Original author: Alfred @GametoRich, Cycle Capital

1. What is a Rune?

At the beginning of 2023, the BRC-20 standard proposed based on the Ordinals protocol set off a wave of construction and speculation around BTC assets, and promoted the hot attention and capital influx of BTC second-layer, Defi and other ecological infrastructure, which played a positive role in the long-term development of the BTC ecosystem. However, the hype of BRC-20 also brought about Bitcoins network congestion and redundant data. In response to this, Casey Rodarmor, the creator of the Ordinals protocol, proposed the Runes protocol in a blog in September 2023, which will build a replaceable token protocol based on BTC UTXO, which is the Rune Protocol.

The Runes protocol was officially launched on April 20 this year when Bitcoin was halved. When it was first launched, the enthusiasm for the first batch of runes pushed the gas fee of the BTC network to more than 1,000 sats, which was unprecedented. But soon the markets attention shifted from runes to other tracks. In the past month, DOG has risen from the bottom sideways price to a new high, driving a wave of increases and new attention for rune targets.

1. How runes work

The Runes protocol uses Bitcoins native UTXO model to issue and track tokens, which is more native and decentralized. In addition, the rune balance is directly held by UTXO, and one UTXO can hold any number of runes. No junk UTXO is created, and the mechanism is more efficient and reduces the space occupied on the chain.

Specifically, the data for a Rune is stored in the OP_RETURN field, which is the operation code (opcode) from a Bitcoin transaction and allows 80 bytes of data to be stored in a transaction output. Transactions are sent using the OP_RETURN marker in a protocol message followed by a capital R data push. Issuance or transfer transactions are specified in a subsequent data push and assigned to a UTXO. Invalid protocol messages will cause the Rune to be burned.

The following diagram intuitively explains how the Runes protocol performs issuance and transfer transactions:

Source: Crypto.com Research, GitHub, Casey Rodarmor Blog

2. Comparison between Rune and BRC-20

Compared with BRC-20, Runes protocol has several important features:

(1) Runes are specially designed as replaceable tokens, based on the native architecture of BTC, do not rely on off-chain data and only need to be minted once, which is simpler and more efficient. BRC-20 is based on the Ordinals protocol, which is more suitable for building non-fungible tokens. It relies on off-chain indexes and needs to be minted twice, which is more complicated overall.

(2) Runes data is stored in the 80-byte OP_RETURN field, while BRC-20 uses witness data, which takes up to 4 MB. In comparison, tokens built on Runes are more compatible, take up less space, and reduce blockchain expansion.

(3) The Runes protocol is based on the UTXO model, which can be integrated with the native BTC architecture and inherit security. It will have stronger scalability in the future and can be perfectly compatible with the BTC ecological development routes such as the Lightning Network and BTC L2.

Source: Binance Research, Ordinals/BRC-20 documentation

3. The meaning of runes

(1) It further creates a way to issue BTC assets that can break through the circle. Since BRC-20 brought inscription assets, this new form of asset has brought more attention and funds into the BTC ecosystem. The meme craze on SOL and Base chains in 2023 has confirmed that the meme cannot be ignored in terms of the capital introduction of the chain. The Runes protocol will create a dedicated, fungible, and more suitable token standard for speculative activities for BTC in the future.

(2) This asset issuance method is simpler, more efficient, and more compatible than before. The Runes protocol is based on Bitcoin鈥檚 native UTXO architecture, does not rely on third parties and off-chain data, takes up less space, reduces network congestion, and will be seamlessly compatible with various upgrades and ecological solutions of the BTC network (such as L2, bridging, etc.) in the future.

(3) The popularity of this asset can further solve the security budget problem of Bitcoin. Rune transactions can contribute more transaction fees to the network, especially after the halving, when miners have a new source of income after the block output decreases, which has a positive effect on maintaining the security and sustainability of the network.

2. Track Data Overview

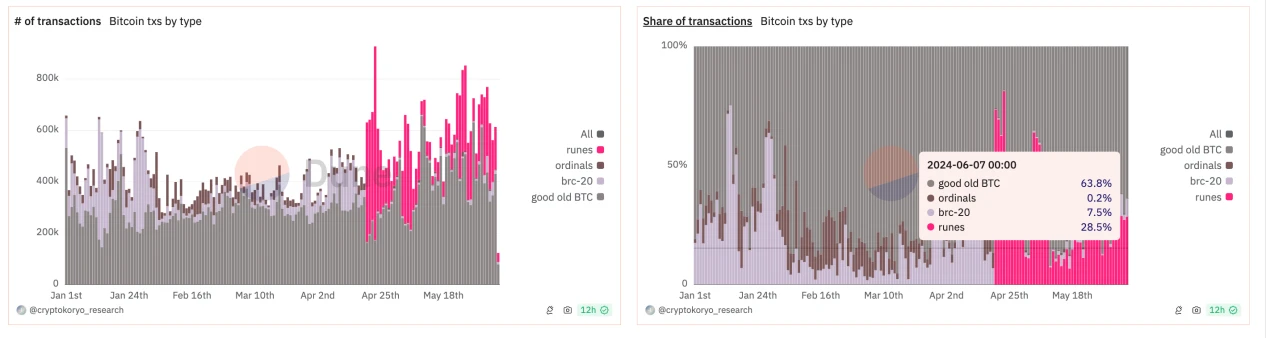

Judging from the BTC network data, in terms of transaction volume and transaction share, Rune currently accounts for about 20% of the total network. When the Rune protocol was first launched, transactions were very fomo, accounting for as much as 81.3%, and then quickly entered a cooling-off period. Currently, Rune accounts for about 10-40% of the network. Combining the data, we can observe how hot the current Rune market is.

Comparing Runes with BRC-20, Runes have become the most actively traded L1 asset outside of non-BTC transactions. The ratio between the two is about 4:1. The highest share of Runes occurred when the halving was launched, about 99%, and the lowest was about 55%. The current popularity of Rune transactions has surpassed BRC-20 tokens.

In terms of fee contribution, the current native Bitcoin transaction fee accounts for 70-80%, Runes account for 10-20%, Ordinals and BRC-20 account for about 10% in total, and Runes account for up to 70% on the halving day. Currently, the hype of Runes has broadened the income sources of BTC network miners and has the highest share among new assets.

Source: Dune@cryptokoryo

If Rune and BRC 20 are both currently considered memes, compared to the market value of meme coins on other chains, the market value of memes on the Bitcoin chain accounts for the lowest proportion, less than 0.1% of the chain. In horizontal comparison, the meme leaders of ETH and SOL chains account for more than 3% of the market value of the chain. As BTC is the chain with the highest consensus, market value, and mainstream funds, the market value of meme coins has the motivation to further expand. In vertical comparison, Rune has surpassed BRC-20 in terms of transaction volume and contribution fees, but Runes Dragon One is also different from BRC-20s Dragon One. If it can land on the first-tier CEX, it has the potential to surpass ORDI.

Source: Cycle Research

3. Rune Evaluation System and DOG Analysis

This article believes that the evaluation of Runes popular projects can be analyzed from three stages and nine dimensions. In the early stage, focus on distribution methods, degree of dispersion, founders and story; in the mid-term, focus on: continuity of dissemination and continuity of price; in the mature stage, focus on: trading volume, market value, chip structure, and price stability.

Combining the above logic, this article believes that the current rune tracks Dragon One is DOG:

1. Distribution method: The distribution design is progressive and bears all on-chain costs, which is a large-scale pattern.

It will be issued in phases before the launch of the Rune Protocol. The Rune Stone NFT (Runestone) will be launched first for hype, and the first rune will be airdropped to the Rune Stone holders after the Rune Protocol goes online on the halving day. At the same time, whether it is the airdrop of the Rune Stone or the airdrop of the first rune, it is all free for the airdrop recipients, the funds are raised by the community, and the project party bears the on-chain costs of the issuance.

2. Degree of dispersion: The early stakeholders were high-quality and large in number, which enabled a rapid cold start and a large number of dissemination among core users.

Rune stones were airdropped to 11w+ users who actively participated in the BTC inscription ecosystem in the past. The rule is to have at least 3 inscriptions in the 826,000th block (excluding inscriptions starting with text/plain or application/json, including curse inscriptions that can be searched by ordinals). The first Rune DOG was airdropped to 7w+ firm Rune Stone holders.

3. Founder and story:

Founder Leonidas is an OG in the BTC community and co-founder of the cutting-edge Ordinals browser Ord.io. He has a close relationship with Casey, the founder of Oidinals, and they interact frequently. The name of the rune stone links the Runes protocol launched on the halving day and the Runestone coding instructions in the protocol, which is very topical and orthodox. In terms of the design of the rune stone, Leo found a sculpture artist to customize the creation, which is artistic. The name of the first airdropped rune is DOG, which is the most contagious meme image in the crypto world, and it will be issued in the form of a new token on the most consensus-based Bitcoin network.

4. Communication continuity: strong and continuous attention attraction

As an OG in the BTC community, founder Leo has strong communication power and resources, especially in the European and American communities. He frequently promotes himself and posts on Twitter up to 100 times a day, most of which contain detailed data and inflammatory content, continuously capturing the markets attention.

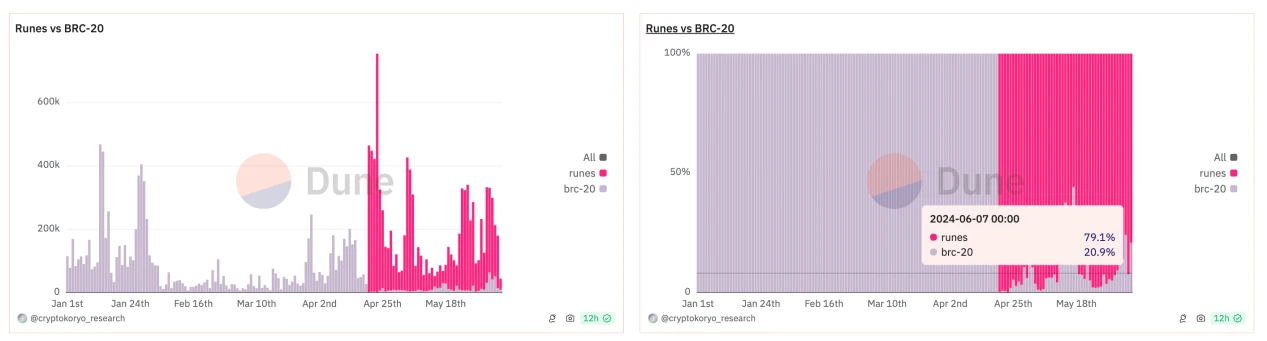

5. Price continuity: Rune stones and runes continue to hype

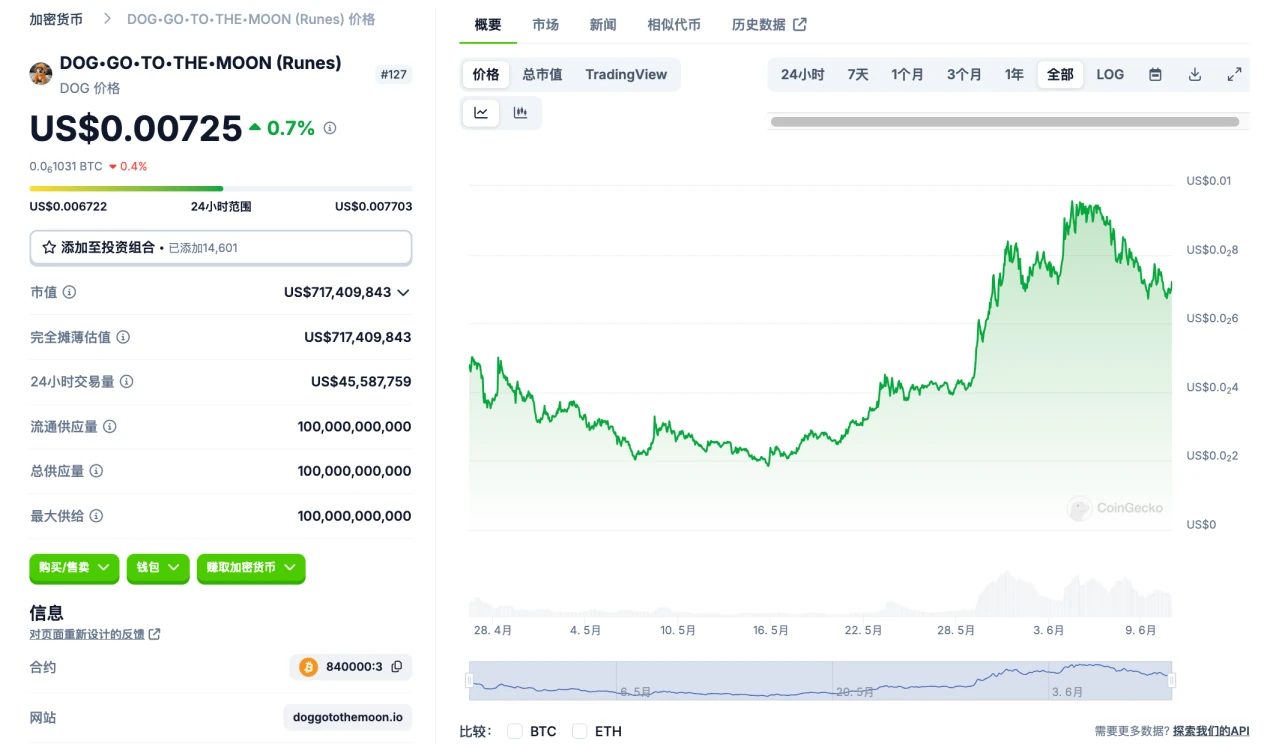

Runestone NFT was preheated before the launch of Runes Protocol, and the price of NFT rose steadily in March and April, with the highest price reaching 0.1166 BTC. After the first Rune DOG airdrop, the price of Runestone fell, and Rune DOG took over the hype. After a month of market pricing and consolidation, the price began to rise from around 0.0025 to a maximum of 0.0097 in mid-May, and currently fell back to 0.0078. There will be two more runestone airdrops (later this year when it becomes the first meme coin with DOG), and the price of Runestone may rise again depending on the price of DOG.

Rune Stone Price, Source: Okx.com

DOG price, source: Magic Eden

6. Trading volume: The trading volume is far ahead of other runes, and the liquidity is the best

The overall liquidity of the Rune sector is poor, and DOG has been the first in terms of trading volume since its launch. The current trading volume is mainly concentrated in Gate, accounting for more than 80%, followed by Bitget, Okx wallet, and Magic Eden. The current daily trading volume exceeds 70 million US dollars, while Runes x, which ranks second in trading volume, is about 2 million US dollars. DOG leads all Rune targets by a large margin and has reached the trading volume of mainstream tokens.

Source: Okx.com

7. Market value: Ranked first in terms of market value

After excluding the ZZZ rune, which has a very low trading volume and a very high unit price, DOGs market value has basically remained the number one at all times since its issuance.

Source: Okx.com

8. Chip structure: There are a large number of holders, but the chips are not concentrated enough

DOGs on-chain holders remain stable at 7w+, ranking third among runes. Since the main liquidity is on CEX, the actual holders should still be the first, with a large number of holders and strong consensus. However, the largest holding ratio of the on-chain address is about 1.69%, and it has been continuously reducing its holdings in recent days. Only 5 addresses have more than 1%. The fifth-ranked address is rapidly increasing its holdings, but the overall degree of chip concentration is not enough, which may be the reason why although the current status of Dragon One is clear, it cannot be listed on the first-tier CEX.

Source: Okx.com

9. Price stability: Prices are stable and rising

The DOG price has been rising steadily and strongly since consolidating at the bottom of around 0.002. It can rise further after consolidating steadily at 0.004 and 0.007, and the buying power in terms of volume and price remains strong when the overall market pulls back.

Source: coingecko

Based on the evaluation system proposed in this article, we can dynamically analyze the top projects in the rune track and screen new targets. Due to space constraints, this article will not discuss this in detail.

IV. 結論

1. Rune is a protocol designed specifically for fungible tokens. Technically, it is simpler, more efficient, and more compatible than BRC-20. It has surpassed BRC-20 tokens in terms of transaction share and transaction fee contribution, becoming a new form of asset that must be taken seriously.

2. The current main function of Rune is to serve as a meme coin to enhance the attention and fund capture of the Bitcoin network. It has the significance of sustainable development, but judging from the data, it has not yet ushered in a full-scale outbreak and has the potential for further price discovery.

3. This article proposes a three-stage, nine-dimensional evaluation system for rune projects. At present, DOG is in the leading position in the track compared with other targets, but the chip structure is relatively scattered at this time, and it may take some time to accumulate before landing on the first-tier exchanges.

This article is sourced from the internet: Cycle Capital: DOG leads the return of rune popularity, when will the track explode?

Related: With millions of dollars a month to earn, who makes the most money in Layer 2?

Original author: Nathan Reiff Original translation: Vernacular blockchain Base, the Ethereum Layer 2 scaling network launched by top US cryptocurrency trading platform Coinbase, generated more than $6 million in on-chain profits in May, becoming the most profitable Layer 2 network, surpassing competitors such as Blast and Optimism. According to L2 BEAT data, Base’s surge in profits stems from the rapid growth of total locked value (TVL), which was driven by Ethereum’s implementation of EIP-4844 and proto-danksharding via the expected Dencun upgrade in March. According to blockchain analytics platform GrowThePie, Base topped all Layer 2 chains with $6.1 million in on-chain profits in May, followed by Blast at $1.5 million and Optimism at $1.4 million. Although Base is far ahead of these competitors in the profit race, its monthly profits fell…