In the past two weeks, the modular computing layer and ZK-RaaS platform Lumoz has been conducting node sales activities.

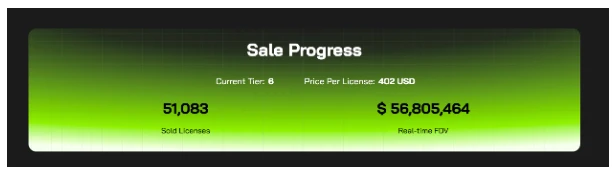

As soon as it was released, it was snapped up by the market, and some community users even paid a lot of money to beg for a Lumoz pre-sale invitation code. During the pre-sale stage, the first four Tier nodes were all sold out in a very short time; it is currently in the second round of node whitelist sales, with a cumulative node sales of more than 51,000 (a total of 100,000), and real-time FDV exceeding US$56 million.

Lumoz is not the first project to launch a node launch. Many high-quality projects including Aethir, CARV and ALIENX have previously launched this model, but Lumoz is the most popular and anticipated one.

With the powerful narrative of modular computing layer and ZK-RaaS supports one-click chain launch, Lumoz has received support from multiple leading capitals including IDG Blockchain, OKX Ventures, HashKey Capital, etc., with a total financing of over US$20 million and a valuation of US$300 million. Community users are looking forward to the future launch of the project on first-tier platforms.

The question is, with the current BTC price continuing to trade sideways at a high level and the future market full of uncertainty, is it really a good business to participate in node sales? Among the many node sales projects, why is Lumoz the ultimate winner?

1. Node sales allow projects to obtain financing and loyal users

In the past few months, many projects have been selling nodes. Why do project owners prefer this method?

A very important consideration is that node sales can help projects obtain a large amount of financing in the market. Especially for some projects that only have a few million dollars in seed rounds or strategic rounds, they lack sufficient costs to develop public chains. Node sales can provide a large amount of sufficient funds. A representative case is Aethir, which only received $9 million in financing before selling nodes in 2023. In the end, node sales raised hundreds of millions of dollars in financing, which ultimately supported the project to go public.

Of course, this method actually involves gambling, because if the project cannot successfully obtain new funds for development through sales, users who purchase nodes in advance may eventually die together with the project. Therefore, when participating in node sales, it is necessary to examine the strength of the project in advance, such as the projects financing status. If the financing is too little or the investment institution is not well-known, it means that the project may fail, so it is recommended to avoid pitfalls. From this perspective, Lumoz seems to be the one with the most outstanding financing amount among the recent node sales projects.

According to public information, in April 2023, Lumoz completed a US$4 million seed round of financing; in April 2024, Lumoz completed a US$6 million Pre-A round of financing with a valuation of US$120 million; in May 2024, it completed a strategic round of financing of over US$10 million with a valuation of US$300 million, with IDG Blockchain, OKX Ventures, HashKey Capital, Polygon, NGC Ventures, KuCoin Ventures, Gate Ventures, G Ventures, MH Ventures, Summer Ventures, Aegis Ventures and others participating in the investment.

What鈥檚 more interesting is that some of Lumoz鈥檚 investment institutions include exchange capital, such as OKX Ventures, which has been accompanying the project鈥檚 growth from the beginning to the end. Therefore, the community generally believes that the probability of Lumoz鈥檚 first listing on OKX in the future is more than 90%, and it may even launch IEO on several trading platforms at the same time.

In addition to financing, node sales can cultivate more loyal users for the project and provide a lot of verification support for the project. In the early stages of a project, it is difficult to directly attract users to participate in node verification due to lack of popularity. In order to pursue decentralization, the participation of these third-party verification nodes is essential. Therefore, node sales can effectively attract early users to participate, and most project parties have reserved a certain proportion of tokens for nodes as rewards.

According to statistics, ALIENX reserves 40% of the tokens, which is the largest proportion, but these tokens need to be unlocked in 5 years, which undoubtedly adds great uncertainty to the future; Aethir only reserves 15%, and it takes 4 years to unlock. Lumoz reserves 25% of the tokens and unlocks them linearly in three years, which is the best choice among all the node sales projects.

2. Profit analysis: Is participating in node sales a good business?

It sounds like the sale of nodes brings many benefits to the project party, and for ordinary users, participating in the nodes is also an investment opportunity to obtain excess returns.

In todays crypto market, Bitcoin is trading sideways at a high level of more than $60,000, while a number of altcoins have not risen, and have even continued to fall. Some investors have summarized this bull market as a VC dump, saying that VC projects have high FDV and low liquidity. This statement is certainly unfair, but it also directly reflects the helplessness of investors: the investment shares of some high-potential value projects have been divided up by VCs, and ordinary investors have become leeks who take over.

Participating in node sales may be a favorable way for investors to change their investment methods. Users can participate in early-stage investments at a lower valuation before the project is listed, in order to obtain higher investment returns.

(1) Participate in node sales to gain early participation

Many people misinterpret and think that node sales are equivalent to public offerings, which is actually incorrect. This is because the valuation of public offerings is much higher than the valuation of the projects last round of financing from VCs. In other words, public offerings are equivalent to taking over from VCs. However, node sales are not completely equivalent to this logic. We can even understand node sales as participating in the primary market.

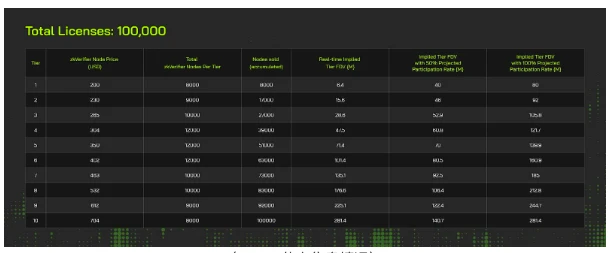

(Lomoz node sales status)

Take the Lumoz node sale in the above picture as an example. The total number of nodes is 100,000, and the number of tiers is 10. If a user buys Tier 1, it only costs $200, and the project valuation is $6.4 million, which is much lower than the current $300 million valuation of Lomozs last Pre-A round. In other words, the cost of users who bought Tier 1 is the same as the cost of VC in the early seed round, and there is no situation where VC takes over. Even if users buy the last level of Tier 10, the final valuation of the project does not exceed $290 million, which is basically the same as the cost of IDG Blockchain, OKX Ventures and other institutions. At present, the whitelist sales have only been carried out to Tier 6, and the project valuation is only $100 million. The earlier you participate, the lower the valuation and the higher the return.

In fact, the total number of Lumoz nodes was originally set at 200,000, and the number of Tiers was initially set at 50. This shift now undoubtedly keeps the project valuation within a reasonable range and prevents excessive inflation. It also reserves sufficient profit space for node participants and enhances their ability to resist risks.

In comparison, Aethir鈥檚 previous node sales were not scientific. It raised $100 million through node sales, and its valuation was directly raised to more than $3 billion. On the first day of its launch, FDV was fixed at $3.2 billion, without a significant increase. Many users who participated in the nodes became leeks – even for Aethir Tier 1 nodes, the current node income is 31.44 ATHs per day, and it will take 7.5 months to recover the investment based on the current coin price of $0.07.

The current expected return of Lumoz nodes, even if estimated based on the FDV of $300 million after launch, users who purchase Lumoz Tier 1 nodes only need one month to recover their investment, with a net return of more than 20 times in half a year; if they purchase Tier 5 nodes, they will recover their investment in 4 months, with a return of nearly 2.5 times in half a year. If Lumozs valuation soars after launch, the corresponding payback period will be even faster.

(2) Lomoz node rights and costs

Of course, in addition to token distribution, Lumoz also provides more abundant rewards for node participants, which is not available in other node sales projects. For example, Lumoz will provide 40 million points rewards to node holders – 1 million points will be distributed every day for 40 days from June 25 to August 4. After TGE, users can exchange these points for Lumoz mainnet tokens.

More importantly, node holders can also receive multiple rewards such as airdrops of potential tokens of new chains in the Lumoz ecosystem. At present, the community size is over one million, and the total TVL of the ecosystem exceeds 4 billion US dollars. The Lumoz RaaS service now supports more than 20 L2 chains such as Merlin Chain, HashKey Chain, ZKFair, Ultiverse, Matr1x, etc. Users who participate in the sale of Lomoz nodes are equivalent to getting airdrop tickets for dozens of public chains.

After talking about the expected returns, another question is whether the threshold for participating in Lomoz is high? Compared with io.nets node mining this year, which requires super-strong hardware equipment investment and various KYC certifications, the hardware configuration requirements for users to participate in Lomoz node operation are relatively low: 4 cores or above CPU, 8 GB RAM memory and 16 Mbit/s bandwidth device. In addition, users can bind their own licenses to run node mining, or entrust NFTs to other nodes for mining.

Of course, considering that the Federal Reserve may cut interest rates in the second half of this year, the macro environment may lead to great uncertainty in the crypto market. In order to prevent node participants from losing money, Lomoz has also thoughtfully set up a repentance mechanism. Six months after the token TGE, a refund window will be opened; users can apply for a refund if they are not satisfied, and will receive 80% of the down payment and return all generated tokens and NFTs. In other words, if the coin price is high at that time, the user can choose to continue mining if the mining income is high; if there is a serious loss, a direct refund can be made, and only 20% of the cost is required, which is equivalent to a direct guarantee.

3. Potential Track: Providing a Modular Computing Layer for ZK Rollup

Although it is backed by a star organization, for investors, if the future prospects of the project are unclear, it is doomed to be difficult to reach the other side, and participating in the node sales will only result in losing all the money.

Especially now, launching a chain has become the first choice for many Web3 entrepreneurs. A number of DeFi projects such as dYdX, Magic, and FXS have also joined the chain-launching camp. After all, the valuation of self-built public chains is much higher than that of a single project. For some teams without native technical genes, the threshold for launching a chain is relatively high. Lumoz provides selling shovels services for projects with such needs.

Lumoz is a modular computing layer and ZK-RaaS platform that solves the computing cost and centralization problems in the process of ZKP proof generation and verification, and provides project parties with the ability to launch chains with one click – through its ZK-Rollup Launchbase that does not require coding, any user can generate a customized zkEVM application chain without code. At the same time, Lumoz provides the underlying computing power for general ZKP calculations through the Decentralized Prover Network. In addition to the Prover Network, Lumoz further opens the verification layer to ordinary users. Its zkVerifier aims to achieve decentralized verification, which can effectively reduce L2 Gas costs.

Lumozs positioning combines ZK-RaaS and DePIN, providing low-cost and convenient ZK-Rollup deployment capabilities. OKX Ventures has seen its progress in the ZK-RaaS field and Prover technology. This investment will help Lumoz accelerate the development and technological innovation of the modular computing layer and ZK-RaaS platform. Dora, founder of OKX Ventures, commented.

In fact, the development potential of ZK-Rollup has long been proven by the industry. Ethereum has been facing scalability issues since its birth. Rollup is the mainstream expansion solution for Layer 2. Its core idea is to publish the packaged transaction data blocks on the chain, thereby reducing the difficulty of verifying the validity of transactions. As early as 2020, Ethereum founder Vitalik Buterin updated the Ethereum roadmap, emphasizing Rollup-centered construction. Rollup usually includes a settlement layer, an execution layer, a consensus layer, and a data availability layer. However, for ZK-Rollup, an additional core module, the Prover Layer, is required. At present, Lumoz is one of the few providers of modular Prover networks in the field of modular Rollup.

Some pain points that the ZK Rollups track is facing: the high cost of calculating ZKP, and most ZK-Rollups currently rely on centralized Prover; the complexity of zero-knowledge technology makes it difficult to build a ZK-Rollup that complies with EVM. In order to solve the computational cost and centralization problems of ZKP, Lumoz proposed the ZK-PoW algorithm, which greatly reduces the computational cost of ZKP. Since its launch, the ZK-PoW mechanism has attracted 145 miners worldwide to participate, and the test network has verified more than 20,000 nodes. In addition, to ensure the security, accuracy and decentralization of the data processing process and its results, the Lumoz network introduced a node verification mechanism, in which zkVerifier verifies the ZKPs generated by zkProver.

In general, the Lumoz modular computing layer solution does not require project parties to consider the construction and operation of the ZKP system, which reduces the difficulty of project parties to issue ZK-Rollup. Users can independently select various Layer 2 components required in their Launch Base, including SDK, settlement layer, data availability layer, sequencer, etc. No code is required during the operation, which greatly reduces the difficulty of issuing ZK Rollup and allows the team to focus on non-technical aspects such as ecological operation.

結論

Behind the top technology is the strong technical core of the founding team. Nan Feng, CEO of Lumoz, graduated from Tsinghua University. The core team has invested nearly 5 years in the research and development of ZK technology, which has created todays Lumoz.

Currently, the Lumoz node sale has entered the whitelist stage and is selling Tier 6 nodes at a price of $402 per node. After the whitelist ends, the official public sale will begin at 3 pm (UTC+ 8) on July 3. Interested users can visit the official website to participate: https://node.lumoz.org/whitelist-sale .

This article is sourced from the internet: With so many release nodes, why is Lumoz the ultimate winner?

Original author: @ Web3 Mario (https://x.com/web3_mario) Following the previous article about TON technology introduction, I have studied TON official development documents in depth recently. I feel that there are still some barriers to learning. The current document content seems more like an internal development document, which is not very friendly to new developers. Therefore, I try to sort out a series of articles about TON Chain project development based on my own learning trajectory, hoping to help everyone quickly get started with TON DApp development. If there are any errors in the text, you are welcome to correct them and learn together. What are the differences between developing NFTs in EVM and developing NFTs on TON Chain? Issuing an FT or NFT is usually the most basic requirement for DApp…