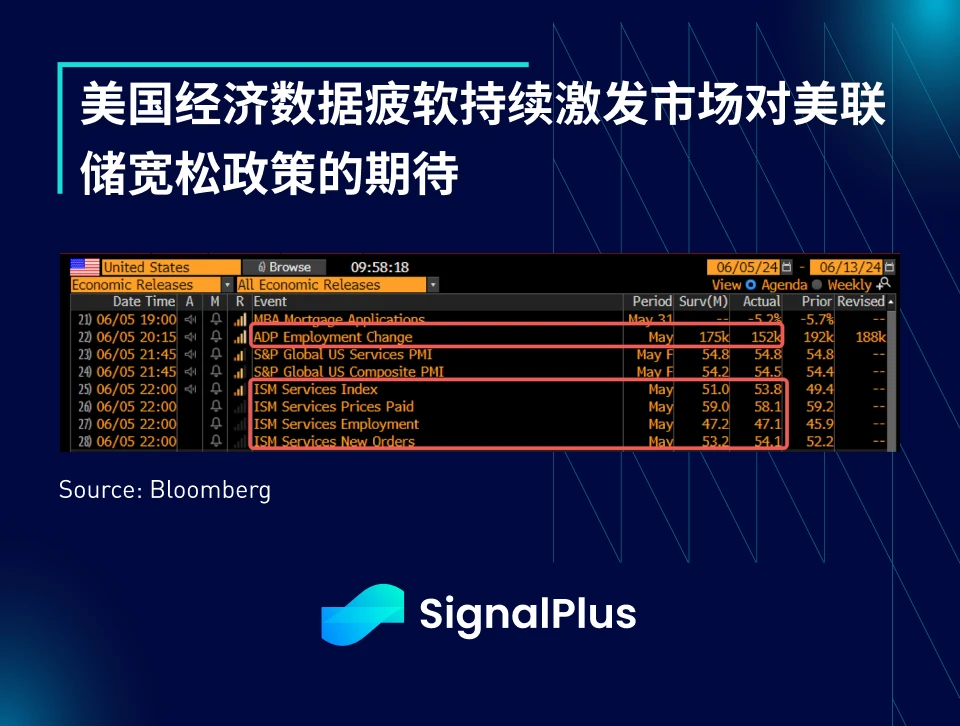

Risk appetite continued on the back of weak ADP employment data (152K vs 175K) and the employment component of the US Services PMI. Survey respondents cited “adjusting our hiring and capital investment strategies and managing borrowing”, “feeling the slowdown”, “hiring is slowing and prices are rising slightly”, and “high interest rates are reducing capital investment and slowing major facility upgrades”, leading the market to ignore the strongest overall performance of the non-manufacturing ISM index in 9 months (53.8 vs 51).

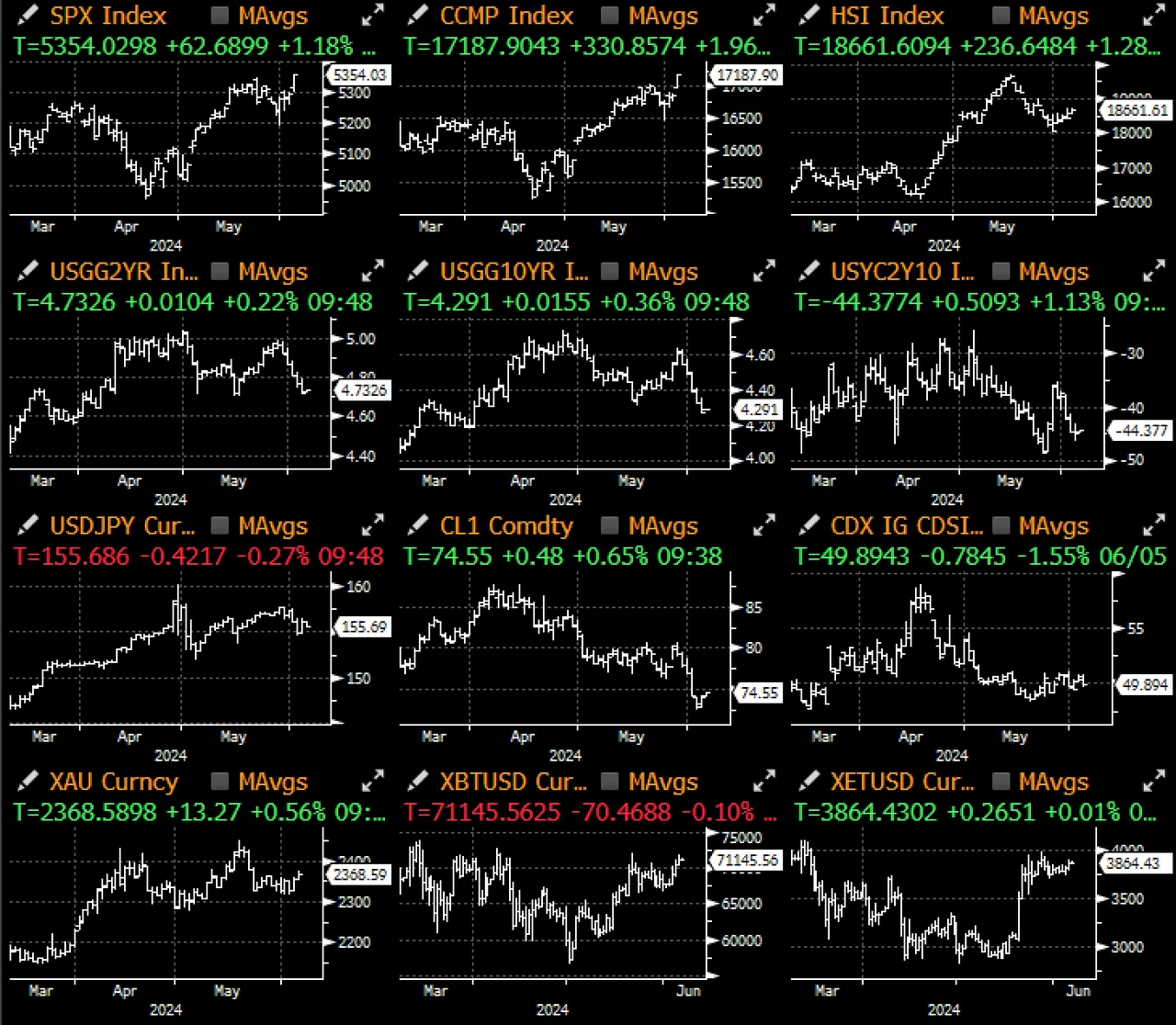

The Bank of Canadas 25 basis point rate cut is seen as the start of the upcoming easing cycle, and federal funds futures pricing shows that there will be two full rate cuts before the end of the year, and the probability of a rate cut in September has also risen to more than 60%. With the full return of the Feds rate cut expectations, the 10-year US Treasury yield is currently below 4.30%, the 2/10 s curve has re-inverted, and the spread has returned to the recent low of -45 basis points.

As yields fell, the Nasdaq rose another 2% yesterday and the SPX rose 1.1%, approaching all-time highs again. With a series of weak employment indicators in the past two weeks, and the market expecting weak non-farm payrolls on Friday, ETF investors have poured $58 billion into the US stock market this month, with inflows up to $315 billion so far this year, the traditional stock market adage Sell in May And Go Away has completely failed to come true.

Incredibly, Nvidias dominance of the market continues to expand, with its daily trading volume almost equal to the next nine stocks combined.

Finally, stocks are also poised to enter a friendly first half of July, the most seasonally positive two-week period for stocks, with data going back to 1928. The crypto space is no slouch either, with ETF inflows continuing to accelerate, with another $333 million yesterday following Tuesdays $886 million inflows. Will prices see more all-time highs? Are there any bears left? Enjoy it while you still can, folks!

ChatGPT 4.0のプラグインストアでSignalPlusを検索すると、リアルタイムの暗号化情報を取得できます。最新情報をすぐに受け取りたい場合は、Twitterアカウント@SignalPlus_Web3をフォローするか、WeChatグループ(アシスタントWeChatを追加:SignalPlus 123)、Telegramグループ、Discordコミュニティに参加して、より多くの友人とコミュニケーションを取り、交流してください。SignalPlus公式サイト:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis (20240606): BTC ETF inflows exceeded $1.2 billion in two days

関連:Dogwifhat(WIF)価格予測:$5に達するでしょうか?

要約 WIF 価格は対称三角形で動いており、ブレイクアウトすると 44% 上昇するでしょう。チャイキン オシレーターは 0 を大きく上回っており、4 月に入ってから買い圧力が高まっていることを示唆しています。MACD も強気のクロスオーバーに近づいており、上昇の可能性を裏付けています。ミーム コイン マニアにより、dogwifhat (WIF) 価格は 3 月を通して最高値を更新しましたが、これが再び起こる可能性があります。買い圧力が高まるにつれて、この抵抗を突破できる限り、Solana ミーム トークンも上昇する可能性があります。Dogwifhat が投資家の間で勢いを増している理由 WIF 価格は、投資家の強気の高まりにより、今後数日間で急騰する可能性があります。これは、チャイキン インジケーターで確認できます。