CoinW Research Institute Weekly Report (2024.12.16-2024.12.22)

Poin Penting

-

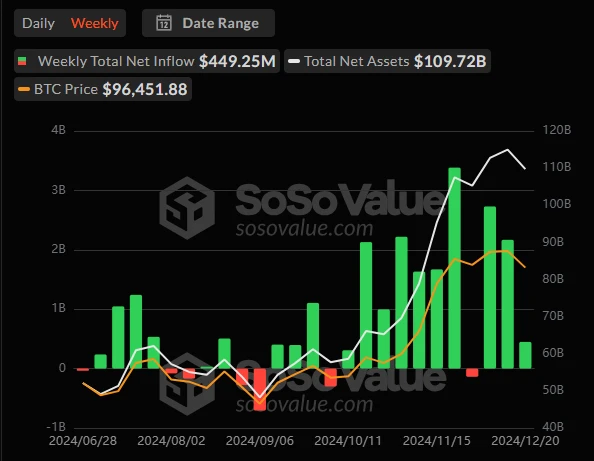

The total market value of global kriptocurrencies is $3.4 trillion, down 13.2% from $3.92 trillion last week. As of December 23, 2024, the total net inflow of the US Bitcoin spot ETF was about $36.05 billion, with a net inflow of $450 million this week; the total net inflow of the US Ethereum spot ETF was about $2.33 billion, with a net inflow of $62.73 million this week, maintaining a net inflow for 4 consecutive weeks.

-

The market value of stablecoins is $210 billion, accounting for 6.19% of the total market value of cryptocurrencies. Among them, the market value of USDT is $139.7 billion, accounting for 66.5% of the total market value of stablecoins; followed by USDC with a market value of $43 billion, accounting for 20.5% of the total market value of stablecoins; and DAI with a market value of $5.3 billion, accounting for 2.5% of the total market value of stablecoins. This week, the USDC Treasury issued a total of 200 million USDC, a 90% drop from the total amount of stablecoin issuance last week.

-

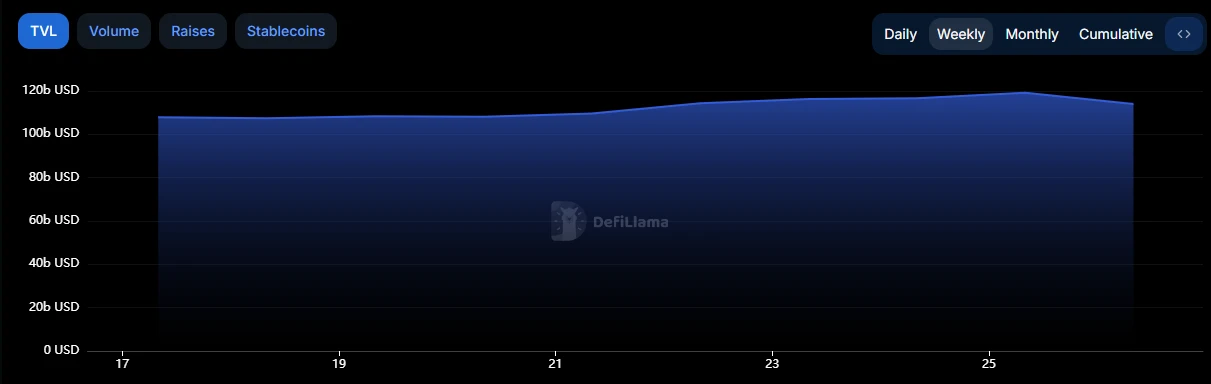

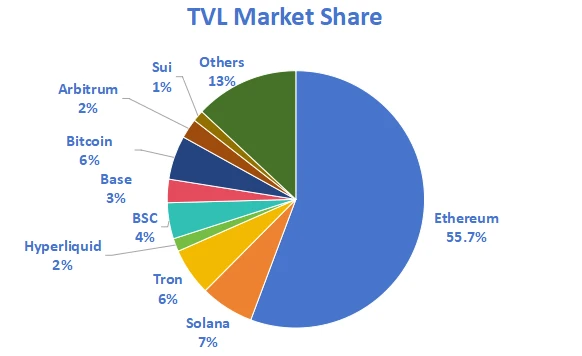

This week, the total TVL of DeFi is 118.9 billion US dollars, a decrease of 15.9% from last week. According to the public chain, the three public chains with the highest TVL are Ethereum chain accounting for 55.7%; Solana chain accounting for 7%; Tron chain accounting for 6%. Ethereum chain is still the leader in the DeFi field.

-

From the on-chain data, the daily trading volume of Layer 1 public chains has been on a downward trend this week, among which BNB has fallen the most significantly, down 71% from last week. Among the daily active addresses, TON ranks first this week, among which SOL active addresses have fallen significantly, down 6% from last week. From the TVL point of view, ETH is still the leader among public chains; the total TVL locked in Ethereum Layer 2 this week reached 45.9 billion US dollars, an overall decrease of 15.7%. Arbitrum One and Optimism occupy the top row with 41.83% and 21.19% respectively, but both have seen a slight decline.

-

Innovative projects to watch: Animix, the first GenAI-powered pet fusion game powered by Sophon. There is no TGE yet, and the game is still in its early stages. Alita Menukarkan, a swap based on SOON that combines the advantages of AMM and PMM. Alita is designed for high-frequency trading, combining transaction speed and liquidity, and is an innovative case of DEX. Chiss Protocol, a permissionless on-chain foreign exchange mixer based on avax, enables seamless earnings, lending, and affordable global trading.

Table of contents

Poin Penting

1. Pasar Overview

1. Total cryptocurrency market value/Bitcoin market value share

2. Fear Index and ETF Inflow and Outflow Data

3. ETF inflow and outflow data

4. ETH/BTC and ETH/USD exchange ratio

5. Decentralized Finance (DeFi)

6. On-chain data

7. Stablecoin market value and issuance

2. Hot money trends this week

1. The top five VC coins and meme coins with the highest growth this week

2. New Project Insights

3. New trends in the industry

1. Major industry events this week

2. Big events coming up next week

3. Important investment and financing last week

1. Market Overview

1. Total cryptocurrency market value/Bitcoin market value share

The total market value of global cryptocurrencies is $3.4 trillion, down 13.2% from $3.92 trillion last week.

Data source: Cryptorank

As of press time, Bitcoin (BTC) has a market cap of $1.88 trillion, accounting for 55.26%. Meanwhile, stablecoins have a market cap of $210 billion, accounting for 6.19% of the total cryptocurrency market cap.

Data source: coingeck

2. Fear Index and ETF Inflow and Outflow Data

The cryptocurrency fear index is at 70, indicating greed.

Data source: coinglass

3. ETF inflow and outflow data

As of December 23, 2024, the total net inflow of US Bitcoin spot ETFs was approximately US$36.05 billion, with a net inflow of US$450 million this week. Only three ETFs, including BlackRock IBIT, achieved weekly net inflows; the total net inflow of US Ethereum spot ETFs was approximately US$2.33 billion, with a net inflow of US$62.73 million this week, maintaining net inflows for four consecutive weeks. Although the price of Bitcoin fell this week, the amount of BTC purchased by US spot Bitcoin ETFs was nearly twice the mining output during the same period, reaching US$423.6 million.

Data source: sosovalue

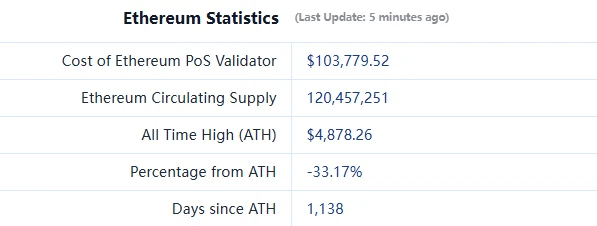

4. ETH/BTC and ETH/USD exchange ratio

ETHUSD: Currently $3,257, historical high $4,878

ETHBTC: Currently 0.034513, the highest in history is 0.1238, a drop of about 72.1%

Data source: ratiogang

5. Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL of DeFi this week is $118.9 billion, down 15.9% from last week.

Sumber data: defillama

By public chain, the three public chains with the highest TVL are Ethereum chain accounting for 55.7%; Solana chain accounting for 7%; Tron chain accounting for 6%. Ethereum chain is still the leader in the DeFi field.

Data source: CoinW Research Institute, defillama

Data as of December 23, 2024

6. On-chain data

Layer 1 Data

The main data of Layer 1 including ETH, SOL, BNB, TON, SUI and APT are analyzed mainly from the perspective of daily transaction volume, daily active addresses and transaction fees.

Data source: CoinW Research Institute, defillama, Nansen

Data as of December 23, 2024

-

Daily trading volume and transaction fees: Daily trading volume and transaction fees are the core indicators to measure the activity of public chains and user experience. In terms of daily trading volume, this week, affected by the overall market decline, except for BNB and SUI, the daily trading volume of other public chains has been on a downward trend. Among them, BNB has fallen the most significantly, down 71% from last week. In terms of transaction fees, ETH chain fees have shown a downward trend, down 72% from last week.

-

Daily active addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of the public chain, and TVL reflects the users trust in the platform. From the perspective of daily active addresses, TON ranks first this week, among which SOL active addresses have dropped significantly, down 6% from last week. From the perspective of TVL, ETH is still the leader among public chains.

Layer 2 Data

-

According to L2 Beat data, the total TVL locked in Ethereum Layer 2 reached US$45.9 billion, a 15.7% overall decrease this week.

Data source: L2 Beat

Data as of December 23, 2024

-

Arbitrum One and Optimism occupied the top positions with 41.83% and 21.19% market shares respectively, but both saw slight declines.

Data source: footprint

Data as of December 23, 2024

7. Stablecoin market value and issuance

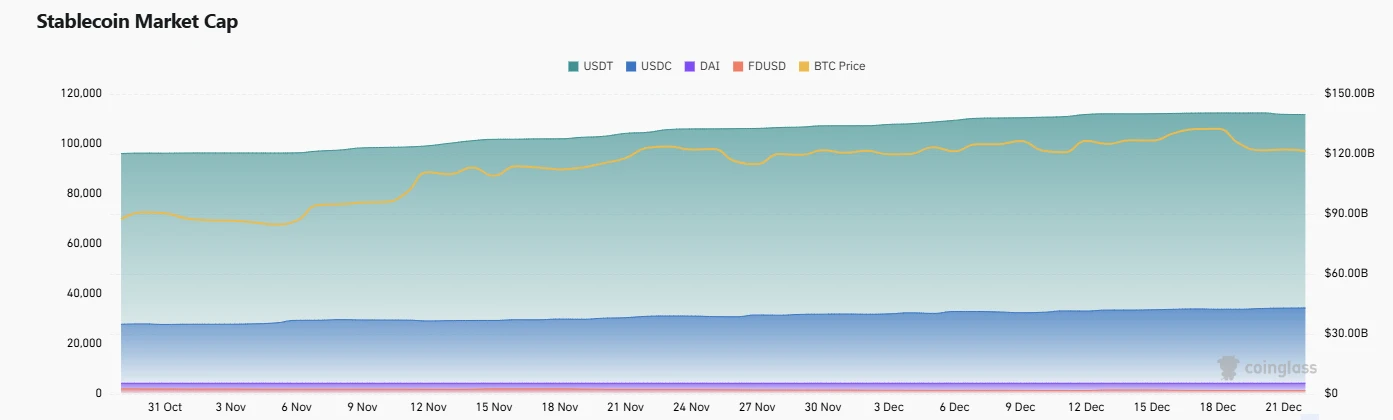

According to Coinglass data, the total market value of stablecoins is now $210 billion, a record high, with an increase of 0.9% in the past week. Among them, the market value of USDT is $139.7 billion, accounting for 66.5% of the total market value of stablecoins; followed by USDC with a market value of $43 billion, accounting for 20.5% of the total market value of stablecoins; and DAI with a market value of $5.3 billion, accounting for 2.5% of the total market value of stablecoins.

Data source: CoinW Research Institute, Coinglass

Data as of December 23, 2024

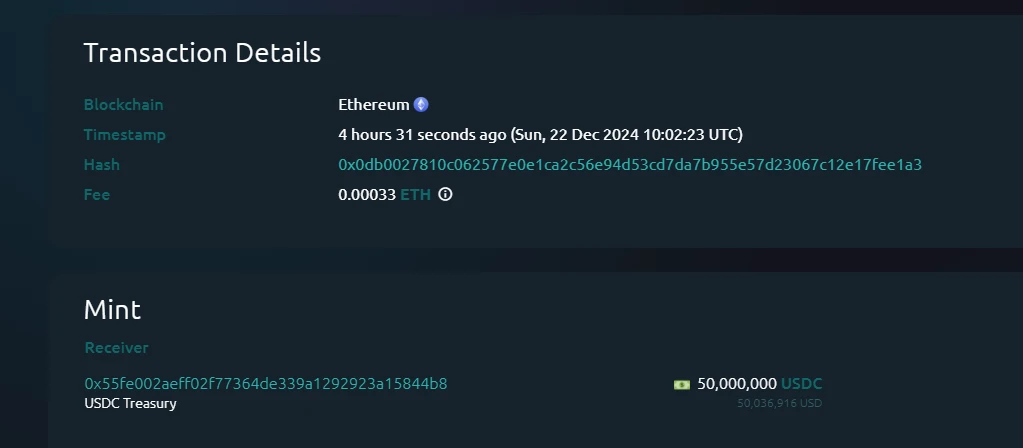

According to Whale Alert data, the USDC Treasury issued a total of 200 million USDC this week, a 90% drop from the total amount of stablecoins issued last week.

Data source: Whale Alert

Data as of December 23, 2024

2. Hot money trends this week

1. The top five VC coins and meme coins with the highest growth this week

Top five VC coins with the highest growth in the past week

Data source: CoinW Research Institute, Coingeck

Data as of December 23, 2024

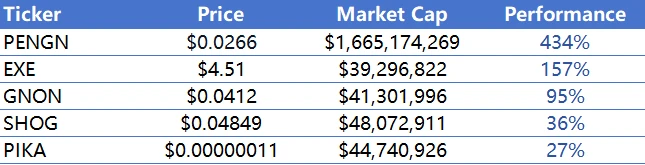

Top 5 Koin Memes That Gained in the Past Week

Data source: CoinW Research Institute, coinmarketcap

Data as of December 23, 2024

2. New Project Insights

Animix, the first pet fusion game powered by GenAI powered by Sophon. There is no TGE yet, the game is still in its early stages. Participate now to get corresponding airdrop points.

-

Alita Exchange is a swap based on SOON that combines the advantages of AMM and PMM. Alita is designed for high-frequency trading, combining transaction speed and liquidity, and is an innovative case of DEX.

-

Chiss Protocol, an avax-based, permissionless, on-chain FX mixer that enables seamless yielding, lending, and affordable global trading.

3. New Industry Trends

1. Major industry events this week

-

The Ethereum Foundation has sold a total of 4,466 ETH in the past year, worth about $12.6 million. According to Lookonchain monitoring, the Ethereum Foundation has sold a total of 4,466 ETH in 32 transactions in the past year, 15 of which were sold at the highest point in a short period of time.

-

Zerebro will work with ai16z to advance the ZerePy open source framework. AI Meme Token Zerebro co-founder Tint said that Zerebro will work with ai16z to advance the open source framework. The ai16z team will be one of the first external contributors to help develop the ZerePy framework, and the Zerebro team will contribute to the Eliza framework.

-

GoPlus tweeted that it seems to be hinting at the upcoming TGE. Web3 network security company GoPlus released three animal emojis, corresponding to tigers, goats and eagles respectively. The first letters of each word are connected to form TGE, which may imply that it is about to conduct TGE.

-

The Trump familys crypto project WLFI increased its holdings by 759 ETH. According to ARKM monitoring, the Trump familys crypto project WLFI exchanged 2.5 million USDC for 759 ETH before December 20.

-

Unichain releases mainnet roadmap, to be launched in early 2025. Unichain released its mainnet phased roadmap and announced that the mainnet will be launched in early 2025. Since the launch of the Sepolia testnet in October, the network has completed 50 million test transactions and more than 4 million test contracts have been deployed. The mainnet will support permissionless fault proofs from the first day of launch to ensure that on-chain activities can be verified, further improving security and decentralization.

2. Big events coming up next week

-

Solanas first global online AI hackathon was held from December 10th to 23rd, with a prize of US$185,000. It included 6 tracks about AI agents. The main track AI Agent product is supported by ai16z and the Solana Foundation. The remaining tracks include: building infrastructure or frameworks for AI agents, building DeFi agents that can interact with the Solana DeFi protocol and manage positions, building tools for artificial intelligence agents to launch and manage token liquidity, building artificial intelligence agents for spot trading, building chat-based agents, and establishing public-facing agents.

-

Sui lending protocol Scallop launched a Christmas airdrop event. From December 14 to December 26, users who meet the loan value greater than US$1,000 or hold more than 1,000 veSCA tokens can participate in sharing 1 million SCA tokens.

-

Sophon released a mining migration timeline, and mainnet mining will be open on December 28. The mining migration timeline of Sophon, a modular blockchain based on ZKsync. The L1 mining withdrawal window will be closed on December 27; all remaining assets will automatically cross-chain to the Sophon mainnet on December 27, and the accumulation of SP points in the first phase will end; mainnet mining will be open on December 28.

-

The Aligned Foundation will distribute a significant portion of the total ALIGN tokens to token holders of Mina, EigenLayer, and Ethereum zk L2, especially those who chose to continue holding at the markets lowest point. Registration closes on December 23, 2024.

3. Important investment and financing last week

-

BVNK, Series B, raised $50 million, with investors including Haun Ventures, Coinbase Ventures, Tiger Global, etc. BVNK provides banking services and payments for crypto-native companies. Companies using BVNK can accept payments in fiat and cryptocurrencies, hold hundreds of different currencies and crypto assets, and send funds around the world. (December 17)

-

Prometheum, $20 million in financing, undisclosed investors, Prometheum is a blockchain-focused company dedicated to building an end-to-end ecosystem for the trading, custody and settlement of digital asset securities. (December 17)

-

Plume Network, raised $20 million, with investors including Haun Ventures, Superscrypt, Galaxy Digital, Faction, HashKey Capital, Brevan Howard Digital, SV Angel, Reciprocal Ventures, etc. Plume is a fully integrated modular chain focused on RWAfi. Plume is building a composable DeFi ecosystem around RWAfis, with an integrated end-to-end tokenization engine and a network of financial infrastructure partners for builders to plug and play. (December 18)

-

Lens Protocol, raised $31 million, with investors including Faction, Fabric Ventures, Foresight Ventures, Wintermute, Borderless Capital, Avail, Digital Finance Group, Circle Ventures, ConsenSys Mesh, Alchemy Ventures, etc. Lens Protocol is a decentralized open social graph that any application can plug into. It aims to enable creators to own the links between themselves and their communities, forming a fully composable, user-owned social graph. The protocol was built from the ground up with modularity in mind, allowing new features and fixes to be added while ensuring that user-owned content and social relationships are immutable. (December 18)

This article is sourced from the internet: CoinW Research Institute Weekly Report (2024.12.16-2024.12.22)

Related: Lumoz Protocol Mainnet Launch: MOZ Token and Node Claims Now Open

To the Lumoz community and users: Today, we are proud to announce that Lumoz Protocol has officially launched its mainnet! This is a significant milestone. Here, we would like to express our sincere gratitude to every community member for their support! Without you, there would be no Lumoz today! After more than two years of preparation, Lumoz has made significant breakthroughs in both technology and market: On the technical level, Lumoz innovatively launched the one-click layer 2 function, and then supported OP Stack + ZK Fraud Proof, creating a new L2 architecture model; then completed the decentralization of the Rollup sorter; the ZK-PoW algorithm continued to optimize, and now it can significantly improve the ZK computing efficiency by 50%; especially the Lumoz ecological chain ZKFair, after applying this algorithm, the…