Task

Ranking

已登录

Bee登录

Twitter 授权

TG 授权

Discord 授权

去签到

下一页

关闭

获取登录状态

My XP

0

0

+0

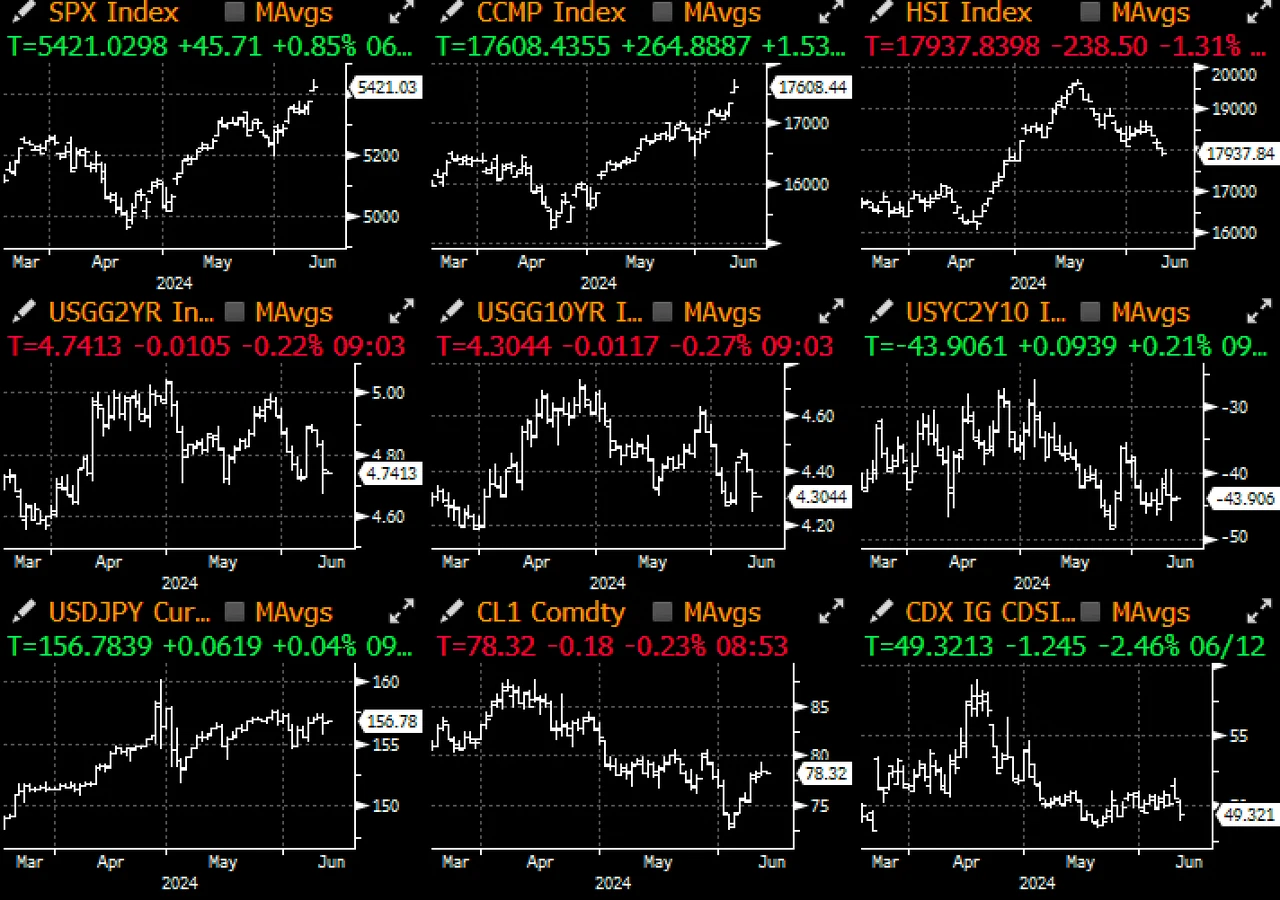

待望のダブルマクロヘッドラインデーがついに到来し、結果は期待通りでした。まず、CPIデータは予想を大きく下回り、コアCPIは前月比0.16%上昇(2021年8月以来の最低水準)で、市場予想の0.3%を大きく下回り、スーパーコアCPIは特に弱くマイナスでした。サービス支出は減少し、商品価格は横ばい、住宅インフレは上昇しましたが、制御可能な範囲内にとどまりました。CPIが発表された後、ウォール街のエコノミストはすぐにPCE予測を2.8%から2.6%に引き下げ、FRBの長期目標の正しい方向に進みました。

マクロ市場はデータに急激に反応し、米国債の強気トレンドが強まった。2年債利回りは17ベーシスポイント急落し、価格は12月のFOMC会合で51ベーシスポイントにまで高まる利下げ期待を反映した。株式市場も数標準偏差で変動した。市場は午後2時のFOMC会合がハト派的になると予想し、SPXとナスダック指数はともに1.5%上昇し、最高値を更新した。

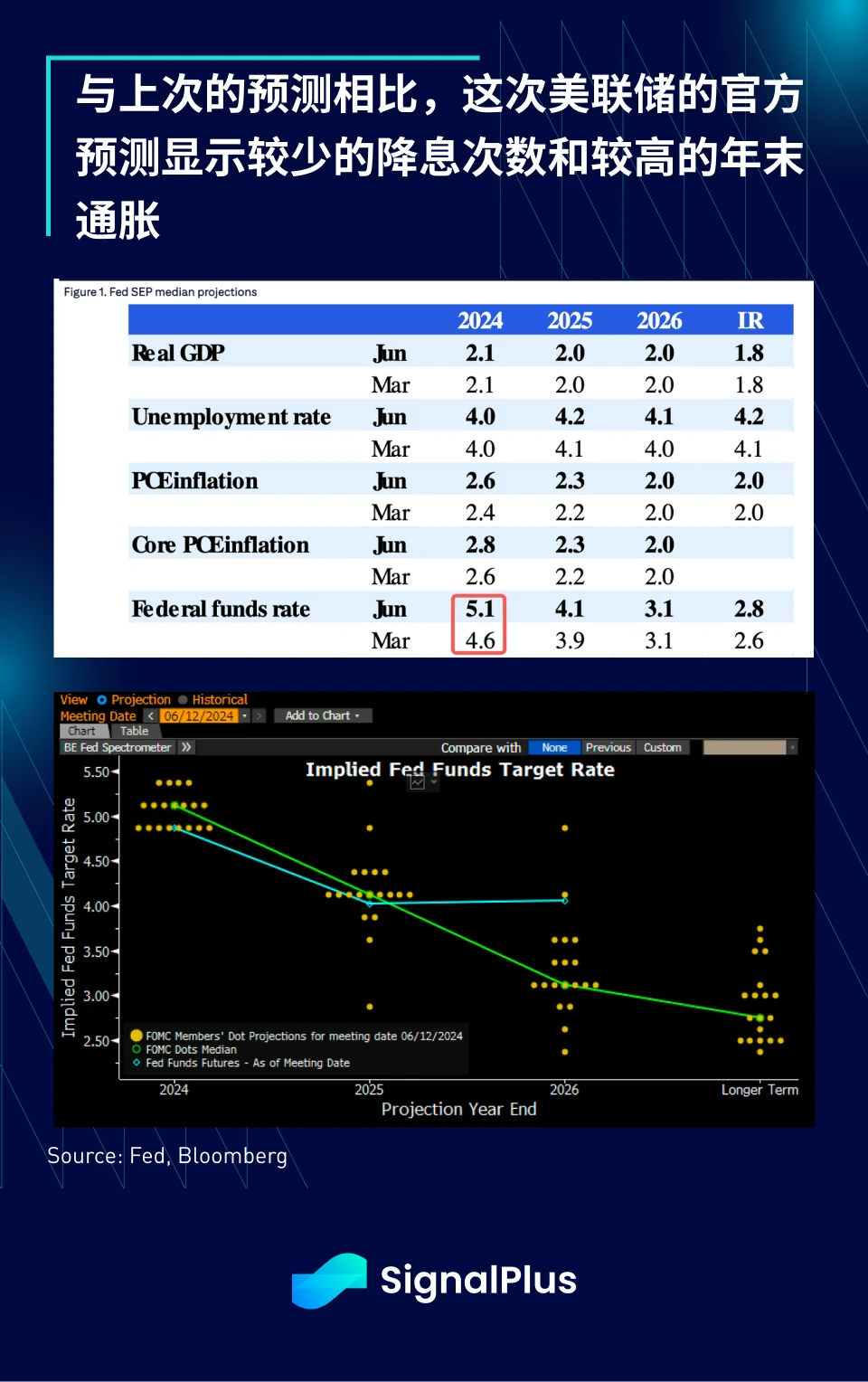

興味深いことに、FOMCの最初の声明とドットプロットはタカ派的なショックをもたらし、最新のFRB予測では2024年の利下げは1回のみと、以前の予測の3回より少なくなっています。さらに、コアPCEインフレ率は年末までに2.8%になると予測されており、以前の予測の2.6%より高くなっています。

当然のことながら、パウエル議長は記者会見の大半を、ハト派的な論調に戻すことに費やし、明らかに公式予測の重要性を軽視しようとした。パウエル議長は、「ほとんどの」当局者が予想を下回るCPIデータを予測に織り込んでおらず、そのためそれらの予測は何らかの理由で時代遅れになっているとまで発言したが、これは非常に巧妙な動きだった。

また、パウエル氏は、雇用市場が感染拡大前と同等の状態に戻り、求人数、退職率、労働力供給の回復はいずれも正常化の兆しを見せていると指摘した。経済面では、FRBは成長が堅調なペースで続くとみており、当局はある程度、われわれが見たいと見ていること、つまり需要が徐々に冷え込んでいることを見ている。最後に、同氏はまた、FRBは下振れリスクに注意を払っており、経済のソフトランディングを最優先課題にしたいと強調した。

要約すると、パウエル議長がインフレに91回言及したのに対し、雇用市場に言及したのは37回にとどまり、物価上昇圧力が依然として主な焦点となっていることを示しているとブルームバーグは指摘した。株式市場はこの傾向に従い、以前のCPIデータに再び焦点を当てることにした。SPX指数は5,438ポイントで終了し、過去最高値に近づいた一方、2年および10年米国債利回りはそれぞれ4.70%と4.3%で終了し、どちらも1週間の安値であった。SPX指数は現在、史上2番目に長い2%未満の下落傾向にあり、新記録を樹立するにはあと1か月しかかからない。

全体的にマクロ環境が強まっているにもかかわらず、暗号通貨の価格は今週ずっと苦戦しています。ロングバイアスの市場ポジショニングとBTC ETF保有者の組み合わせにより、年初からの流入のうち、相対価値やベーシス取引ではなく蓄積のための流入がどれだけあったのかという疑問が生じ、BTCは$70,000を突破するのに苦労しています。ETHも今週8%下落しましたが、これは主にETF承認による刺激が薄れ、手数料の低下とL2との競争が続いているためです。現時点では技術的な状況は少し難しいように見え、暗号通貨は株式市場のセンチメントの遅れた反転の影響を受けやすい可能性があります。

ChatGPT 4.0のプラグインストアでSignalPlusを検索すると、リアルタイムの暗号化情報を取得できます。最新情報をすぐに受け取りたい場合は、Twitterアカウント@SignalPlus_Web3をフォローするか、WeChatグループ(アシスタントWeChatを追加:SignalPlus 123)、Telegramグループ、Discordコミュニティに参加して、より多くの友人とコミュニケーションを取り、交流してください。SignalPlus公式サイト:https://www.signalplus.com

この記事はインターネットから引用したものです:SignalPlus Macro Analysis (20240613): 米国経済のソフトランディング

関連:柴犬(SHIB)価格予測:黄金比での強気反発の可能性?

要約 Shiba Inu (SHIB) は大幅な調整の後、重要な黄金比サポート レベルに達し、強気のリバウンドの可能性を示唆しています。 SHIB 価格の上昇はミームコインのトレンドを反映しており、ミームコインの時代について疑問が生じています。 SHIB の混合指標には、4 時間チャートのデッド クロスと週足チャートの強気シグナルが含まれており、強気のリバウンドの可能性があります。 Shiba Inu (SHIB) は現在、大幅な調整段階にあります。 ただし、価格は現在、重要な黄金比サポート レベルに達しており、強気のリバウンドの可能性を示しています。 実際、Shiba Inu の価格は急上昇しており、他の多くのミームコインで見られるトレンドを反映しています。 これは、この時代にミームコインの台頭を目撃しているのだろうかという疑問を提起します。 Shiba Inu が重要な黄金比サポート レベルに到達 Shiba Inu が最近遭遇した...