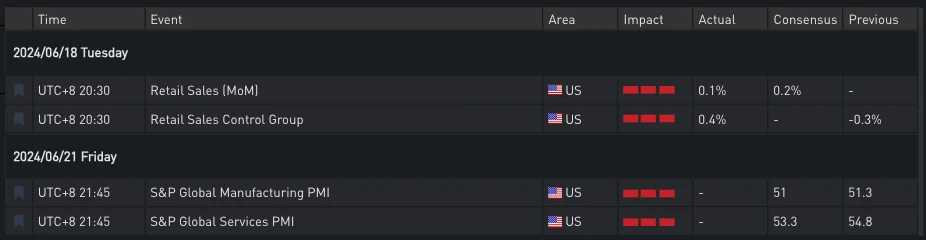

Yesterday (JUN 18), the monthly rate of US retail sales in May, which was called horrible data by the market, was lower than expected by 0.1%, and the previous value was revised down from 0% to -0.2%. After the data was released, the yield of US bonds fell slightly, giving up yesterdays gains, and the three major stock indexes closed slightly higher. On the other hand, many Fed officials gave speeches, expressing the conservative view that it would take a few more months or a few quarters to see data supporting interest rate cuts.

出典: SignalPlus、経済カレンダー

In terms of digital currencies, the markets focus over the past day has been on Ethereum. The first thing to mention is that the SEC has ended its investigation into the Ethereum 2.0 blockchain ecosystem. Consensys, an Ethereum developer, tweeted: The SEC Enforcement Division has informed us that it will end its investigation into Ethereum 2.0. This means that the SEC will not charge that the sale of Ethereum is a securities transaction. The market sees this as an important positive, pushing the price of Ethereum to rebound, rising more than 3.+% on the day.

In addition, James Seyffart, an ETF analyst at Bloomberg, said that Ethereum spot may be launched before July 4, which once again attracted traders to place bets. It is worth mentioning that Lark Davis, a cryptocurrency analyst, pointed out that Glassnode data showed that the balance of ETH exchanges has reached an 8-year low, and only 10% of ETH is currently circulating on exchanges. At the same time, he also pointed out that if the Ethereum spot ETF begins trading in the next two weeks, a large amount of institutional funds will flow into the market, and a large-scale supply shock is coming.

Source: TradingView, ETH price vs BTC price trend comparison

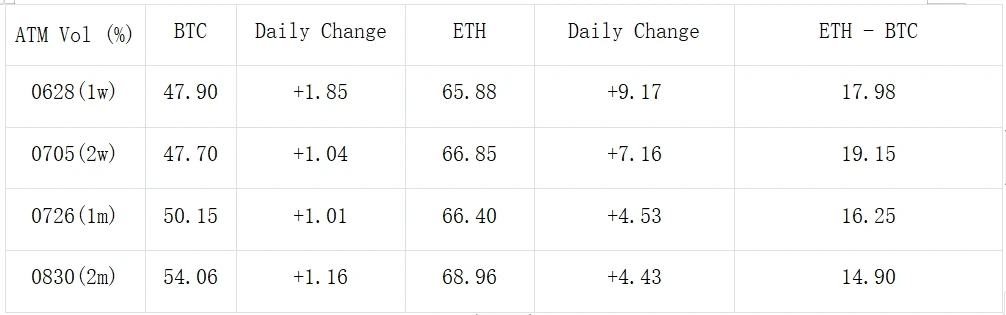

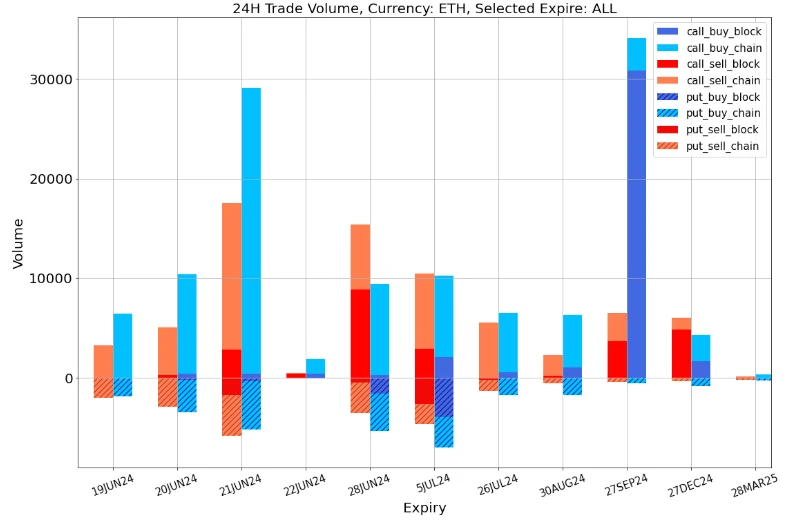

In terms of options, affected by macro news, the ETH option implied volatility curve flattened and rose, reaching about 65% overall. Large call option transactions were hot, with a total of 30,500 purchases of forward 27 SEP 24-4000-C and a single purchase of 7,000 28 JUN 24-4000-C. The weekly call options were also boosted by price increases and were very popular among retail investors, pushing the smile curve to tilt toward call options as a whole.

Source: Deribit (as of 19 JUN 16: 00 UTC+ 8)

Source: SignalPlus, ETH IV levels have risen significantly

Source: SignalPlus, ETH Vol Skew tilts towards calls

データソース: Deribit、ETH取引の全体分布

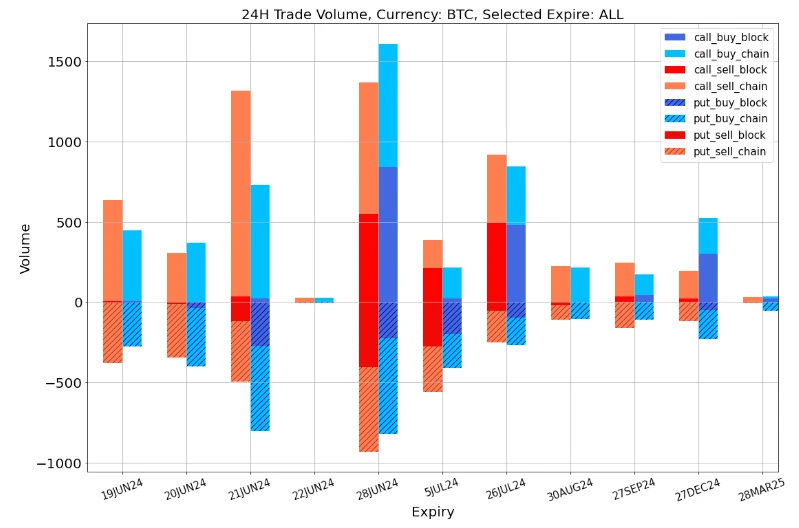

データソース: Deribit、BTC取引の全体分布

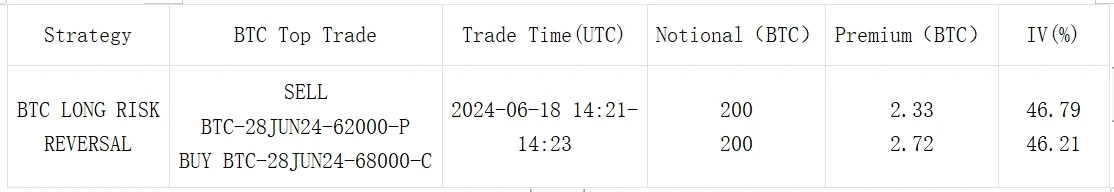

出典: Deribit ブロック取引

出典: Deribit ブロック取引

ChatGPT 4.0のプラグインストアでSignalPlusを検索すると、リアルタイムの暗号化情報を取得できます。最新情報をすぐに受け取りたい場合は、Twitterアカウント@SignalPlus_Web3をフォローするか、WeChatグループ(アシスタントWeChatを追加:SignalPlus 123)、Telegramグループ、Discordコミュニティに参加して、より多くの友人とコミュニケーションを取り、交流してください。SignalPlus公式サイト:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240619): SEC ends investigation into Ethereum

Related: Outlier Ventures: The rise of decentralized social networks

Original article by: Lorenzo Sicilia , Head of Engineering at Outlier Ventures Original translation: xiaozou, Golden Finance Outlier Ventures has noticed healthy growth in some decentralized social networks, and Farcaster and Lens Protocol have begun to gain real user attention. When it comes to mass-market products, crypto is becoming more and more practical and efficient. Until now, the lack of private key management and mobile-first experience has hindered peoples crypto adoption. In this article, we’ll take a deep dive into several of the main crypto-decentralized social media contenders, their respective features, architecture, and the opportunities that Web3 founders are keen on building new permissionless social graph protocols. 1. Social Networks After more than a decade of using Instagram, Facebook, Twitter and other platforms, everyone knows how social networks work. The…