Master the Secrets of Ethereum Passive Income Strategy by 2025

Ethereum is known as the King of DeFi and has played an important role in changing the traditional financial model. Its powerful blockchain technology supports a thriving decentralized application (dApps) ecosystem, allowing people to better control their assets. With the rapid development of the DeFi market, how to achieve steady growth through passive income strategies has become the focus of many people.

As a leader in the kripto industry, XT Menukarkan has created a series of innovative tools tailored for Ethereum investors. Whether it is earning rewards by staking ETH or taking advantage of structured products such as Shark Fin , XT Financial Management can provide you with flexible and diverse options to help you easily increase your returns. These tools not only make complex DeFi operations simple and clear, but also allow users to make wise decisions more confidently. With the continuous upgrading and development of Ethereum, XT.COM will become an excellent platform for you to achieve wealth growth.

Table of contents

How Ethereum Powers DeFi and Passive Income

A powerful combination of DeFi strategies and XT financial products

Potential risks and what you need to know

How to maximize profits

The future of Ethereum passive income

How Ethereum Powers DeFi and Passive Income

Ethereum is at the core of decentralized finance (DeFi), supporting a rich and diverse ecosystem of decentralized applications (dApps), allowing users to enjoy greater financial freedom and convenience. Through Ethereum, traditional finance is being redefined, and innovative solutions continue to emerge in areas such as lending, mempertaruhkan , and trading.

Ethereums upgrades have further consolidated its leading position. For example, The Merge transformed Ethereum to a proof-of-stake (PoS) mechanism, which is more environmentally friendly and efficient, and the Shanghai Upgrade significantly increased transaction speeds and reduced fees. These changes make Ethereum more efficient and scalable, providing more opportunities for investors who are looking for long-term stable growth.

ETH not only occupies a core position in the DeFi protocol, but as the second largest cryptocurrency by market capitalization, it also has a high market recognition. This makes it an ideal passive income tool. With the continued expansion of the Ethereum DeFi ecosystem and the increase in global adoption, ETH is destined to provide investors with more financial growth possibilities in 2025 and beyond.

A powerful combination of DeFi strategies and XT financial products

Earning passive income through Ethereum is now easier than ever, thanks to the variety of flexible tools provided by XT Financial. Whether you are a beginner or an experienced investor, you can find the right option for you. Here are XT Financial products and their corresponding DeFi strategies to help you get started quickly and make smart choices.

Proof of Stake (PoS) Staking

Mempertaruhkan Ethereum is one of the simplest and most stable ways to earn rewards. Traditionally, this requires at least 32 ETH and a certain level of technical ability to build a node. But XT Finance makes everything easier. Without the need for a technical background or a lot of money, XT Finance provides a convenient PoS staking service , allowing users to stake with small amounts of money and enjoy stable returns. The operation is simple and clear, and novice users can get started quickly. At the same time, the platform also ensures security, making investment more secure.

DeFi comparison:

Image Credit: DeFi Rate

Staking platforms like Lido atau Rocket Pool also allow users to bypass the 32 ETH limit through funding pools, but the operation is relatively complicated and users need to manage liquid staking tokens (such as stETH) and learn how to use them in other DeFi applications.

-

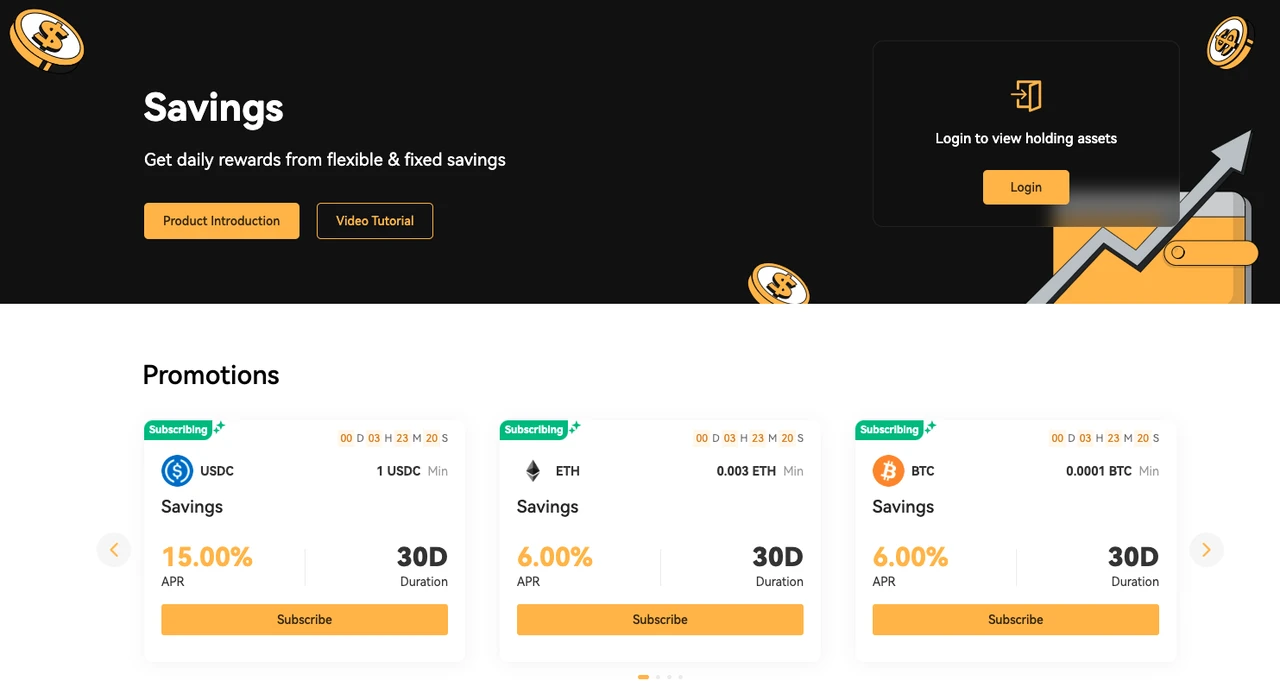

Financial Management

XT Financial Management provides a perfect solution for investors who value liquidity and flexibility. You can get competitive daily returns without locking up your funds and can access them at any time. This is perfect for those who want to retain control of their funds while enjoying stable returns.

DeFi comparison: Lending platforms such as Yaa atau Menggabungkan allow users to deposit ETH into liquidity pools to earn interest, but these platforms require users to actively manage investments, pay attention to interest rate fluctuations, adjust positions, and even deal with risks brought by market fluctuations. In contrast, XT Financial Management makes all this simpler and more efficient.

-

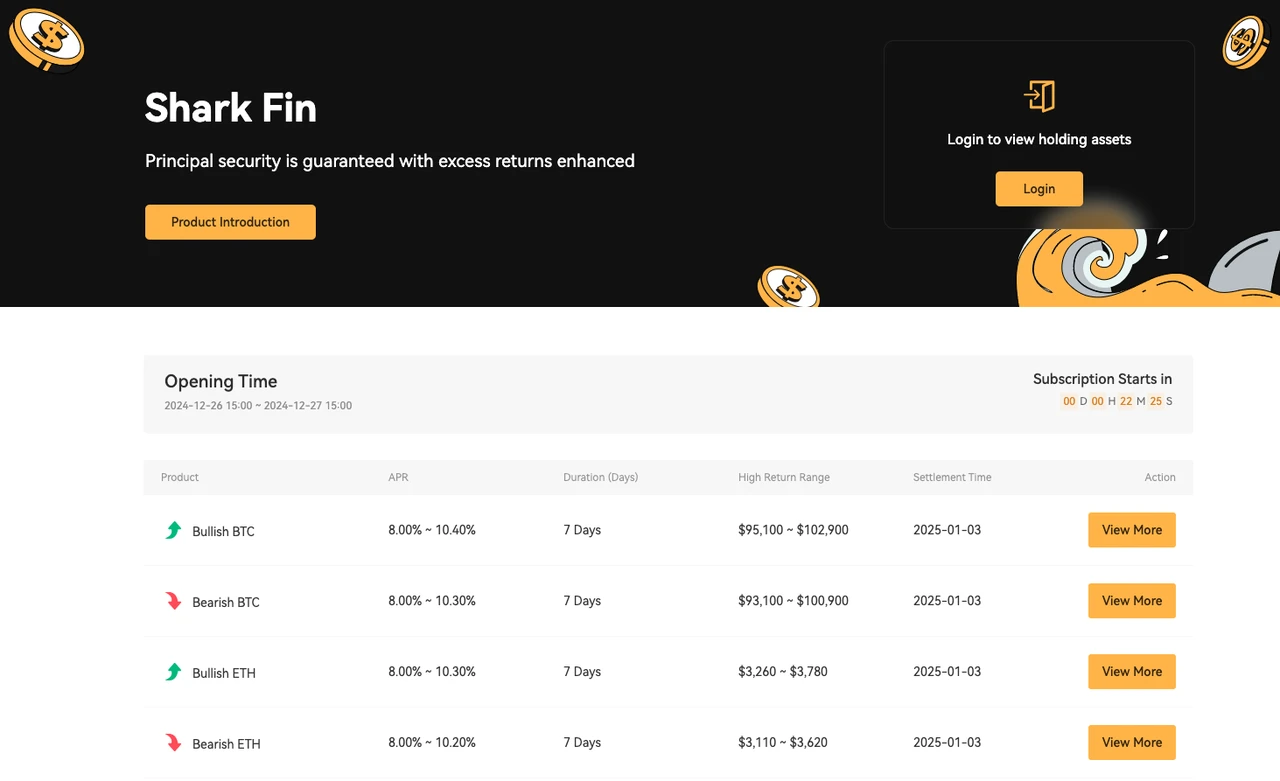

Shark fin products

If you prefer a more conservative investment approach, XT Financials Shark Fin product may be the right choice for you. This structured investment tool provides principal protection while also providing a capped return based on market performance. For investors who want to reduce risk but are unwilling to give up the opportunity for income, this is a very attractive option.

DeFi comparison: Using options strategies (such as covered calls or protective puts) on platforms such as Deri Protocol can achieve similar effects, but these methods require investors to have a deep understanding of options trading and market trends. XTs Shark Fin product makes the participation process simpler and suitable for a wider user group through an intuitive interface and clear terms.

Why choose XT Financial Management?

XT Financials products are not only user-friendly and easy to operate, but also provide comprehensive security. Whether you are a novice or an experienced trader, the platform provides you with clear and transparent terms and professional support to help you easily optimize your returns.

With XT Financial Management, you can easily diversify your investment strategies, balance risks, and fully grasp the unlimited potential of Ethereum in the DeFi field. From low-risk fixed-term products to high-yield market products, XT Financial Management provides comprehensive support for your passive income path.

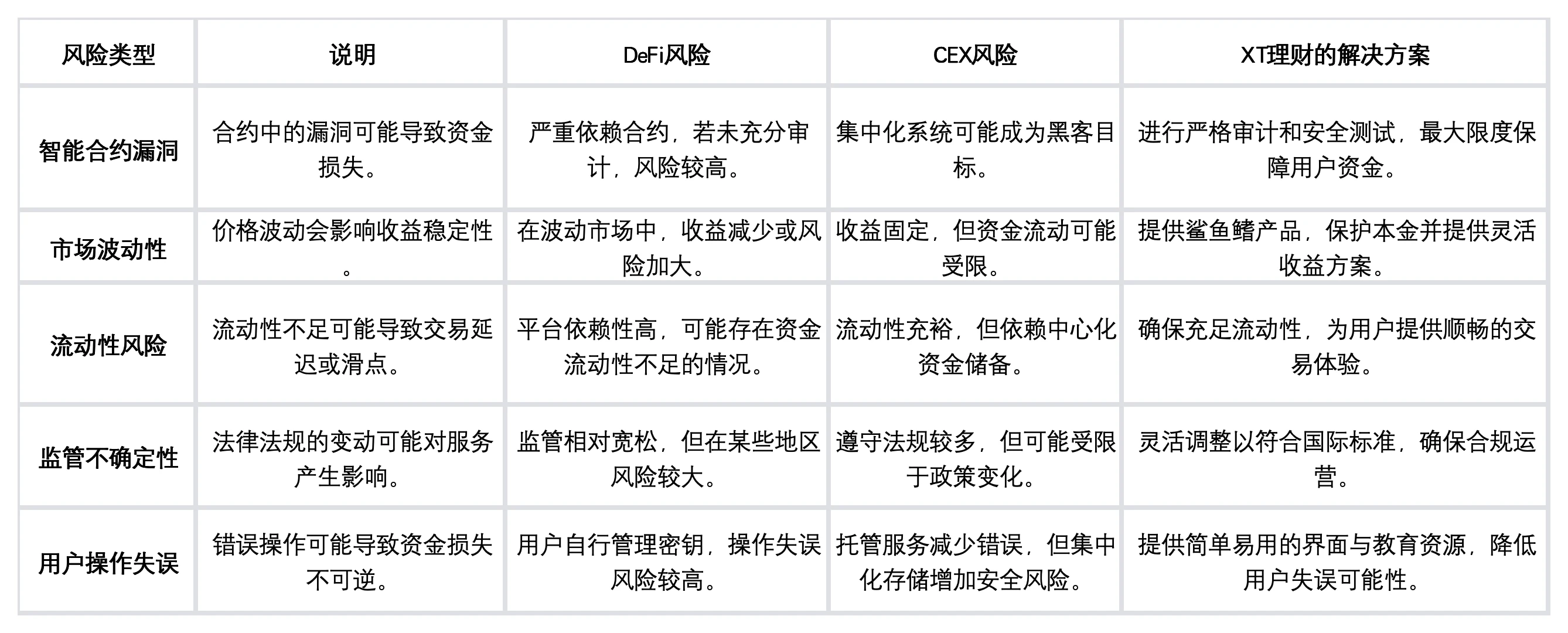

Risks and precautions

Although cryptocurrency investment is full of opportunities, it also comes with unique risks. Whether using centralized exchanges (CEX) or decentralized finance (DeFi), you need to have a clear understanding of potential problems. The following are common risks and how XT Financial Management can help users avoid these challenges:

Although the DeFi world is full of profit opportunities, investors must be aware of potential risks and take steps to protect their assets. For example, smart contract vulnerabilities are a common hidden danger that can be maliciously exploited to cause losses. XT Finance ensures that all products are safe and reliable through rigorous code audits and testing, allowing users to use them with confidence. XT Finance not only simplifies the complex process of crypto investment, but also enables users to confidently control their financial future and navigate the complex crypto investment environment through well-designed solutions, transparent operations and innovative tools.

How to maximize profits

In the DeFi world, maximizing returns requires a combination of reasonable planning, product understanding, and flexible investment management. XT Finance provides a range of tools to help you tailor your investment strategy to achieve higher return goals while reducing risks. Here are some practical strategies to help you get started easily:

-

Diversify investments and balance risks

Dont concentrate all your funds on one product. Diversified investments can balance risks and returns. For example, put 50% of your ETH into Shark Fin products to ensure the safety of your principal, and the remaining 50% into flexible wealth management products so that you can respond to market changes at any time.

-

Reinvest funds to maximize returns

By reinvesting funds to achieve compound interest, long-term returns can be greatly improved. For example, the rewards from XT PoS staking can be reinvested quarterly to allow the returns to continue to grow like a snowball.

-

Grasp the market trend

Paying attention to Ethereum s market trends and DeFi industry dynamics can help you better optimize your investment strategy. For example, when the price of ETH is expected to rise, you can increase the proportion of funds in mempertaruhkan or regular products to ensure stable returns while the value grows.

-

Risk diversification, steady progress

Combining high-yield and low-risk products, diversifying risks and ensuring steady growth. For example, 30% of funds are allocated to shark fin products to protect the principal, and the remaining 70% are invested in pledges atau wealth management products to obtain stable returns even when the market fluctuates.

-

Regularly rebalance your portfolio

The market is changing rapidly, and it is crucial to regularly check and adjust your portfolio. For example, after a sharp rise in ETH prices, you can appropriately transfer funds from shark fin products to high-yield mempertaruhkan to maximize returns while keeping risks under control.

The future of Ethereum passive income

As the core of decentralized finance (DeFi), Ethereum has a future full of possibilities. With the continuous upgrading of technology and the expansion of the ecosystem, Ethereum will bring more diversified passive income methods to investors and continue to lead the innovation wave of crypto finance.

Layer 2 Scaling Solutions: Making Participation Easier

Image Credit: L2 Beat

Ethereums Layer 2 solutions, such as Optimistic Rollups and ZK Rollups, are maturing rapidly. These technologies can significantly reduce transaction costs while improving network efficiency. Lower fees and faster transaction speeds will attract more users to participate in Ethereum S mempertaruhkan , periodic products, and yield strategies, promoting a more inclusive global financial ecosystem.

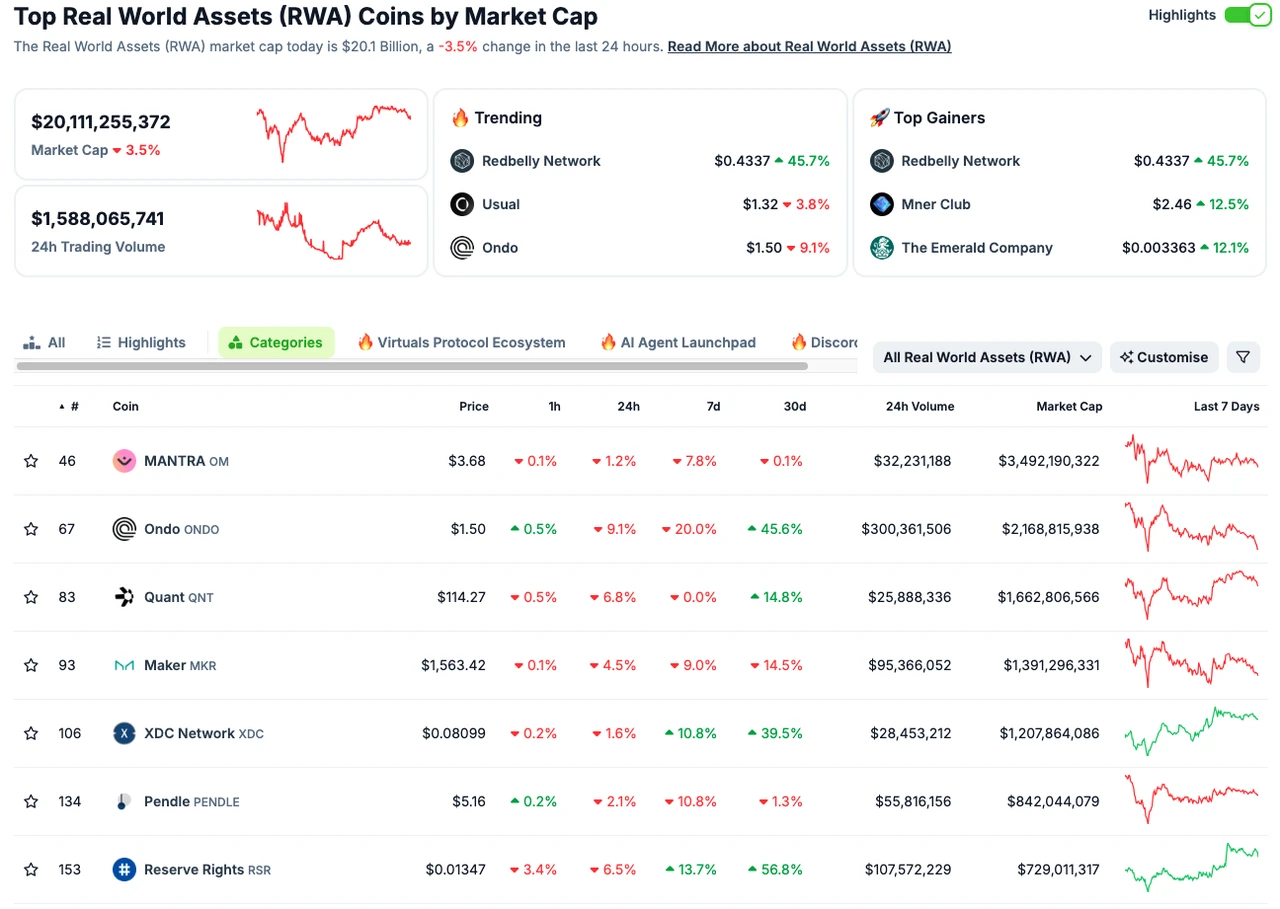

Tokenization of physical assets: connecting tradition and future

Image Credit: CoinGecko

Another exciting development is the tokenization of physical assets. From real estate to art to commodities, these traditional assets are gradually entering the blockchain in the form of tokens. This change not only broadens the choices for investors, but also creates new passive income opportunities, making the integration of traditional and digital assets possible.

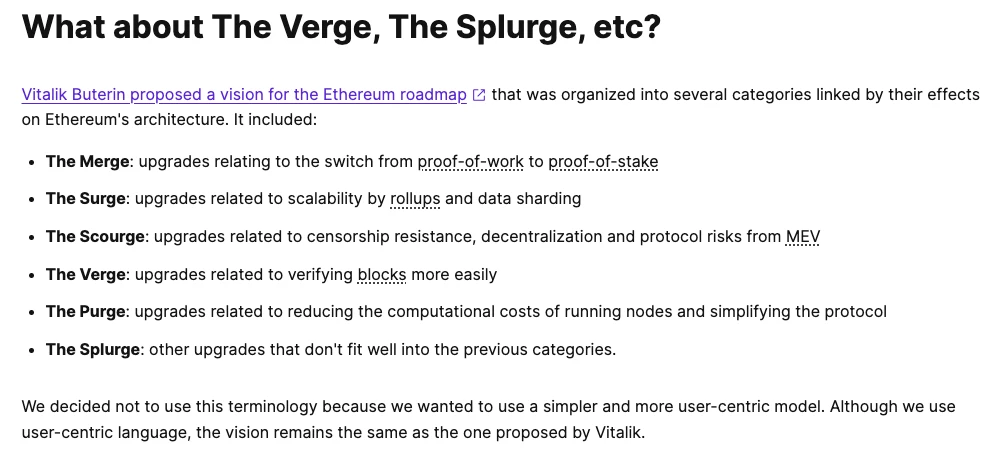

Continuously upgrading the Ethereum protocol: improving efficiency and value

Image Credit: Ethereum.org

Ethereum鈥檚 future upgrades, such as a more efficient proof-of-stake mechanism, will further enhance its scalability and stability. These improvements will solidify Ethereum 鈥檚 position as the preferred network for mempertaruhkan and yield generation, and also provide investors with a more stable long-term development foundation.

Pertanyaan Umum

Q1: What are the advantages of XT financial products compared with other DeFi tools?

XT Finance focuses on providing a simple and easy-to-use interface, high-return yields, and strong security guarantees to help users easily participate in DeFi investment and have a good experience.

Q2: Is it safe to use XT Financial products?

Very safe. XT Finance uses top security protocols and undergoes regular rigorous audits to ensure your funds are always protected.

Q3: Can I withdraw my ETH at any time?

Yes, most XT financial products support flexible withdrawals, but the specific rules may vary depending on the product type.

Q4: Which product is suitable for investors with lower risks?

For investors with a lower risk appetite, shark fin products are a good choice. They not only provide principal protection, but also bring capped returns when the market performs well.

Q 5: Are there any fees for using XT financial products?

XT Finances fees are very transparent and reasonable. Fees vary between products, but they are clearly listed before use so you can understand the costs.

Q 6: What assets does XT financial management support, besides Ethereum?

XT Financial Management supports a variety of mainstream cryptocurrencies, including Bitcoin, stablecoins, etc., allowing you to easily diversify your assets.

Q 7: What if I forget my account login information?

XT Finance provides a convenient account recovery process, helping you quickly retrieve your account through secure identity verification, ensuring the safety of your funds.

About XT.COM

Founded in 2018, XT.COM currently has more than 7.8 million registered users, more than 1 million monthly active users, and more than 40 million user traffic within the ecosystem. We are a comprehensive trading platform that supports 800+ high-quality currencies and 1,000+ trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading products such as spot trading , leveraged trading , Dan contract trading . XT.COM also has a safe and reliable NFT trading platform . We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

This article is sourced from the internet: Master the Secrets of Ethereum Passive Income Strategy by 2025

Related: Caldera now supports SVM, becoming a multi-virtual machine Rollup platform

Caldera, the RaaS (Rollups-as-a-Service) platform that powers major blockchains such as Manta Pacific, Injective, Apechain, and Kinto, announced today that it has integrated the SOON stack, which will allow developers to deploy Solana Virtual Machine (SVM) functions on Ethereum Rollup. This integration makes Caldera the first Rollup platform in the Web3 space to support multi-VM. Caldera’s strategic collaboration with SOON marks a major advancement in blockchain scalability technology, enabling developers to deploy high-performance SVM Rollups alongside traditional EVM Rollups through Caldera’s proven one-click Rollup building platform. SOONs innovation lies in decoupling the SVM architecture and separating Solanas virtual machine from its consensus layer. This technological breakthrough allows developers to take advantage of the performance of SVM while taking advantage of Ethereum Layer 1 security, thereby unlocking a range of on-chain…