This year, the airdrops of several major projects such as STRK, ZK and ZRO are difficult to describe in a few words. The insider trading scandal and large-scale witch cleansing activities have made retail investors and studios miserable, and the Blast airdrop has become synonymous with the next big one is coming.

Yesterday, Blast officially opened airdrop applications and announced its token economics. The total supply of BLAST is 100 billion, 50% of which will be airdropped to the community, of which the first phase of airdrops accounts for 17% of the total supply.

Good news for retail investors and studios

Unlike previous airdrops, when searching for the keyword blast on Twitter, most of the content displayed on the homepage is praise.

In the first phase of Blast airdrop, Blast points holders can get 7 billion BLAST, gold points holders can get 7 billion BLAST, and Blur Foundation can get 3 billion BLAST. Most importantly, Blast airdrops do not check witches. After experiencing the baptism of layerzero, blast is undoubtedly generous to the studio.

In addition, according to community feedback, those who work hard or persevere in dapp tasks can get a few thousand gold points at least, and the cost is less than one Ethereum, which means that even with a small investment, the return can be doubled at worst. Therefore, there are many voices on Twitter that speak well of BLAST, believing that its coin price is undervalued.

However, Blurs end does not seem to be smooth. Although Blur announced the launch of the fourth quarter rewards and loyalty program in a timely manner, it still faces redemption selling pressure.

According to the monitoring of on-chain data analyst Ember, after receiving the BLAST airdrop (partially unlocked), two BLUR staking whales redeemed 12.52 million BLUR (about 2.71 million US dollars) and 8.39 million BLUR (about 1.79 million US dollars) respectively, and transferred them to CEX for trading. BLUR also crashed in a short period of time, and the price of the currency fell sharply. Not only that, when receiving the airdrop, there was an abnormality in the Blur Season 3 airdrop collection contract, and some users were prompted to pay more than 1,000 US dollars in Gas when receiving it.

But BLASTs airdrop undoubtedly made small retail investors and studios happy, and some even called Pacman, the founder of BLAST, a genius. It seemed that the big one is really coming this time. However, amid the cheers, the big investors of BLAST were stabbed in the back.

PUA continues, big investors get backstabbed

In the airdrop announcement, blast emphasized that the airdrops for large users will be linearly vested, that is, the top 0.1% of users (about 1,000 wallets) will linearly vest part of the airdrop within 6 months. According to the first phase of activities, the vesting needs to reach the monthly points threshold.

In other words, not only are the positions locked, but users are also required to continue to interact for 6 months. Moreover, there was no sign of linear unlocking before. It should be noted that in the recent sluggish market, the possibility of these BLAST tokens returning to zero after half a year is not zero, which is a disaster for large investors.

According to the Blast official website, the first user @beijingduck 2023 has a total score of about 281.2 billion and 1.22 million gold points. According に him, he received 64,000 BLAST, which is only worth $1,664 at the current price of $0.026.

Judging from Twitter operations, @beijingduck 2023 seems to be a new account created for blast points. The user himself has not expressed many opinions on blast, while other big users who have obtained BLAST points seem not so calm.

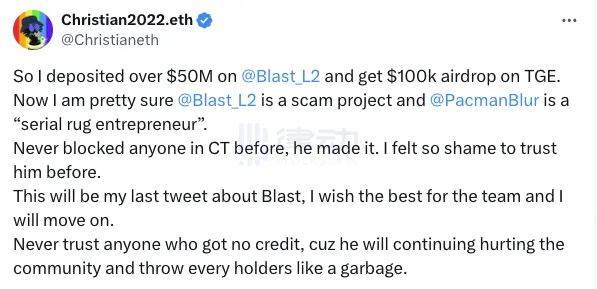

Christian, co-founder of crypto fund NDV, 言った he deposited more than $50 million on blast and received 20,912,000 BLAST, worth about $540,000, but due to linear unlocking, he can only receive an airdrop of $100,000. Christian labeled blast a scam project and called its founder Pacman a serial rug entrepreneur.

After feeling deeply betrayed by blast, Christian chose to block Pacman and wrote a long article accusing the genius Pacman of the seven deadly sins.

Christian believes that blast missed the opportunity to issue coins at the best time. The market was good in March and the time was short. If the coins were issued synchronously with the main network, all participants would benefit greatly, and even large investors would be willing to accept lock-up. However, the project was delayed for more than three months, resulting in a decline in market value expectations, and OKX and BN no longer supported it.

In addition, insufficient technology is the main problem of blast. Due to the lack of technical accumulation and lagging infrastructure construction, although the yield model seems good, even the experience of basic needs such as cross-chain bridges is very poor. Exchanges cannot directly withdraw coins, and retail investors find it difficult to enter. Moreover, the blast project has been constantly PUA users from March to May, and then from May to the end of June. Now large users have found that they will be PUA for another six months.

Christian also has his own views on the liquidity issue. He believes that the project parties do not have a deep understanding of liquidity, probably because they have no experience in traditional Defi and are not large investors. He emphasized that large investors are the group that cannot be offended in the currency circle. Although they are few in number, they support the on-chain ecology and currency prices. Large investors are the key to supporting currency prices and ecological liquidity. Although the exchange data can be dealt with by faking volume, the real fundamentals are still supported by the 20% large investor group.

Although the distribution of gold is relatively decentralized, Christian believes that it is still controlled by small interest groups. Although he is also an investor in some of these projects, he said that this binding means that the quality of ecological projects cannot be compared with organic development in the long run.

Finally, Christian pointed out from a personal perspective that Pacman was irresponsible. He mentioned that the blast project team had agreed to have a phone call with him to get feedback, but he did not show up at the agreed time. It was 1 a.m. in China at the time, and he waited for an hour. He sent a message but received no reply, and there was no apology afterwards.

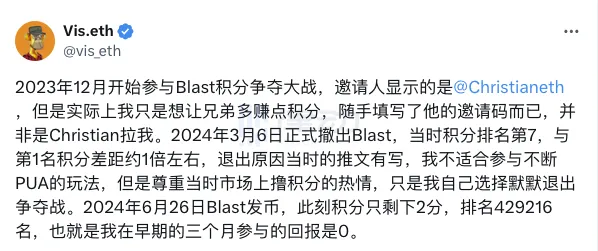

Vis initially recharged more than 10,000 Ethereum in Blast, but when recalling his subsequent participation in Blast, he said that because he withdrew from the PUA game early, the returns from his participation in the first three months were directly zero.

Not only that, @GCsheng, one of the top five bidders for Blur, also said that the rules for receiving Blast are to queue up, and those with fewer coins will jump to the front of the queue, so the waiting time will be longer and longer. And Blur farmers can only get 1 million at most at a time.

Huang Licheng takes over, will Blast go the black and red route?

Currently, the two major trading platforms Binance and OKX have not launched BLAST. In addition to Coinbase, only Bybit, Bitget, Upbit, Bithumb and WOO X have announced the launch of BLAST. According to coingecko data, the price of BLAST is $0.025 at the time of writing, with a 24-hour increase of 2.4%.

Judging from the performance of the coin price, whether Blast can escape the coin issuance means death fate is still unknown. But as Christian said, the big players are the group that the coin circle cannot offend the most. Although they are few in number, they support the on-chain ecology and coin prices. Now Blasts airdrop has indeed angered the big players, and its development after losing the support of the big players is even more unpredictable.

According to on-chain data analyst Yu Jin鈥檚 monitoring, Blast allocated 220 million BLAST to 6 market makers for market making, including: 80 million to Wintermute; 50 million to Manifold Trading; 30 million to GSR Markets; 20 million to Auros Global; and 20 million to Amber.

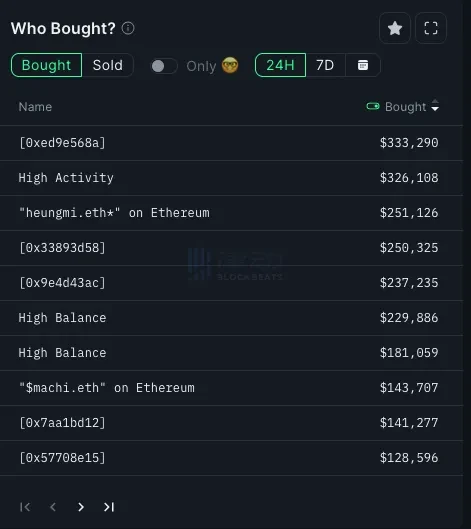

But as the saying goes, the more you curse, the higher the traffic, and black and red are also red. At present, Blast has not made any statement on this, and even because of this dispute of interests, many people are willing to continue to invest in BLAST. According to Nansen data, Huang Lichengs address has accumulated purchases of BLAST worth 5.37 million US dollars, ranking first on the on-chain purchase list.

According to on-chain information, Huang Lichengs address has continued to buy BLAST in batches since last night, and provided liquidity for BLAST on the Blast ecosystem DEX protocol Thruster. As of press time, he is still buying BLAST.

This article is sourced from the internet: Big investors were backstabbed, while retail investors were delighted. Will Blast take the black and red route?

Related: Crypto Market Rainmakers: Top Fee-Based Protocols

Original title: The Rainmakers of the Crypto Market Original author: TokenTerminal Original translation: Mars Finance, MK introduce This newsletter focuses on the protocols (both blockchains and decentralized applications) that generate the most significant fees. We focus on these protocols for the following reasons: Which protocols do users prefer to pay for services? What kind of services do these protocols provide and what is their business model? How much do users actually pay in total? Which specific market sectors are more popular than others? Are there any protocols that dominate certain market sectors? By analyzing a detailed chart, we will delve into the industry trends of the cryptocurrency market. Let’s explore it in detail! 1. Focus on the top charging protocols of blockchain The protocols in focus include: Ethereum, Tron, Bitcoin,…