After three consecutive inflation data exceeded expectations, the CPI data released on Wednesday was roughly in line with expectations. This result is enough to stimulate another round of large-scale rebound in risk markets.

-

SPX hits new high

-

US 1-year 1-year forward rates saw their biggest one-day drop since early January

-

2025 Fed Funds futures pricing in a 25 bps drop from April highs (equivalent to one rate cut)

-

The US dollar index DXY recorded its biggest one-day drop so far this year

-

Cross-asset volatility (FX, equities, rates) retreats to medium-term and/or historic lows

Will the Fed cut interest rates soon? Federal Funds Futures for June show only a 5% chance of a rate cut, and only a 30% chance for July. Even for September, the chance of a rate cut is only about 64%. So what are you all excited about?

Will the Fed cut interest rates soon? Federal Funds Futures for June show only a 5% chance of a rate cut, and only a 30% chance for July. Even for September, the chance of a rate cut is only about 64%. So what are you all excited about?

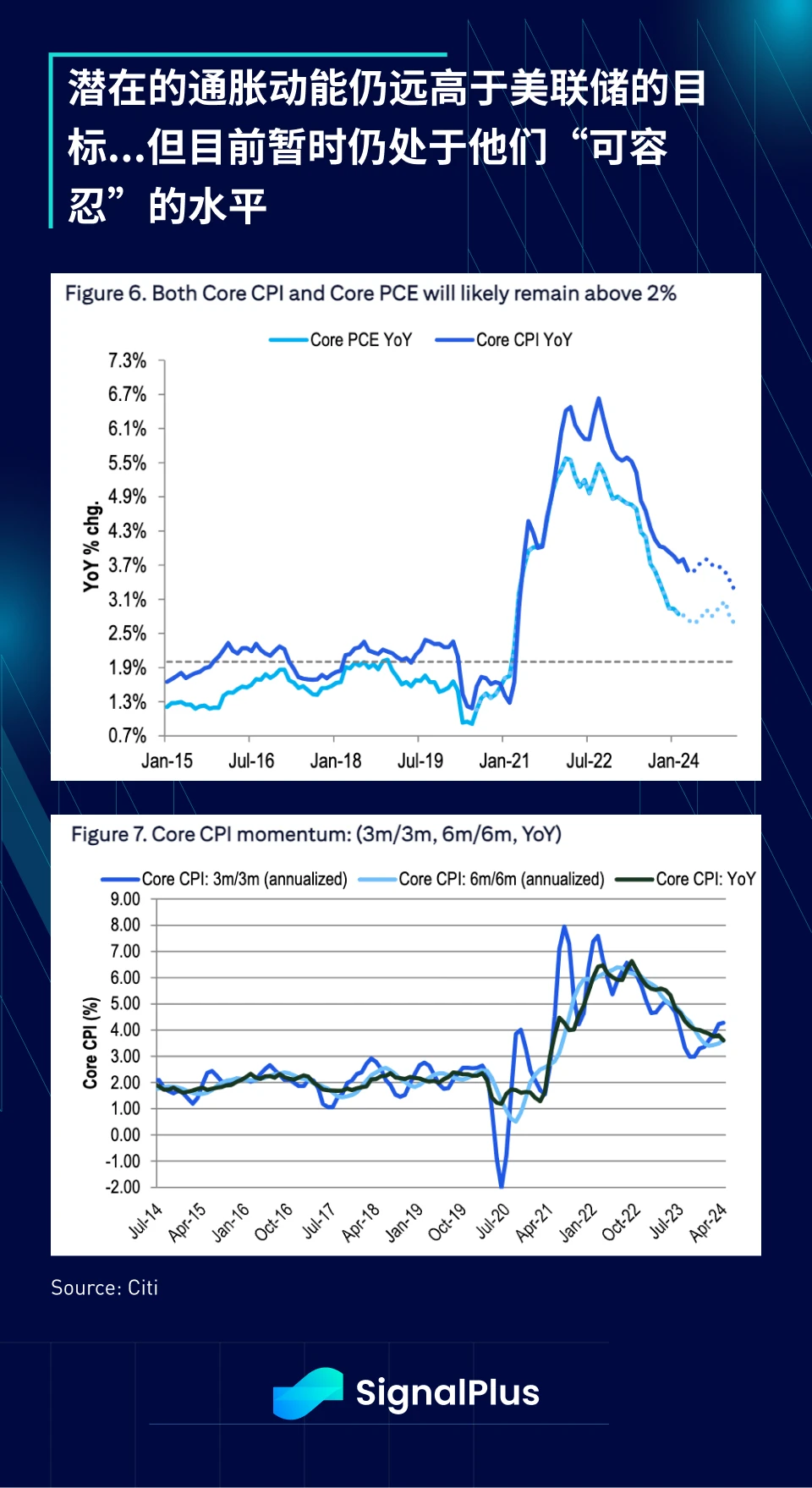

As we have mentioned before, the Fed has moved to a completely unbalanced position, whereby persistent inflationary pressures are tolerated as long as inflation does not re-accelerate, and any signs of weakness in the job market are seen as a driver for policy easing. Therefore, while headline and core inflation remain above the Fed’s 3.6% and 3.4% targets, respectively, the market is concerned about re-acceleration of prices, which did not occur last month, which fits with the Fed’s theme of returning to “watching the timing of easing” as both “slowing job market” and “high but tolerable inflation” are being confirmed one by one.

Back to the CPI data itself, the core CPI rose 0.29% month-on-month in April. After exceeding expectations for three consecutive months, the data results this time were only slightly lower than market expectations. The weakness mainly came from the decline in commodity prices and the controlled growth of housing prices and owners equivalent rents. Core service inflation excluding housing rose 0.42% month-on-month, roughly in line with expectations.

After the release of CPI/PPI, Wall Street expects core PCE to grow by around 0.24% month-on-month in April, moving towards an annualized level of 2% and the Feds comfort zone. Traders remain confident that inflation will continue to fall in the second half of the year.

On the other hand, retail sales data in April weakened significantly, with a general softening in different spending categories. Retail sales were flat month-on-month, lower than the consensus expectation of a month-on-month increase of 0.4%-0.5%, and control group spending fell 0.3% month-on-month, and the previous value was also revised down. General merchandise and even non-store sales saw the largest decline since the first quarter of 2023.

The weaker-than-expected retail sales data continued a recent string of weak consumer data, including rising credit card and auto loan delinquencies, the depletion of accumulated excess savings, and a deteriorating job market. While it is too early to call a significant economic slowdown, we appear to be approaching a turning point in economic growth. Are high interest rates finally starting to erode the U.S. economy?

As always, the market is happy to ignore any risk of a slowdown and focus only on the Feds easing policy for the time being. As a reminder, while the market is very forward-looking and good at incorporating all available information into pricing, please be aware that the market is not that forward-looking. Enjoy the current party for a short while!

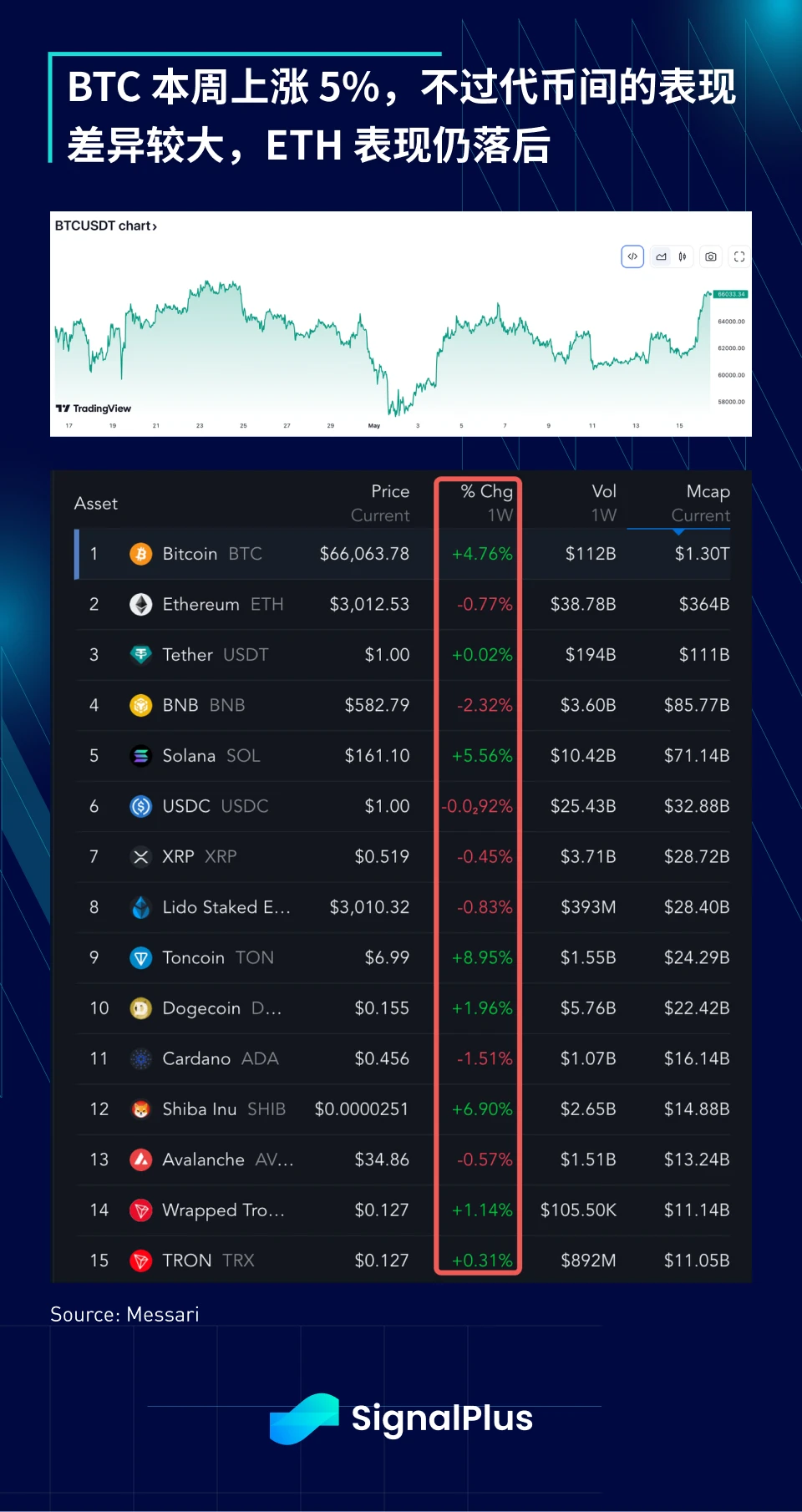

On the crypto side, BTC prices continue to be influenced by overall stock sentiment, with prices breaking through this month’s highs and returning to the April peak of around $67,000. ETF inflows have also been very healthy, with an additional $300 million in inflows following yesterday’s CPI announcement, and even GBTC seeing net inflows. However, the performance of individual tokens remains highly variable, with ETH and some of the top 20 tokens still struggling to recover losses, and market gains increasingly concentrated in a small number of tokens (BTC, SOL, TON, DOGE) rather than overall market gains.

Expect this to continue, with the focus remaining on BTC, the main beneficiary of TradFi inflows (13 F filings show some large hedge funds have increasing exposure to BTC ETFs), and relatively less FOMO on native or degen tokens in this cycle. Good luck everyone!

ChatGPT 4.0のプラグインストアでSignalPlusを検索すると、リアルタイムの暗号化情報を取得できます。最新情報をすぐに受け取りたい場合は、Twitterアカウント@SignalPlus_Web3をフォローするか、WeChatグループ(アシスタントWeChatを追加:SignalPlus 123)、Telegramグループ、Discordコミュニティに参加して、より多くの友人とコミュニケーションを取り、交流してください。SignalPlus公式サイト:https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: Asymmetric

関連:エテナ(ENA)は$1の抵抗を狙う:統合の終わりが見えてきた

要約 Ethena (ENA) は、$1 に向かう可能性のある動きでトレーダーとアナリストの関心を刺激しています。ソーシャルメディアでの言及が急増し、最近は主要なオピニオンリーダーが強調しています。上昇の勢いにもかかわらず、長期的な感情の安定性は持続的な関与にかかっています。 Ethena (ENA) は注目を集めており、$1 マークを反転させることを目的とした潜在的な価格軌道でトレーダーとアナリストの間で議論を巻き起こしています。暗号通貨は、現在主要なトレンドセクターである AI またはミームトークンを取り巻く誇大宣伝なしに関連性を維持しています。最近の感情と市場動向に基づくと、ENA は強気のブレイクアウトの兆候を示しています。 ソーシャルプラットフォームでの Ethena の言及が増加中 過去 1 か月間、暗号通貨コミュニティ内の主要な影響力のあるアカウントは着実に ENA に言及しており、関心が高まっていることを示しています。分析によると、32 人の重要な X ユーザーが ENA について議論しました…