オリジナル | Odaily Planet Daily

著者 | あずま

With the sudden change in expectations for the approval of the Ethereum spot ETF (Bloomberg analyst Eric Balchunas has raised the probability of approval from 25% to 75%), ETH surged 20% overnight, breaking through the $3,700 mark at one point.

Eric explained that the SEC may make a 180-degree turn on this issue due to some political reasons . This sudden change seems to indicate that the regulatory direction surrounding cryptocurrencies is quietly changing.

Ron Hammond, director of government relations at Blockchain Association, the industrys most prominent policy lobbying organization, wrote in a statement that the Biden administration will have a total of three opportunities this week to express its new attitude toward cryptocurrency regulation. In addition to the well-known ETH ETF review, Biden will make the final decision as president on the bill to overturn SAB 121, which has passed votes in both the Senate and the House of Representatives. The House of Representatives will also vote on the FIT 21 bill.

Can SAB 121 be successfully overturned?

The so-called SAB 121, the full name of which is “Staff Accounting Bulletin No. 121”, is a staff accounting rule issued by the U.S. SEC in March 2022 and implemented in April 2022. It mainly outlines the SEC’s requirements for financial workers when accounting for the company’s crypto assets.

The core content of SAB 121 is to require companies that hold cryptocurrencies to record customer-held cryptocurrencies as liabilities on their balance sheets. However, the cryptocurrency industry generally believes that this regulation is too strict, which actually hinders custodians or companies from holding crypto assets on behalf of their clients, which is not conducive to the further development of the industry. Therefore, it has long been trying to overturn SAB 121 through lobbying and other means.

Odaily Planet Daily Note: Hester Peirce, a friendly regulator known as Crypto Mom in the industry, has also criticized SAB 121 many times.

-

On May 8, the bill to overturn SAB 121 was submitted to the House of Representatives and was ultimately passed by a vote of 228 to 182. The majority of votes in favor were from Republican lawmakers, but 21 Democratic lawmakers also expressed support.

-

5月17日、 the issue was brought to the Senate and passed again by a vote of 60 to 38 .

-

According to the rules, the bill will then be submitted to President Bidens office, and Biden will make a final decision on the bill before May 28 .

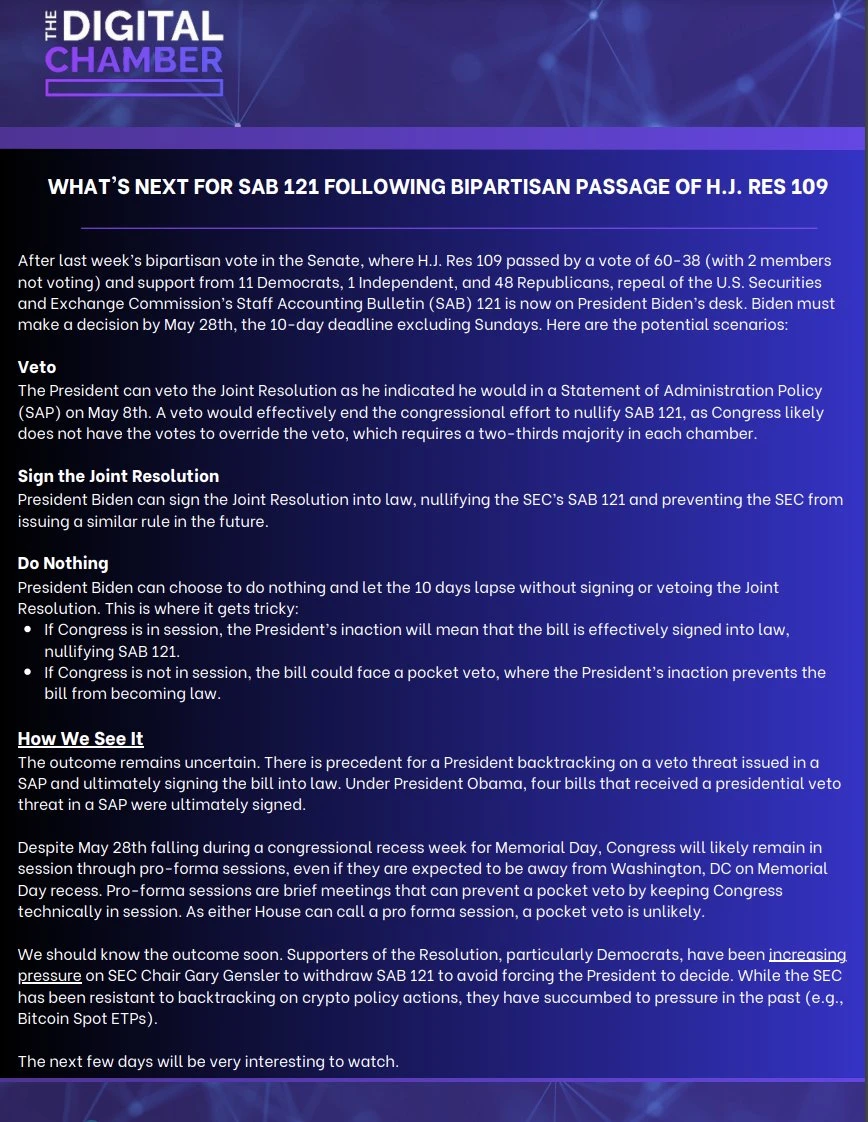

The Digital Chamber analyzes three possible decisions Biden might make, as follows.

-

The first possibility is a veto . If this happens, SAB 121 will be difficult to overturn because the Senate and the House of Representatives need at least 2/3 of the votes to veto the presidents decision again, but judging from the previous vote patterns (228 to 182, 60 to 38), it does not seem to be enough.

-

The second possibility is signing , in which case SAB 121 will be invalidated and the SEC will not be able to issue similar rules in the future.

-

The third possibility is to shelve the bill , which would allow the May 28 deadline to pass. This would automatically pass the bill if Congress is in session, but would force it into a pocket veto if Congress is not in session .

It is worth mentioning that May 28th happens to be the congressional recess week for Memorial Day, but it cannot be ruled out that Congress will hold meetings through indirect means such as pro-forma sessions in order to prevent veto suspension.

As for Bidens potential attitude, Ron Hammond analyzed that although Biden had stated that he would veto the bill before the Senate vote, given that the bill received unexpectedly high support in the Senate, making it the most widely supported bipartisan cooperation case besides the DC Crime Act, and that both the Speaker of the House of Representatives and the Senate Majority Leader voted in favor, it is not ruled out that Biden will temporarily change his attitude towards the DC Crime Act as he did before – that is, Biden may choose to sign it, thereby allowing the bill to pass the legislative process and overturn SAB 121.

FIT 21 Challenge Begins

The so-called FIT 21 (also known as HR 4763), the full name of which is “Financial Innovation and Technology for the 21st Century Act”, is a new bill aimed at clarifying the regulatory framework for cryptocurrencies.

In yesterday’s article, a16z analyzed and pointed out that if the bill can be successfully passed, the impacts it will bring include:

-

Providing a safe and efficient way for blockchain projects to launch in the United States;

-

Clarify the regulatory boundaries between the SEC and the CFTC , i.e. who regulates what in cryptocurrencies and whether digital assets are securities or commodities;

-

Ensure oversight of cryptocurrency exchanges and further protect American consumers by enforcing rules governing cryptocurrency transactions.

According to the current progress, all members of the House of Representatives plan to vote on FIT 21 this week (voting is expected to begin late Wednesday or early Thursday local time, possibly at the same time as the ETH ETF) . Previously, digital asset organizations and companies including Coinbase, Kraken, a16z, DCG and about 50 others have written to House Speaker Mike Johnson through the Cryptocurrency Innovation Committee, hoping that the bill can be passed smoothly.

Fortune analyzed the bills prospects for passage and said that FIT 21 is expected to pass the House of Representatives vote with a high probability, but is expected to encounter obstacles in the subsequent Senate vote.

Ron Hammond gave a similar analysis, that is, it is difficult for FIT 21 to pass the Senate within the year, but Ron also mentioned that FIT 21 is likely to gain support from both parties, and its support rate in the House of Representatives vote will also affect its subsequent performance in the Senate vote.

Trump’s “roundabout way to save the country”?

In summary, including the well-known ETH ETF review, the Biden administration will have a total of three opportunities this week to express its new attitude towards cryptocurrency regulation.

The reason why the word new is emphasized is because Eric once mentioned that the SEC may change its attitude based on some political reasons, and Ron also mentioned the changing impact of cryptocurrency on the election trends, saying that Trump is winning this group.

On May 9, Trump announced that he would accept donations to the US presidential campaign in the form of cryptocurrency, and said: Biden doesnt even know what cryptocurrency is. If you like cryptocurrency, youd better vote for Trump.

Combined with todays new developments, its hard not to wonder…

However, as to whether the Biden administration’s regulatory attitude has changed, no one knows the real answer until the above three issues are finalized. In this regard, Jake Chervinsky, a legal professional who served as Compound’s general counsel, wrote today: “ If the spot ETH ETF is really approved, everyone I know who understands the regulatory situation in Washington will be shocked, but this does not mean it will not happen. The real significance of this matter is that the approval of the ETF may indicate that the US cryptocurrency regulatory policy has undergone a major shift after the SAB 121 vote, which may be more important than the ETF itself.”

This article is sourced from the internet: Has the policy direction changed? In addition to ETFs, these two major events reveal a new attitude towards crypto regulation

Related: Dynamic balance after BTC halving: mining revenue plummets, shutdown price reaches $55,000

Original author: Carol, PANews Bitcoin has successfully completed its fourth halving on April 20. After this halving, the block reward has dropped to 3.125 BTC. The halving will first affect the mining industry, and miners income will plummet in the short term. In addition, the halving will also affect Bitcoins inflation rate. The market expects that the increase in scarcity will drive the price of the currency further up. But the actual situation is that since the halving, Bitcoin has still been sideways at a high level, with a slight drop of 3.87%, which has caused miners to face stress tests and many short-term investors to face losses. In essence, each halving is another dynamic balance of market supply and demand. In this rebalancing process, what trends in market funds…