Analisis Makro SignalPlus (20240426): PDB AS pada kuartal pertama jauh lebih rendah dari perkiraan

Several unfriendly economic data affected risk sentiment during the New York trading session. The US GDP grew by only 1.6% in the first quarter, far lower than the 3.4% in the fourth quarter. Among them, the growth rate of personal consumption fell from 3.3% to 2.5%, and the expenditure on goods fell from 3.0% to -0.4%. Inventories (-0.3%), net exports (-0.86%), and federal government spending (-0.2%) all dragged down the growth in the first quarter. At the same time, the deflator jumped untimely to 3.1% (vs. the previous value of 1.6%), the highest level since the second quarter of 2023, and local demand was the only bright spot, increasing by 3.1%. At the same time, the growth of the core PCE price index in the first quarter jumped sharply to 3.7% (vs. the previous value of 2.0%), which hit all the remaining optimism and also meant that the core PCE inflation data for March, which will be released today (and is the focus of the Fed), has a chance to be higher than the market forecast of 2.7%.

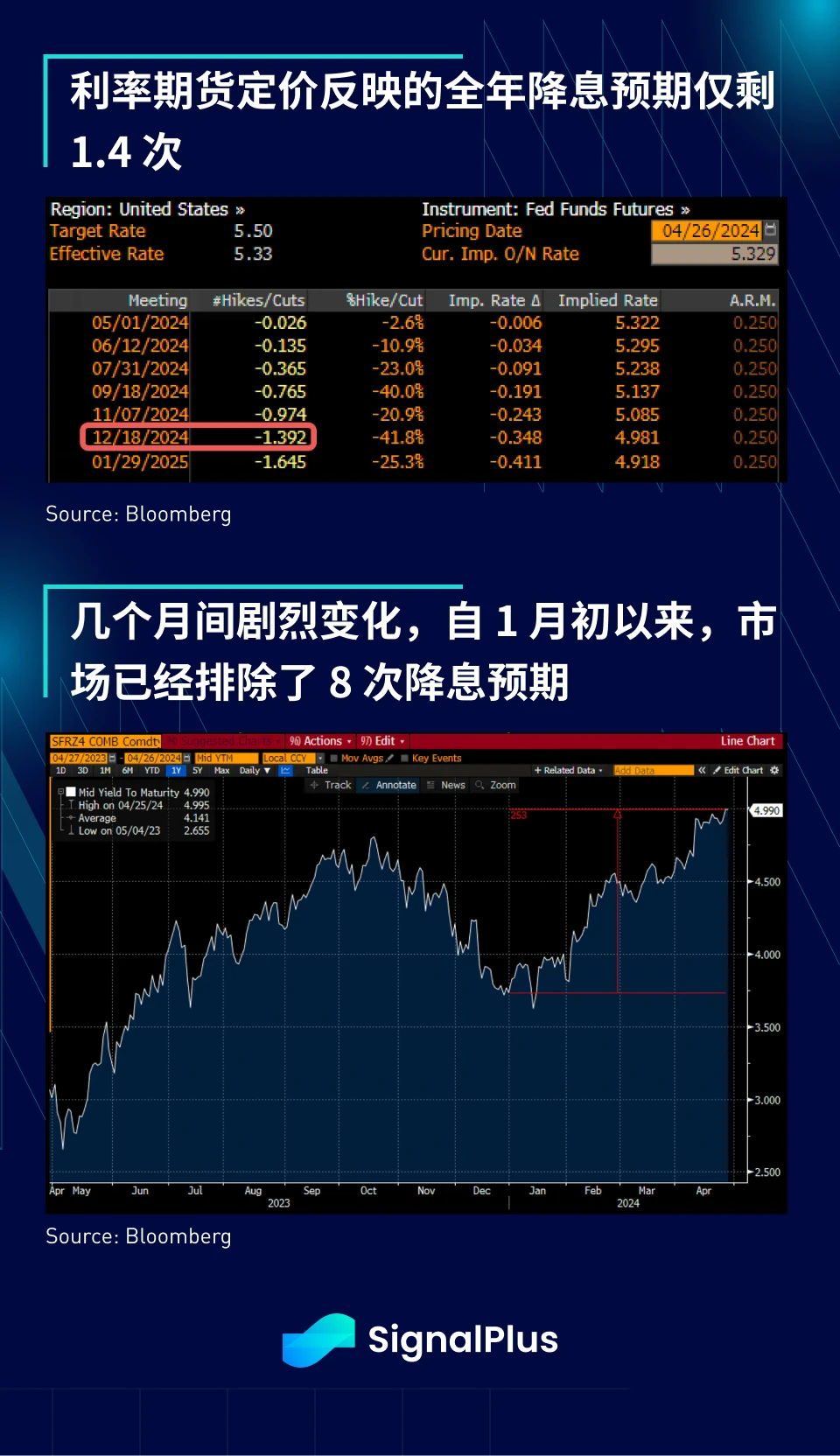

Overall, weak economic output coupled with rising prices (can we say… stagflation?) is pretty bad for asset prices. The entire US Treasury yield curve jumped 6-8 basis points, with the 2-year yield breaking 5% at one point before falling back to 4.99%. The cumulative rate cut expectations for 2024 have fallen back to just 1.4, which is a pretty drastic change compared to the market expectations of 8 rate cuts (!!) in early January.

Unless the PCE inflation data turns out to be significantly lower than expected, the market expects Powell to do some recalibration at the FOMC press conference next week. Recall the earlier interview of Chicago Fed President Goolsebee:

After six or seven months of very substantial improvement and inflation numbers close to 2%, we are now seeing levels well above that and we have to readjust and we have to wait and see.

–Chicago Feds Goolsebee

It is reasonable to expect the Chairman to withdraw his March comments and be forced to accept the fact that inflation has not developed as the Fed hoped. Another variable is whether the hawkish recalibration will affect the timing of the slowdown of the balance sheet, which is currently expected to start as early as May. It is worth paying close attention to whether there are few participants who say they will continue to shrink the balance sheet under the current circumstances until they see a further deterioration in reserve levels.

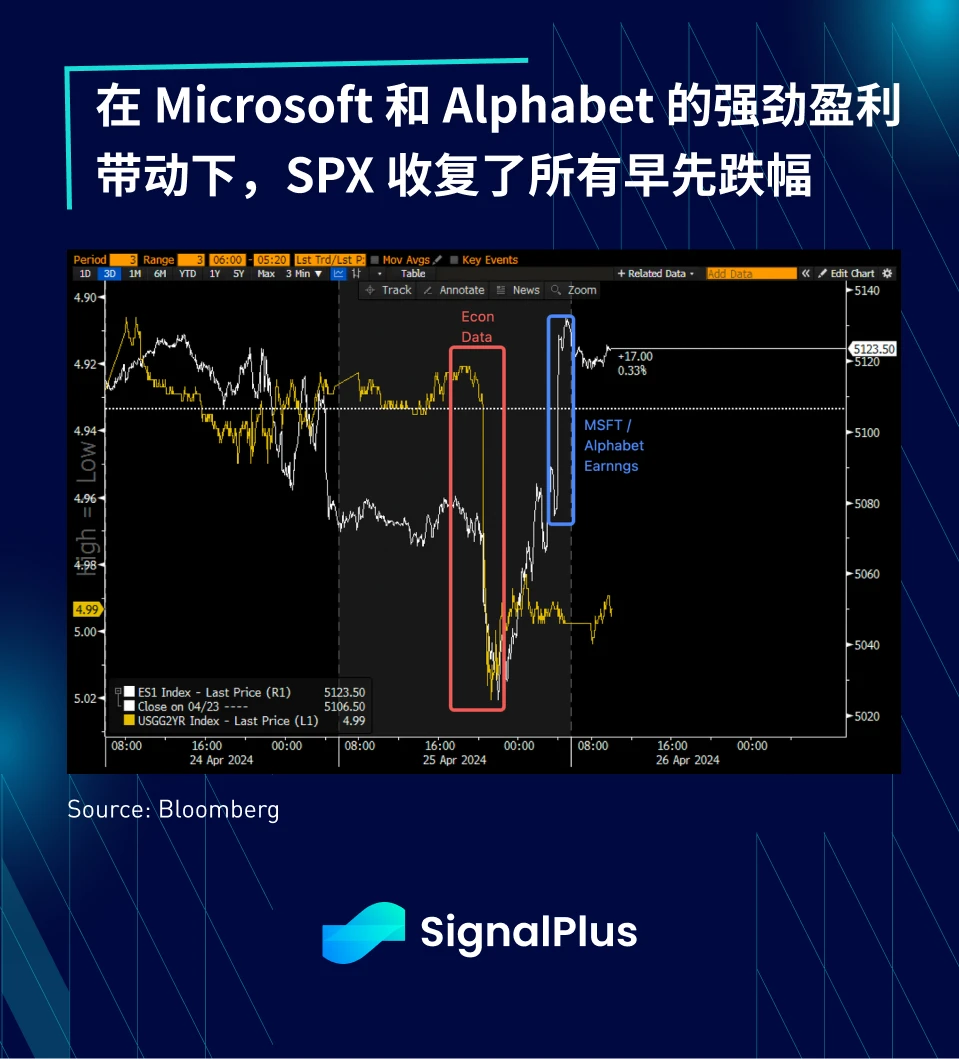

US stocks were down 1% for most of yesterday, dragged down by poor Meta earnings results, before rebounding +2% after Microsoft and Alphabet earnings reports. Microsoft shares rose more than 5% on revenue growth across all sectors, while Google rose more than 11% after advertising and service revenue exceeded expectations and announced a $70 billion share buyback and its first dividend.

In crypto, investors attention remains distracted by the strong performance of memecoin/BTC runes this year, and the prices of major currencies remain stagnant. As mainstream investor interest slows significantly, BTC ETFs have seen outflows for two consecutive days, continuing the disappointing trend of the past 4 weeks. We currently maintain a neutral view on price movements and recommend a cautious attitude.

Finally, following the SEC’s likely formal refusal to approve an ETH spot ETF in May, we saw Consensys fight fire with a lawsuit against the SEC, accusing the agency of “attempting to unlawfully regulate ETH through specific enforcement actions against Consensys and potentially others.”

The most important lesson learned in this field over the past few years? Always be optimistic about the role of lawyers in this industry. Have a great weekend everyone.

Anda dapat mencari SignalPlus di Plugin Store ChatGPT 4.0 untuk mendapatkan informasi enkripsi real-time. Jika Anda ingin segera menerima pembaruan kami, silakan ikuti akun Twitter kami @SignalPlus_Web3, atau bergabunglah dengan grup WeChat kami (tambahkan asisten WeChat: SignalPlus 123), grup Telegram, dan komunitas Discord untuk berkomunikasi dan berinteraksi dengan lebih banyak teman. Situs Resmi SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis (20240426): US GDP in the first quarter was significantly lower than expected