導入

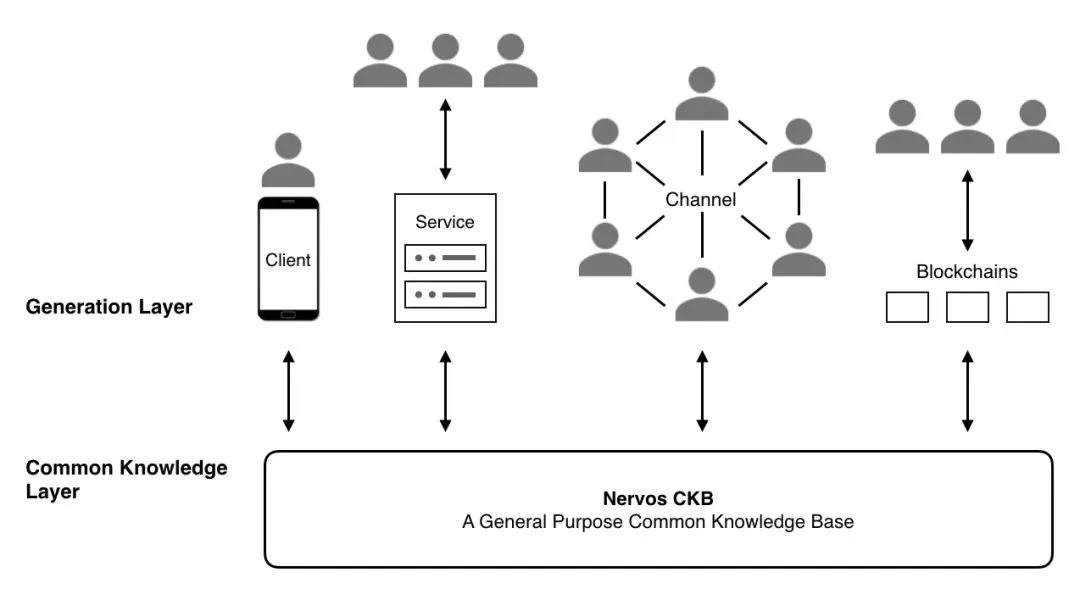

As a public chain, Nervos Network aims to solve the expansion limitations faced by traditional networks such as Bitcoin and Ethereum.

The Nervos blockchain uses a proof-of-work (PoW) consensus and supports a layer-1 protocol for smart contract development. It also includes a range of layer-2 scaling solutions to facilitate high-volume use cases. Nervos native token (CKByte or CKB) allows users and developers to apply for storage space on the Nervos blockchain in proportion to their holdings.

On February 13, 2024, Nervos Network announced the release of a new product: RGB++. Nervos Network embarked on the road of transformation: from Layer-1 to Bitcoin Layer-2, using its own advantages to specialize in Bitcoins second-layer expansion.

プロジェクトの基本情報

project team

コアチーム

Jan Xie: Founder and Chief Architect. He is also the founder of Cryptape, a former researcher and developer at the Ethereum Foundation, focusing on Casper and Sharding, co-founder of ethfans.org, and former architect of Peatio.

Inal Kardan: Co-founder and CEO. Core developer of Yunbi Peatio, co-founder of Teahour. Very experienced developer.

Kevin Wang: Co-founder. Studied at the University of Pennsylvania with a bachelors degree in telecommunications and networking. Worked on enterprise data solutions at IBM Silicon Valley Lab. Kevin Wang is also the co-founder of Khalani, an intent-driven centralized solver infrastructure.

Daniel Lv: Co-founder and COO. Former CTO of imToken (the worlds largest Ethereum wallet), former CTO of Yunbi, co-founder of ruby-china.org, and also worked as a senior engineer at Intridea.

Cipher Wang: Co-founder. Studied at Peking University. Chief Product Officer of Cryptape. Former Director of Blockchain Laboratory of China Banknote Printing and Minting Corporation.

資金調達

Nervos Network has raised approximately $100 million in two rounds of funding.

Seed round

In August 2018, Polychain Capital led the investment, with participation from Sequoia China, Wanxiang Blockchain, Blockchain Capital, etc. The amount was US$28 million.

Series A

On October 16, 2019, Nervos Network completed its ICO on Coinlist with an amount of US$72 million.

In the two rounds of financing, Nervos Network raised US$100 million, and well-known investment institutions such as Polychain Capital, Sequoia China, Wanxiang Block, and Blockchain Capital made large investments in it. Nervos Network has been favored by many well-known capital parties.

Development Strength

Nervos Network was established in 2018 by founder Jan Xie. The key events in the development of the project are shown in the table:

From the key events of Nervos Networks project development, Nervos Network has been deeply involved in the UTXO model in the Bitcoin network and is a leader in the field of UTXO model research, which has also formed a technical barrier for Nervos Network. In addition, in terms of the time when Nervos Network implemented various key technical nodes, Nervos Network completed the development of project technology on schedule, which shows the strength of the Nervos Network technical team.

操作モード

Nervos Network upgraded its business on February 13, 2024, and changed the project from the original public chain to the current BTC-L2 track by launching the RGB++ product.

RGB

The RGB protocol is an extension of the original BTC protocol. It is essentially an off-chain computing system that uses a similar idea to the Lightning Network: users personally verify and authorize asset changes related to themselves, and submit the results/commitments approved by the transaction initiator to the Bitcoin chain.

The RGB protocol is mainly about mapping the assets of Bitcoin UXTO. RGB stores the Commitment of off-chain transaction data on the Bitcoin chain, instead of publishing complete DA data like the Ordinals protocol. According to the commitment value recorded on the Bitcoin chain, the RGB client can verify whether the RGB historical data provided by other clients is valid. At the same time, the Commitment alone cannot restore the original image behind it, and the outside world cannot directly observe the off-chain data corresponding to the commitment value on the chain, which can protect privacy, and compared with the inscription, only putting the commitment on the chain can save space. RGB also takes advantage of the one-time spending feature of Bitcoin UTXO, and associates the ownership of RGB assets with Bitcoin UTXO through an idea called one-time sealing. In this way, with the help of Bitcoins strong security, RGB assets can be prevented from being double-spent/double-spent (as long as Bitcoin UTXO is not double-spent, RGB assets will not be double-spent).

At the same time, the problems with RGB are also very obvious:

-

As a smart contract system implemented under the Bitcoin chain, it relies on different clients to store historical data locally, and different clients only store data related to themselves and cannot see the asset status of others. Although this data island protects privacy, it also makes RGB face difficulties in large-scale adoption, and it is more like a P2P network composed of OTC traders (in the final analysis, the problem of the DA layer has not been effectively solved);

-

In order to successfully transfer money to others, users must first obtain the other partys consent and confirmation, and both parties must be online at the same time;

-

Due to the lack of a globally visible data recording method, contract users must first obtain the interface functions contained in the contract from the contract issuer. The specific method of obtaining information can be through email or scanning a QR code.

To sum up, RGB is in a relatively original operating mode!

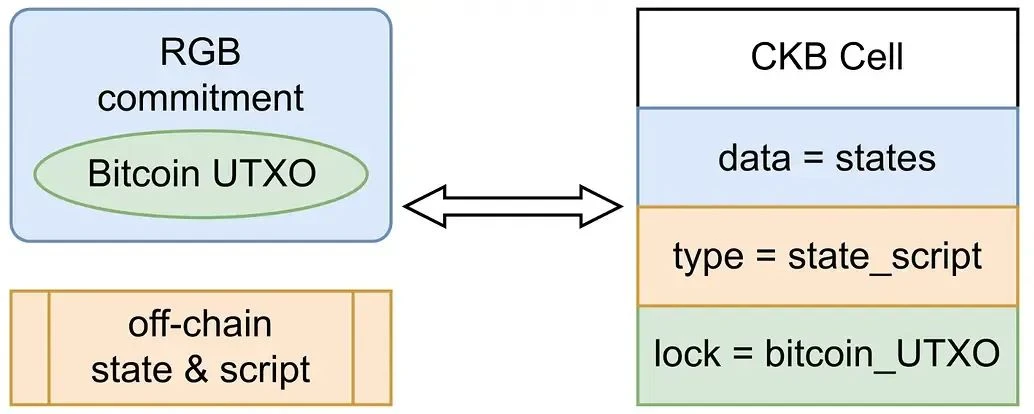

RGB++

Nervos Network itself is an extended UTXO model (Cell), which can write the off-chain information of RGB assets into Cell and establish a one-to-one mapping relationship between Cell and Bitcoin UTXO, realizing the RGB asset data custody and verification solution based on Nervos Network, thereby solving the usability problem and serving as an enhanced supplement to the original RGB solution.

The RGB++ technology implementation process uses the Cell on the Nervos Network chain to express the ownership relationship of RGB assets. It moves the asset data originally stored locally on the RGB client to the Nervos Network chain and expresses it in the form of Cell, allowing the Nervos Network to serve as a public database for RGB assets. The Cell representing the RGB asset will have a 1-to-1 mapping relationship with the UTXO on the Bitcoin chain, and this mapping relationship will be directly displayed in the Lock field of the Cell.

The workflow related to the commitment on the BTC chain is still carried out on the BTC mainnet, which means that RGB++ still needs to publish Commitment on the Bitcoin chain and associate it with the RGB asset transaction records that occurred on the Nervos Network. The work that the client is responsible for off-chain in the RGB protocol is now handled by the Nervos Network, which solves the problem of RGB client data islands and the defect that the contract status cannot be globally visible. At the same time, the RGB contract can be directly deployed on the Nervos Network chain, which is globally visible and can be referenced by RGB Cell, thus avoiding a series of strange operations when the RGB protocol contract is released.

The essence of RGB++ is to trade privacy for ease of use, and it can also bring about scenarios that the RGB protocol cannot achieve. If users value the simplicity, ease of use and completeness of functions, they will favor RGB++. If they pursue privacy and the security of Verify by yourself, they will favor the traditional RGB protocol. Everything depends on the users own choice (similar to Vitaliks comment on Ethereum Layer 2: If you pursue security, use Rollup; if you pursue low cost, use non-Rollup solutions such as Validium and Optimium).

In summary, after launching RGB++, Nervos Network has changed the original narrative of the project and has become a BTC-L2 project. It mainly uses Cell to express the ownership relationship of RGB assets. By establishing a 1:1 mapping relationship between Cell and Bitcoin UTXO, it solves the problems of RGBs original data islands and operational difficulties, and enhances the local Bitcoin experience without increasing complexity or damaging decentralization. Nervos Network has achieved the premise of retaining the transaction purity of the Bitcoin UTXO model, making the deployment of smart contracts on BTC-L2 a reality.

Technical features

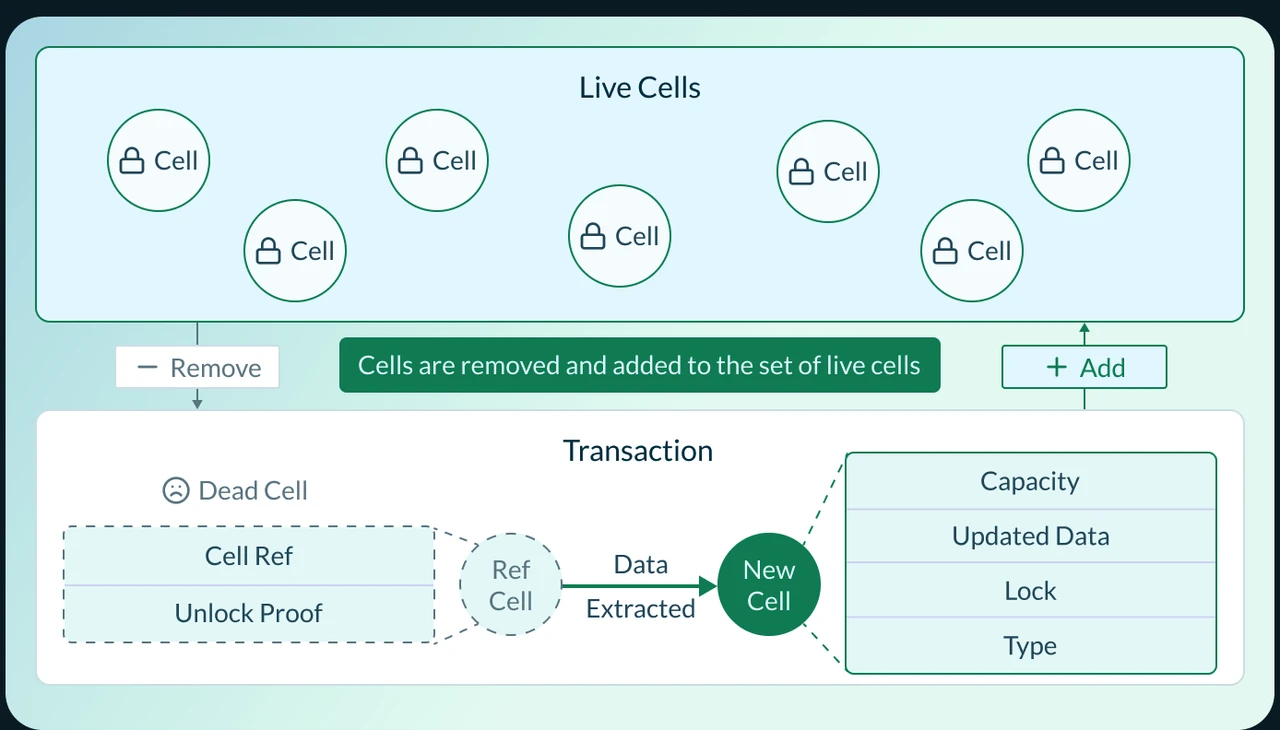

Cell Model

The construction of the Cell model is the key to the successful transformation of Nervos Network and the key to RGB++. The Cell model is an upgraded version of UTXO, which not only retains the transaction purity of the Bitcoin UTXO model, but also provides the data status of account models such as Ethereum.

The Cell model contains four fields: Capacity, Type, Data, and Lock:

-

Capacity represents the size of the on-chain space owned by this Cell;

-

Data refers to the data set contained in the Cell, which can be read or modified;

-

Type is the program code bound to this Cell, which limits the modification conditions of data;

-

Lock represents the ownership verification logic of Cell, which is similar to the unlocking script of Bitcoin UTXO.

From its fields, we can see that Cell is an upgraded version of UTXO, with two more fields, Type and Capacity, and Data can customize data types. As for the way to change the ownership of Cell, it is similar to Bitcoin UTXO, and is achieved through unlocking scripts. The most important one is the Data field. The main function of Data is to save all historical transaction status and other data in any form, which is equivalent to the DA layer in Ethereum modularization. The biggest problem of the previous RGB project was that the problem of data availability was not solved.

Non-interactive nature of transactions

An important problem with the RGB protocol is that the payee must first send a message to the payee, indicating that one of its UTXOs is bound to the RGB asset, before the RGB transfer can be successfully implemented. This requires multiple interactive communications between the payee and the payee to complete an ordinary transaction, which obviously increases the difficulty of user understanding and the complexity of the product. RGB++ takes advantage of the characteristics of the Nervos Network as a data hosting and computing platform, allowing counterparties to complete transfers through asynchronous, non-interactive methods.

Interacting with Bitcoin chain assets without cross-chain

As an off-chain settlement layer, Nervos Network aggregates a batch of transactions after multiple RGB transfers occur, generates a Commitment corresponding to the batch transaction, and publishes it to the Bitcoin chain at one time. After RGB++ realizes the association mapping between Bitcoin UTXO and Nervos Network Cell, it can directly realize interoperability without cross-chain assets. You can transfer your Bitcoin UTXO to others through RGB++ transaction declaration, and the other party can transfer the ownership of their CKB assets to you. This model has a lot of room for imagination. In theory, it can realize BTC-Nervos Network on-chain asset interoperability without BTC assets crossing chains.

Payment Channels

As the underlying public chain, Nervos Network has the ability to expand through payment channels, such as Perun, a payment channel framework developed by Polycrypt. These payment channels can process transactions off-chain and settle on-chain, thereby supporting a variety of applications from micropayments to payment gateways, thereby improving the performance of Nervos Network. Perun utilizes the Cell model of Nervos Network, where Cell carries capacity, Lock Script, Type Script, and data to manage the state of the channel. One of the channel implementations (PerunLockScript) can manage the access rights of the channel real-time Cell, while the other implementation (PerunTypeScript) can handle the verification logic of the state transition. These transitions are automatically managed from the channel obtaining funds to closing. Nervos core developers are also working to connect CKB to Bitcoins Lightning Network, enabling users to exchange BTC and Nervos Network without relying on third parties.

プロジェクトモデル

ビジネスモデル

The Nervos Network economic model consists of three roles: POW miners, application developers, and blockchain application users.

POW miners: Nervos Network adopts the Proof of Work (PoW) consensus mechanism, using NC-MAX, an upgraded version of the Bitcoin algorithm, and Eaglesong function to ensure the security of the network. Eaglesong is an ASIC-neutral custom hash function that can replace the widely used SHA 256 hash function. POW miners protect the security of the chain and maintain the normal operation of the Nervos Network by complying with the consensus mechanism of the Nervos Network, so that they can obtain block rewards as economic incentives. After the halving in 2023, the annual issuance of CKB will drop from 4.2 billion to 2.1 billion.

Application developers: As a BTC-L2 project, one of the keys to the success or failure of Nervos Network is the prosperity of its own ecosystem. Therefore, Nervos Network attaches great importance to its own ecological construction, providing Nervos Network ecosystem developers with greater innovation space. At the same time, application developers will occupy a certain amount of on-chain space when developing projects, and will pay a certain amount of storage fees to Nervos Network, which is also one of the sources of income for Nervos Network.

Blockchain application users: The gas fees paid by users on the Nervos Network are the main source of income for the Nervos Network.

From the above analysis, we can see that the revenue of Nervos Network is:

-

Gas fees paid by blockchain application users

-

Storage fees paid by app developers

トークンモデル

トークンの割り当て

CKBs unique economic model ensures that miners are permanently paid regardless of transaction volume, incentivizing them to provide security for the network, while also ensuring that CKB tokens act as hard assets so that the rights of long-term CKB holders are not diluted. CKBs economic model creates a flywheel effect, where the demand for holding CKB blockchain assets directly generates demand for CKB tokens. This creates a value capture mechanism for the native CKB token, ensuring that the security of the CKB blockchain grows in direct proportion to the value of the on-chain assets it protects.

There is no upper limit on the total amount of CKB. The total amount of tokens issued at the first level was 33.6 billion, and now all of them have been unlocked.

The CKB distribution in the genesis block is as follows:

In order to provide continuous rewards to miners, the Nervos team also designed a secondary issuance.

The purpose of secondary issuance is to collect state rent, ensuring that miners are compensated for their role in permanently protecting the security of the network regardless of CKBs on-chain transaction volume. Secondary issuance has no cap and follows a fixed issuance schedule of 1.344 billion CKB per year. However, unlike the base issuance, which is entirely for miners, secondary issuance is distributed between miners, NervosDAO depositors, and the treasury fund.

The specific allocation ratio of secondary issuance depends on how the currently circulating CKB is used in the network. For example, assume that of all circulating CKB, 50% is used to store state, 30% is locked in NervosDAO, and 20% is fully maintained liquidity. Then, 50% of the secondary issuance will be allocated to miners, 30% will be allocated to NervosDAO depositors, and the remaining 20% will be allocated to the treasury fund. Currently, secondary issuances deposited in the treasury fund are directly destroyed, which may change in the future through a community-initiated hard fork. It is important to emphasize here that the inflation caused by secondary issuance has a limited impact and only affects on-chain state occupiers, which means that CKB can act as both a deflationary token for long-term holders and an inflationary token for blockchain users.

Nervos’ token economics aims to solve the state explosion and value consistency problems that plague mainstream blockchains. Nervos does this in three main ways: limiting state explosion by pegging state growth to the CKB token, privatizing the state space, and introducing secondary issuance to transfer state rent from state occupiers to miners or state protectors.

トークンエンパワーメント

Nervos was originally a Layer-1, and its native token CKB is mainly used as the network transaction fee in the Nervos Network, that is, the Gas fee. All user operations in the Nervos Network need to pay CKB.

The role of staking is that when users stake CKB to NervosDAO, they will receive secondary-issued CKB tokens as inflation income in proportion.

Storing value, storing data on-chain, or occupying state space all require locking up CKB, which creates a direct long-term demand for CKB tokens. This means that holding non-native assets on the blockchain requires owning native tokens, which increases the value of native tokens, thereby increasing miner rewards and improving the security of the chain. This incentive structure is more in line with the goals of value-preserving asset storage platforms such as CKB, as their main goal is not to settle as many transactions as possible, but to reliably store and protect assets over the long term.

Token Price Performance

https://www.coingecko.com/en/coins/nervos-network

According to Coingecko statistics, the price of CKB has risen more than 11 times since June 2023 (lowest point 0.0028 US dollars, highest point 0.0322 US dollars), and the main trading venues are first-tier exchanges such as Binance and HTX.

-

The current price of CKB is $0.0115, the current circulation is 44,442,588,518, and the market value is $514.83 million.

-

CKBs daily trading volume is US$36 million, its market capitalization is approximately US$514.83 million, and its turnover rate is 6.99%, which is on the low side.

Therefore, compared with similar projects, the value of CKB is seriously underestimated.

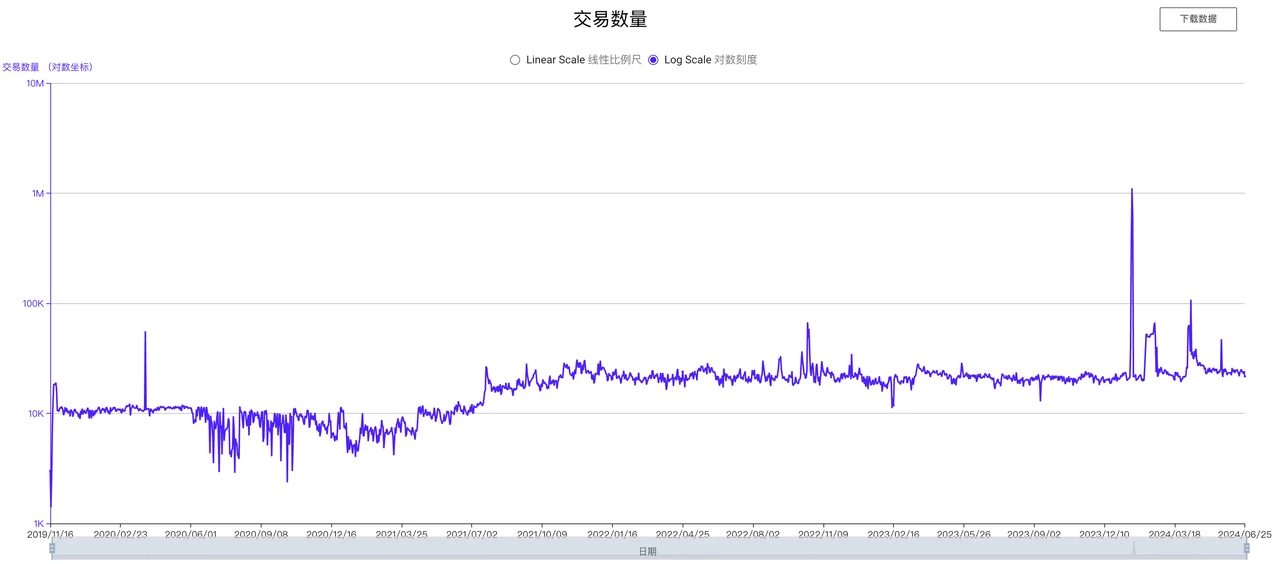

On-chain transaction volume

https://explorer.nervos.org/en/charts/transaction-count

As can be seen from the figure, the on-chain transaction volume of Nervos Network remains at a stable level.

Mining Difficulty

The mining difficulty of Nervos Network has been on an upward trend. Although the price has fallen back, the difficulty remains high, so more miners are joining the Nervos Network.

https://explorer.nervos.org/en/charts/difficulty-hash-rate

Number of addresses

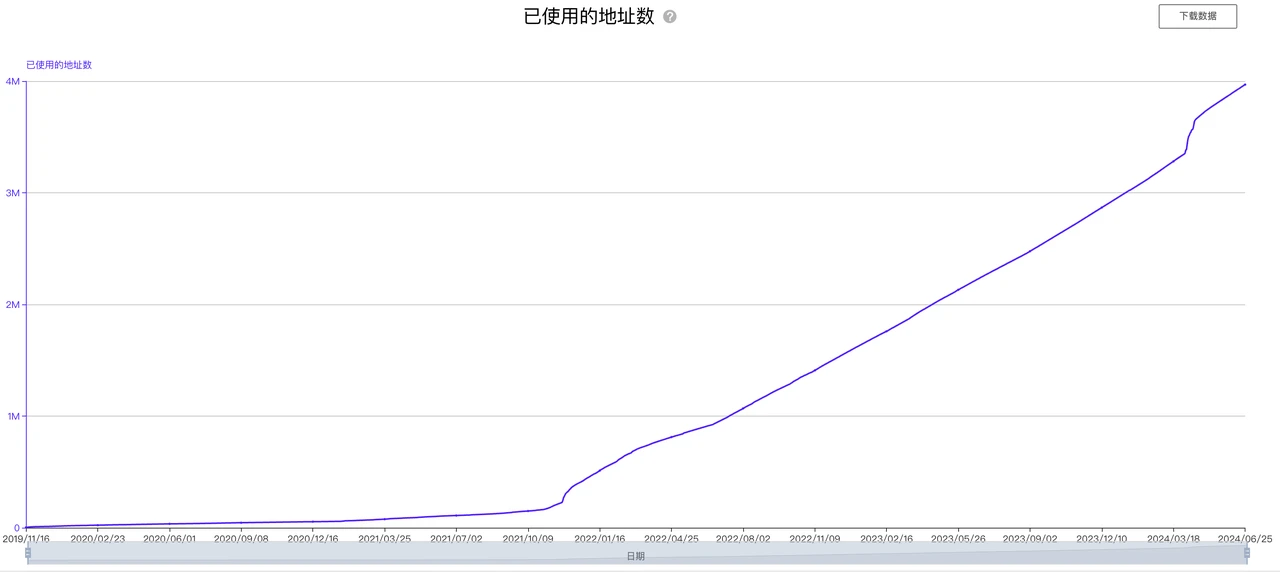

The number of addresses in Nervos Network has maintained a very high growth rate.

https://explorer.nervos.org/en/charts/address-count

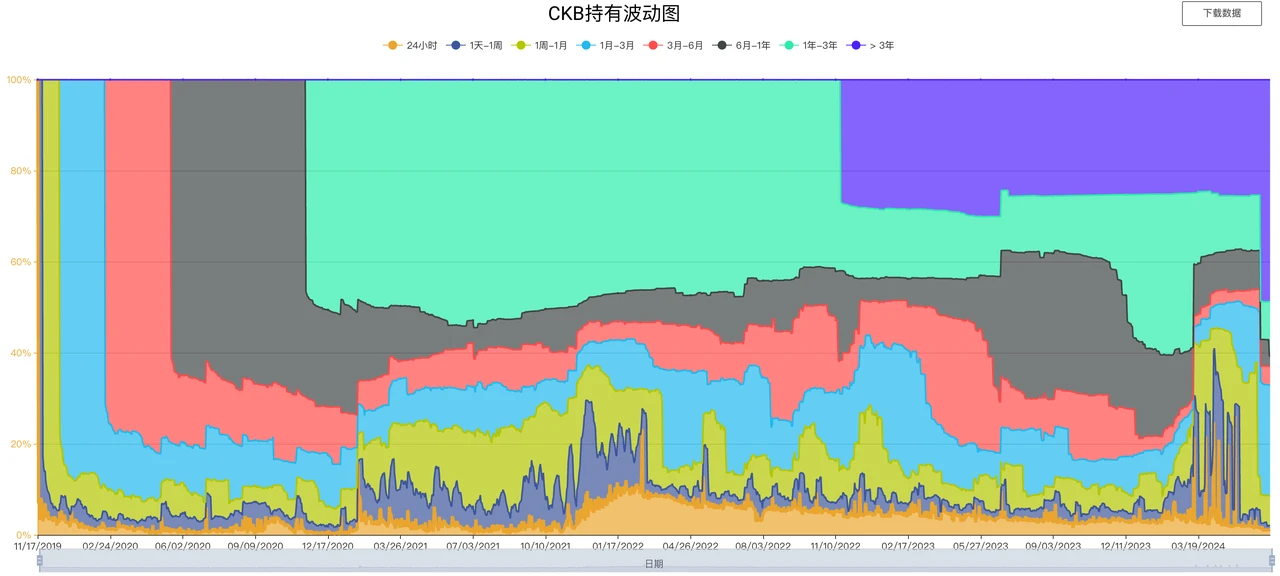

CKB Holdings Chart

https://explorer.nervos.org/en/charts/ckb-hodl-wave

As can be seen from the figure, the proportion of CKB held for more than 3 years is 48.77%, indicating that a considerable number of users are optimistic about the long-term development of Nervos Network.

Project Ecosystem

Nervos Network is committed to driving the development of the ecosystem by providing ongoing support in terms of funding, infrastructure, and tools. Since the launch of the mainnet in November 2019, approximately 5.7 billion CKB has been allocated to the Ecosystem Fund. The CKB Ecosystem Fund aims to provide initial funding for various ecosystem development initiatives that drive network expansion, and is focused on nurturing and investing in early and seed-stage projects that use the RGB++ protocol to connect CKB and Bitcoin. The CKB Ecosystem Fund aims to promote the development of important infrastructure and decentralized applications across multiple fields, including DeFi, games, tools, and NFT markets. In January 2024, the CKB Ecosystem Fund launched the BTCKB program, which aims to strengthen the integration between the Bitcoin and CKB blockchains through the PoW consensus mechanism and the UTXO model. The BTCKB program introduces new smart contract functions that can integrate BTC, Taproot Assets, and RGB++ assets into the CKB blockchain, thereby enhancing the functionality of the Bitcoin blockchain.

Since the launch of the RGB++ mainnet, more than 15 existing ecological projects have issued assets. Ecological projects worth paying attention to include:

-

UTXO Stack: Bitcoin L2 “OP Stack” based on the RGB++ protocol.

-

JoyID: A non-custodial wallet that leverages biometrics for user authentication and supports multiple networks including Ethereum, Bitcoin, and RGB++ assets.

-

HueHub: Decentralized exchange and launchpad that supports RGB++ assets on Bitcoin.

-

Stable++: A decentralized stablecoin protocol that supports CKB and BTC.

-

World 3: Autonomous world game based on RGB++ protocol and DOB.

-

Nervape: A multi-chain composable digital object based on Bitcoin, whose base assets are issued on Bitcoin and subsidiary assets are issued on CKB.

-

Haste: RGB++ asset management solution.

-

d.id: A decentralized identity protocol for the Bitcoin ecosystem.

プロジェクトリスク

-

The Nervos Network team mainly focuses on technical development, and has not done enough work in promoting the project, resulting in many users in the market only knowing the Nervos Network project, but not knowing its superior performance. In addition, the community operation of Nervos Network is not ideal, and users in the community have not formed a strong consensus.

-

The on-chain + off-chain technology adopted by Nervos Network makes it more convenient for users to use the Nervos Network, but this method makes the project more dependent on external networks in terms of data availability and asset issuance. Once the off-chain network fails, the entire Nervos Network will face the risk of asset loss and network shutdown.

-

The lack of comprehensive development tools and multi-party interaction solutions in the Nervos Network limits the ability of the Nervos Network to effectively support decentralized applications. In addition, the essence of the Nervos Network is to use privacy in exchange for ease of use, which will undermine the privacy advantages originally provided by the RGB protocol.

要約する

RGB++ demonstrates the potential of CKB as an off-chain settlement layer for Bitcoin. This idea will be adopted by more and more Bitcoin Layer 2 or asset protocols in the future. CKB, which focuses on POW and UTXO and has many years of technological accumulation, may be able to demonstrate its technological advantages in this modular blockchain competition.

Nervos token economics directly addresses the state explosion problem and the problem of misaligned value capture mechanisms. The CKB blockchain links state explosion to its native CKB token, effectively limiting the rapid growth of blockchain state. Treating state as a first-class private asset encourages optimization and efficiency, limiting unnecessary state expansion. In addition, Nervos introduces state rent, which inflates state holders. This solution provides miners with a predictable source of income, which not only prevents excessive state expansion, but also ensures long-term blockchain security.

The CKB blockchain uses a unique value capture mechanism that requires the storage and operation of on-chain data to lock up CKB tokens, thereby creating direct long-term demand for them. This increases the value of the tokens and improves the security of the blockchain, consistent with the goal of ultimately becoming an asset storage platform.

However, the Nervos Network team mainly focuses on technical development, but lacks in project promotion, resulting in many users in the market only knowing the existence of the project but not its excellent performance. In addition, the community operation of Nervos Network is not ideal, and there is a lack of user groups that can form a strong consensus.

In summary, Nervos Network enhances the experience on the local Bitcoin chain without increasing complexity or compromising decentralization. Its technology is in a leading position in the BTC-L2 track, and its long-term focus on the UTXO model has formed a solid technical barrier for it. Therefore, the future development of Nervos Network is worth looking forward to.

This article is sourced from the internet: CKB: BTC-L2 is seriously undervalued

Original author: LD Capital, Duoduo basic situation pSTAKE Finance is a multi-chain liquidity staking project. The token was launched in early 2022. The project originally provided liquidity token staking services for the BSC chain and the Cosmos ecosystem, with a TVL of approximately US$7 million. Recently, it cooperated with the BTC staking project Babylon to launch BTC staking business. More than 90% of the project tokens have entered circulation, with a token market value of US$57 million. Team and Financing: Binance Labs strategic investment in 2022 The founder is from Singapore and graduated from Nanyang Technological University. The project received angel round financing of US$10 million in November 2021. Investment institutions include Galaxy Digital, Coinbase Venture and other institutions. The token price of this round of financing is US$0.1, and…