原作者: ジャリール・ジアリウ 、ブロックビーツ

“Meme is the real valuable coin, even institutional VCs won’t play with it,” said a community member.

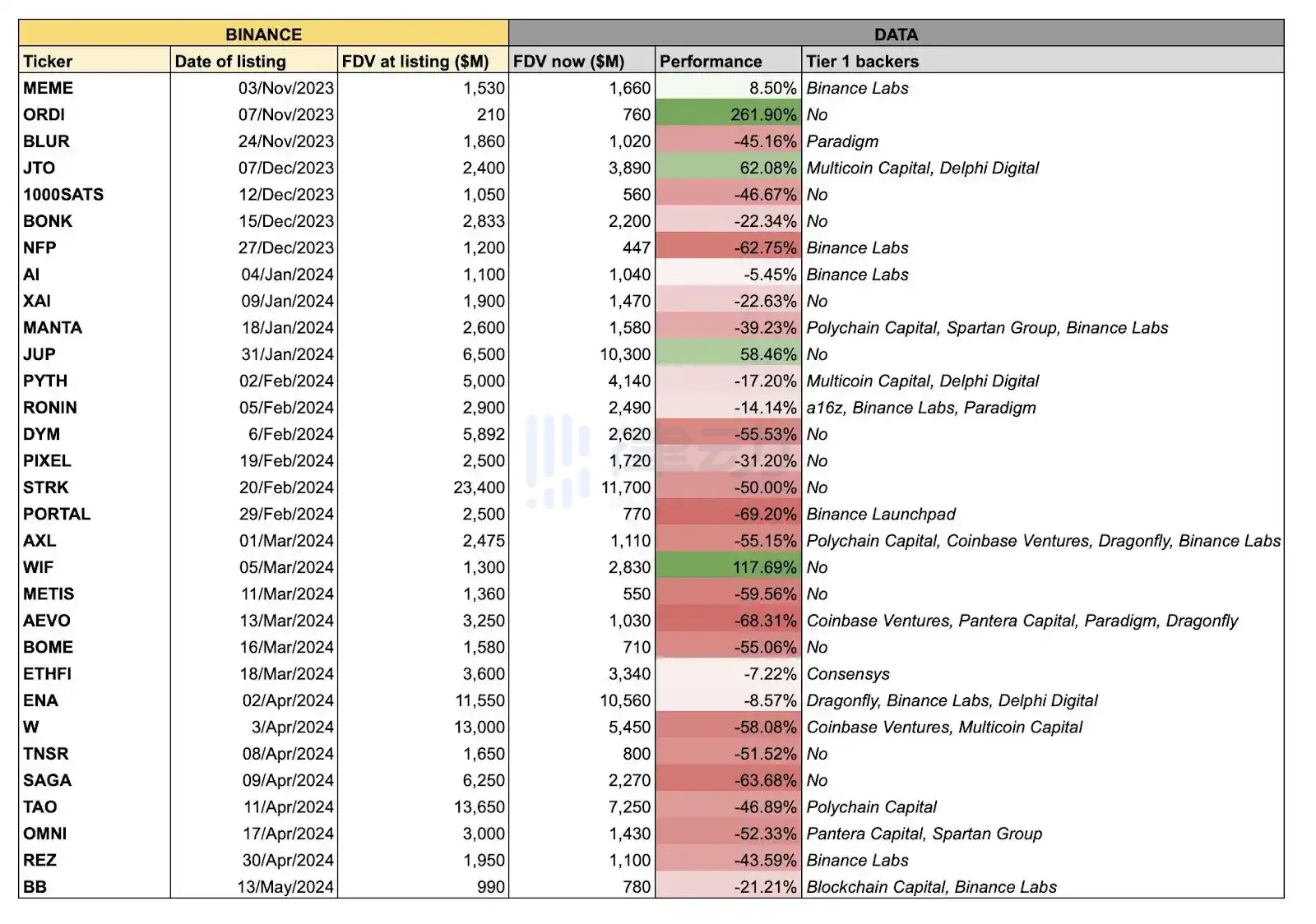

As the price of Bitcoin approaches its all-time high, the performance of new coins on several major trading platforms has been poor, sparking widespread discussion. According to the cryptocurrency KOL Chuanmu, the circulation of most of the new coins listed on Binance this year is only about 10%, while the unlocked market value is as high as billions of US dollars. This model of high valuation and low circulation has led to a serious diversion of market funds. It is estimated that the circulating part of Binances IEO project may have absorbed tens of billions of liquidity, while the unlocked part will absorb hundreds of billions of funds at the end of the bull market and in the bear market.

In such a market environment, these new coins with high FDV and low circulation are likely to become the culprits for accelerating the arrival of the bear market at the end of the bull market. Obviously, Binance has also realized this, so it recently issued an announcement that it intends to modify the listing rules. The dissatisfaction of retail investors in the market with the performance of these new coins has gradually shifted to VCs. Community retail investors and VCs do not understand each other and look down on each other.

Meme coins became a means for the community to resist VCs. Through fair distribution and high participation, Meme coins gained wider support and popularity, while VC coins were widely condemned. Ultimately, the absurdity of the capital formation process led to the confrontation between venture capital and retail investors. Venture capital accused Meme coins of disrupting the market, while retail investors, in turn, accused VCs of doing evil.

Binance changes its listing rules

On May 20, Binance announced that it would revise its listing rules and start supporting small and medium-sized crypto projects, aiming to provide opportunities for more small and medium-sized projects with good fundamentals, organic community foundation, sustainable business model and industry responsibility, and promote the development of the blockchain ecosystem. According to the official announcement, Binance will invite high-quality teams to apply for listing projects through direct listing, Launchpools and Megadrops, and contact the team after preliminary screening, reserving the right to decide whether the project is suitable for listing.

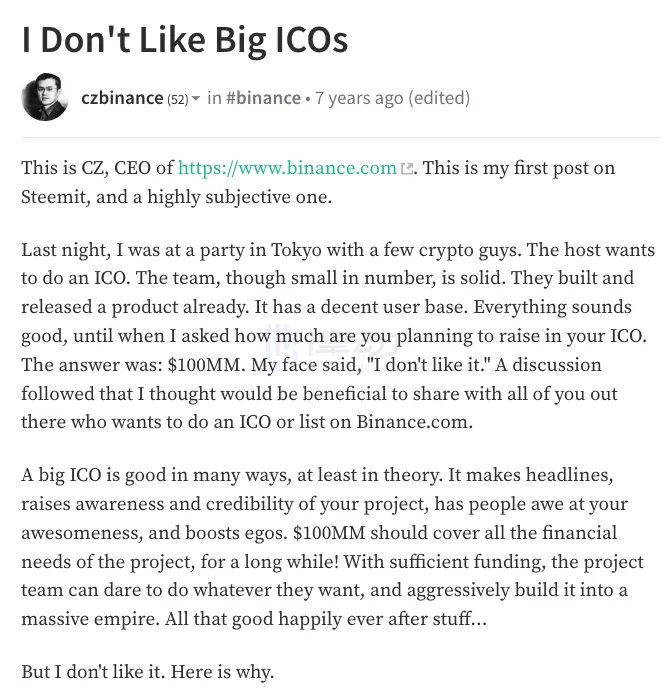

However, this strategic shift did not happen suddenly. As early as seven years ago, Binance founder CZ (Changpeng Zhao) published an article on Steemit, elaborating on his doubts about large-scale ICOs.

From 7 years ago, CZ saw today

記事では CZ: I dont like large ICO projects. It may not be right to obtain huge amounts of funds at one time , CZ expressed several core views: realizing the maximum value of a project during ICO is usually not conducive to its long-term development. Instead, it may bring about a series of negative effects, including price drops, reputation damage and user loss.

In the article, CZ explicitly opposed the practice of large-scale ICOs, pointing out that ICO maximization = bad, I dont like to see projects realize their maximum value on ICOs. In the long run, this is usually harmful to these projects. This is counterintuitive for many ICO entrepreneurs . At the same time, he also emphasized the negative consequences of high-valuation ICOs, including short-term traders selling off and causing price drops, which in turn triggered a series of negative effects, such as the spread of negative news and user loss.

Therefore, CZ suggested setting the ICO valuation at a lower level to make it easier to be oversubscribed, thereby ensuring that the token price will rise after listing, attracting more users and positive attention. This low-valuation ICO can not only bring positive market response, but also provide better support for the subsequent development of the project, forming a virtuous circle.

In 2023, six years after the publication of this article, Binance was caught up in the Bestie Coin rumor. Nearly nine months after Binances IEO masterpiece Stepn, Binance finally restarted IEO at the end of last year. However, it coincided with the bear market, and the market performance of several IEOs last year was not as good as expected, causing some dissatisfaction in the community. The rumors of Bestie Coin intensified, and Binance, as one of the largest platforms in the industry, has often faced heavy selling pressure on new coins launched in the past six months, and the peak situation has occurred as soon as they were launched.

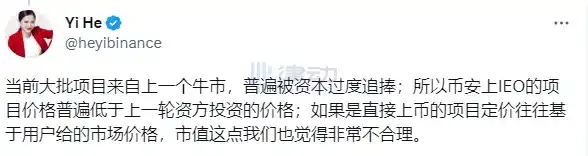

In the face of increasingly intense rumors, He Yi made a number of responses, as detailed in He Yis 19 responses: About Binance listing, IEO bestie rumors and market share .

In clarifying the listing standards, He Yi replied: Binance makes money from users, so the underlying logic of Binance listing is to try to list projects that can survive longer and bring returns to users. This is actually the difference in investment research capabilities and aesthetic differences. The platform that can identify the right projects and timing for listing in the long run will have users who can survive longer. This is the core competitiveness of the platform.

At the same time, He Yi also expressed a similar view to CZs that year. The phenomenon that IEO projects reached a market value of nearly 10 billion as soon as they were listed was because the market value of that batch of projects was priced by the previous bull market and was generally over-sought after by capital. Binance also believed that this situation was very unreasonable.

From todays perspective, Binances modification of the listing rules seems very sudden, but in fact, Binances modification of the listing rules to support small and medium-sized crypto projects is not a temporary decision, but has far-reaching causes and consequences. It can be said to be a return to the original intention in a sense.

Retail investors who embraced the meme collectively cursed VC coins

After Binance modified its listing rules, Meme coin communities of all sizes flocked to the platform and organized their community members to submit listing applications to Binance.

First of all, attitude is above all else, Really good coins should be verified on DEX before being listed on the trading platform, otherwise the market control will be too serious, After talking about high FDV for so long, finally some trading platforms have started to take action, BlockBeats received these positive responses after asking several traders for their opinions, which may represent the thoughts of many retail investors.

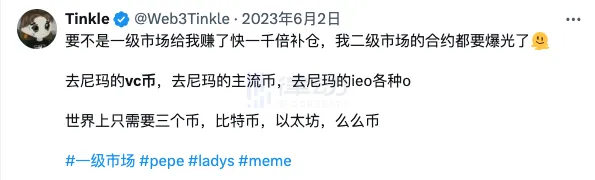

While most community members support Binance’s new listing rules, they also believe that this is a counterattack against large VCs manipulating the market. Retail investors’ dissatisfaction with VCs has also clearly intensified.

Therefore, we can see that KOLs are leading retail investors to charge forward, and their aversion to VC coins has reached a peak.

Although there have been discussions in the community about the circulation of VC coins before, this is the first time such a large-scale discussion has taken place.

As early as 2021, I encouraged everyone to play Meme coins and embrace Meme. The KOL cryptocurrency philanthropist said this to BlockBeats on the other end of the phone.

「 The vast majority of retail investors have a total net worth between 50,000 and 300,000 RMB, or between 8,000 and 50,000 USD. These people are the main force in the market, and for them, the growth of VC coins is really too limited. 」

Take some recent examples, TIA is the most prominent one in the VC coin track, but it can only increase by 10 times in a long time, while others like ENA have increased from 0.5 to 1.5 at the highest, only 3 times. And the meme coin Bome has increased from 20 million US dollars to 1.6 billion US dollars in a short period of time, achieving an 80-fold increase. Even if it only gets a lower increase, it can still be 20 to 30 times.

For retail investors who are looking to get rich quickly, such an increase is not very meaningful, and the profit and loss ratio is not cost-effective compared to Meme. In short, VC coins are more suitable for investors with more than $1 million in funds, while retail investors with less than $50,000 in funds are more suitable for playing Meme, dividing the funds into 100 parts, and the odds are higher. This is what the philanthropist in the cryptocurrency circle suggested.

From Can you still get on board? to No one will take over from each other, the slogan of this cycle has changed significantly.

But in fact, in the cryptocurrency circle filled with PVP mutual cutting games, the relationship between retail investors and VCs has always been bad. This contradiction was not sudden and without reason. Looking back, a conflict incident occurred in 2020.

The past and present of retail investors vs. VCs in the cryptocurrency world

In July 2020, when Uniswap was finally discovered and the wealth effect reached its peak, another DEX SushiSwap emerged. Without further ado, SushiSwap was targeting Uniswap.

This is a community-initiated DEX, which copied Uniswap’s code. The biggest difference is the token gameplay. SushiSwap completely stands on the side of retail investors, giving them enough returns, and even said that Uniswap’s LPs can migrate over and will be rewarded. Uniswap was not even sure about issuing tokens at that time. Uniswap is a VC project, and they are on the VC side. Retail investors’ support for SushiSwap shocked the industry.

As a result, SushiSwap obtained US$700 million in liquidity within 65 hours of its launch. Two weeks later, half of Uniswaps liquidity was transferred to Sushi. This was a hearty plunder of VC by the community.

That was the first large-scale community-VC confrontation, and four years later, the confrontation is still intensifying. This time it is Meme.

Meme Maker, History Repeats Itself for Pump.fun

The rise of Pump.fun is like Uniswap in 2020, and with the rise of trading bots, Meme coin transactions have become faster and more efficient.

Pump.fun has facilitated the issuance of millions of MemeCoins and created billions of value for these MemeCoins. For the first time in human history, anyone can create a financial asset for less than $2 and in less than 2 minutes. MemeCoins have become not only an excellent fundraising mechanism, but also an effective listing strategy. Traditionally, projects raise large amounts of money by allocating 15-20% of tokens to venture capitalists, then develop products, and finally build communities through memes and marketing. However, this model often leads to communities being abandoned by venture capitalists.

In the Meme era, people could raise funds by launching their own Meme coins (without a roadmap, just for fun), forming a tribal community early on, and then continue to build applications and infrastructure to add utility to the Meme coin without making false promises or providing a roadmap. This approach takes advantage of the tribalism of the Meme community and ensures high engagement from community members who become business developers and marketers for the project. This also ensures a fairer distribution of tokens and resists the pump and dump strategy of low circulation and high FDV adopted by venture capital.

Retail investors have woken up, and more and more retail investors have begun to embrace Meme coins and community coins. BOME is a typical example.

How long does it take for a great project to be born? The answer for BOME is three days, creating a market value of $1.5 billion in three days. The rapidity with which BOME was listed on Binance has made many crypto projects break the defense. These projects have worked hard for several years but have not been able to be listed, while BOME did it in just three days. This phenomenon shows that the market appeal and rapid listing capabilities of Meme coins have far exceeded the expectations of traditional crypto projects.

The success of BOME lies not only in its own market performance, but also in the fact that it has stimulated a surge in the number of newly issued Meme coins on the Solana network, further promoting the improvement of network activity. Although BOME is not the first person to pre-sell Meme, BOMEs success has undoubtedly ignited the pre-sale craze.

The rapid increase in BOMEs value reminds people of the original inscription ecology: If you are prejudiced, let the Bitcoin ecology grow until you have no prejudice.

After twelve years, the crypto industry has formed a set of accustomed logic: project owners create new concepts and new narratives, tie up with VC institutions, warm up through airdrops, and then make various arrangements to get the secondary market to take over. In this bull market, only TIA and SOL are considered good projects in the minds of old investors – they have a good team, good VC, Binance listing, and the track is expected to be hyped.

However, the Meme track has undergone a series of mutations and derivations, and the Ordinal, as a spoiler, was born. The emergence and popularity of all inscriptions in the Bitcoin ecosystem was completely unexpected.

Since its birth, Inscription has naturally carried the community spirit of fair launch and first is first, which happens to be the slogan of Meme. Since its birth in March, prejudice has been closely associated with the Bitcoin ecosystem, but it seems that it has never given up persuading everyone: If you have prejudice, let the Bitcoin ecosystem rise until you have no prejudice. The cost of printing an ORDI (1 including 1,000 coins) is 2 to 3 US dollars. If it is not sold at the high point, this is an investment that has increased by more than 20,000 times.

The interest game and confrontation between retail investors and VCs

The antagonism between retail investors and VCs has intensified, almost to the point of severing ties.

I dont understand it anyway, so I might as well speculate on memes. Many veteran investors in the community seem overwhelmed by the rapid changes in the market, while new investors are even more at a loss. Compared to the repeated iterations of the narrative in the cryptocurrency circle, the meme culture has always been thriving.

Memes continued popularity seems to be a mockery of VCs long-term value investment philosophy. Eddy Lazzarin, CTO of a16z Crypto, severely criticized Meme Coin in an article on April 25, saying that it undermines the long-term vision of cryptocurrency, tarnishes the public, regulators and entrepreneurs view of the industry, and acts as a casino for a relatively small number of people. He pointed out: Meme Coin has changed the public, regulators and entrepreneurs views on cryptocurrency. At best, it looks like a risky casino, or a series of false promises covering up a casino. This deeply affects adoption, regulation/law and the behavior of blockchain builders. I see this damage every day.

Similarly, Michael Dempsey, managing partner of Compound, also said: Seeing Meme coins lead to an exodus of cryptocurrency developers, the extent of which is even more serious than the bear market in the past few years. These views all reflect the VCs deep dissatisfaction and concerns about Meme coins.

At the same time, retail investors are increasingly dissatisfied with VCs’ manipulation of the market. Most governance tokens are backed by venture capital, and these tokens are usually launched at high valuations and gradually transferred to retail investors. Today, VCs are not only trying to control “VC coins”, but also trying to manipulate Meme coins to further “play” with retail investors.

On May 21, community member Rahul | Polygon Intern published a long article on the social media platform, accusing Polygons senior executives and internal staff of manipulating a meme coin called $ELE, and attached a large number of screenshots as evidence. These evidences not only involved Polygon executives, but also included Symbolic Capital, Multibit, BounceBit, GeekCartel, Salus Security and other projects and their leaders. This revelation triggered a strong reaction from the community. Although the relevant allegations have not been confirmed, the fermentation of the incident has attracted widespread attention.

In the eyes of retail investors, VCs are just instigators in the core circle who collude with each other, and in the eyes of VCs, retail investors who play memes are of no help to the industry.

Retail investors and VCs don’t understand each other, and each looks down on the other.

I think the sense of opposition comes from the communitys belief that VC is money without value. The main value that most VCs bring to projects is money, which has actually become a liability for the secondary market community. Ye Su, founder of ArkStream Capital, expressed his views, The fundamental reason is that the reservoir (buying) of altcoins has not increased, but the fundraising amount (selling) of industry VCs has increased fivefold compared to 2020. I think the current split is even more serious. With Binances new policy, more non-Meme projects may consider fair distribution and low market capitalization listing.

This sense of confrontation between retail investors and VCs is more serious than in 2020 because this time it is due to systemic contradictions, said KOL trader and cryptocurrency philanthropist.

A cryptocurrency philanthropist further explained to BlockBeats: In the traditional venture capital model, VCs do solve problems. They invest in consumer, chip and high-tech industries and provide financial support to these start-ups. However, only a very small number of crypto VCs can promote long-term positive innovation. Most of them are just for short-term interests. They collude with project owners to participate in market manipulation and gain profits through capital. Retail investors can only become the leeks that are harvested in the end.

In the eyes of cryptocurrency philanthropists, young people’s embrace of the cryptocurrency hype meme is the choice and result of the times, and it is also the most ideal way.

“The casino culture of cryptocurrency is actually an important way for ordinary people in today’s society to change their class. In the absence of fundamental changes in the current productivity and production relations, casino culture has become the best choice without bloody revolution. Some people may hate this casino culture, but for those young people who are eager to change their destiny, cryptocurrency casinos provide an opportunity without bloodshed and sacrifice. Otherwise, they can only achieve class leap through more extreme revolutions, but this will cause greater damage to the stability of the entire society.”

In this context, the communitys dissatisfaction and resistance to VCs are becoming increasingly strong. Meme coins have become a means for the community to resist VCs. Through fair distribution and high participation, Meme coins have gained wider support and love. VCs manipulation and market manipulation are widely condemned by the community.

Ultimately, the absurdity of the capital formation process led to a confrontation between venture capitalists and retail investors. Venture capitalists accused Meme coins of disrupting the market, while retail investors, in turn, accused VCs of doing evil.

Whose fault is it?

Some time ago, a project with a valuation of 2 billion US dollars came to me for KOL round of financing. Can you imagine 2 billion US dollars? I was really angry. When he said this, the tone and emotion of the cryptocurrency philanthropist gradually became excited.

“In 2014, Ethereum’s valuation was only $26 million during its ICO. In 2022, Optimism (OP)’s valuation was $150 million. Now, any new project can have a valuation of $1 billion to $2 billion. In the past, there was only one Optimism and one Ethereum, but now there are a lot of projects with FDVs exceeding $1 billion. Is there really that much money in the market to take it?”

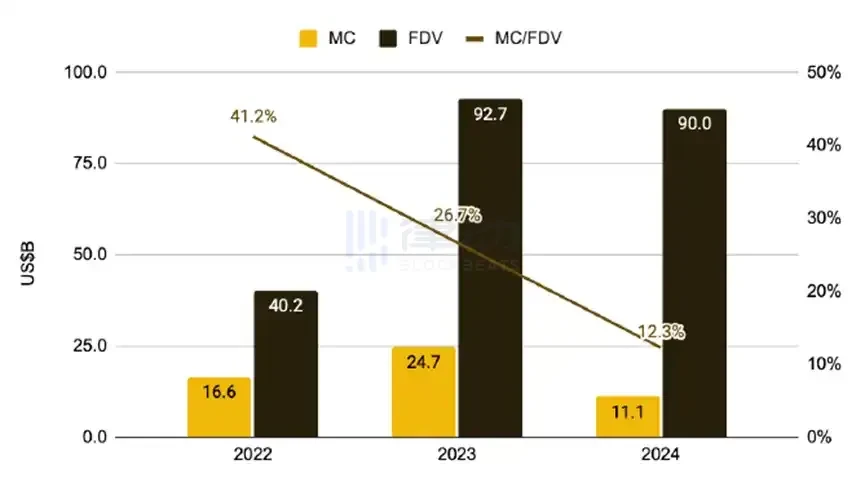

Image source: Binance Research

In Binance Research’s report “ Low Circulation and High FDV Tokens Prevalent, Why Has the Market Become What It Is Today? ”, the market capitalization and FDV of tokens issued in the past three years are also shown, highlighting the growing gap between these indicators over time. Although only a few months away from 2024, the FDV of tokens launched in the first few months is close to the total number in 2023, highlighting the prevalence of high-valuation tokens.

The prevalence of overvalued and low-circulation tokens in the current market is due to a variety of structural reasons and changes in capital operation models.

記事では Memeccoins > Governance Tokens , researcher Yash Agarwal wrote: Take EigenLayer as an example, the largest Ethereum protocol in this cycle, in its governance token distribution, venture capital and team hold up to 55% of the shares, while the initial community airdrop accounts for only 5%. This low circulation, high FDV (fully diluted valuation) token issuance method allows insiders to greatly increase their wealth by controlling the token supply. This model exists not only in EigenLayer, but is becoming more and more common in the entire cryptocurrency market.

There is a deep logic behind venture capital firms pushing for high FDV token issuance. Suppose a large venture capital fund invests $4 million in exchange for a 20% stake in a project with an initial valuation of $20 million. In order to ensure high returns for venture capital, they need to increase the FDV to at least $400 million when the token is issued. The larger the fund, the more likely it is to set an absurdly high private valuation for the project, and with the help of a strong narrative, eventually go public at a higher public valuation. This high-valuation issuance strategy forces retail investors to become takers when the token is listed, causing the price to plummet.

For example, the case of Starkware shows that launching with a high FDV only led to a downward price spiral and zero attention, whereas in the case of Celestia, launching with a low FDV not only allowed retail investors to profit from the repricing, but also helped form a strong community and mindshare.

Binance Researchs report also points out several reasons for the current high FDV low circulation tokens: The prevalence of high FDV low circulation tokens is mainly due to the massive influx of private market capital, aggressive valuation strategies, and optimistic market sentiment. The influx of funds from the private market has pushed up project valuations, making the price of tokens high when they are launched on the public market. Aggressive valuation strategies are more obvious when the market is hot, and venture capital firms tend to invest at higher valuations. Coupled with the markets optimism, project teams use this sentiment to raise funds at high valuations, resulting in the prevalence of high FDV low circulation tokens.

After calming down, we need to regain some rational thinking. Is VC really of no help in this industry? Is Meme Coin definitely better than VC Coin?

Everyone is to blame

Let’s go back to what we mentioned at the beginning of this article. A batch of tokens recently listed on Binance are all falling. Most of them are ridiculed as “high FDV (fully diluted value), low circulation” tokens, which means that they have a fairly high FDV valuation, but a small circulating supply on the first day.

Ye Su also told BlockBeats that the current market funds mainly flow to Bitcoin through ETFs, while liquidity has not flowed significantly to altcoins. As a leading trading platform, Binance has recently launched several IEO projects such as BounceBit, Renzo, Saga and Omni, with record low yields and a clear lack of buying. In response to this situation, Binance adjusted its listing rules and lowered the valuation range of new projects from the source, from a fully diluted valuation (FDV) of $200-1 billion to between $500 million and $200 million. This change provides users with more room for participation and makes the market fairer and more open.

This new rule will greatly facilitate the listing of small projects. In the past, many projects had to go through 3-4 rounds of financing, with a total amount of tens of millions of dollars, before they could enter Binances coin selection pool. Now, as long as the projects product technology is mature and the community foundation is solid, these projects will have more opportunities to obtain financing and be listed. Such rule changes not only provide more opportunities for small projects, but also allow more investors to participate in the development of these projects, promoting the healthy and sustainable development of the entire cryptocurrency market.

Cryptocurrency philanthropists also believe that this is not a problem with a single trading platform, but a problem with the entire market pricing mechanism. After all, many people on Twitter have criticized the OKX trading platform, saying that many of its recently launched projects have performed poorly and prices have fallen rapidly after they were launched.

記事では Why are all these low float / high FDV coins down bad? , Haseeb, partner of cryptocurrency venture fund Dragonfly, explored the issue of market pricing. When people lose money, everyone wants to know who to blame. Is it the founder? VC? KOL? Trader? Market maker? Trader? The best answer may be no one or everyone, he wrote.

Haseeb pointed out that the market pricing mechanism is problematic, which is not only a problem for VCs and trading platforms, but also a problem for retail investors. If the market mechanism does not pay, it will force trading platforms and VCs to change their issuance models. This is a process of market self-regulation.

Everything is the markets choice and no one can escape blame.

Are retail investors completely fleeing VC coins?

Faced with the VC coins with high FDV and low circulation on the market, have retail investors really given up on playing? The answer from cryptocurrency philanthropists is “yes and no”.

Although as mentioned above, cryptocurrency philanthropists have been encouraging everyone to pay attention to Meme coins, this does not mean that VC coins have no chance. He explained: It does not mean that Meme coins are necessarily good and VC coins are necessarily evil. The key lies in the analysis of individual projects. Retail investors need to choose high-odds projects that suit them according to their investment preferences and risk tolerance.

Under BlockBeatss questioning, cryptocurrency philanthropists gave their three criteria for selecting targets: chip structure, circulating supply, and narrative space.

Specifically, the holding and distribution of project tokens are understood through the chip structure, including the pre-sale, airdrop, project party holdings and circulation in the market. Projects with a clear and reasonable chip structure are usually more worthy of attention. The circulating market examines the release of tokens before and after the launch of the project. Projects with reasonable release control before and after the launch are more likely to maintain a stable price. Narrative space evaluates the market positioning and future development potential of the project. For example, as a trending project, TIA has a strong market space and narrative ability; while IO projects in the AI track have high growth potential due to their technology and market demand.

The focus of investing is to find mispricings in the market, and the focus of trading is to understand and manipulate market reflexivity, the cryptocurrency philanthropist also emphasized his recent insights.

Traders in the secondary market not only play with Meme coins, but also in the primary market, VC coins are even more indispensable.

To do primary investment, you have to find VC coins, evaluate the investors behind the project, and then wait to cash out on Binance, a trader focusing on primary investment told BlockBeats. Although they are also concerned about Binances adjustment of the listing rules and the discussion on high FDV and low circulation VC coins, they believe that this has little impact on their overall logical architecture.

Is there no value in the existence of VC?

When Meme coins become popular, VCs will inevitably make corresponding layouts and investments. In response to the question, In this round of bull market and the subsequent cycles, VCs will invest in more small and medium-sized projects or Meme coins. Will this be a long-term trend? Ye Sus answer is yes and no.

VCs with high valuations will not invest in small and medium-sized projects. In the 2017 and 2020 cycles, VCs did tend to invest in more small and medium-sized projects, but as the industry matures and liquidity gathers, small and medium-sized projects face the dilemma of a short life cycle. Ultimately, Web3 venture capital will converge with Web2, with only a small number of top projects being able to get listing opportunities and bring long-term returns to VCs with a four-year lock-up period. Small and medium-sized projects are widely issued on DEX through fair distribution, and VCs with flexible fund strategies with community resources may become the main supporters of such projects. Ye Su told BlockBeats.

But let’s face a more basic and direct question: If community coins become the mainstream of the market, then what value will remain for VCs?

Ye Su, founder of ArkStream Capital, told BlockBeats: “The core investment of VC is to promote the infrastructure construction, application development and large-scale popularization of the industry. For example, in the early stage of investment projects, ArkStream Capital will not only deeply participate in the narrative and product construction of the project, but also help the project financing and formulate growth strategies. Whether in the Web2 or Web3 field, VC has played a core role in the financing and development of all early companies.”

“The essential interests of VCs and retail investors are not in conflict,” Ye Su further said, “VCs use their professional skills to help users identify high-quality projects and promote project development. At the same time, due to regulatory reasons, most projects will be accompanied by a one-year lock-up period for VCs when they go public. The core issue still lies in whether the project’s token economic design and product iteration are competitive.”

Finally, researcher Yash Agarwal said that VCs like a16z should syndicate their deals to allow anyone to participate, and using a platform like Echo is a good fit for this.

As he wrote, most retail investors are not actually against VC/private funding, and the community advocates for fairer distribution and a more level playing field.

This article is sourced from the internet: Systemic contradictions intensify, retail investors fight against VCs in the cryptocurrency circle

関連: インターネット コンピュータ (ICP) の統合: 強気価格の継続前に落ち着きますか?

要約 ICP OI加重資金調達率は、ユーザーによる安定した、中程度のポジティブな関心を示しています。ICP RSI 7Dは3週間一貫して下落しており、健全な購買エコシステムと関心の低下の可能性を示しています。ICP EMAラインは1週間前にゴールデンクロスを形成し、価格は急騰しましたが、このパターンはすぐに置き換えられる可能性があります。インターネットコンピューター(ICP)の価格は最近注目を集めており、OI加重資金調達率が示す安定した、中程度のポジティブなユーザーの関心を反映しています。3週間にわたるRSI 7Dの一貫した下落にもかかわらず、活気のある購買エコシステムと関心の低下の可能性を示唆しています。ただし、この強気の傾向はすぐに変わる可能性があります。驚くべきことに、ICPは過去1か月で38.68%急上昇し、わずか2日間で驚異的な45.60%の増加を記録しました。ただし、EMAラインはすぐに価格をシフトさせる可能性があります…