LBank Labs 2024 Memecoins Report: From Controversial Narrative to a $100B Market

Perkenalan

Sebagai kriptocurrency market matures and evolves, memecoins have emerged as a promising sector with a market capitalization exceeding $100 billion, driven by their unique value-capturing model and community consensus. Against the backdrop of market volatility and tightening regulatory environments, their resilience and vitality have sparked a deep reflection within the industry on their core value.

Bank Tabungan Negara Labs, in collaboration with MetaEra and Lebah Network, has jointly published “2024 Memecoins Report: From Controversial Narrative to a $100B Pasar” to provide comprehensive insights into memecoin trends and future prospects. This in-depth analysis examines market size, ecosystem, infrastructure, and exchange strategies. The report thoroughly outlines the evolution of the Meme market from a retail-driven game to a $100 billion sector, showcasing its ecological value and future growth potential.

- As of November 29, 2024, the total market capitalization of memecoins has surged to $116.82 billion, accounting for 3.5% of the crypto market share, with a continued growth trajectory.

- The overall performance of memecoins in 2024 has been outstanding, with a benchmark index of 279.8%, outperforming major cryptocurrencies like Bitcoin and Ethereum. Memecoins have emerged as a new investment trend, gaining popularity among retail investors, institutions, and funds.

- The flourishing memecoin market owes much to the advancements in underlying infrastructure, particularly the innovative platforms such as Pump.fun, SunPump, and Moonshot, which have significantly reduced the costs of token issuance and participation.

- Memecoins on chains like Solana and Ethereum have demonstrated stronger competitiveness, despite short-lived surges in Q2 and Q3 on Base and Tron chains, respectively, driven by SunPump’s launches. However, these narratives lacked long tail effects.

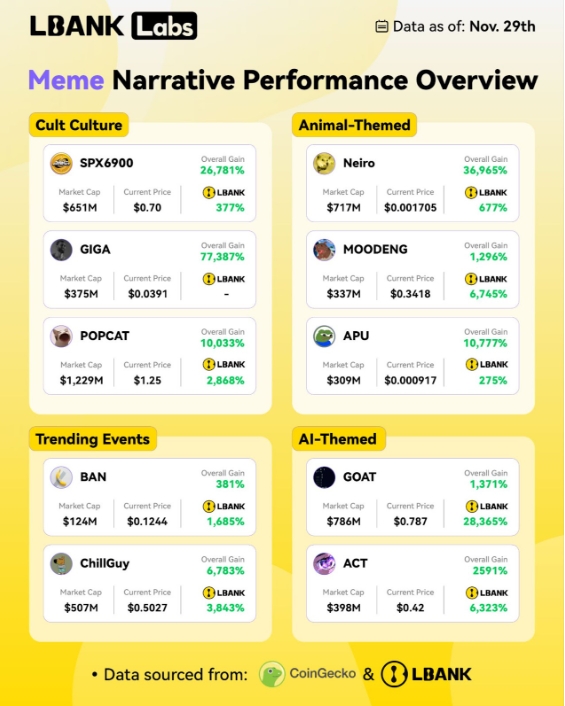

- The 2024 memecoin wave has been influenced by narratives, social trends, and technological advancements. Animal-themed memes and cult culture-based memes dominate the scene, supported by rich cultural roots and loyal fan bases.

- Memecoins have become a new battleground for crypto exchanges, intensifying competition for user traffic between leading platforms and aggressive newcomers. LBank has solidified its position as the “Meme King,” leveraging its early adoption of memecoins and concentrated wealth effects.

- Despite early controversies surrounding memecoins, institutional and retail perspectives have gradually shifted as the market delivered significant returns in the latter half of the year.

1. Memecoin Market Outperforms Other Narratives

Superior Market Performance

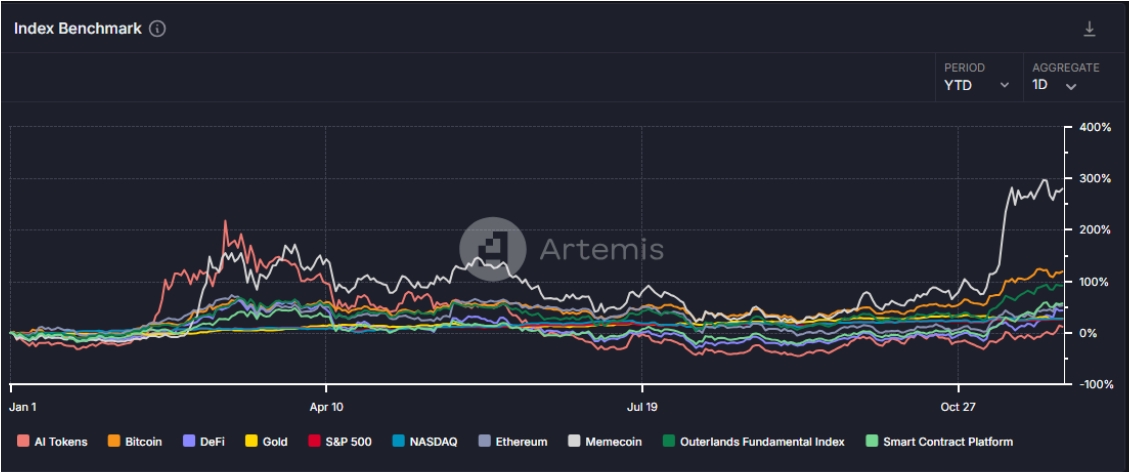

According to Artemis Terminal, as of November 29, 2024, memecoins have achieved a benchmark index performance of 279.8%, significantly outpacing Bitcoin (118.9%) and gold (27.4%). During the first half of 2024, AI tokens led the market, but by March, memecoins surpassed them, maintaining top benchmark performance above 40%. In the second half, as the market recovered, memecoins, Bitcoin, and gold showed positive correlation, with memecoins consistently outperforming.

Source: Artemis Terminal

CoinMarketCap data shows that by November 29, 2024, memecoins’ total market capitalization soared from $22.28 billion at the beginning of the year to $116.82 billion, representing a remarkable 424% increase. Daily trading volume also surged, peaking at $71.91 billion on November 14, compared to a low of $685 million in early February.

Market Cap and Trading Volume

Sumber: KoinMarketCap

November saw the resurgence of a “Meme Summer,” with daily trading volumes stabilizing around $30 billion and occasionally surpassing $70 billion. This trend reflects a robust rebound in market interest and confidence, nearing the highs observed in March.

In 2024, the crypto market underwent a natural selection process, with traditional narratives being questioned amidst financial nihilism. Memecoins, characterized by their viral nature and theatrical absurdity, gained mainstream recognition and became a prominent growth sector within the crypto market.

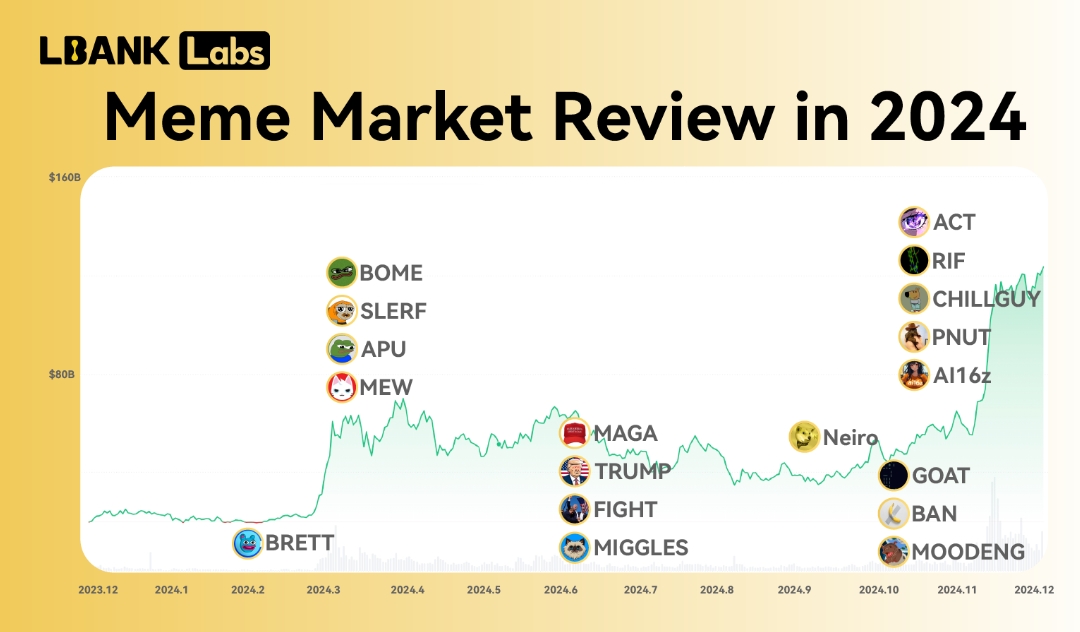

Annual Meme Market Highlights

Starting from mid-March 2024, BOME’s Meme token presale sparked a market frenzy. BOOK OF MEME (BOME), created by Pepe Meme artist Darkfarm, caused a gas fee surge on the Solana blockchain and achieved a market capitalization of $1.9 billion within three days. By late March, Slerf adopted a presale strategy but unexpectedly became a “Fair Launch” social experiment after the founder mistakenly destroyed liquidity tokens. This mishap turned Slerf into a sensation, with its market cap surpassing $100 million, crowning it the new king. From June onwards, the total value locked (TVL) on the Base chain surged to $8 billion, attracting attention to Meme token projects. In July, Mister Miggles’ Meme token skyrocketed by 900 times. As the U.S. presidential election approached, politically themed Meme tokens like People and MAGA (TRUMP) fueled speculative waves.

In Q4, Neiro led a dramatic wave of dog-themed Meme tokens. On Solana, Neiro saw a 50x surge in value after Vitalik sold off MEME tokens. Meanwhile, the uppercase NEIRO on Ethereum briefly rebounded to a market cap of $180 million with the help of exchange promotions but later faced a trust crisis due to a “front-running” scandal. During this time, the community-driven lowercase $Neiro was launched on Binance and soared by 30x, emerging as a rising force in the Meme token space. By late October, $GOAT (Goatseus Maximus), an AI-themed Meme token, rose 70x in just four days and debuted on Binance Futures. At the end of October, $Ban, inspired by a banana artwork auctioned at Sotheby’s, quickly surpassed a market cap of $20 million, becoming a focal point of performance art.

Simultaneously, $ACT and $PNUT became representative Meme tokens in the AI and “rescue-themed” categories. $PNUT, inspired by the tragic story of Peanut the squirrel, evolved into a symbol of political and cultural intersections. On pump.science, two Meme tokens, $RIF and $URO, skyrocketed by 20x within just two days. Binance Labs made its first foray into the DeSci sector, sparking another wave of market innovation. In mid-to-late November, ChillGuy leveraged tweets by the President of El Salvador and Elon Musk to push its market cap beyond $600 million, solidifying its position as a rising star in the Meme token space and showcasing the seamless integration of Meme culture and social media hype.

2. Solana and Ethereum Dominate Meme Ecosystems

Solana and Ethereum have emerged as the main ecosystems for memecoin activity, hosting prominent projects like BOME, Neiro, MOODENG, and GOAT.

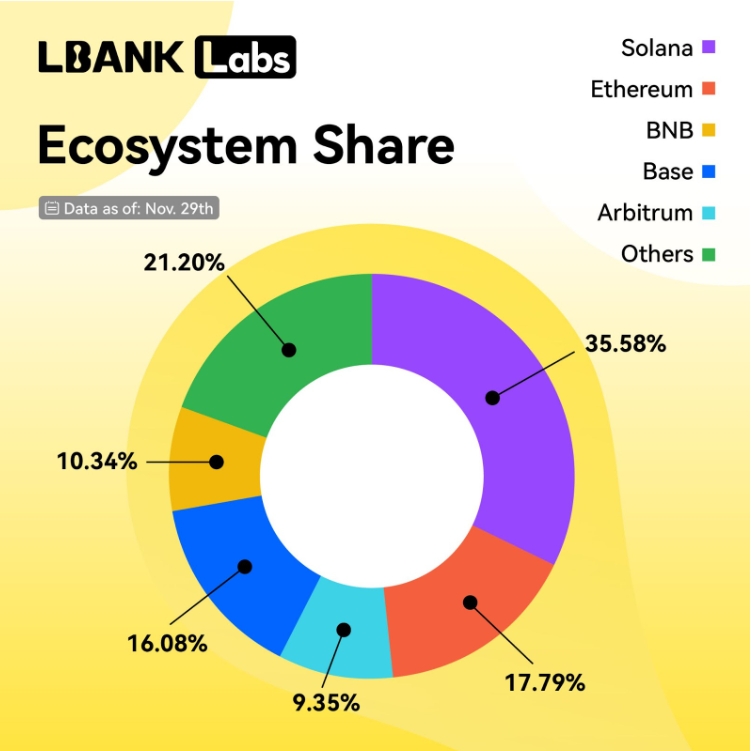

According to CoinGecko data, as of November 29, the total market capitalization of Meme tokens has exceeded $116.82 billion, with daily trading volume remaining around $10 billion. Among these, the market cap of Ethereum-based Meme tokens has surpassed $34 billion, while Solana-based Meme tokens have reached over $20.4 billion. Together, these two blockchains account for 46.56% of the overall market. Notably, the majority of the Top 10 Meme projects originate from Ethereum and Solana, further underscoring their strong influence and appeal in the Meme token ecosystem.

DexScreener data reveals that a substantial number of Meme tokens are created daily, particularly during the Pump.fun and SunPump hype periods, when the number of new Memes created per day reached an astonishing 100,000. Meme tokens have shown remarkable growth across various blockchain ecosystems, including Solana, Ethereum, Base, and BNB.

Ethereum Meme Token Ecosystem

As the birthplace of Meme tokens, Ethereum possesses irreplaceable advantages. Among the Top 10 Meme projects by market capitalization, four are based on Ethereum, with a combined market cap reaching $26.2 billion as of November 29, accounting for 20.85% of the total.

From multiple perspectives, including market share, development history, user base, and user demographics, the leading Ethereum-based Meme tokens not only hold significant market advantages but also enjoy robust community support. In terms of launch dates, most high-market-cap Ethereum Meme tokens were introduced relatively early, with Anjing Shiba Inu (Shib) being the earliest, launched in August 2020, and currently boasting a market cap exceeding $14.8 billion. These tokens have undergone extensive market testing, with time further solidifying user consensus around these projects.

A notable trend observed during this Meme token boom is that liquidity for the same projects on Ethereum is generally much higher than on Solana. For instance, MAGA’s liquidity on Ethereum is a staggering 15.5 times that on Solana, highlighting a significant disparity. Moreover, Ethereum outperforms Solana across key metrics such as market cap, trading volume, and holdings scale, as seen in the case of Neiro.

While Ethereum maintains an edge in market size within the Meme token sector, largely supported by legacy Meme tokens like SHIB and PEPE, its performance in generating new Meme concepts during this “Meme Summer” has been relatively lackluster. The content of Ethereum Memes remains predominantly focused on zoo-themed and PEPE derivative themes.

Solana Meme Token Ecosystem

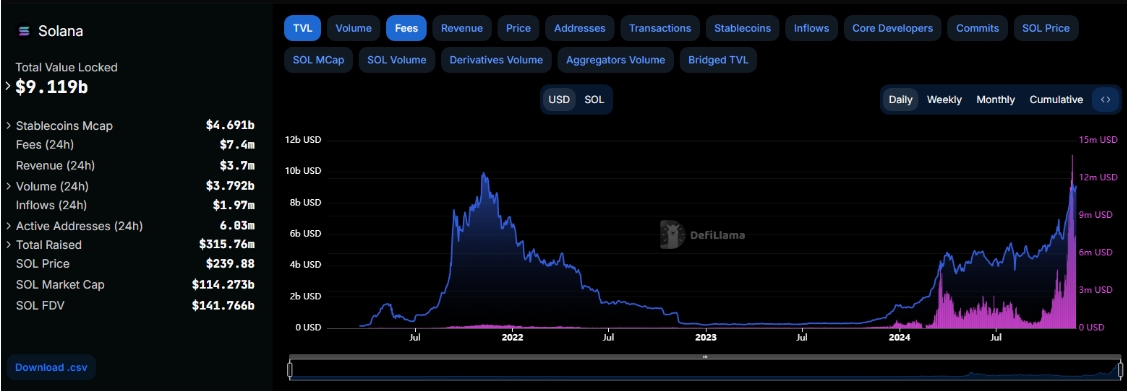

Solana has emerged as fertile ground for this wave of Meme token mania, producing several rising stars that have significantly driven Solana’s data growth and on-chain activity. According to DefiLlama, fueled by the surging speculative fervor around Meme tokens, daily transaction fees on the Solana blockchain peaked at $13.86 million on November 22.

Sumber: DefiLlama

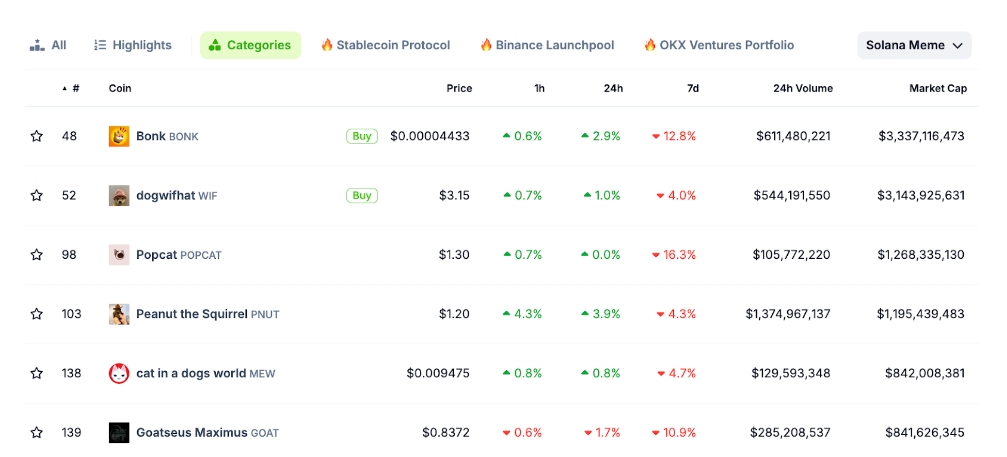

As of November 29, the total market capitalization of Meme tokens on Solana exceeded $20 billion. Among them, Bonk ranks first with a market cap of $3.3 billion, followed by WIF ($3.1 billion), POPCAT ($1.2 billion), PNUT ($1.19 billion), MEW ($840 million), and GOAT ($840 million).

On November 17, Solana witnessed a historic milestone: for the first time, six Meme tokens on the platform each surpassed a $1 billion market cap, all ranking among the top 100 tokens globally.

Sumber: KoinGecko

The Meme boom within the Solana ecosystem owes much to the explosive success of BOME and SLERF in March. These two projects not only created overnight wealth miracles but also, fueled by widespread FOMO sentiment, drove Solana’s rapid growth. Additionally, the extensive engagement of Solana’s founders further amplified the momentum, significantly broadening its influence.

Meme projects on Solana stand out for their ability to capture trending topics quickly, drawing substantial attention. They demonstrate remarkable price growth potential and strong capital attraction. Moreover, their themes are exceptionally diverse, ranging from adorable pets (cats, dogs) and humorous memes to cutting-edge PolitiFi and AI concepts.

3. Infrastructure Enhancements Propel the Meme Market

The explosive growth of the Meme market has been underpinned by advancements in infrastructure and the rapid development of on-chain tools, including robust sniper bots that offer features like limit orders and pool monitoring. These tools enable smarter decisions based on real-time data and actionable signals. At the same time, infrastructure improvements—such as “one-click token listing”, “ultra-low costs”, and “streamlined processes”—have fueled market prosperity. Platforms like Pump.fun, Moonshot, and SunPump have emerged, accelerating the arrival of Meme Summer.

Among these, Pump.fun has leveraged its first-mover advantage to secure a prime position within the ecosystem, continuously attracting market attention and creating a liquidity aggregation effect. This platform not only generates traffic but also sustains liquidity growth through incremental inflows.

Pump.fun Overview

Pump.fun, founded by Alon in January 2024, is a Solana-based platform for creating and trading Meme tokens. It allows anyone to launch their own Meme token at minimal cost (0.02 SOL). To date, Pump.fun has issued over 1 million Meme tokens, accounting for 67.5% of Solana’s daily token issuances, and has become the most profitable protocol on Solana.

In 2024, many popular Meme tokens were launched on Pump.fun, including PNUT (market cap: $1.19 billion) and GOAT (market cap: $840 million).

Fitur Inti

- Core Mechanisms:

- No team allocations

- No presales

- Automated liquidity injection

- Unique Bonding Curve Pricing Model

- Low Token Listing Costs and Ease of Use:

Users do not need any programming skills or technical background. By paying only 0.02 SOL, they can create and issue their own Meme tokens.

Pump.fun’s Market Performance and Wealth Effect

According to Dune Analytics, as of November 29, Pump.fun has deployed over 4 million Meme tokens since its launch in February. The platform has captured a total of 1,527,143 SOL in revenue, amounting to over $1.5 million in total earnings.

Sumber: Bukit pasir

Sumber: Bukit pasir

According to data from DefiLlama, Pump.fun is currently the eighth-highest revenue-generating blockchain protocol. Over the past 30 days, it recorded a transaction fee revenue of $86 million, with cumulative fee revenue surpassing $225 million. On November 25, Pump.fun achieved a significant milestone by surpassing Tether in daily revenue for the first time. It reported $14.49 million in daily income, becoming the highest revenue-generating protocol within a 24-hour period.

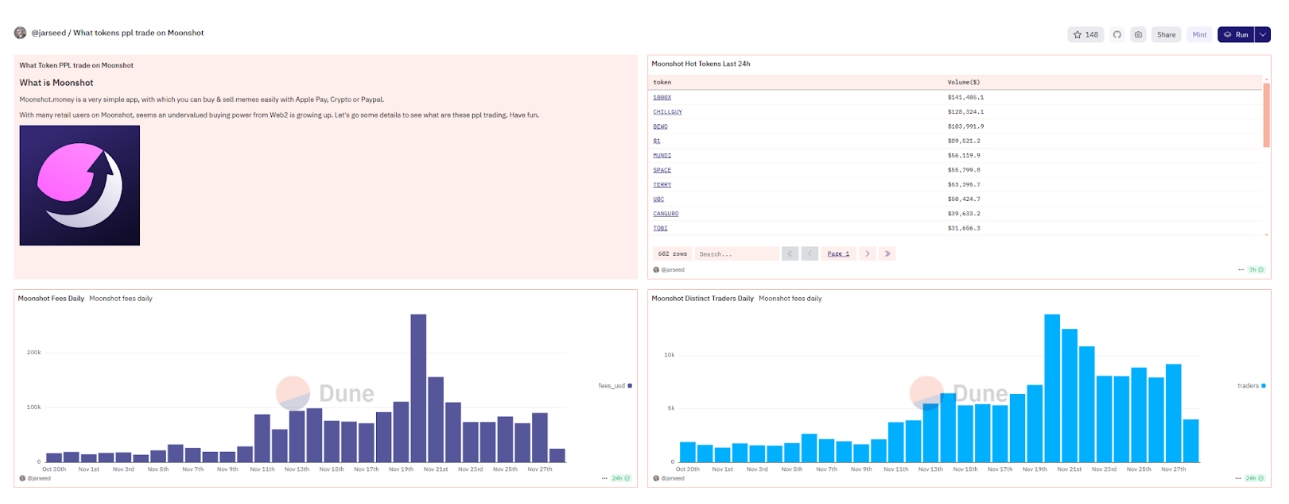

MoonShot

Moonshot is a mobile application built on the Solana network, specifically designed for Meme token trading. It allows users to purchase Meme tokens directly using fiat currencies via Apple Pay, credit cards, and PayPal. By simplifying cryptocurrency operations, Moonshot has attracted a significant number of traditional users to invest in Meme tokens.

Moonshot was incubated by the Alliance DAO, the team behind Pump.fun. During its initial launch, it was endorsed by the emerging Meme influencer Murad. Following the listing of $MOODENG and $GOAT, both tokens experienced exponential growth, with gains exceeding tens of times their initial value, quickly capturing mainstream attention.

Fitur Inti

- Fiat Onboarding: Users can swiftly fund their accounts through Apple Pay, credit cards, and PayPal.

- Token Screening and Listing Mechanism: Moonshot rigorously screens and rapidly lists trending Meme tokens, offering users opportunities for substantial returns.

- Seamless Trading: All transactions are conducted via the Solana blockchain, eliminating the need for wallet management or gas fees, and are completed within seconds.

Moonshot’s Market Performance and Wealth Effects

Data from Dune reveals a consistent upward trend in Moonshot’s trading volume and transaction fees. Since September, Moonshot’s daily transaction fee revenue peaked at $270,000, with a maximum of 13,856 active users in a single day.

Sumber: Bukit pasir

As a mobile platform focused on Meme token trading, Moonshot maintains a strategy of low-frequency, high-quality token listings through its stringent screening mechanism. Several promising Meme tokens have delivered stellar performances shortly after their listing. Notably, MOODENG and GOAT achieved remarkable growth of 100x and 30x, respectively, post-launch, rapidly drawing attention from retail investors and triggering waves of short-term value surges. Moonshot’s “curated listings and explosive growth” model has emerged as a highly sought-after feature in the Meme token market.

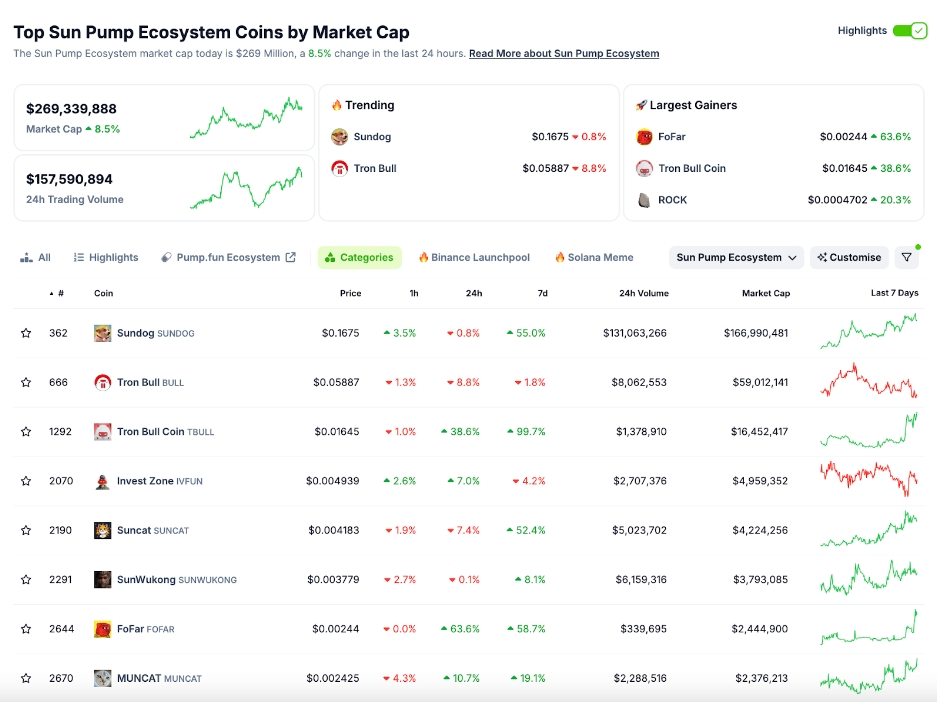

SunPump

SunPump is a Meme token generation platform built on the TRON network. Launched by Sun.io on August 9, the platform enables users to create their own Meme tokens by simply selecting an image, defining the token supply and theme, and paying a minimal fee.

Fitur Inti

- One-Click Token Issuance: Users can issue their own Meme tokens by filling out basic information, such as token name, symbol, description, and image, and paying a small TRX fee.

- Bonding Curve Pricing Model: SunPump leverages a bonding curve pricing model, ensuring fair trading conditions for all participants and mitigating price manipulation issues commonly associated with traditional ICOs.

- Automatic Liquidity Injection: When a Meme token’s market cap reaches a specific threshold, SunPump automatically injects a portion of funds into the SunSwap V2 liquidity pool and burns an equivalent number of tokens.

- Gas Fee Discounts: SunPump offers gas fee reductions of up to 99%.

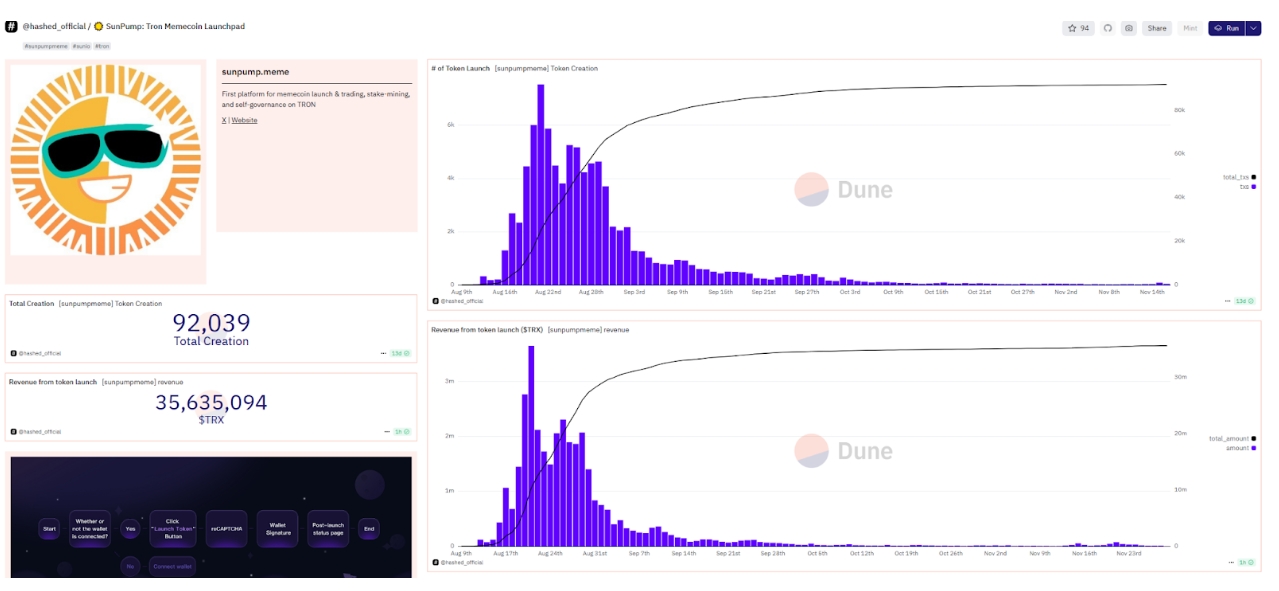

SunPump’s Market Performance and Wealth Effects

Sumber: KoinGecko

According to data from CoinGecko, as of November 29, the market capitalization of the SunPump ecosystem exceeded $220 million. Insights from Dune revealed that SunPump had successfully facilitated the creation of 92,039 Meme tokens, generating a total profit of 35,635.04 $TRX. On-chain gas fees and trading volumes peaked on August 21, with daily revenue surpassing Pump.fun, reaching $560,000.

Sumber: Bukit pasir

While Meme projects on the SunPump platform exhibit notable short-term effects, they often face challenges in sustaining long-term growth. For instance, Sundog, the most popular Meme token on SunPump, rapidly climbed to a $200 million market cap within a week of its launch. However, its subsequent momentum waned, with its market cap stabilizing at approximately $160 million.

4. Meme Narratives Shaped by Trending Events, Celebrity Endorsements, Cult Culture, and AI Integration

Meme tokens, a unique phenomenon in the cryptocurrency market, have demonstrated diverse developmental trajectories across different market cycles. The Meme Summer of 2024 reflected the influence of market sentiment, narrative innovation, celebrity endorsements, technological advancements, and the adoption of unique mechanisms. Meme tokens have evolved into multifaceted instruments, mirroring investor sentiment, highlighting trending events, and leading market narratives.

Current Meme tokens can be categorized into four primary types:

- Cult Culture Tokens: Exemplified by POPCAT, these tokens gain market traction through distinctive community culture and symbolism.

- Established Meme coins like DOGE, endorsed by the “Meme Godfather” Elon Musk, and emerging players like Neiro form zoo-themed tokens category, leveraging celebrity endorsements and enduring market influence.

- Trend-Driven Tokens: Tokens such as BAN, which capitalize on trending events and quickly transform them into quantifiable market opportunities.

- AI-Themed Tokens: Examples like GOAT and ACT incorporate technological narratives to capture the attention of tech enthusiasts and investors.

The Cult and Zoo-themed Meme tokens demonstrated remarkable market resilience during the Meme Summer of 2024, especially after enduring market corrections and prolonged periods of volatility. By early November, they experienced a clear rebound and continued to display strong long-tail effects.

Cult-themed Meme tokens, such as POPCAT, have gained significant market recognition through specific cultural symbols and a carefully crafted community spirit. In contrast to the widespread appeal of Zoo-themed Meme tokens, Cult culture tokens place greater emphasis on community cohesion and exclusivity. These tokens maximize user engagement through a unique “inner-circle” culture, which not only strengthens loyalty during market upturns but also demonstrates robust market endurance during downturns or times of increased uncertainty.

Zoo-themed Meme tokens are among the most entertaining and socially engaging categories in the crypto landscape. From Doge and Shib, bolstered by Elon Musk’s frequent endorsements, to rising stars like Neiro and APU, these tokens leverage simple, highly shareable imagery and humorous marketing strategies to maintain strong user engagement over the long term. While the early performance of Meme tokens often hinges on market sentiment fluctuations and speculative hype, their distinctive cultural and social identity, coupled with celebrity backing, equips them with greater market resilience. In 2024, as the market rebounded, Zoo-themed Meme tokens experienced renewed momentum, underpinned by their long-standing cultural resonance. Notably, the PNUT redemption story emerged as a milestone for Zoo-themed Meme tokens, symbolizing the category’s unparalleled resilience and inclusiveness. PNUT’s comeback catalyzed the rise of a wave of redemption-themed Meme tokens, further underscoring the durability of Zoo-themed Memes.

Hotspot-mapping and AI-themed Meme tokens represent the convergence of rapidly shifting market trends and advancements in technology. Tokens like BAN, which arise from hotspot mapping, derive their value from their ability to respond swiftly to market events and convert that agility into significant investor attention. Meanwhile, AI-themed Meme tokens capitalize on “technology-driven” and “future potential” narratives, attracting a substantial audience of tech-savvy investors and AI enthusiasts.

The Meme Summer of 2024 was dominated by Cult culture, Zoo-themed tokens, hotspot events, and AI innovation. As the Meme market continues to evolve, its narratives are expected to become increasingly diverse. Platforms like TikTok and other short-video ecosystems have significantly amplified the speed and reach of Meme dissemination. For instance, TikTok-themed Meme tokens like Chillguy captivated the market, exemplifying the seamless integration of hotspot events with celebrity influence. Looking ahead, the interplay of multidimensional narratives will continue injecting fresh vitality into the Meme market, paving the way for greater innovation and creative potential.

5. Meme coins as Traffic Magnets: LBank Ascends as the New Meme King

In the increasingly competitive landscape between centralized exchanges (CEXs) and decentralized exchanges (DEXs), traditional CEXs are experiencing mounting pressure. To secure new revenue streams and capture a greater share of the market, CEXs are strategically adjusting their listing policies, increasingly catering to the rising demand for Meme tokens. Thanks to their viral nature and rapid wealth-generation potential, Meme tokens have emerged as a critical tool for attracting new users and driving capital inflows.

Much like Bitcoin’s dual nature as both a safe-haven and a risk asset, Meme tokens represent a distinct asset class for most exchanges. Their explosive growth potential satisfies investors’ strong appetite for returns while lowering the entry barrier to allocating risk assets.

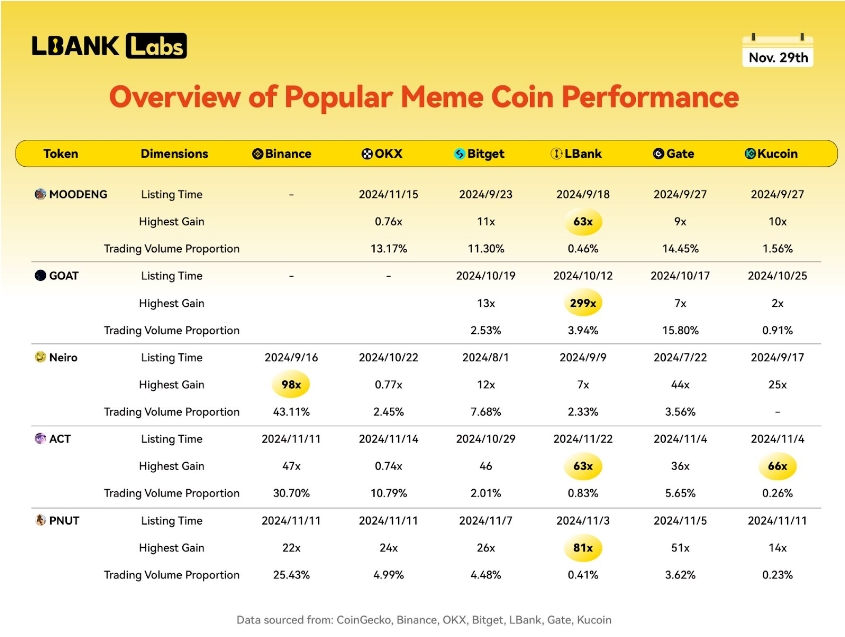

To evaluate the competitiveness of exchanges listing Meme tokens, we’ve compiled key data from leading Meme tokens. Metrics such as listing timelines and peak price surges provide a comprehensive picture of how effectively exchanges respond to market trends. Details are as follows:

- Meme Token Listings Overview

An analysis of Meme token listings across major exchanges in 2024 reveals that LBank, Gate, and Bitget lead in the number of listed Meme assets, totaling 281, 63, and 46 tokens respectively. Meme tokens constitute a significant portion of their listings, with LBank at 34%, Gate at 15%, and Bitget at 9%.

- Key Performance of Popular Meme Tokens

Key metrics, including listing timelines, price growth, and market trading volume, offer insights into the competitive dynamics of Meme tokens. Binance maintains the largest market share and significant listing influence. However, compared to second-tier exchanges like LBank, Bitget, and Gate, Binance’s listing impact has shown signs of diminishing.

Second-tier exchanges, including LBank, Gate, and Bitget, have leveraged sharper market insights and faster listing speeds to capture early advantages in the Meme token market. These platforms have become prime venues for PVP (player-vs-player) trading strategies targeting Beta returns. For instance: On September 23, LBank was the first to list MOODENG, achieving a staggering 63x price increase. Additionally, tokens like GOAT and PNUT saw record-breaking gains of 299x and 81x respectively on the platform.

In April, LBank’s special partnership with SLERF attracted significant traffic, with tokens like GOAT and Neiro surpassing KuCoin in trading volume and matching OKX’s performance. During the early stages of the Meme token frenzy, exchanges that quickly listed trending projects successfully drew large community user bases and trading volumes. This strategy established strong competitive barriers in the sector.

The competitive landscape for Meme tokens is becoming increasingly segmented: Top-tier exchanges rely on brand influence and existing user bases, while second-tier exchanges, such as LBank, have emerged as leaders by adopting agile listing strategies closely aligned with market sentiment, often outpacing larger competitors in capturing market share.

This trend underscores a shift in exchange competitiveness, moving beyond scale and branding to emphasize timeliness and precision in addressing user demands. These strategic adjustments reflect a proactive alignment with Meme culture and a calculated effort to capitalize on the cyclical nature of the crypto market. By fostering a narrative around the “emerging retail investor force,” exchanges are enhancing their influence and relevance in the evolving market landscape.

This evolution highlights the critical role of Meme-driven sentiment as a core

component of exchange revenue strategies, reinforcing its importance in shaping market trends.

6. Evolving Attitudes Toward Koin Memes Among Institutions and Investors

VC-backed tokens, once hailed as the “future stars” of the crypto industry due to their robust financial backing and technical teams, have faced challenges. The influx of private capital and aggressive valuations have led many VC tokens to struggle with low circulating supply and high fully diluted valuations (FDV), making it difficult to realize their long-term value.

In mid-to-late April, a16z General Partner Eddy Lazzarin publicly endorsed VC-backed tokens and criticized meme coins for disrupting the crypto market, triggering backlash from retail investors and fueling a debate between proponents of VC-backed tokens and meme coins. However, in October, an offhand remark by a16z co-founder Marc Andreessen sparked the creation of the first AI-driven meme coin, GOAT, marking a new trend for meme coins.

Unlike VC tokens, which rely heavily on technological and financial support, the value of meme coins is derived from community enthusiasm and the cultural resonance of memes. While this unique dynamic introduces uncertainty and volatility, it also injects unprecedented vitality into the crypto market.

Different types of meme coins reflect diverse cultural contexts and fan bases, which directly influence their longevity, virality, and community engagement. Animal-themed memes, cult-culture memes, and AI-driven memes, supported by their rich cultural backdrops and dedicated fan communities, continue to captivate the market. By contrast, other meme coin types often rely on short-term trends, experiencing rapid spikes in interest that fade quickly.

With the increasing adoption of decentralized issuance mechanisms, meme coins have improved in transparency and credibility, gaining broader recognition. Notably, large institutions have started accelerating their involvement in the meme space. For instance:

- Paul Veradittakit, a partner at Pantera Capital, described meme coins as the “Trojan horse of crypto.”

- Market makers like DWF Ventures highlighted meme coins as a strategic new go-to-market (GTM) approach.

- VanEck’s MarketVector introduced a meme coin index.

- Franklin Templeton published multiple reports on meme coins.

The meme coin frenzy has also caused market distortions and new levels of abstraction in the space. Trends like “sending tokens to Vitalik Buterin,” token name capitalization differences, and the use of blank characters have amplified speculative behavior and short-term market manipulation.

The rise of AI meme coins like GOAT has captured significant attention, achieving astronomical returns in a matter of days. For example, GOAT experienced a 1,000x surge in a single week, contrasting with the longer cycles seen in earlier meme coins that built community consensus over months.

Yet, an analysis of on-chain data and online influencer dynamics reveals potential pitfalls of a player-versus-player (PVP) trap. Early a16z co-founder investments of $50,000 BTC offered a foundation for GOAT’s meteoric rise, bolstered by BitMEX co-founder Arthur Hayes’ enthusiastic promotion. GOAT’s market cap soared to $500 million but plummeted 54% after Truth Terminal linked the token to a stock ticker with the same name. This downturn reversed within 24 hours when top trader Eugene announced on social media that he had purchased GOAT, while the founder of Truth Terminal stated, “I will not sell my personal holdings of 1.25 million GOAT for now.” Following these announcements, GOAT rebounded past 0.44, surging over 50% within an hour. As of November 29, GOAT’s market cap stabilized around $800 million.

The meme coins attract significant liquidity in a short time, with price fluctuations directly influenced by institutional actors and KOL statements. It remains unclear whether this behavior represents disguised institutional manipulation or market makers exploiting speculative cycles.

To be frank, VC coins and Meme coins are not inherently opposing or contradictory. The core issue lies in the way expectations are realized. Rather than being adversaries, the two appeal to user groups with different preferences.

The debate between VC tokens and meme coins highlights differing economic models and market dynamics in crypto. VC tokens leverage financial and technological resources to quickly attract attention and capital. In contrast, meme coins thrive on community-driven culture and emotional resonance, fostering innovation and market excitement despite their volatility. Both approaches serve distinct user preferences and contribute to the broader development of the crypto ecosystem.

As 2024 draws to a close, the “Meme Summer” phenomenon continues to dominate, cementing meme coins as an integral part of the crypto landscape. No longer just speculative assets, meme coins are evolving into a structural component of the market. For retail investors, developers, and institutional participants alike, meme coins demonstrate the transformative power of culture, sentiment, and community in shaping the future of the crypto industry.

With advancements in AI and the expansion of the Web3 ecosystem, meme coins are poised to become one of the most representative and disruptive asset classes in crypto. The next wave of innovation will unfold at the intersection of meme culture and societal trends, with emerging narratives and projects redefining the value and significance of crypto assets.

Joint Publishing Unit:

About MetaEra

MetaEra is a Hong Kong-based leading blockchain media platform dedicated to advancing the Web3 ecosystem and blockchain technology. With a focus on delivering high-quality news, in-depth analysis, and industry insights, MetaEra has become a trusted source of information for blockchain enthusiasts and professionals worldwide.

MetaEra covers a wide range of topics, including blockchain technology, cryptocurrency markets, decentralized finance (DeFi), NFTs, and the metaverse. Through its multilingual content and global reach, the platform bridges the gap between communities and fosters collaboration within the Web3 space.

In addition to its media coverage, MetaEra actively engages the industry through online seminars, expert interviews, and co-hosted events, positioning itself as a key player in promoting dialogue and innovation in the blockchain industry.

About Bee Network

Bee Network is a blockchain-based ecosystem designed to facilitate the widespread adoption of decentralized technology by providing an accessible and user-friendly platform. Through its mobile application, Bee Network enables users to earn Bee Tokens by participating in simple, daily activities, thereby lowering the barriers to entry for blockchain engagement.

With a vision to create a transparent, secure, and scalable ecosystem, Bee Network aims to expand the practical use cases of its token, including applications in payments, decentralized transactions, and broader blockchain functionalities. The platform’s community-driven approach fosters global engagement, and through ongoing technological development, Bee Network seeks to offer sustainable value and opportunities to its growing user base.

Original article by: Aoyon Ashraf, Nick Baker Original translation: BitpushNews summary: After MicroStrategy’s coin hoarding strategy worked, many companies (some small-cap and non-crypto-related) began to announce similar moves. The strategy has led to sharp short-term gains in the share prices of some of these companies, but the long-term remains uncertain, according to market watchers. While optimists see this as a step towards more mainstream Bitcoin adoption, skeptics see it as just short-term hype from a few small companies. text: Fitness equipment manufacturers, biopharmaceutical companies, battery materials producers…what do these diverse companies have in common? Of course it’s Bitcoin. As BTC surged to unprecedented levels this month, at least a dozen public companies that had nothing to do with crypto previously announced plans to buy Bitcoin (BTC) as a medium to…