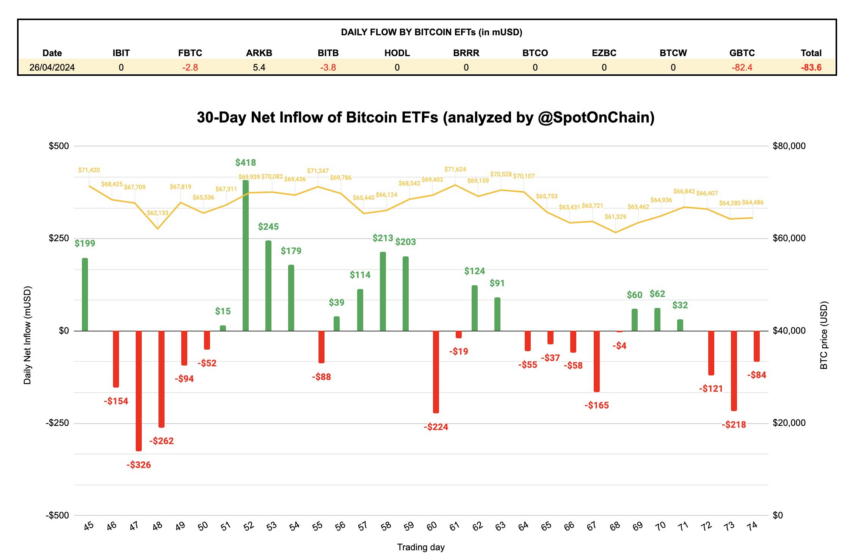

BlackRock’s Bitcoin ETF experienced three consecutive days without any new investments. This starkly contrasts other Bitcoin ETF investment products, which saw significant outflows totaling $328 million.

The iShares Bitcoin Trust (IBIT) had enjoyed a streak of 71 days with continuous inflows before this recent trend of no new investments.

Explaining BlackRock’s Zero Inflows

Due to the current zero flow trend, some community members have interpreted it as indicative of diminishing investor interest in Bitcoin. However, Bloomberg ETF analyst James Seyffart explained that the pattern was common within the broader ETF market.

Zero flows manifest when there is no notable difference between the supply and demand for an ETF. According to Seyffart, this disparity must be substantial enough to trigger the creation or redemption of ETF shares, a process executed in units.

Market makers only intervene in the underlying market when the discrepancy surpasses a certain threshold.

“Minor mismatches will see the market makers handle trading of shares just like they would a stock. But it needs to be lopsided—more than a creation unit in either direction for market makers to tap the APs/underlying market,” Seyffart added.

Therefore, the absence of inflows in BlackRock IBIT’s ETF does not suggest a lack of trading activity. Instead, it indicates that the net flow is not significant enough to warrant the creation or redemption of units.

Baca selengkapnya: Cara Berdagang ETF Bitcoin: Pendekatan Langkah-demi-Langkah

Another Bloomberg ETF expert, Eric Balchunas, corroborated this notion, citing the iShares MSCI Emerging Markets ETF EEM, which saw $70 billion in volume between mid-January and mid-April despite registering zero daily flows.

However, the lack of inflows into BlackRock’s Bitcoin ETF has impacted BTC’s price, which has remained stagnant during the past week.

Baca selengkapnya: Prediksi Harga Bitcoin 2024/2025/2030

Crypto analyst Skew noted that Bitcoin remains within a defined range between $72,000 and $61,000, with a point of correction (PoC) or mid-range pivot at $66,000. The analyst highlighted specific interest price levels for continued observation at the March low of $61,598 and the previous week’s low of $63,498.

“PoC is often an inflection zone for trends so backtesting from above or retesting from under can be important contextually how the market trades around a PoC often with other respectful confirmations leads to the next move by this I mean failure to auction higher or lower with respectful flows is often great confirmation to close out of trades or getting into trades,” Skew explained.