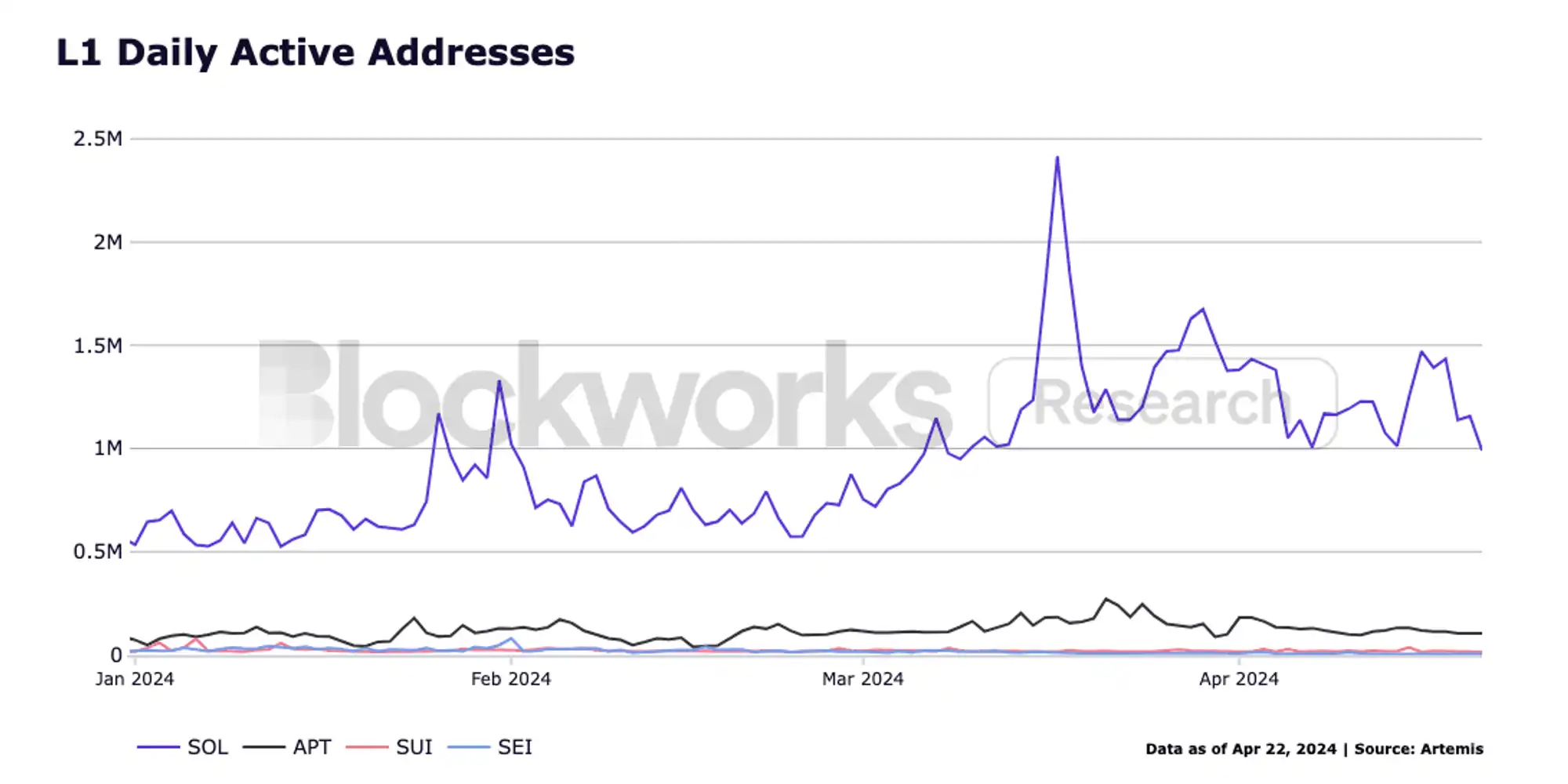

According to official data, Aptoss daily active addresses (DAA) averages around 120,000, making it the second-highest DAA in the Alt L1 field after Solana. One of the biggest reasons for this is that Aptos is going all out to build the DeFi field. After all, high farm returns are the most powerful weapon for a chain to attract active addresses. In addition, the high-performance infrastructure brought by the Move language is also a necessary condition.

Last September, the Aptos Foundation and the Aptos ecosystem DeFi project Thala Labs jointly launched a $1 million fund to incentivize the development of DeFi protocols based on Aptos, called Thala Foundry. It plans to support the launch of more than five new DeFi protocols on Aptos, and is expected to grow to $5 million after the protocol is launched and expanded.

In addition to supporting latecomers, Thala, as the first and most robust DeFi project in the Aptos ecosystem, has also achieved outstanding performance in this cycle. Its TVL ranked first in the Aptos ecosystem in the first quarter. Thanks to its good product architecture and farm income, its native token THL has risen from $0.6 at the beginning of the year to a maximum of $3. Currently, Thalas TVL ranks second in the Aptos ecosystem, and the first place is the lending protocol Aries Markets.

Capturing traditional financial institutions

In addition to supporting DeFi, Aptos has also set its sights on the more macro field of TradFi.

Aptos has a fairly complete stablecoin suite, especially through Thala Labs overcollateralized stablecoin MOD, and the USDY introduced by the Aptos Foundation in cooperation with Ondo Finance in February this year, enabling Aptos to use traditional financial instruments globally without barriers. This is also the first of many RWA initiatives that Aptos is about to launch.

In April this year, Aptos Labs also established a partnership with Microsoft, Brevan Howard, SK Telecom and Boston Consulting Group to develop Aptos Ascend, a digital asset management platform for financial institutions. The institutional platform aims to expand decentralized finance to institutional capital through the Aptos network and increase the liquidity of tokenized assets globally.

Aptos Ascend positions Aptos as a competitive TradFi entity and RWA through built-in compliance and customizability, which means that Aptos will look beyond the on-chain crypto market.

On June 4, the U.S. Commodity Futures Trading Commission appointed Mo Shaikh, co-founder and CEO of Aptos Labs, as a member of the Digital Asset Subcommittee. The 34 members of the Digital Asset Subcommittee also include executives from BlackRock, Polygon Labs, Uniswap Labs and BNY Mellon. This means that Aptos will focus on traditional financial institutions and bring broader opportunities to the entire ecosystem.

The airdrop season is coming, what are the projects worth paying attention to in Aptos?

The current Aptos ecosystem is like Solana at the end of last year. There are a number of high-quality ecological projects that have been developed hard in the past one or two years waiting for wider market exposure. Most of them have clearly stated that they will carry out airdrops, which is another major focus of Aptos worthy of attention.

アリエスマーケット

Aries Markets is the first lending project in the Aptos ecosystem and has maintained the largest lending in the ecosystem since its launch. At the beginning of this year, Aries became the DeFi protocol with the highest TVL in the entire Aptos ecosystem and has remained so to date. Aries Markets TVL exceeds 250M, accounting for nearly 50% of the TVL in the Aptos ecosystem. At present, the platforms borrowing amount has exceeded 100 million US dollars. The high amount of borrowing highlights the activeness in the ecosystem and also establishes Aries Markets current core position in the ecosystem.

Aries Markets is a platform that integrates lending, leveraged trading, and bridge. Aries has completed the connection with decentralized exchanges Liquidswap, pancakeswap, thala, and the hyperparallel chain order book Econia, and users can perform leveraged trading on Aries. Recently, Aries has launched a new feature E-mode, and the LTV of some related assets can be as high as 90%. Aries can get a high rate of return of 50%+.

Since January this year, Aries has been running the APT incentive program, which provides additional rewards for both lending and borrowing. Currently, the APY lending interest rate of stablecoins on Aries is around 20%-30%, and the lending interest rate of stablecoins has even reached negative interest rates in the past. The incentive program is still running and has reached cooperation with OKX and Pancake many times.

It is worth noting that Aries recently launched a points program, which allows users to earn rewards through lending and referring friends, and it is considered to be directly related to subsequent airdrops.

Liquidswap

Liquidswap is the first and most traded AMM protocol in the Aptos ecosystem, with a current TVL of $34 million and an average daily trading volume of $10 million, accounting for more than 80% of the Aptos ecosystems trading volume. According to official data, its average daily active users are 10,000, making it the project with the highest number of daily active users in the Aptos ecosystem.

The team behind Liquidswap is the founding team of Pontem Wallet, the largest wallet in the Aptos ecosystem. Pontem has its own small ecosystem. In addition to Pontem Wallet, Liquidswap, and NFT, there is also Layer 2 Lumio that supports MoveVM, SolanaVM, and EVM.

Pontem is the earliest ecosystem developed on the Move language besides Aptos and Sui. It was developing Move even before Aptos appeared. It raised $10.5 million in funding from investors such as Pantera Capital, Aptos Foundation, Wintermute, etc., to enable developers to build applications that are compatible with both the Ethereum Virtual Machine and Move, thereby expanding the use of the Move programming language beyond the Aptos and Sui blockchains.

It is worth noting that the Pontem team has also issued two NFT series, Pontem Pirates and Dark Ages. Some farmers on Liquidswap can also get additional rewards by verifying their ownership of these two NFTs.

Recently, the most popular project of Aptos should be Liquidswap. With TGE approaching, many airdrop hunters have released tutorials on how to get liquidswap. Coupled with the subsequent linkage with Lumio, the flagship project of the Pontem team, its potential may be even greater than Thala, the earliest DeFi protocol to issue coins.

アムニスファイナンス

Amnis Finance is the leading LRT staking protocol within the Aptos ecosystem, and has achieved remarkable success in just 8 months since its launch. Even more impressive is that Amnis has grown entirely on its own, relying solely on the team鈥檚 resources and funding.

Amnis Finance has a TVL of over $114 million, with over 15 million APT staked and over 200,000 active stakers. In addition, it has an active community of over 80,000 followers and has established partnerships with over 30 leading players in and outside the Aptos ecosystem.

Their newly released NFT series Draconian sold out on the first day and became the #1 popular NFT series on Wapal, Mercato and Tradeport. The series has now reached a total sales of 5.94K. The recent Lucky Wheel event further stimulated user participation, with a total of more than 230,000 draws and nearly 1 million APT staked.

Looking ahead, Amnis Finance plans to work with many protocols to explore new use cases for LSD. In addition, Amnis Finance will soon launch its AMI governance token, and users can accumulate points to qualify for the upcoming airdrop. The number of tokens each participant receives will depend on their leaderboard ranking and accumulated points. With its innovative approach, autonomous development success, and upcoming airdrop, Amnis Finance is undoubtedly a project to watch in the Aptos ecosystem.

Merkle Trade

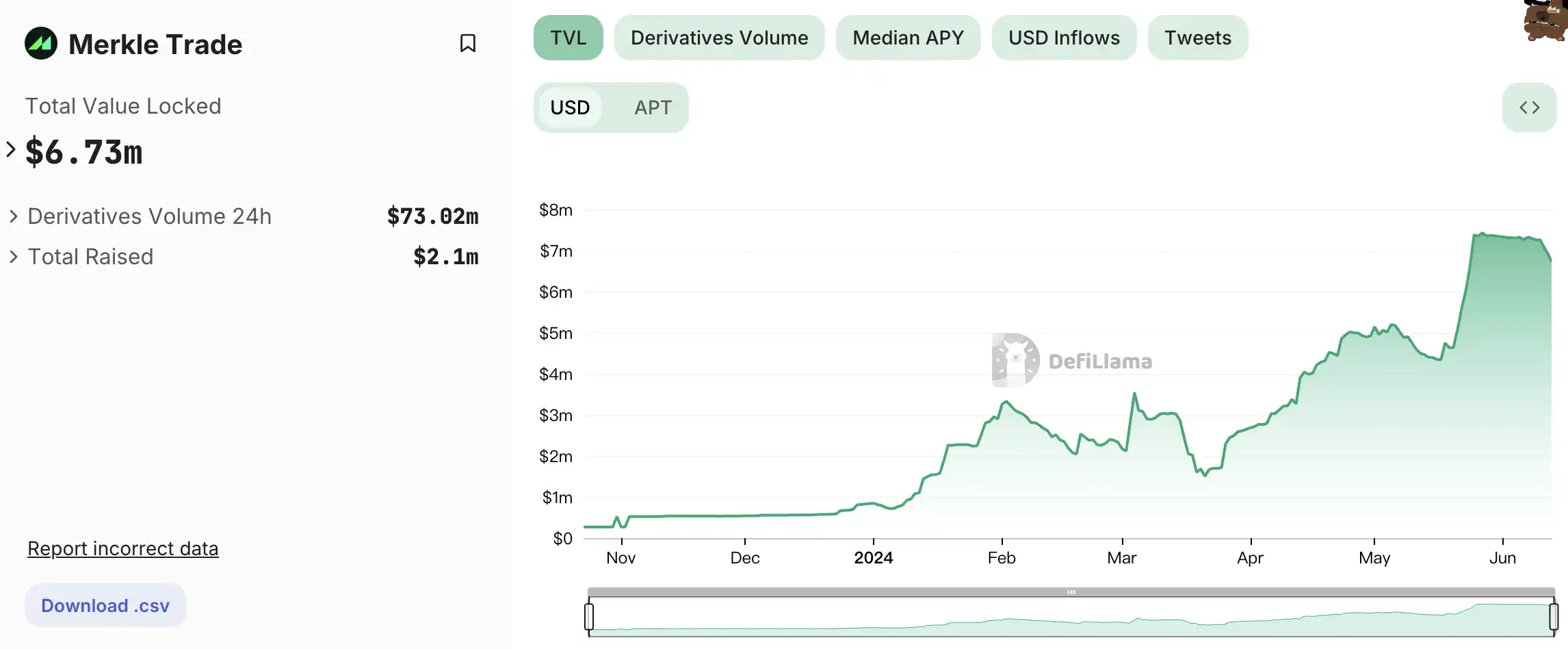

Merkle Trade is the first perpetual contract DEX based on Aptos and Omnichain gamification through LayerZero, combining a high-performance, robust and secure perpetual DEX with the fun, social and interactive aspects of online RPG games. Merkle Trade offers up to 150x leverage on cryptocurrency pairs and allows up to 1000x leverage on forex and commodities.

Currently, Merkle Trade has a cumulative trading volume of $10.11 billion, with a trading volume of $2 billion in both April and May, and an average daily number of traders exceeding 800. Its LP structure is uniquely efficient, with $6.8 million in locked LPs seamlessly handling daily trading volumes of up to $300 million.

In April this year, Merkle announced the completion of a $2.1 million seed round of financing, led by Hashed and Arrington Capital, with participation from Morningstar Ventures, Amber Group, Aptos Labs, Re 7 Capital and Dorahacks. The funds raised will be used for the platforms growth plan.

Merkle Trade recently announced that its TGE is scheduled to take place in the last week of July. Launching on the Perp DEX protocol Vertex with over $300 million in FDV and $10 billion in cumulative trading volume, it also plans to disclose its token launch and token economics in the coming weeks.

Kana Labs

Kana Labs is a decentralized trading platform in the Aptos ecosystem that can rival CEX trading experience. Its intelligent routing algorithm combines liquidity aggregators and cross-chain bridging layers to find the best path and price for each transaction, enabling fast and economical exchanges. In addition, Kana Labs product suite seamlessly connects EVM and non-EVM chains, building a true full-chain crypto ecosystem.

Kana Labs core product is Paymaster, which sponsors transactions for Kana Labs end users, eliminating gas fee friction to increase conversion rates and enhance user experience. Developers deposit Aptos into a fund managed through Kana Labs Paymaster, and Paymaster then handles the allocation of gas fees to facilitate transactions. By sponsoring user transactions, applications can lower the barrier to entry and attract more users without requiring them to manage their own Aptos wallets.

Kana Labs is also using cross-chain functionality in its Aptos spot trading book and is building a Perp DEX.

Kana Labs native token is $KANA, with a maximum supply of 300,000,000. The main application scenarios include staking to earn incentives, enjoying a 50% discount on Kana Labs platform fees, obtaining exclusive NFT Tokens and identities, etc.

Last November, Kana Labs completed a $2 million seed round of financing, with participation from NetMarble subsidiaries MarbleX, Nexus One, Klaytn and Gate.io. The funds raised will be used to enhance products such as smart wallets and Web3 middleware toolkits. In addition, it will also focus on user acquisition and international expansion, with a special focus on Asia-Pacific regions such as South Korea, Japan, Hong Kong, China and Taiwan.

最終的な考え

Aptos Labs has raised $400 million from institutions such as Andreessen Horowitz and Jump Crypto. Its latest round of financing was conducted in September 2022, with a valuation of more than $4 billion. However, due to the black swan events such as FTX, the market expectations at that time did not bring positive impetus to Aptos. However, Move, as an infrastructure with outstanding underlying technology, has enabled Aptos to maintain its competitive position in the current market.

In the previous article, we talked about the DeFi track of the Aptos ecosystem, but in addition to DeFi, Aptos is also developing another layer of games and consumer applications. Users can also look forward to Aptos integration with stablecoin providers and the injection of new funds through airdrops. In terms of tokenization, Aptos Ascend may bring a new wave of financial institutions to the chain in the coming months, and the partnerships with Microsoft and io.net have brought new possibilities to Aptos, which is expected to become a new force at the intersection of cryptocurrency and artificial intelligence.

A few days ago, Alex Svanevik, CEO of data analysis company nansen.ai, said that Aptos is one of the chains that should be in the top 20. In terms of ecological performance and market popularity, Aptos is indeed underestimated. BitMEX founder Arthur Hayes directly predicted in a video interview that in the current cycle of L1 competition, Aptos will surpass Solana and become the second largest L1. This may take one to three years. He will reveal more details in September this year.

The new public chain narrative is not over yet, let us wait and see the future of Aptos.

This article is sourced from the internet: Seize the ecological airdrop opportunity: Aptos recent developments and investment opportunities at a glance

Related: Deep Parsing Chain Abstract Key Elements (CAKE) Framework

Original author: Favorite Mirror Reads Archive Original translation: TechFlow Summary of key points The default crypto user experience today is for users to always know which network they are interacting with. However, Internet users do not need to know which cloud provider they are interacting with. Bringing this approach to blockchain is what we call Chain Abstraction. This article introduces the Chain Abstraction Key Elements (CAKE) framework. The framework consists of four parts : application layer, permission layer, solver layer, and settlement layer , and aims to provide users with a seamless cross-chain operation experience. Achieving chain abstraction requires a complex set of technologies to ensure the reliability, cost-effectiveness, security, speed, and privacy of the execution process. We define the cross-chain tradeoff in chain abstraction as a trilemma and propose…