2024 Bitcoin Year-end Review: Price Increased 131%, Less Than Last Year, TVL Surges 21 Times to Over $6.7 Billion

Original author: Carol, PANews

In 2024, Bitcoin broke through the $100,000 mark in an upward trend, setting a new milestone for the development of digital assets. The three keywords ETF approval, halving and US election have driven the market changes of Bitcoin throughout the year. Behind this overall picture, what specific changes are worth paying attention to in the trading market, on-chain fundamentals and application levels of Bitcoin? What potential impact do these changes have on development in 2025?

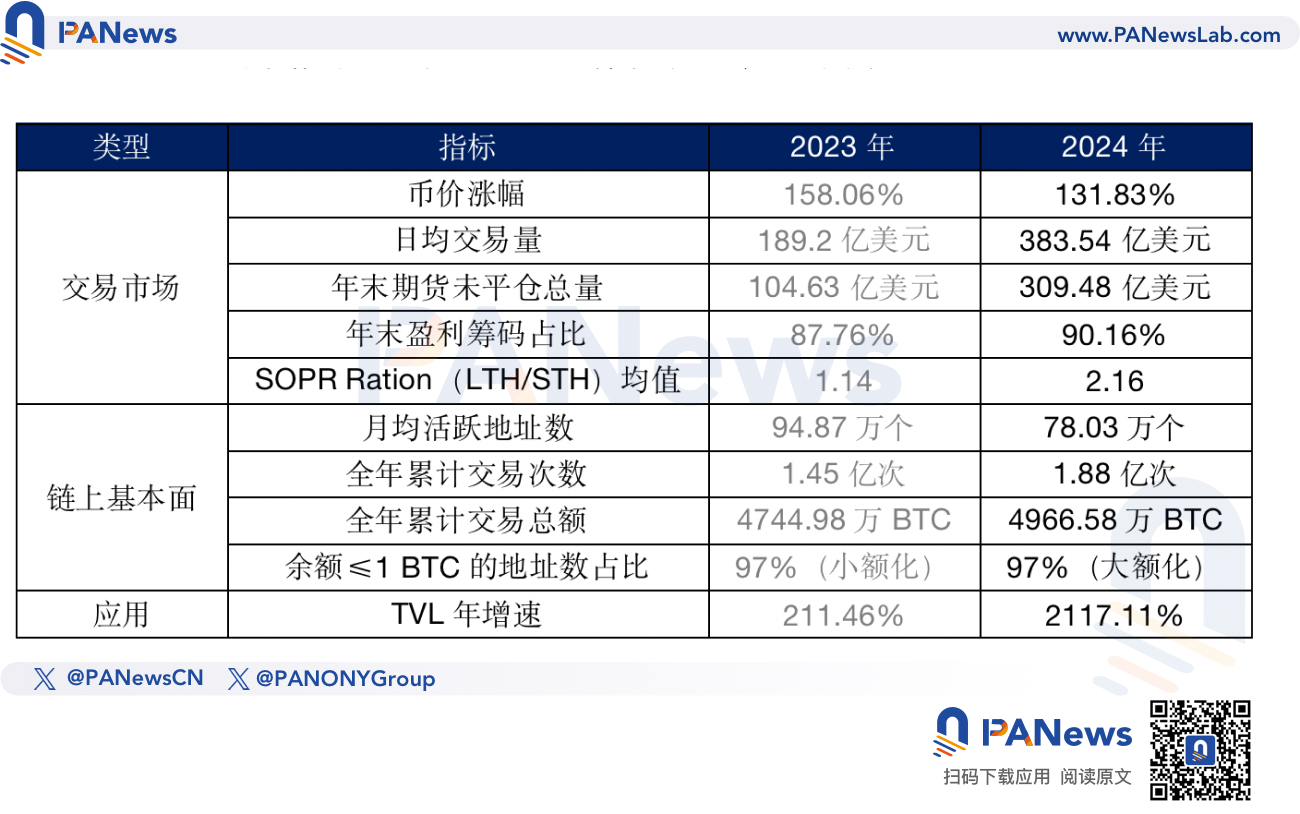

PANews data column PAData uses multi-dimensional data to look at the changes in Bitcoin in 2024. In general:

Jual beli Pasar:

-

Bitcoins annual increase reached 131.83%, lower than last years 158.06%.

-

The main driving force behind the rise in Bitcoin prices this year is the gradual friendliness and relaxation of the regulatory environment, rather than simple supply scarcity (halving).

-

Long-term holders have seen better profitability this year, and they tend to reduce their exposure earlier when the market approaches overheating.

-

This years trading market has seen both volume and price increase. The average daily trading volume for the whole year was approximately US$38.354 billion, an increase of 102.72% over last year. The total amount of open positions at the end of the year was approximately US$30.948 billion, an increase of 195.79% over the end of last year.

-

The total holdings of Bitcoin ETFs reached 11.2006 million BTC, a strong increase of 80.87% throughout the year.

On-chain fundamentals:

-

The average monthly active addresses of Bitcoin on the chain this year are about 780,300, down 17.75% from last year. This may indicate that with a clear upward trend, long-term holding strategies are dominant, and the market may shift to a low-liquidity growth phase dominated by institutional investors.

-

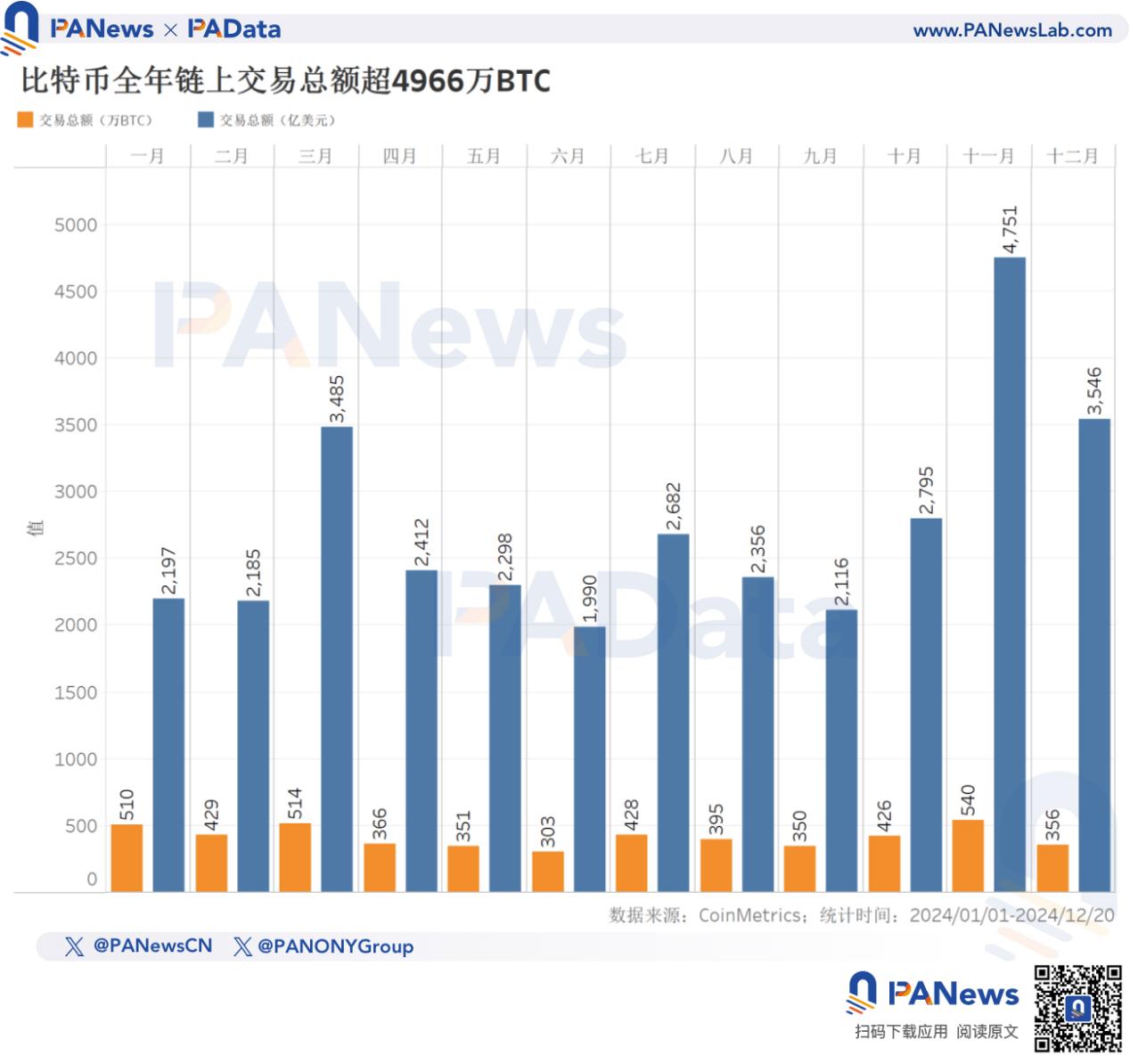

The total amount of on-chain transactions for the whole year was approximately 49.6658 million BTC, equivalent to 3.28 trillion US dollars. The total amount of currency-based transactions increased slightly by 4.67% compared with last year.

-

The number of addresses with balances between 100 and 1,000 BTC increased by 11.21%, which indicates that the trend of address balances decreasing in recent years has changed, and this year it has shown a trend of increasing.

Application level:

-

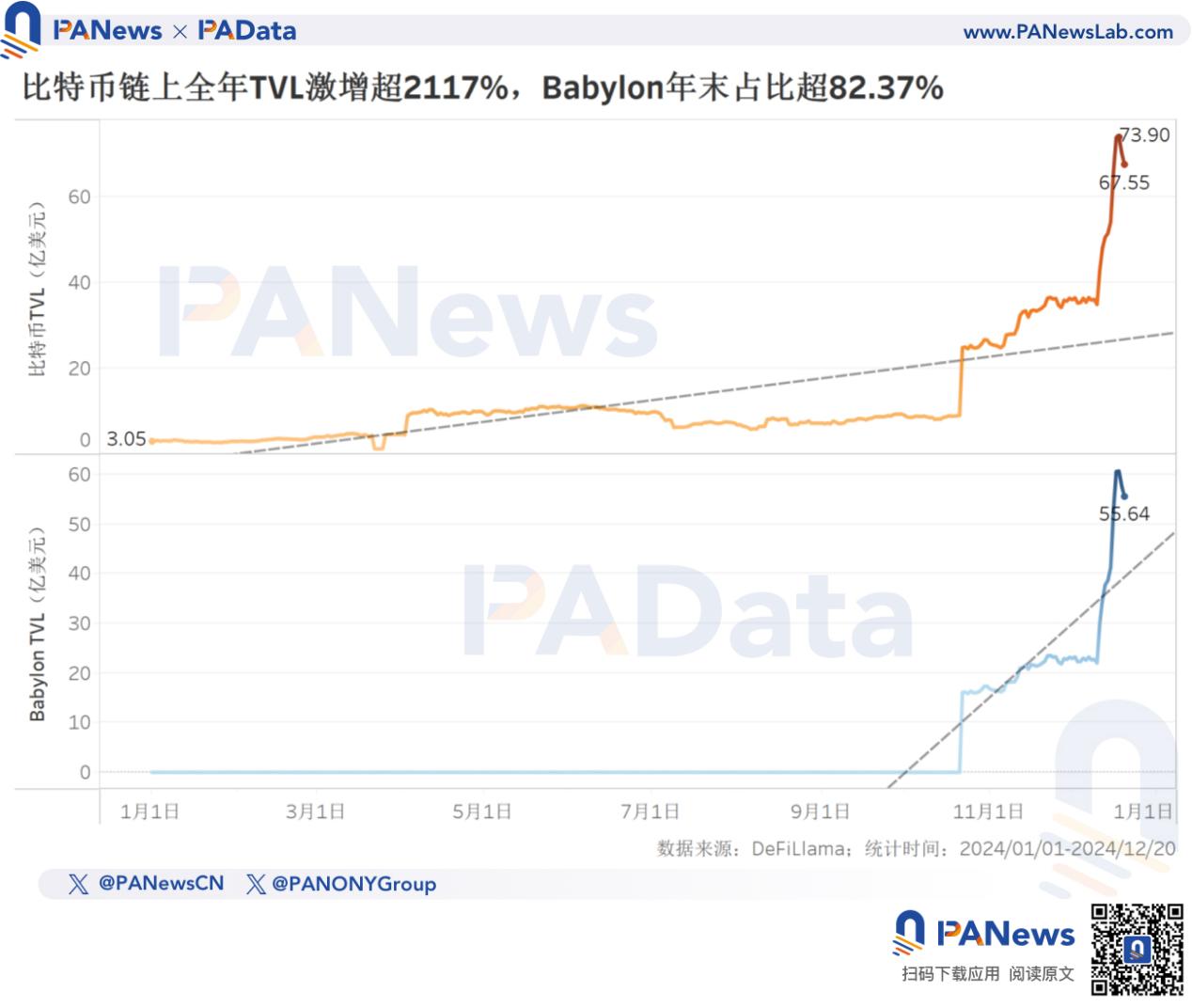

At the end of the year, the TVL of Bitcoin was approximately US$6.755 billion, with an annual increase of 2117.11%, of which Babylons TVL accounted for 82.37%.

-

Staking has replaced payment (Lightning Network) as the mainstream application of Bitcoin.

Outlook for next year:

-

The hawkish interest rate cuts under the background of QT have tightened both long-term and short-term liquidity, which constitutes the main pressure for Bitcoin to continue to rise next year.

-

This years rise is related to the expected friendly regulatory environment after the election. If the regulatory environment can be further relaxed next year, it will be conducive to the continued rise of Bitcoin.

-

BTCFi may develop further, but if applicability is to become the main logic for Bitcoin pricing, it is necessary to first achieve a continuous expansion in the scale of application. As far as next year is concerned, this may still be difficult.

Trading market: The price of the currency has increased by more than 131% throughout the year, and the ETF holdings exceed 1.12 million BTC

In 2024, the price of Bitcoin rose from $42,208 at the beginning of the year to $97,851 at the end of the year (as of December 20), with an annual increase of 131.83%. On December 17, it broke through the $100,000 mark, setting a record high of $106,074, with a maximum annual increase of about 151.31%. Although it began to pull back slightly at the end of the year, the price is still running at a historical high.

From the overall trend, this year, Bitcoin has experienced three stages of rising-sideways-rising, which basically correspond to the three major events of ETF approval, 4th halving and US presidential election. In general, the logic of Bitcoins rise this year is not just attributed to the supply scarcity brought about by halving, or at least not entirely the traditional logic of supply scarcity. The approval of ETFs and the results of the US election both show that the main driving force behind the rise in Bitcoin prices lies in the gradual friendliness and relaxation of the regulatory environment. This change has attracted a large amount of institutional funds to enter the market, injecting liquidity into the market and further boosting prices.

According to glassnode data, the profit chips at the end of the year have reached 90.16% (as of December 20), which is at a historical high. From the perspective of profit strategy, LTH-SOPR/STH-SOPR (output profit ratio of long-term holders/output profit ratio of short-term holders) rose from 1.55 at the beginning of the year to 2.11 at the end of the year, with an annual average of 2.16. Especially since late November, this ratio has been greater than 3 many times, and the highest was greater than 4. A ratio greater than 1 indicates that the profit level of long-term holders is higher than that of short-term holders. The larger the value, the higher the profit level of long-term holders.

In general, long-term holders have better profit levels this year, and this advantage becomes more obvious towards the end of the year. In addition, the comprehensive currency price also shows that the peak of long-term holders profit levels appears earlier than the peak of currency prices, which means that long-term holders tend to reduce their risk exposure earlier when the market is close to overheating.

This year, the Bitcoin trading market has seen an increase in both volume and price, with the steadily rising price of the currency accompanied by an increase in trading volume.

According to statistics, the average daily trading volume of Bitcoin for the whole year was about 38.354 billion US dollars, and the highest single-day trading volume exceeded 190.4 billion US dollars. The peak of trading in the year occurred after November, with the average daily trading volume in November and December being 74.897 billion US dollars and 96.543 billion US dollars respectively, significantly exceeding the previous monthly average of 30.8 billion US dollars.

The futures market was also active, with total open interest increasing from $10.915 billion at the beginning of the year to $30.948 billion at the end of the year, a significant increase of 183.53% throughout the year.

As one of the main factors driving the rise in Bitcoin prices, the asset holdings of various ETFs have always attracted much attention this year. According to statistics, the total holdings of various Bitcoin ETFs increased from 619,500 BTC at the beginning to 11.2006 million BTC at the end of the year, a strong increase of 80.87% throughout the year. The rapid growth period is basically the same as the period of rapid price increase, both in February-March and after November.

Currently, BlackRock holds 524,500 BTC, the largest among all ETFs. In addition, Grayscale and Fidelity also hold a large amount, reaching 210,300 BTC and 209,900 BTC respectively. The holdings of other ETFs are relatively low, basically below 50,000 BTC.

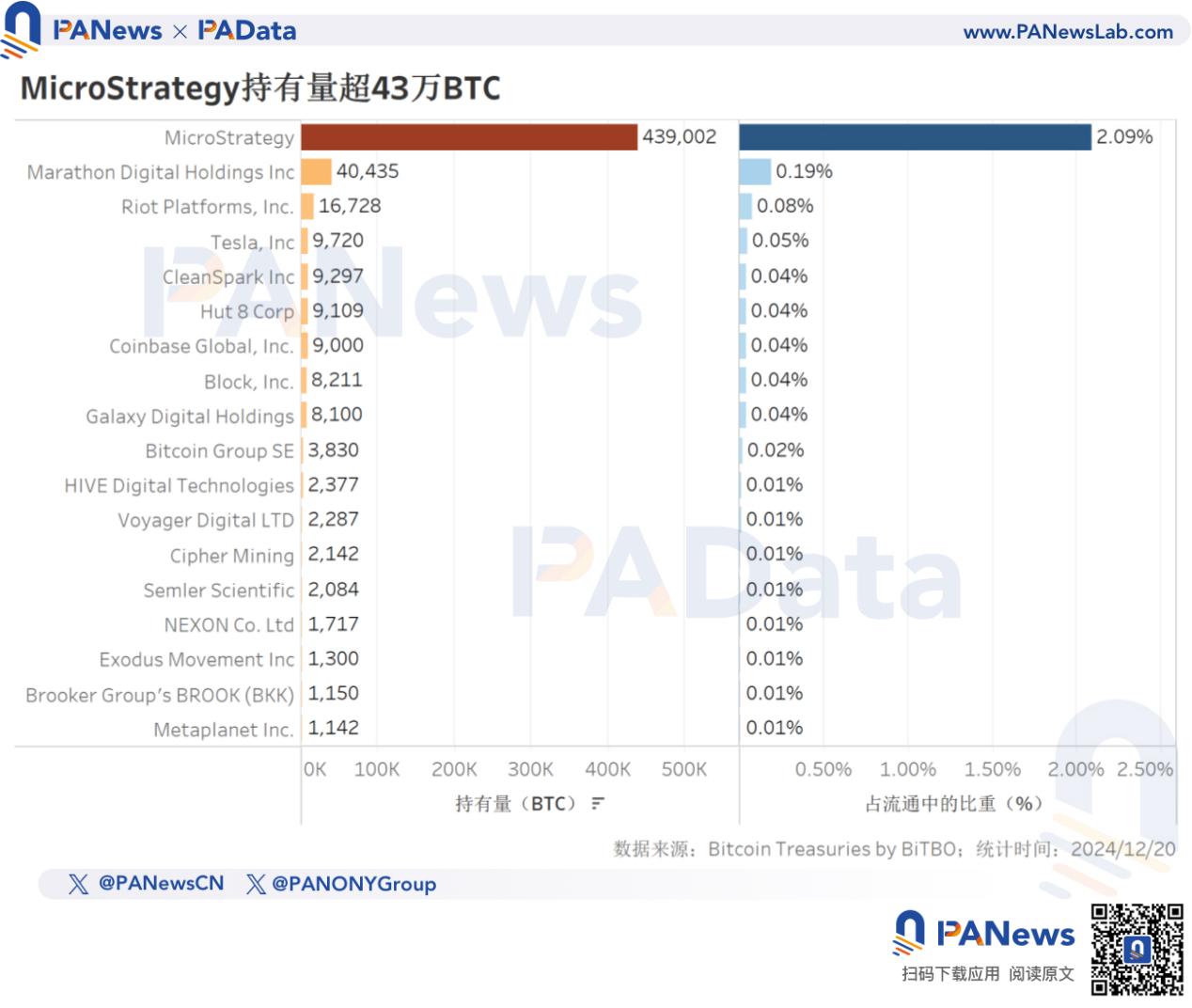

In addition to ETFs, more and more listed companies have become buyers of Bitcoin, which may bring more possibilities to the market. According to statistics, the company with the largest holdings is MicroStrategy, which holds a total of 439,000 BTC, which exceeds the holdings of many ETFs. In addition, Marathon Digital Holdings and Riot Platforms, the leading companies in the field of Bitcoin mining in North America, also hold relatively large amounts, exceeding 40,000 BTC and 10,000 BTC respectively.

On-chain fundamentals: active addresses fell, large addresses increased, and total transaction volume increased to 49.66 million BTC

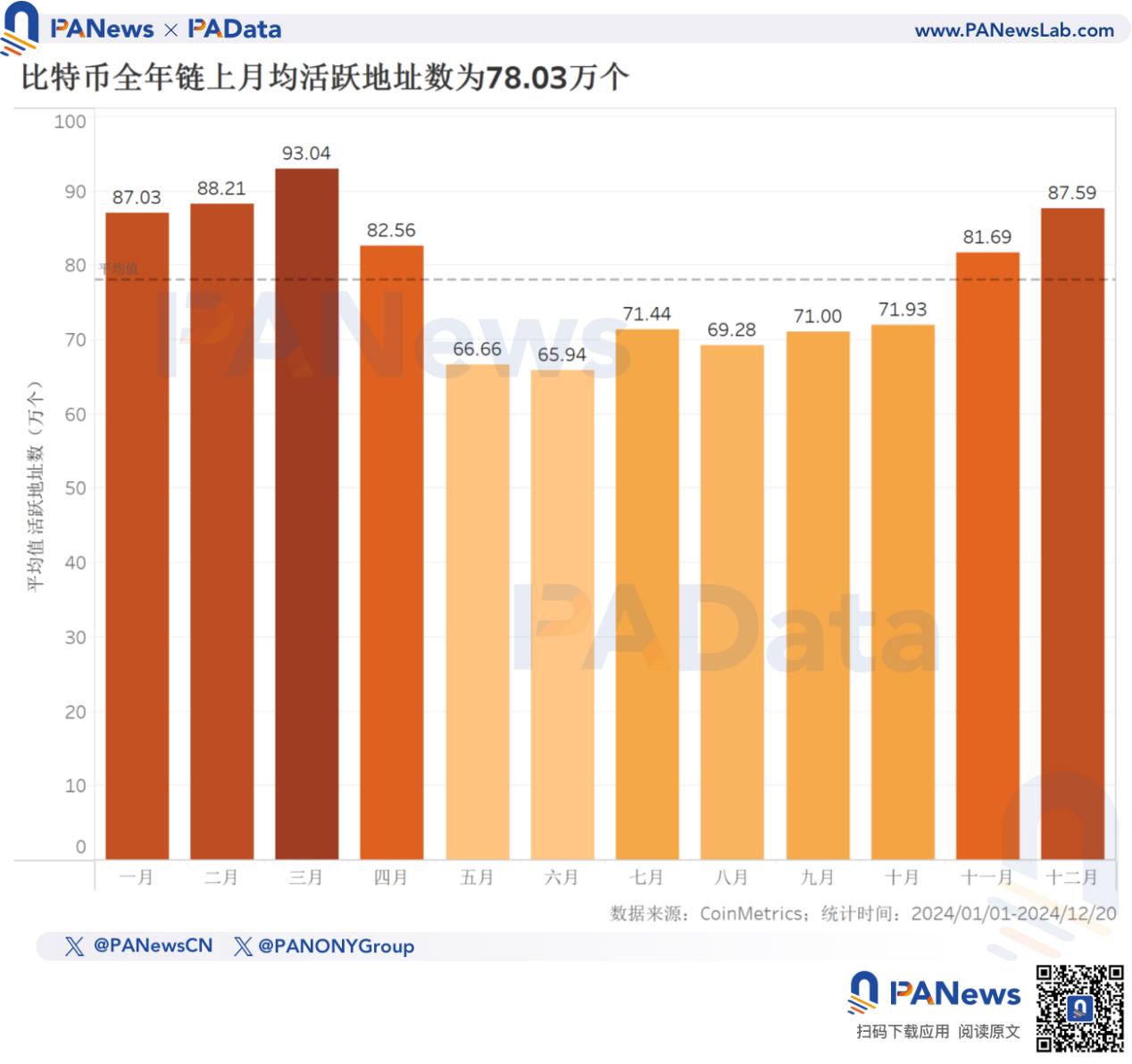

The average monthly active addresses on the Bitcoin chain this year are about 780,300, a significant decrease of 17.75% from 948,700 last year. Among them, the average monthly active addresses from January to April and November to December were both above 800,000, but the average monthly active addresses from May to October were all below 720,000.

Although this is basically consistent with the trend of the currency price, it is worth noting that against the backdrop of a record high Bitcoin price, the average monthly active addresses for the whole year have declined, and the highest number of active addresses in a single month has also declined. This change may mean that with a clear upward trend, long-term holding strategies will prevail, and the market may shift from a high-frequency trading stage dominated by general investors to a low-liquidity growth stage dominated by institutional investors.

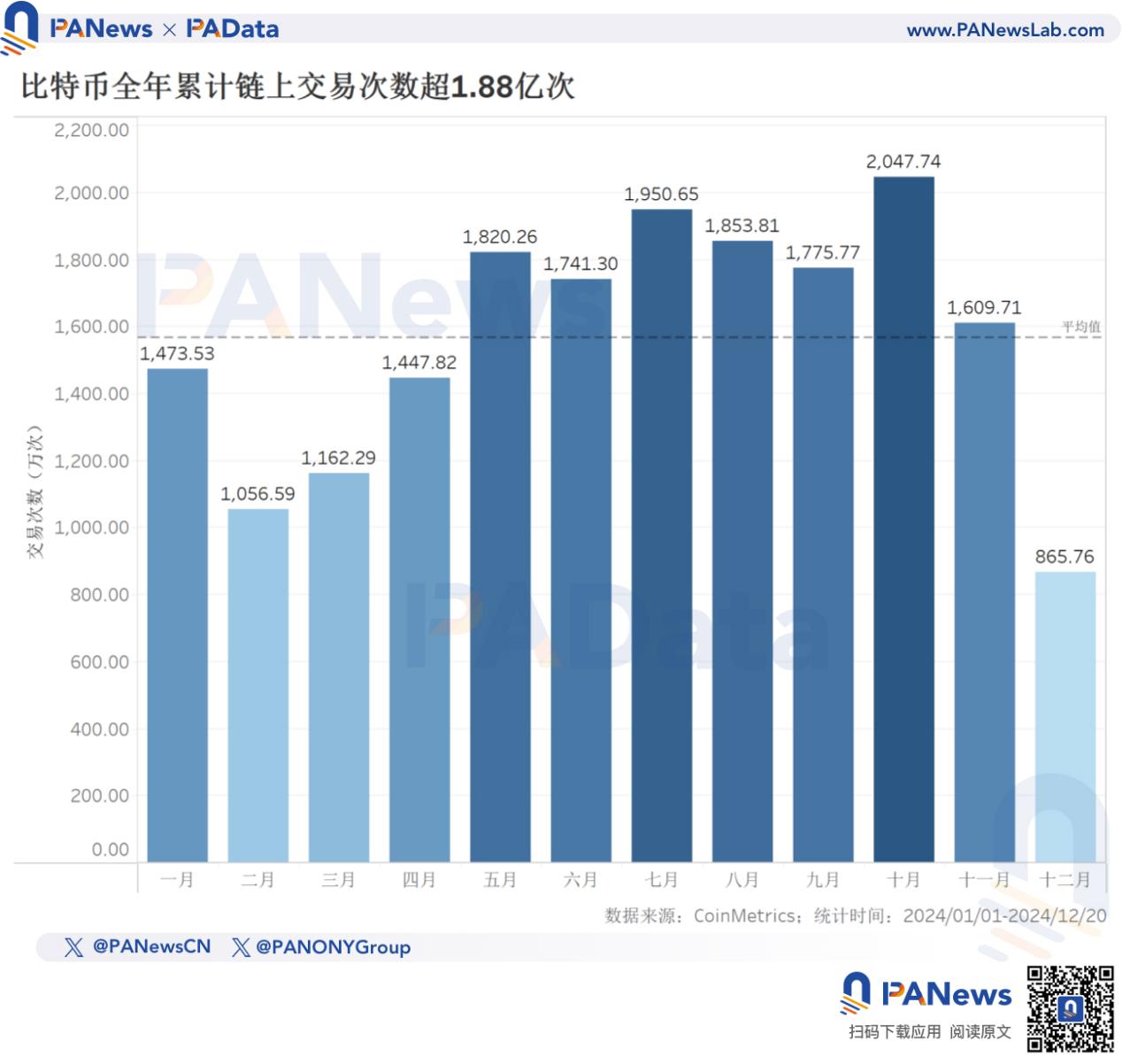

This year, the total number of Bitcoin transactions on the chain exceeded 188 million times, an increase of about 29.66% over last year, and has risen for two consecutive years. The average monthly cumulative number of transactions is 15.671 million times, of which October has the most transactions, reaching 2047.74 times. It is worth noting that during the sideways price stage, the number of on-chain transactions is actually higher. This may be affected by many factors, such as short-term arbitrage transactions, address sorting, contract liquidation, etc.

The total on-chain transaction volume for the whole year was about 49.6658 million BTC, equivalent to 3.28 trillion U.S. dollars. The total transaction volume in currency standard increased slightly by 4.67% compared with last year. The average monthly cumulative transaction volume this year was about 4.1388 million BTC, equivalent to about 273.451 billion U.S. dollars.

In general, the relative trend of transaction times and transaction amounts still continues the differentiation pattern of last year, that is, compared with 2022 and before, the number of Bitcoin transactions has increased, while the total transaction amount has decreased. The main reason is the expansion of the application level in the high coin price environment, such as the outbreak of the Ordinals protocol last year.

From the distribution structure of address balances, the number of addresses with balances between 0.001 and 0.01 BTC, 0.01 and 0.1 BTC, and 0.1 and 1 BTC is still the largest, currently accounting for 97.24% of the total number of addresses. However, the number of addresses in these three balance ranges has shown a downward trend this year, with a decrease of 3.94%, 2.74%, and 2.62% respectively. Among all balance ranges, only the number of addresses with balances between 100 and 1000 BTC and 1000 and 10000 BTC increased by 11.21% and 1.68% respectively. This means that the trend of address balances becoming smaller in recent years has changed, and this year it has shown a trend of increasing in size, which may be related to address consolidation and institutional capital positions.

Application layer: From Inscription to BTCFi, TVL surged 2117% throughout the year

This year, the application focus of Bitcoin has shifted from inscription to BTCFi, and from asset issuance to asset availability. According to DeFiLlama data, the TVL of Bitcoin DeFi surged from $305 million at the beginning of the year to $6.755 billion at the end of the year, with an annual increase of 2117.11%, and the highest TVL once exceeded $7.3 billion. At present, Bitcoin has become the fourth blockchain with the highest TVL after Ethereum, Solana and Tron.

From the perspective of protocol types, the largest protocol on Bitcoin this year has changed from the Lightning Network in the payment field to Babylon in the staking field. As of December 20, Babylons TVL has reached 5.564 billion US dollars, accounting for 82.37% of the total. According to Dune (@pyor_xyz), as of December 23, the number of independent addresses of Babylon has exceeded 140,000, and the growth rate of staking addresses in the past 7 days has reached 100%.

The rapid development of Babylon has led to a series of pledge and re-pledge protocols. At present, in addition to Babylon, there are 10 other protocols on the Bitcoin chain, including Lombard, SolvBTC LSTs, exSat Credit Staking, Chakra, Lorenzo, uniBTC Restaked, alloBTC, pSTAKE BTC, b 14 g, and LISA BTC LST. These pledge protocols are likely to bring network effects to the application of Bitcoin and further promote its application expansion.

Outlook for next year

Bitcoin has already seen sufficient growth this year. Looking ahead to 2025, Bitcoin is likely to enter a period of adjustment at the beginning of the year. Its subsequent performance will continue to be affected by the macroeconomic environment, regulatory environment, and industry development. There are opportunities in volatility.

From the perspective of the macroeconomic environment, the Federal Reserve turned to a hawkish rate cut at the end of this year, and more importantly, the quantitative tightening (QT) policy background has not changed, which means that under the goal of controlling inflation, long-term liquidity is still tightening, and short-term liquidity growth may also slow down. Therefore, there is a certain pressure for Bitcoin to continue to rise next year.

However, judging from the price trend of Bitcoin this year, it is more sensitive to changes in the regulatory environment. The result of the US presidential election directly stimulated the price of Bitcoin to break through $100,000. If there is a greater degree of relaxation in regulatory policies next year, it may provide momentum for Bitcoin to continue to rise.

From the perspective of industry development, the rapid rise of BTCFi has pushed Bitcoin into a new stage of asset application. Staking agreements and other agreements are likely to promote the network effects of these assets, which will further provide value support for the price of Bitcoin. However, if the price of Bitcoin is highly affected by applicability, then for Bitcoin, this will be a new logic of increase that is different from supply scarcity or digital gold, and this has high requirements for the scale of application, which may be difficult to achieve in the short term.

This article is sourced from the internet: 2024 Bitcoin Year-end Review: Price Increased 131%, Less Than Last Year, TVL Surges 21 Times to Over $6.7 Billion

Related: What assets might the Trump family project WLFI buy next?

Original|Odaily Planet Daily Author: jk As the American narrative and the Trump narrative have prevailed since Trumps victory and Bitcoin broke through the 100,000 mark, the markets attention is focused on World Liberty Financial (WLFI), which has a strong family connection. Since its launch in September 2023, WLFI has quickly attracted widespread attention from the market with its unique narrative and large-scale capital operations. In particular, during December, WLFI made a large purchase of nearly $45 million worth of crypto assets. This series of on-chain operations has brought a lot of speculation to the market. Investors and analysts are trying to answer a key question: What tokens might WLFI continue to buy in the future? Background Information World Liberty Financial (WLFI) was officially launched in September 2023. It claims to…

Hai