ビットゲットリサーチインスティテュート:米国SECがイーサリアムスポットETF 19b-4を承認、ETHFiおよびその他のエコロジカル資産が共存すると予想される

Cryptocurrency prices saw significant volatility on Thursday, with liquidations of all leveraged crypto derivatives positions surging to over $360 million that day, the highest level since May 1:

-

The sectors with strong wealth-creating effects are: RWA sector and Ethereum staking sector;

-

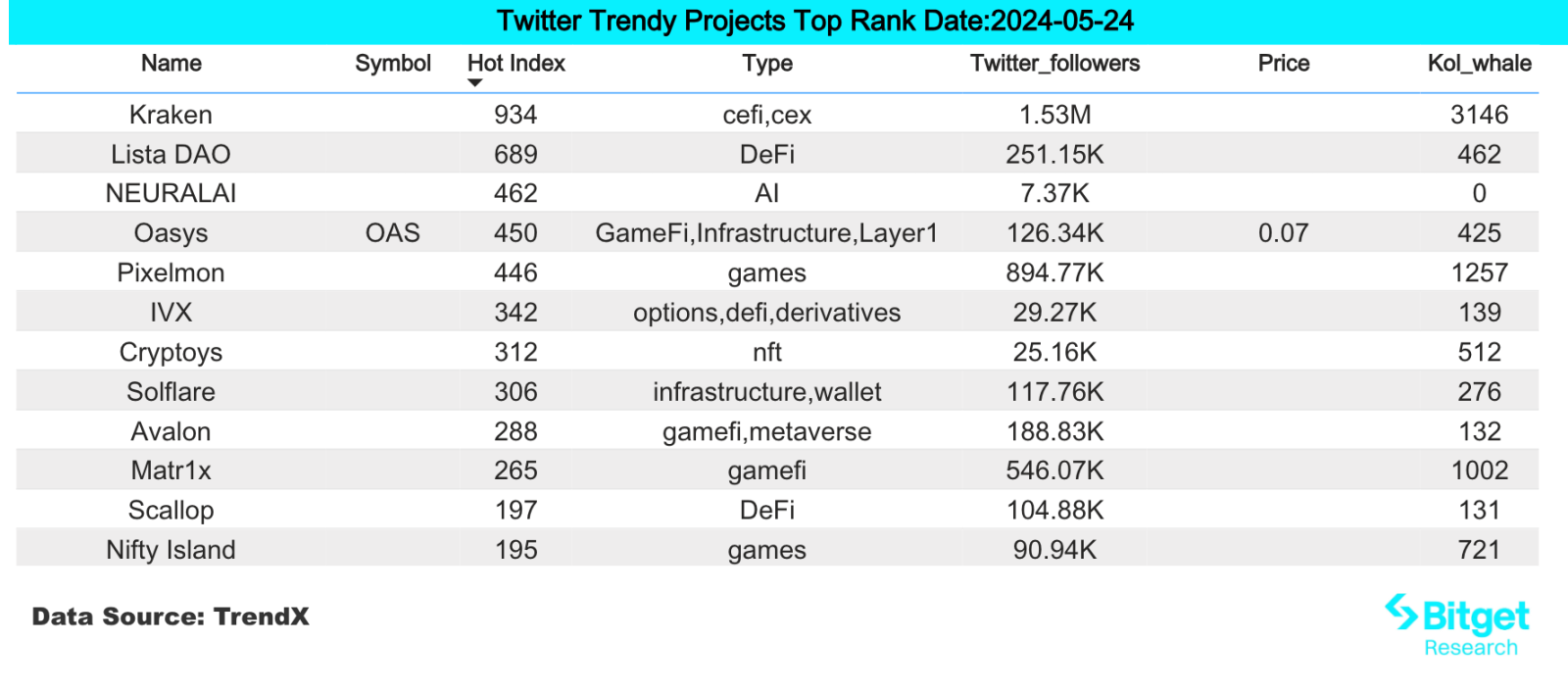

Hot search tokens and topics by users are: Plume Network, Lista (LISTA);

-

Potential airdrop opportunities include: Sanctum, Synthr;

Data statistics time: May 24, 2024 4: 00 (UTC + 0)

1. 市場環境

Cryptocurrency prices saw significant volatility on Thursday. Before the approval, ETH first fell to $3,500 around the closing time of the traditional U.S. market, then soared to around $3,900, and finally stabilized above $3,800 after confirmation. Bitcoin also fell to a low of $66,000, then soared to $68,300 before falling back below $68,000.

According to data from CoinGlass, during this turbulent period, liquidations of all leveraged crypto derivatives positions soared to more than $360 million that day, the highest level since May 1. Most of the liquidated positions were long positions, worth about $250 million, indicating that highly leveraged traders were concentrated on betting on an immediate surge after the ETF was approved. ETH traders were hit the hardest, with liquidations reaching $132 million.

2. 富裕層セクター

1) Sector changes: RWA sector (ONDO)

Main reason: This bull market mainly originated from the traditional market buying brought by ETFs. As a way to introduce traditional financial markets, RWA has been constantly updating its products and raising funds. Recently, RWA layer 2 network Plume Network completed a $10 million seed round of financing.

Rising situation: ONDOs daily increase today is 13.46%;

市場見通しに影響を与える要因:

-

マクロ金融政策の変更:マクロ環境の面では、10年米国債の利回りの上昇がRWAトラックのファンダメンタルズを支えています。米ドル指数、米国債利回り、暗号通貨市場のその後の変化に注意し、取引戦略を動的に調整する必要があります。

-

プロジェクト TVL の変化: RWA トラック プロジェクトは基本的に TVL によってサポートされます。RWA トラックの TVL の変化に注目してください。プロジェクトの TVL が上昇し続けるか突然上昇する場合、通常は購入のシグナルです。

2) Sector changes: Ethereum staking sector (LDO, SSV, ETHFI)

Main reason: The U.S. Securities and Exchange Commission today approved the 19 b-4 forms of multiple Ethereum spot ETFs, including those from BlackRock, Fidelity and Grayscale. Since ETFs only allow Ethereum tokens and do not allow staking, this regulation greatly reduces the attractiveness to ETF investors, so the Ethereum re-staking sector will usher in substantial benefits.

Rising situation: LDO rose 10.8% in the past 4 days, SSV rose 7.97% in the past 7 days, and ETHFI rose 22.85% in the past 4 days;

市場見通しに影響を与える要因:

-

Fund inflow after ETH ETF is approved: At present, the ETF is in the countdown for listing after approval. If a large amount of funds flow in after approval, it will further push up the ETH price.

-

Protocol trends: The cash flow of staking sector projects is relatively stable and easy to predict. They are a type of project whose token prices can be estimated more accurately. The main influencing factors are the protocol TVL, income distribution method, token destruction, etc.

3) The sector that needs to be focused on in the future: TON ecosystem

主な理由:

-

Panteras investment in TON may be at least over US$250 million, which is Panteras largest investment in cryptocurrency in history.

-

Notcoin, a high-traffic project in the TON ecosystem, has been listed on Binance, but the TON token itself has not yet been listed on Binance. The market expects that it is only a matter of time before TON is listed on Binance.

-

The infrastructure of the TON ecosystem is in its early stages. Currently, high-traffic projects such as Notcoin and Catizen have emerged, demonstrating a huge user base backed by Telegram.

-

The increase in the issuance of stablecoins in the ecosystem has brought financial vitality. The supply of USDT on the TON chain reached 130 million within two weeks, making it the eighth blockchain in terms of USDT issuance.

具体的なプロジェクトリスト:

-

TON: The native token of the Ton chain, currently listed on exchanges such as OKX and Bitget.

-

FISH: Ton ecosystem head meme token.

-

REDO: A dog-themed meme coin on the Ton chain.

3. ユーザーのホット検索

1) 人気のDapps

Plume Network:

Modular RWA L2 network Plume Network announced its launch on Arbitrum Orbit. Plume is a modular L2 blockchain dedicated to real-world assets (RWA), integrating asset tokenization and compliance providers directly into the chain. Plume Network team members come from companies and projects such as Coinbase, Robinhood, LayerZero, Binance, Galaxy Digital, JP Morgan, dYdX, etc. Yesterday, it completed a $10 million seed round of financing, led by Haun Ventures, and participated by Galaxy Ventures, Superscrypt, A Capital, SV Angel, Portal Ventures and Reciprocal Ventures. The funds raised will be used to recruit more employees in engineering design, marketing and community functions. The Plume Network open incentive testnet will be launched in the next few weeks, followed by the mainnet later this year.

2) ツイッター

Lista (LISTA):

Binance Megadrop will launch Lista (LISTA), a liquidity staking and decentralized stablecoin protocol. The maximum supply of the token is 1 billion, the initial circulation is 230 million (23% of the supply), and the total Megadrop is 100 million (10% of the supply). Binance will list LISTA after the Megadrop is completed, and the specific listing plan will be announced separately. Lista DAO is a liquidity staking and decentralized stablecoin lending protocol. Users can stake and liquidity stake on Lista, as well as borrow lisUSD using a range of decentralized collateral. The report also introduces the LISTA token: LISTA is the governance token of Lista DAO, which is used for the following functions: governance, protocol incentives, voting, and fee sharing. The protocol consists of the following main parts that work together: decentralized stablecoin lisUSD and BNB liquid staking token slisBNB.

3) Google検索地域

世界的な視点から:

ETH ETF: A new compliance milestone in the crypto world: Ethereum spot ETF finally approved. On May 23rd, local time in the United States, the U.S. Securities and Exchange Commission (SEC) officially approved all Ethereum ETFs, providing investors with a new opportunity to invest in Ethereum through traditional financial channels. This decision is seen as a major endorsement of the cryptocurrency industry, becoming the second cryptocurrency ETF approved by the SEC after the spot Bitcoin ETF. After approval, the price of Ethereum rose slightly and fluctuated around $3,800, reaching a high of $3,856. It is currently reported at $3,807, a 24-hour increase of 1.3%. After the news landed, the fluctuation was not as large as in the previous few days, but it caused a lot of attention on the entire Twitter social media.

各地域の人気検索から:

(1) Europe and CIS regions show a certain degree of interest in MEME:

As the crypto market rebounded significantly, PEPE tokens continued to hit new highs, and users began to buy back their chips into MEME coins to gain higher returns. From the searches of European users, it can be seen that European users generally search for MEME coins more frequently, which also means that users in the European market are more involved in the MEME coin market.

(2) The Asian region has shown a clear increase in attention to BTC, ETH ETFs, etc.:

Influenced by Bloombergs report that Hong Kong may pass BTC and ETH ETFs this week, searches in the Asian region have clearly increased their attention to the event. As the core region of Asian finance, Hong Kong has always been at the forefront of financial innovation. With the passage of ETFs, it has once again become the focus of Asia. Traditional finance and large funds can enter the encryption field through this channel, which has a positive impact on both industry development and retail investment.

潜在的 エアドロップ 機会

聖域

Solana Ecosystem LST Protocol Sanctum officially announced the launch of the loyalty program Sanctum Wonderland. According to reports, Sanctum Wonderland aims to make full use of SOL to gain benefits through a gamified experience. Users can collect pets and earn experience points to upgrade by staking SOL, and earn EXP through pets.

Previously, the Solana ecosystem liquidity staking service protocol Sanctum completed its seed round extension round of financing, led by Dragonfly, with participation from Solana Ventures, CMS Holdings, DeFiance Capital, Genblock Capital, Jump Capital, Marin Digital Ventures and others. The total financing has now reached US$6.1 million.

Specific participation method: open the link, connect the wallet, fill in the invitation code, ② exchange Sol for Infinity, deposit at least 0.122 SOL + 0.05. The deposit wallet needs to prepare at least 0.172 SOL, and deposit at least 0.11 SOL. The pet will automatically grow and earn EXP. Once the LST balance is lower than 0.1 SOL, the pet will enter hibernation and stop earning EXP. Those who are capable are recommended to deposit more than 1 SOL. 1 SOL will earn 10 EXP per minute, which can be withdrawn at any time, and the GAS fee is extremely low.

Synthr

Synthr is a full-chain synthetic protocol that allows cross-chain minting and transfer of synthetic assets without the need for cross-chain bridges. The project mints assets on-chain through synthetic assets (Synthetix), which means that its technology can easily bring RWA to the chain, such as real estate, bonds or stocks, for cross-chain transactions and transfers.

The project raised $4.25 million from top funds including MorningStar Ventures, Kronos Research, and Axelar Fdn.

Specific participation method: The project has just been opened for testing. Users can participate in early interactions by entering the test network, registering a wallet, and receiving test coins through the faucet. Continue to pay attention to the subsequent progress of the project and actively participate in various on-chain interactions.

Bitget Research Instituteの詳細情報: https://www.bitget.fit/zh-CN/research

Bitget研究所は、オンチェーンデータに焦点を当て、価値ある資産を採掘することに重点を置いています。オンチェーンデータのリアルタイム監視と地域のホット検索を通じて最先端の価値投資を採掘し、暗号愛好家に機関レベルの洞察を提供します。これまで、Bitgetsのグローバルユーザーに、[Arbitrumエコシステム]、[AIエコシステム]、[SHIBエコシステム]などの複数の人気分野の初期段階の価値ある資産を提供してきました。徹底したデータ駆動型研究を通じて、Bitgetsのグローバルユーザーに優れた富の効果を生み出します。

【免責事項】市場にはリスクが伴いますので、投資の際はご注意ください。本記事は投資アドバイスを構成するものではなく、ユーザーは本記事の意見、見解、結論が特定の状況に適しているかどうかを検討する必要があります。この情報に基づく投資は自己責任で行ってください。

This article is sourced from the internet: Bitget Research Institute: US SEC approves Ethereum spot ETF 19b-4, ETHFi and other ecological assets are expected to continue to rise

関連:チェーンゲーム週報 | NYANトークンは5月21日にBYBITで発売予定。DMTの週次増加は100%を超える(5.13-5.19)

オリジナル | Odaily Planet Daily 著者 | Asher 過去1週間、ビットコイン価格の力強い反発に伴い、GameFiセクターも良い増加を見せています。おそらく今はGameFiセクターに投資するのに良い時期です。そこで、Odaily Planet Dailyは、最近人気がある、または人気のある活動があるブロックチェーンゲームプロジェクトをまとめて整理しました。ブロックチェーンゲームセクターのセカンダリーマーケットのパフォーマンス Coingeckoのデータによると、ゲーム(GameFi)セクターは過去1週間で6.9%上昇しました。現在の総時価総額は$20,475,708,280で、セクターランキングで28位にランクインしており、先週の総時価総額セクターランキングから3つ下がっています。過去1週間で、GameFiセクターのトークン数は360から365に増加し、5つのプロジェクトが追加され、ランキングは…