In the past 48 hours, both the cryptocurrency market and the TradFi lobbying group were caught off guard by the sudden change. The U.S. SEC suddenly changed its position on the approval of the ETH ETF, suddenly requiring various ETF issuers to update their latest 19 b-4 filings and notify the NYSE and CBOE that these funds will be listed on the exchange, indicating that the possibility of the ETH ETF being approved is quite high.

In response, five institutions that applied to issue ETFs (Ark 21, Fidelity, Franklin Templeton, Invesco/Galaxy, and VanEck) updated their 19 b-4 filings in the past 24 hours. VanEck’s product has even been listed on DTCC under the name $ETHV. This progress is really too fast!

So what’s changed in the updated document? ETF Analyst reports that, unsurprisingly, the SEC asked all issuers to remove all references to ETH staking, as this is the agency’s main argument for ETH being a security, so the underlying assets of the final ETH ETF may not be “staking for profit”, but what if it is packaged through a centralized exchange, or done through a third-party platform willing to pay deposit interest? How will the final S-1 document describe it? This industry is indeed still the most advantageous for lawyers!

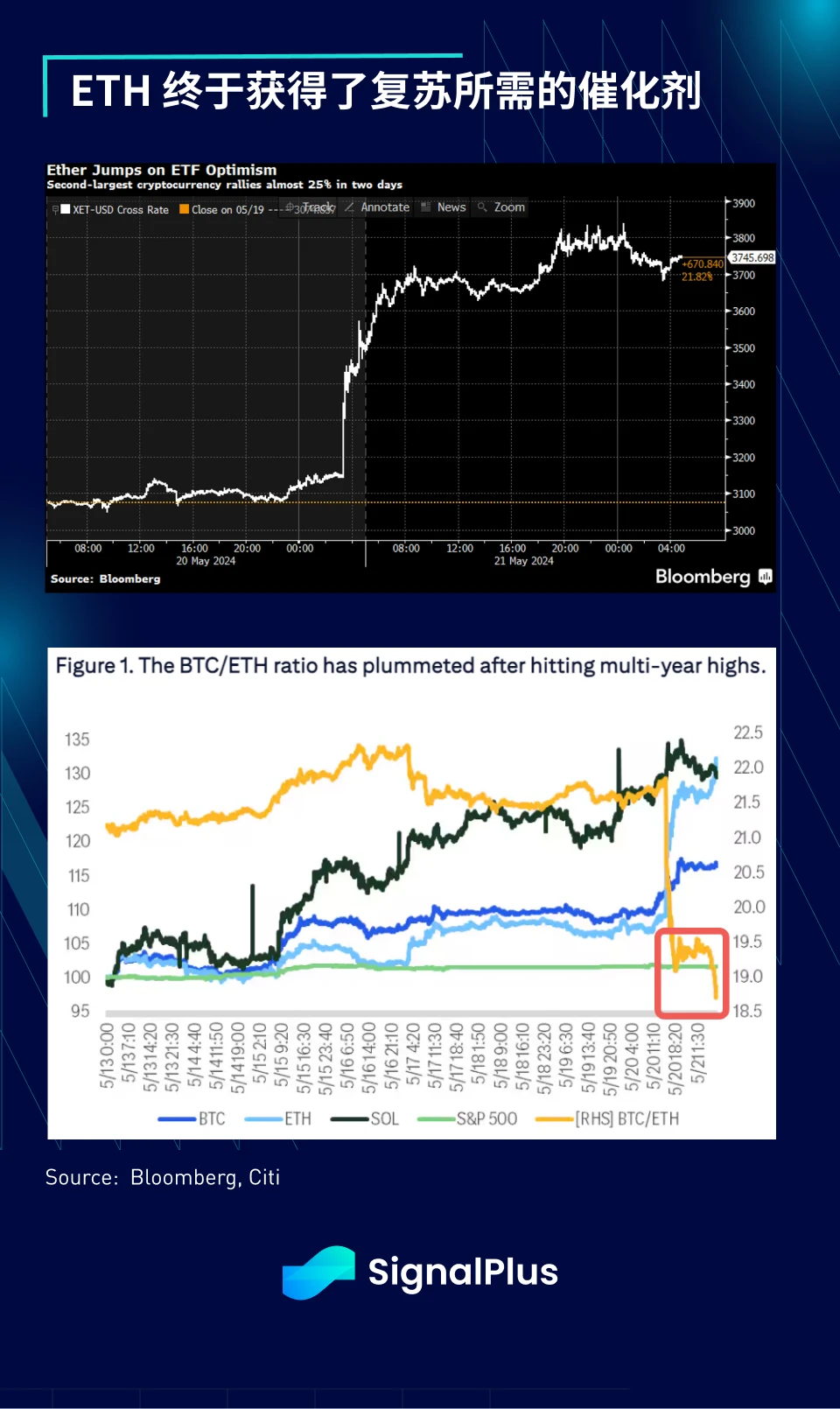

ETH of course surged on the news, surging 25% from $3,100 to $3,750 in less than 2 days. ETH has performed relatively poorly over the past 2 years, and has significantly lagged behind BTC over the past year, facing falling fees, competition from L1-EVM, and an over-focus on complex liquidity staking and re-staking, taking away the original sound money narrative of Ethereum before POS. Today, similar to the approval of the BTC ETF, the entry of TradFi bigwigs is once again expected to be the catalyst Ethereum needs to get out of its trough.

Unlike in January, the market now has a playbook for how these ETF launches will work, or at least a precedent to look to:

-

Since the approval of the BTC ETF in January, the Bitcoin price has been increasingly driven by the speed of inflows into the TradFi ETF.

-

BTCs correlation with macro factors and even Nasdaq is much higher than in previous cycles

-

BTC experienced a rapid bullish cashing out in January, falling from around $57,000 to around $50,000, and then the accumulated capital inflows quickly pushed the price to a new high of over $72,000. Will market participants behave in the same way this time?

-

Given that ETH is so unpopular, have native users accumulated enough ETH? Unlike the case of the BTC ETF, the possibility of the original ETH ETF being approved has long been in a very small state.

-

What impact will the combination of Grayscales selling backlog and ETF inflows ultimately have on prices?

-

The circulation of ETH is much smaller than that of BTC. Should we expect future net inflows/outflows of ETH to cause larger price fluctuations?

-

How aggressively will Larry Fink and Wall Street promote ETH this time?

-

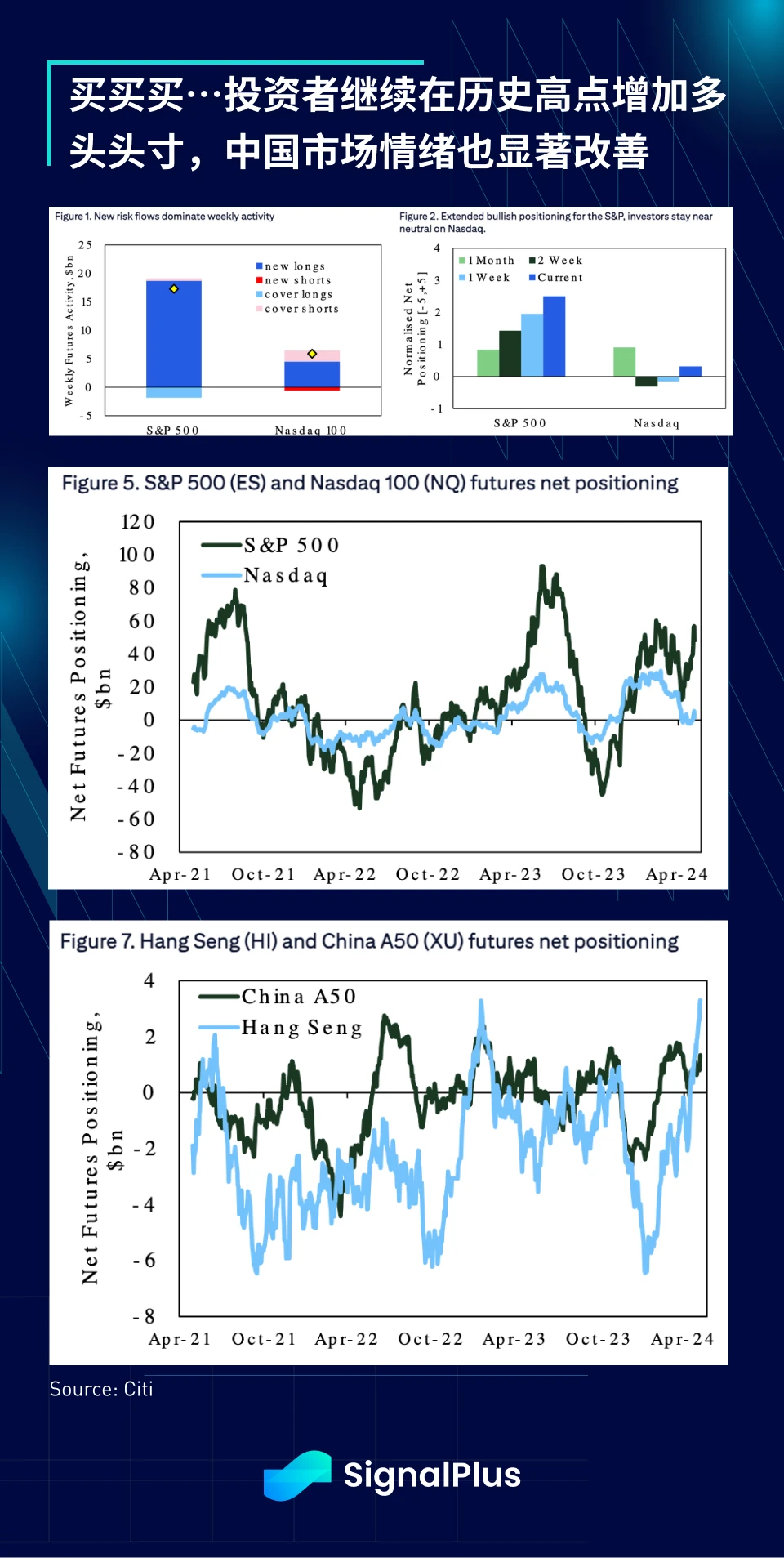

As trading volumes continue to shift towards the US time zone, will the influence of the US market (which is at an all-time high year-to-date) continue to grow?

-

From a timeline perspective, there is still a long way to go before the final S-1 approval date. By the time the ETF is launched, will the macro environment (economy and interest rates) have changed significantly?

Speaking of changing macro factors, while the market awaits Nvidia’s earnings report today, a host of Fed speakers have quietly but firmly changed their rate narrative once again, this time back to a hawkish stance. This week and the past week alone:

-

Fed Governor Waller: In the absence of significant weakness in the job market, I need to see a few more months of good inflation data before I can feel comfortable supporting an easing of the monetary policy stance.

-

Vice President Jefferson: It is too early to tell whether the recent deceleration in inflation will continue

-

Vice Chairman Michael Barr: Inflation data for the first quarter of this year were disappointing. These results do not give me the confidence to support loosening monetary policy

-

Atlanta Feds Bostic: Im in no rush to cut rates… My forecast is that inflation will continue to decline this year until 2025, he said, adding, however, that prices will fall more slowly than many expect.

-

Cleveland Feds Mester: My previous forecast was three (rate cuts), but based on what Im seeing in the economy right now, I dont think thats still appropriate… I need to see a few more months of inflation data showing that inflation is falling

-

San Francisco Feds Daly: Its not clear whether inflation is actually receding, and theres no urgency to cut rates

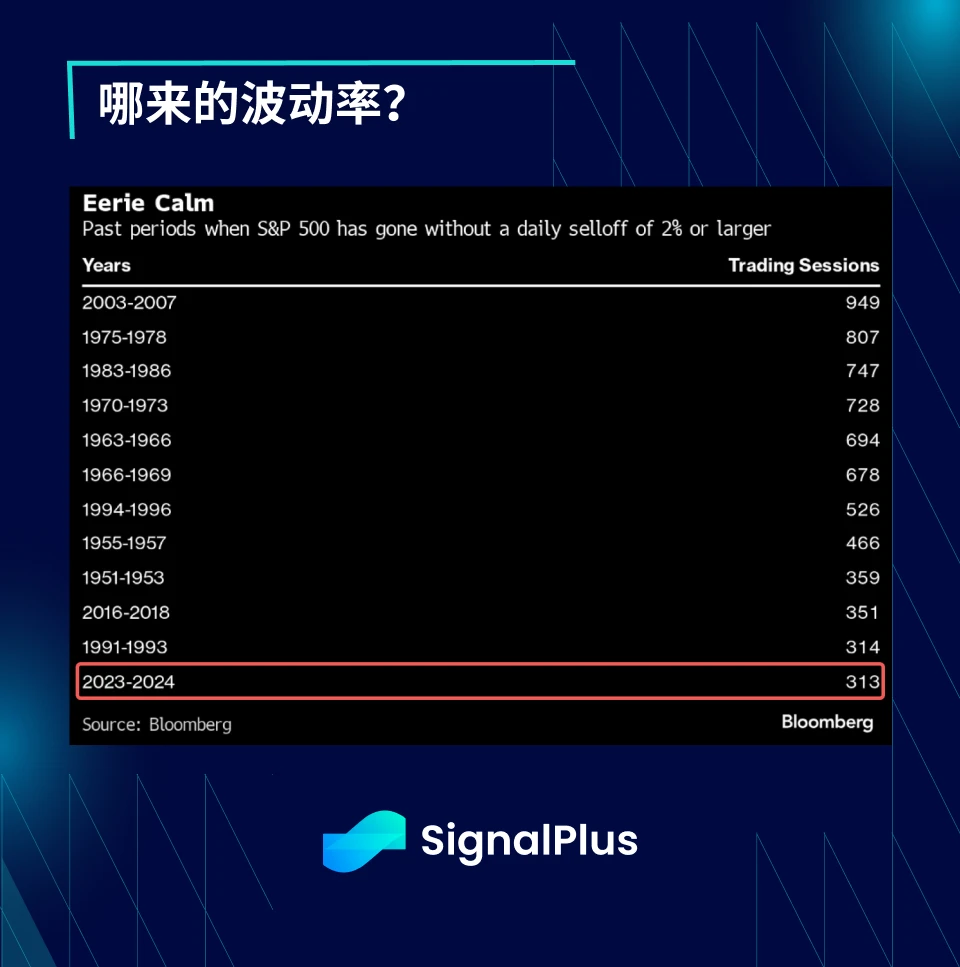

The SPX has not fallen by more than 2% in a single day for 313 days. The last time this happened was from 2016 to 2018, when the record was 351 consecutive days. The longest record was from 2003 to 2007, when there was no decline of more than 2% for about 3 years. No wonder everyone is selling volatility.

ChatGPT 4.0のプラグインストアでSignalPlusを検索すると、リアルタイムの暗号化情報を取得できます。最新情報をすぐに受け取りたい場合は、Twitterアカウント@SignalPlus_Web3をフォローするか、WeChatグループ(アシスタントWeChatを追加:SignalPlus 123)、Telegramグループ、Discordコミュニティに参加して、より多くの友人とコミュニケーションを取り、交流してください。SignalPlus公式サイト:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: Et tu, ETH?

関連: チェーンゲームウィークリーレポート | イミュータブルが$5000万ゲーム報酬プランを開始、90%以上のゲームトークンが減少 (4.22-4.28)

原文 | Odaily Planet Daily 著者 | Asher 編集者 | Qin Xiaofeng 先週、暗号市場全体は比較的低迷していましたが、GameFiセクターでは依然として大きな動きを出した人気プロジェクトが数多くありました。 おそらく、市場が回復するにつれて、アルトコインのローテーションがGameFiセクターにやってくるでしょう。 そこで、Odaily Planet Dailyは、最近人気がある、または人気のある活動があるブロックチェーンゲームプロジェクトをまとめて整理しました。 ブロックチェーンゲームセクターの二次市場のパフォーマンス Coingeckoのデータによると、ゲーム(GameFi)セクターは過去1週間で9.8%下落しました。現在の総時価総額は$ 19,853,737,045で、セクターランキングで22位にランクインし、先週の総時価総額セクターランキングから1つ下がっています。 先週、トークンの数…