Di balik perdebatan sengit tentang nilai meme: pendidikan terbalik terhadap VC oleh komunitas

Penulis asli: flowie, ChainCatcher

Editor asli: Marco, ChainCatcher

It took Doge 4 years to break through the market value of 1 billion US dollars, while BOME only took 3 days. It seems that more retail investors prefer to accept local dog stocks rather than VC stocks.

But as memes become more and more popular among retail investors, VCs seem to be a little unhappy.

Top VC a16z has criticized meme coins one after another. a16z first published an article on its official website pointing the finger at the SEC, accusing encryption policies of allowing memes to run rampant while not protecting real blockchain innovation.

a16z Crypto CTO Lazarrin later complained on the X platform, Memecoin destroys the long-term vision of keeping many people in the crypto field, and is not technically attractive; it is not attractive to builders.

Compound VC managing partner Michael Dempsey also accused meme coins of causing a large loss of real builders.

VCs blamed meme coins for destroying crypto innovation, which soon aroused dissatisfaction in the crypto community.

Solana co-founder Raj stood up to defend meme coins. He sarcastically responded to the argument that meme coins cause a large number of real builders to leave. He said that if these so-called real builders are so fragile that they are afraid of meme coins, then they will never succeed.

Retail investors, in turn, questioned the value coins advocated by VCs. A heated debate on the value of memes turned into a rant about VC coins/value coins.

A reverse education for VCs from the community

VCs who like to educate users are educated by users.

First of all, meme coins are not to blame for undermining crypto innovation. @MarinadeFinance quipped that people often look for excuses, but in fact, no one or anything can stop you from building something truly innovative.

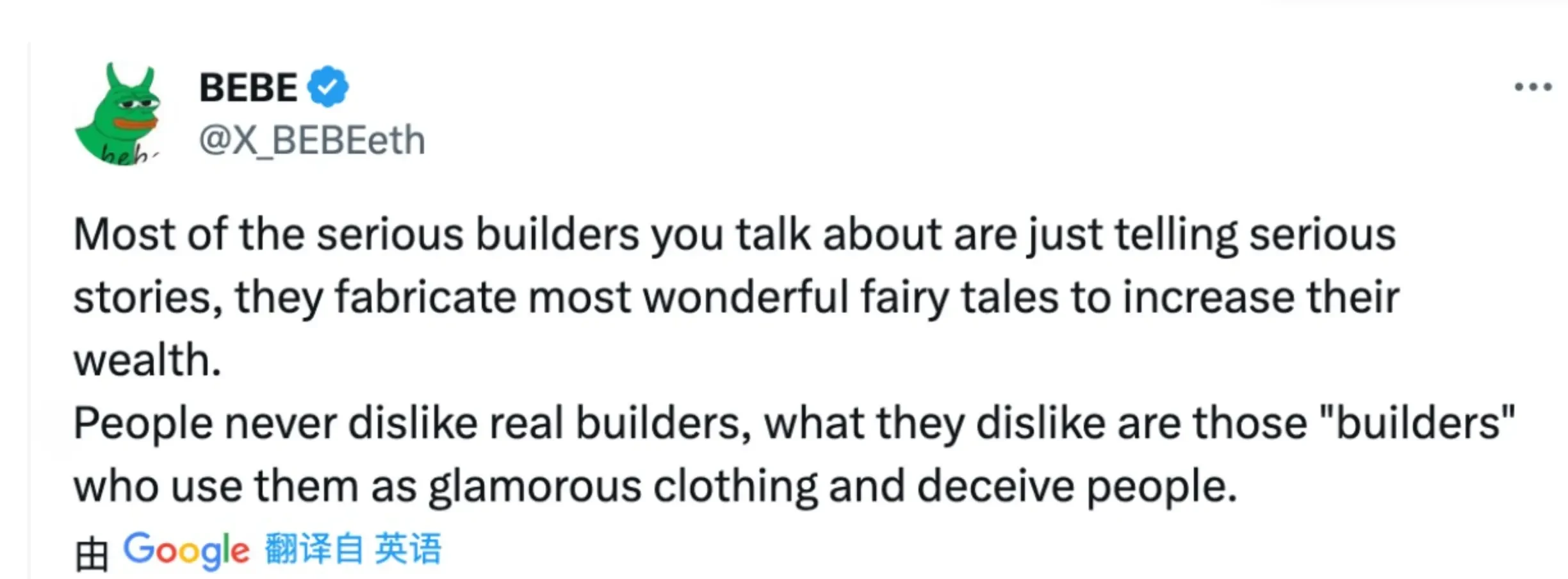

And @XBEBEeth added that no one hates these real builders, they just hate the builders who deceive users with gorgeous narratives.

Instead of criticizing meme coins for being worthless, we should reflect on whether the innovation promoted by VCs is real innovation. @mfer 7166 believes that pseudo-innovation should be blamed more. And the problem is not memes, but that in this cycle, the industry has no epic narratives.

The fact that they only dare to speculate on memes shows the helplessness of retail investors.

AI+Crypto, DEPIN, RWA, Modularity, Bitcoin Layer 2…VCs are becoming more and more adept at concocting some mysterious and impressive narratives. It is best to let the project parties superimpose these concepts and then sell them to secondary retail investors, hoping that they will pay for these long-term visions.

It’s not that retail investors in the past didn’t buy into this. They hoped that some new narratives would be widely adopted, and that even if they couldn’t get the meat, they could at least get some soup from the VC-backed projects.

But times have changed. Retail investors have begun to realize that the technological innovations promoted by VCs seem to be just hype, and there has been no real progress in the application of them. And in terms of speculation, following VCs will not only not make any profit, but may also lead to a loss of everything.

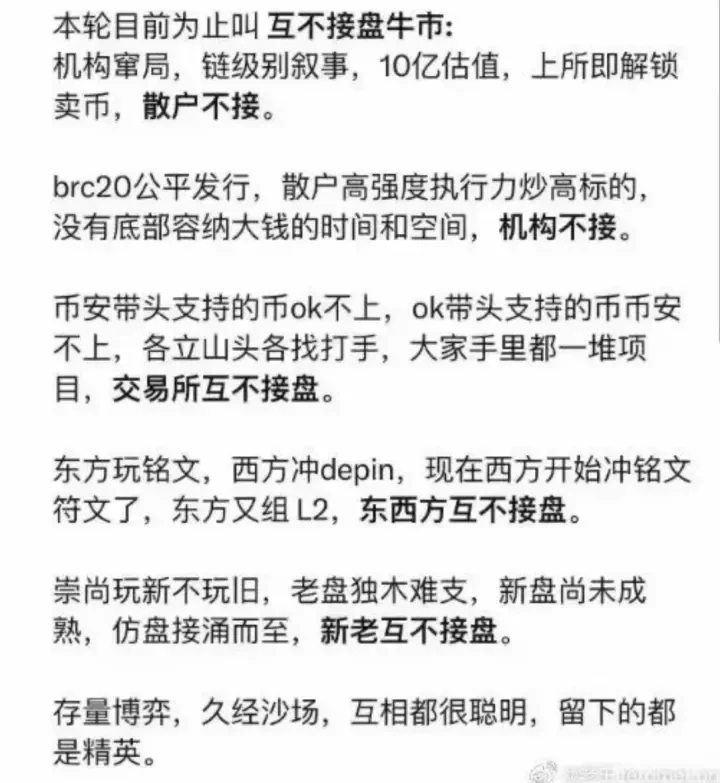

The bull market theory of no mutual takeover mentioned some time ago resonated with many people. But @connectfarm 1 said frankly that there is no such thing as no mutual takeover. If you dont take over, you cant afford it.

Currently, the market value of so-called value coins has increased, but the coin prices have generally not increased. Retail investors are troubled by the value coins with large market value, high valuation, low circulation, and have been unlocked.

Some of the new value coins listed on the exchange have generally lost their wealth-creating effect. WLD was valued at $3 billion before it went online, and its FDV reached $28 billion on the day it went online, which is equivalent to OpenAIs valuation at the time. With such a high market value, how much growth space is left for the secondary market? New coins such as Merl, the leader of Bitcoin Layer 2, also fell all the way after they went online.

Moreover, there are too many new concepts and the market is changing rapidly, so it is hard to understand. @Eason_Jiang_s experience is that he held a valuable coin, and the price of the coin took a roller coaster ride back to where the dream began, and the profit was greatly withdrawn or even trapped because his attention was diverted to other tracks.

It seems that retail investors are no longer able to buy at the bottom and chase highs. ARB, the leader of Ethereum Layer 2 and the representative of value coins, fell from $2 to $1. Retail investors want to buy at the bottom, but VCs have unlocked a large number of coins, and the coins in VCs’ hands have doubled, so they may end up being buried.

As the entire encryption has not yet been widely used, 90% of the market is currently speculators. Although memes have no intrinsic value, compared with value coins, retail investors are closer to opportunities that are 100 times or 10,000 times higher.

@BTCdayu expressed the thoughts of many retail investors, Meme coins are simple, and the release is better. Basically, everyone is gambling directly in a relatively fair environment. Its greatest value is actually buy me, I may increase by 10 0x.

Although the fairness of memes needs to be put in quotation marks, retail investors are more tolerant of memes than the blatant attempts of VC coins to value coins.

Meme is nothing more than a game between players, with life and death decided in a few days. Most users bet small amounts on a big return, and even if most of them suffer losses, they can recover them cleanly without suffering from years of PUA.

Of course, not all VCs are against memes. Some VCs are aware of the situation and will join in if they can’t beat them.

Mechanism Capital has already started building positions in memes. Its co-founder Andrew Kang said on his social platform that Mechanism Capital has completed the first batch of positions for 2024, and the underlying assets are Trump-themed meme tokens and NFTs.

DWF Ventures has publicly stated that it would be interested in investing in similar large-scale community participation projects in the future.

DWF Ventures stated that Meme Coin will become a new GTM (go-to-market) strategy for many ecosystems and projects, and believes that Meme Coin will serve as an effective marketing strategy in the following verticals: infrastructure ecosystem, consumers and games, and new projects with a Meme Coin background.

Variant co-founder Li Jin started hosting a memeathon, writing, Born too late, unable to explore the earth; born too early, unable to explore the universe; born at the right time, host a meme hackathon.

Meme temporarily takes on the responsibility of Mass Adoption

The seemingly worthless meme may be shouldering the heavy responsibility of Mass Adoption.

@mdudas refuted a16z CTO, saying, “Meme coins have attracted a lot of users, making chains like Base, Blast, and Solana active.”

In fact, compared to the disdain of some VCs for memes, meme coins have become the top priority for activating the public chain ecosystem.

After Solana founder Anatoly personally made Silly Dragon popular last year, Solana continued to reap the Meme dividend. The popularity of BOME coins has made Solana the number of active addresses ranked first. Three days after BOME went online, Solanas active wallet addresses increased from 1.24 million to 2.42 million, a surge of 95%.

In addition, Solana’s on-chain network fees and revenues have also increased significantly.

The public chain that was questioned as not being used by many people, at least some people used it because of the meme. Solana’s huge success in memes has also attracted the attention and imitation of other public chains.

Base creator says Memecoin will be key to getting millions of users onboard to the Base network. Arbitrum community proposes to set up Memecoin fund

Some public chains even issue meme coins.

On March 17, Aptos launched its official Meme coin $LME.

On March 18, Bitcoin Layer 2 public chain Ligo announced the launch of Meme coin SOLIGO on Solana.

There are also public chains that hold meme innovation competitions to encourage meme innovation on the chain.

BNB Chain recently officially announced the launch of the Meme Innovation Battle event, competing for a total prize pool of $1 million. TON announced the launch of Memelandia, a meme currency and community token cultural center, to reward the top meme currency and community token on TON.

The TON Foundation also airdropped more than $200 worth of TON to active Meme coin traders within the ecosystem.

Fantom has begun to work on the development of meme framework standards. Recently, Andre Cronje, co-founder of the Fantom Foundation, tweeted that he is busy conducting due diligence on memecoin so that a framework can be created to launch, support and cultivate community-safe meme coins on Fantom.

Ethereum co-founder Vitalik Buterin previously mentioned when talking about memes, I hope to see more high-quality interesting projects that contribute positively to the ecosystem and the world around it (not just attracting users).

In fact, in addition to serving as the traffic bearer for many public chains, some meme coins have also begun to take part in the market.

Shib, known as the Dogecoin killer, announced the launch of the Beta version of the Layer 2 solution Shibarium at the beginning of last year, aiming to reduce the load on the blockchain network and improve the user experience of the metaverse and gaming applications.

With the meme rush, will there still be a copycat season?

Meme coins and value coins are not completely opposite. For most retail investors, both are tracks that need to be participated in.

Generally, there are three stages in a bull market: Bitcoin rises; after Bitcoin rises, Ethereum rises, and drives the hot altcoins to soar together. Finally, the crypto market enters a comprehensive rise stage, and meme coins begin to rise.

But in this cycle, the rotation order of sectors seems to have been rearranged, with meme coins taking the lead and becoming the main line of this cycle.

After the meme outbreak, will the altcoin season dominated by so-called value coins come? This is also the question that retail investors are most concerned about.

Shenyu said in a recent interview that the alt season may not come. Because the current players in the market are different from the previous players, from the perspective of miners, after the Bitcoin spot ETF was passed on January 10, risk hedging has been carried out several months in advance to cope with the risk of Bitcoin halving.

Shenyu mentioned that this cycle is characterized by the inflow of funds into Bitcoin mainly through channels such as ETFs. As for when these funds will flow into other cryptocurrencies, it remains to be seen.

Crypto trader Thiccy also expressed pessimism about whether the alt season will come. Thiccy said that due to more and more projects issuing coins, the growth rate of FDV has exceeded the circulation, and it has increased by about 70% since the beginning of the year. Now there are 3-5 high-quality tokens added to the market every week, and everyone looks happy. But ask yourself, who will buy all these tokens. Unless institutions or retail investors pour in, it will just be a perpetual PvP.

Crypto KOL @BTCdayu believes that the alt season is over. The total scale of altcoins, especially various L2 and new narratives, has reached the peak of the last bull market.

But there are still investors who believe that the altcoin season will not be absent. At a time when the market is generally pessimistic about value coins, crypto researcher @0x Ning 0x believes that it is the best time to build a position. At this stage, I quietly buy the top assets of modular public chains, RollAPP, AI Agent, ZK hardware acceleration, RWA, Bitcoin L2 and other sectors, and actively serve as the markets exit liquidity.

@0x Ning 0xs logic is that the golden rule of investment has always been I take what others discard, and I discard what others take. As meme coins account for an increasing proportion of everyones investment portfolio, truly high profit-loss ratio Alpha opportunities begin to emerge in the value coin sector.

This article is sourced from the internet: Behind the heated debate on the value of memes: a reverse education of VCs by the community

Terkait: Inilah Mengapa Harga Shiba Inu (SHIB) Bisa Segera Turun 23%

Singkatnya, ukuran transaksi rata-rata SHIB turun sebesar 50% dalam dua minggu terakhir, menunjukkan Shiba mungkin kehilangan momentum. RSI-nya masih dalam tahap overbought, yang mungkin mengindikasikan akan terjadi lebih banyak koreksi dalam waktu dekat. Garis EMA membentuk potensi skenario bearish, yang dapat menyebabkan koin memasuki tren turun. Harga Shiba Inu (SHIB) mengalami penurunan tajam, dengan rata-rata ukuran transaksi turun 50% dalam dua minggu terakhir. Hal ini menunjukkan kemungkinan perubahan sentimen investor terhadap Shiba Inu. Penurunan ukuran transaksi mungkin mengindikasikan perlambatan dari lonjakan pembelian baru-baru ini, mungkin menandakan penilaian ulang pasar yang lebih luas. Menambah sikap hati-hati, indikator teknis SHIB, seperti RSI overbought dan EMA bearish, menunjukkan koreksi yang akan datang. Faktor-faktor ini…