Original author: Nathan Reiff

Original translation: Vernacular blockchain

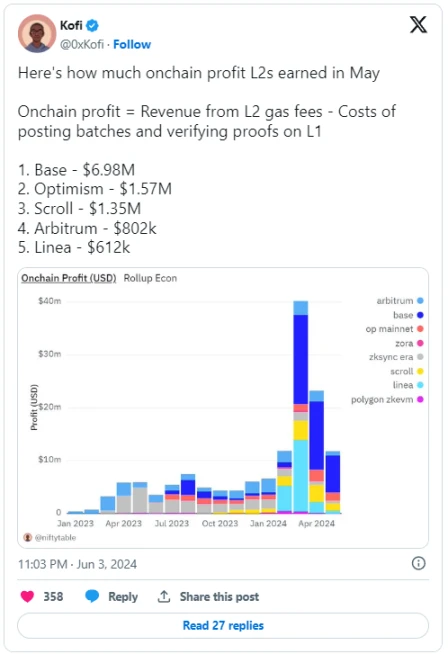

Base, the Ethereum Layer 2 scaling network launched by top US cryptocurrency trading platform Coinbase, generated more than $6 million in on-chain profits in May, becoming the most profitable Layer 2 network, surpassing competitors such as Blast and Optimism.

According to L2 BEAT data, Base’s surge in profits stems from the rapid growth of total locked value (TVL), which was driven by Ethereum’s implementation of EIP-4844 and proto-danksharding via the expected Dencun upgrade in March.

According to blockchain analytics platform GrowThePie, Base topped all Layer 2 chains with $6.1 million in on-chain profits in May, followed by Blast at $1.5 million and Optimism at $1.4 million. Although Base is far ahead of these competitors in the profit race, its monthly profits fell sharply after the Dencun upgrade in March.

On the other hand, Blast, an emerging Layer 2 network launched by the developers of the Blur NFT 市場, has recently gained recognition for its unique native returns on ETH and stablecoins, as well as for projects such as Pacmoon and Fantasy Top offering lucrative incentives to users.

Blast’s share of all Layer 2 profits grew from 5.3% in April to 15.2% in May. However, it still lags far behind Base, which accounted for 56.8% of all Layer 2 profits last month.

The on-chain profitability of a Layer 2 network refers to the balance between the revenue earned through fees, token issuance, and other means, and the costs required to interact with the Layer 1 network (Ethereum). In simple terms, it is to ensure that the network can cover the various expenses incurred by interacting with the Layer 1 network while making a profit. It does not include any off-chain fees, so it should not be considered a complete picture of running these networks from top to bottom.

The Dune dashboard, maintained by an on-chain analyst who goes by the pseudonym Kofi, also lists Base as the top, but with just under $7 million in profits for May. The discrepancy is likely due to differences in how each data provider measures revenue and expenses. However, Dune’s dashboard does not include data from Blast, so it is impossible to fully understand the leading Layer 2 network in this regard.

According to GrowThePie, Base has been the most profitable Layer 2 network since March 2024. In the past three months, its total locked value (TVL) has increased almost sixfold from $1.3 billion to $7.6 billion, setting an all-time high for the chain. As Optimism’s TVL has remained largely unchanged over the past month, Base has the potential to surpass OP Mainnet.

Both Base and OP Mainnet are built on the OP Stack and are part of the Optimism hyperchain ecosystem, although they are considered independent Layer 2 networks within that ecosystem. In terms of total locked value, Base is still far behind industry leader Arbitrum, which has a TVL of $19.1 billion.

In addition to the upgrades brought about by the Dencun fork, Base has gradually grown in traction in the cryptocurrency community since Coinbase announced the launch of a new Smart Wallet to increase accessibility to on-chain transactions for new users.

Coinbase’s Smart Wallet will use account abstraction to provide convenient on-chain transactions for those who are not familiar with the details of DeFi. Base also benefits from the popularity of Coinbase and the additional exposure it brings, as well as promotional pushes such as the recent “On-Chain Summer” rewards event, which started this week.

This article is sourced from the internet: With millions of dollars a month to earn, who makes the most money in Layer 2?

Original author: Haotian (X: @tmel0211 ) What do you think of the recently hotly debated Ethereum proposal EIP-7702? Simply put, it is an optimized and advanced version of EIP-3074, which is more compatible with the ERC-4337 Ethereum account abstraction strategy. But in my opinion, calling for EIP-7702 caters to the orthodox development framework of ERC-4337, but it will limit the unlimited potential of EIP-3074 in invoker, and can only be regarded as a compromise. Why? Next, share my views: 1) By definition, ERC-4337 is the most familiar to everyone. It allows users to delegate permissions to a new contract account address to control it, and then implement a series of account abstraction operations that optimize user operation experience, such as social recovery and gas payment, through proxy contract functions such…