Understand the economic pulse and seize the opportunity of the crypto market with XT: Weekly calendar

This article will focus on analyzing strategies on how to capture trading opportunities during volatility.

This weeks economic hot spots – consumer confidence, inflation data and job market dynamics – have triggered sharp fluctuations in Bitcoin , Ethereum dan lainnya altcoins . Is your trading strategy ready? Looking ahead to next week, what changes will the market usher in?

Staying Ahead of Crypto Pasar Opportunities: This Week’s Key Events

Global economic events are increasingly affecting the kriptocurrency market, and as a trader, it is particularly important to keep up with the latest developments. This weeks economic calendar covers a number of important data releases, including the Consumer Confidence Index, the Personal Consumption Expenditure (PCE) inflation report, and unemployment claims data. These data may be the key to driving market volatility in Bitcoin (BTC), Ethereum (ETH), and other altcoins.

These economic events bring profit opportunities to the market, but also come with potential risks.

This article will focus on analyzing:

-

Strategies on how to capture trading opportunities during volatility.

-

The most noteworthy economic data this week.

-

How this data may affect the Bitcoin, Ethereum, and altcoin markets.

Economic data highlights

Consumer Confidence Index (US) – Tuesday

Why it’s important: The Consumer Confidence Index is an important indicator for measuring consumers’ views on the current state of the economy and future expectations. It directly affects consumption trends and market liquidity, and has a significant impact on the sentiment of the cryptocurrency market.

Image source: The Conference Board Consumer Confidence Index

Data review: The consumer confidence index rose to 102.0 in November, higher than 99.1 in October, indicating that consumers are optimistic about the future economic outlook. However, the current situation index fell slightly to 138.2, reflecting that consumers still have different views on the current economy and job market.

Impact on the crypto market:

-

Positive for altcoins: Positive consumer sentiment boosts demand for speculative assets, especially altcoins .

-

Bitcoin remains stable: Bitcoin continues to attract conservative investors due to its safe-haven properties.

-

Stablecoin hedging: Using stablecoins as a hedge against short-term market fluctuations helps reduce risk.

2. PCE Inflation Report (US) – Wednesday

Why it’s important: PCE inflation data is a key reference for the Federal Reserve to formulate monetary policy, directly affects market liquidity and investor sentiment, and plays an important role in cryptocurrency prices.

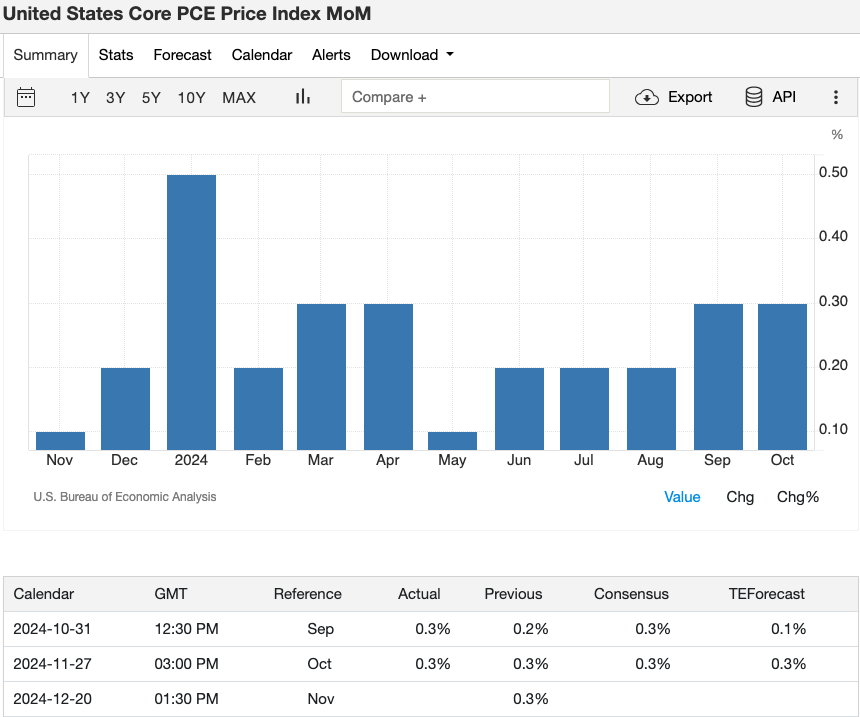

Image source: Trading Economics

Data review: In October, the core PCE index increased by 0.3% month-on-month and 2.8% year-on-year, in line with market expectations and reaching a six-month high. Service prices rose by 0.4%, while commodity prices fell by 0.1%.

Impact on the crypto market:

-

Good for Bitcoin: Stable inflation data may ease market concerns about further interest rate hikes and boost optimism. High-yield assets such as Bitcoin will perform better in this environment.

-

Altcoins are under pressure: High inflation data may lead to increased concerns about tightening policy, weaken market liquidity, and be unfavorable to the performance of altcoins .

3. Other data releases

a. Revised GDP (US) – Wednesday

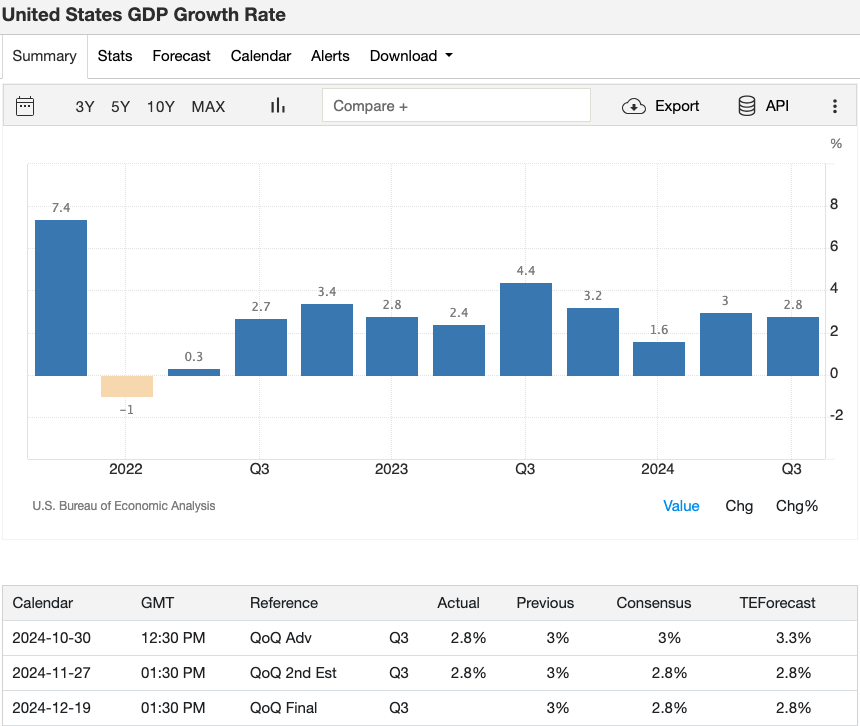

Why it’s important: GDP revisions reflect economic growth more accurately and have an important impact on investor confidence and market risk appetite.

Image source: Trading Economics

Data review: The annual growth rate of US GDP in the third quarter was 2.8%, in line with market expectations, but lower than 3% in the second quarter. Consumer spending grew by 3.5%, exports grew by 7.5%, but corporate investment grew only slightly by 0.3%. At the same time, the personal savings rate fell to 4.8%.

Impact on the crypto market:

-

Positive signal: Steady GDP growth shows economic resilience, which may boost investor confidence and drive up demand for cryptocurrencies.

-

Liquidity considerations: Slower growth may prompt more cautious monetary policy, which will have an indirect impact on market liquidity.

b. Personal Income and Outlays (U.S.) – Wednesday

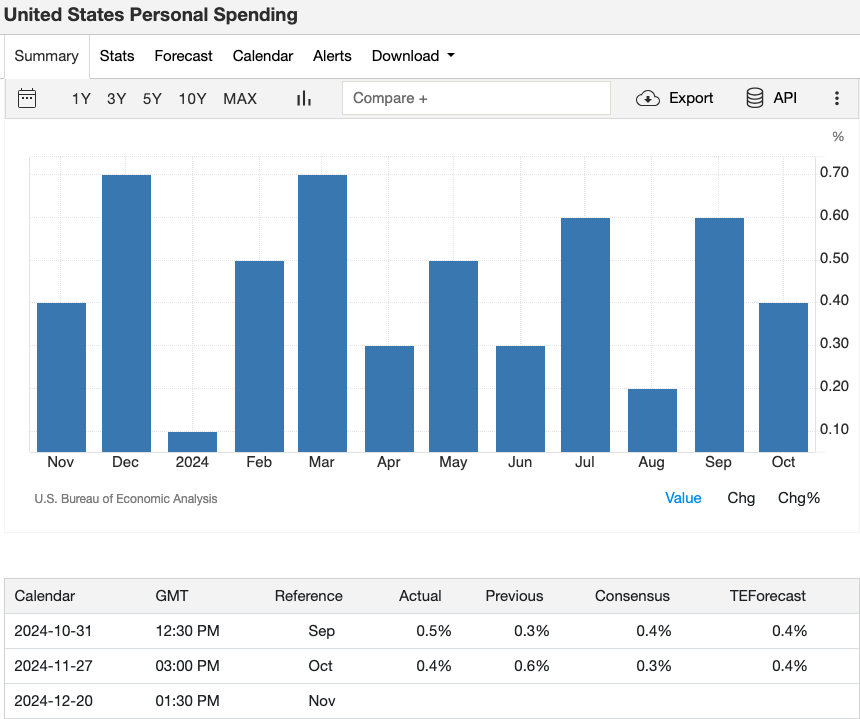

Why its important: Personal income and expenditure data reflect consumers financial status and purchasing power, and are important indicators of market liquidity and economic activity.

Image source: Trading Economics

Image source: Trading Economics

Data review: Personal income in October increased by 0.6% month-on-month, the largest increase in seven months, and personal spending increased by 0.4%, higher than market expectations. Service spending was the main growth driver, while commodity spending remained basically flat.

Impact on the crypto market:

-

Positive for risky assets: Growth in income and spending shows economic resilience and could boost demand for cryptocurrencies.

-

Industry Trends: Increased spending on services could boost the appeal of payment-oriented blockchain projects, while growth in durable goods spending could drive market sentiment related to the DeFi and NFT ecosystems.

c. Unemployment Claims (US) – Wednesday

Why it matters: Jobless claims data is an immediate indicator of the health of the labor market and has an important impact on consumer confidence and spending trends.

Image source: Trading Economics

Data review: The number of first-time unemployment claims remained at 213,000, lower than the market expectation of 216,000. However, the number of unadjusted unemployment claims rose sharply to 243,389, indicating that employment pressure in some regions has increased.

Impact on the crypto market:

-

Liquidity impact: Continued strength in the labor market could delay the implementation of loose policies, affecting trading volumes and price volatility of cryptocurrencies.

Crypto Market Outlook and Trading Opportunities

Current Market Trends

-

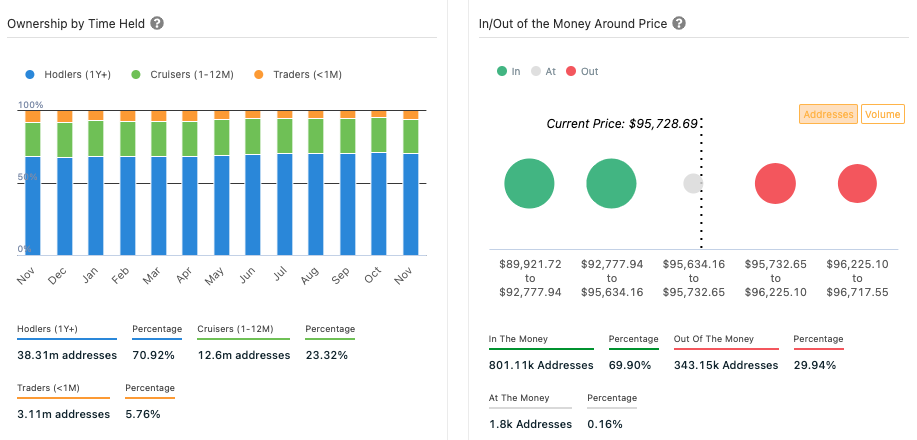

Bitcoin (BTC): Currently trading at around $95,943, despite a pullback from highs near $100,000, continued buying by institutional investors such as MicroStrategy shows long-term confidence in Bitcoin.

Image source: IntoTheBlock

-

Ethereum (ETH): Ethereum , currently priced at $3,677, has benefited from the rapid development of decentralized finance (DeFi) and the growing popularity of Layer-2 scaling solutions.

Image source: IntoTheBlock

-

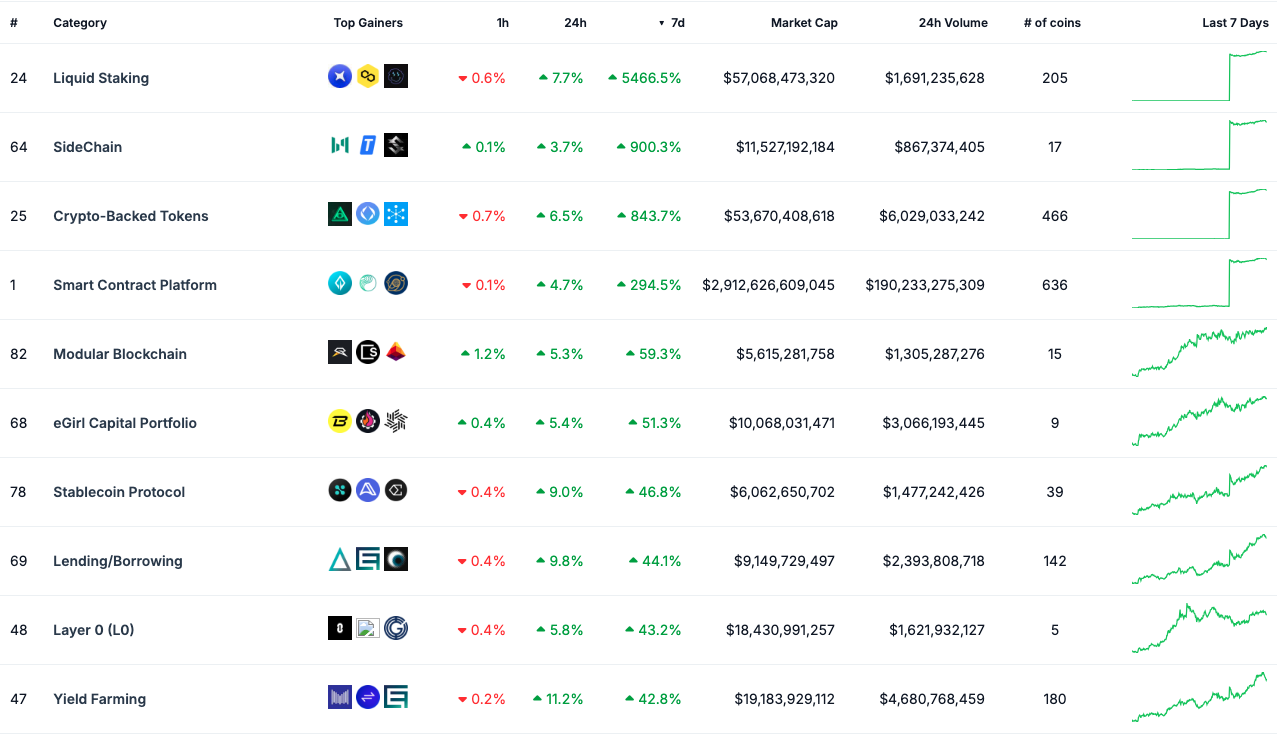

Altcoins: Dogecoin surged 17.2% last week. In addition, tokens related to Liquid Staking, Layer-2, modular blockchains, and crypto lending have attracted much attention and gradually become a hot spot in the market.

Image source: CoinGecko

Trading opportunities

-

Capture market volatility: Recent price volatility in Bitcoin Dan Ethereum has presented excellent opportunities for short-term traders, particularly for scalping and swing trading.

-

Institutional buying boosts: Institutions such as MicroStrategy continue to increase their holdings of Bitcoin, which not only enhances market stability but also provides strong support for future price growth.

-

DeFi Yield Opportunities: Stablecoin lending and staking platforms such as Yaa Dan Melengkung offer solid returns in an uncertain macro environment and are ideal for investors.

Risks to watch out for

-

Regulatory policy uncertainty: Although the regulatory environment for cryptocurrencies has been relaxed recently, sudden policy changes may have a significant impact on the market and need to be closely monitored.

-

Market correction pressure: Bitcoin’s failure to break through the $100,000 high reflects that there is still some downward pressure in the market, which may trigger wider market fluctuations.

-

Liquidity Risk: If inflation persists or the Fed maintains a hawkish stance, market liquidity may tighten, which would be particularly unfavorable for the performance of speculative tokens and small-cap altcoins .

-

Leverage risk: High-leverage transactions can easily trigger forced liquidation during sharp fluctuations, causing investors to suffer greater losses.

Strategic Recommendations

Traders need to adopt flexible strategies to seize short-term opportunities brought by market fluctuations, while focusing on long-term growth areas such as DeFi and blockchain infrastructure . Using stablecoins to hedge market risks, combined with effective risk management strategies, can help you stay invincible in a rapidly changing market environment.

Outlook: Key economic indicators for next week

As we enter the first week of December, a number of key economic data will have a significant impact on market sentiment. These data may directly affect the performance of Bitcoin , Ethereum and other cryptocurrencies.

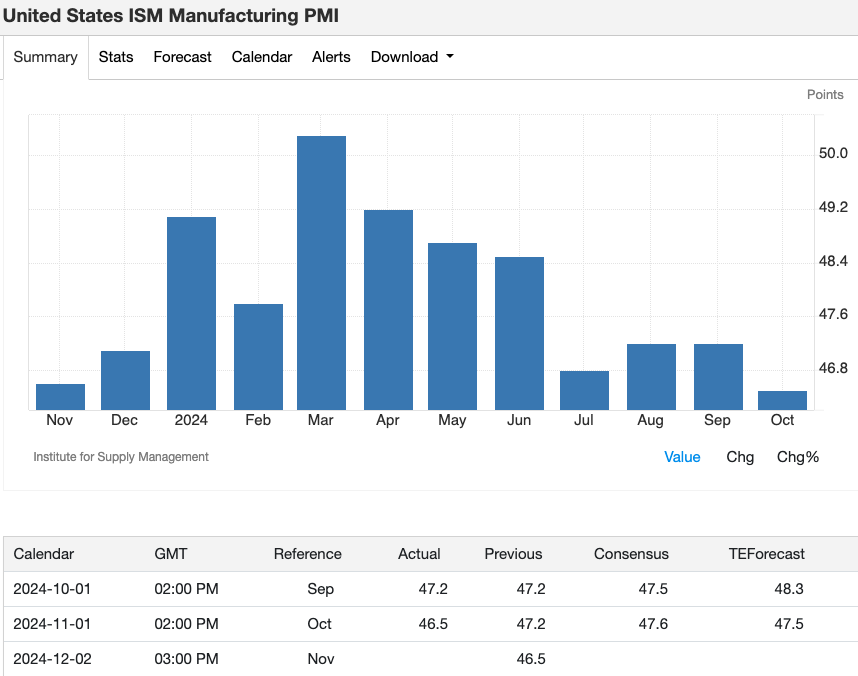

1. ISM Manufacturing PMI (US)

Release date: Monday, December 2 Why its important: The ISM Manufacturing PMI is an important indicator of the activity of the US manufacturing sector. A reading below 50 indicates that the economy may be in a state of contraction, which has an impact on risk appetite in global markets.

Image source: Trading Economics

Impact on the crypto market:

-

Weak data: Bitcoins appeal as a safe-haven asset increases.

-

Strong data: Investors may prefer the stock market, and funds are less likely to flow into the crypto market.

2. JOLTS job openings (US)

Release date: Tuesday, December 3 Why its important: JOLTS data reflects the vitality of the labor market and is an important reference for assessing economic momentum.

Image source: Trading Economics

Impact on the crypto market:

-

If job vacancies decrease, it may increase market expectations for loose policies, which is good for Bitcoin Dan Ethereum .

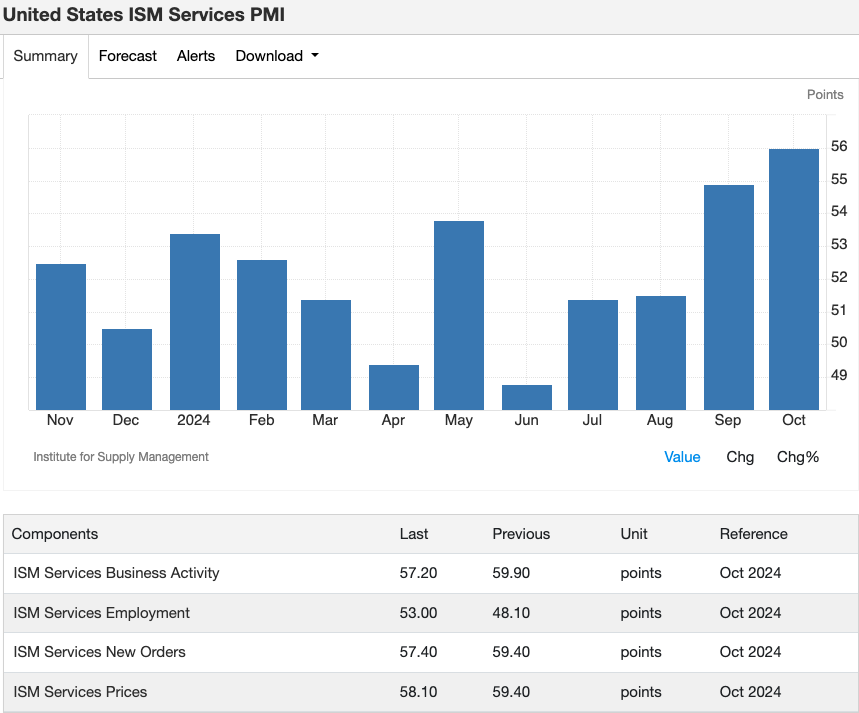

3. ISM Services PMI (US)

Release date: Wednesday, December 4 Why it matters: The service sector plays an important role in the US economy. This data can reveal the health of the service industry and its impact on market sentiment cannot be ignored.

Image source: Trading Economics

Impact on the crypto market:

-

The data shows strong performance: it may drive the growth of demand for payment altcoins Dan DeFi related projects .

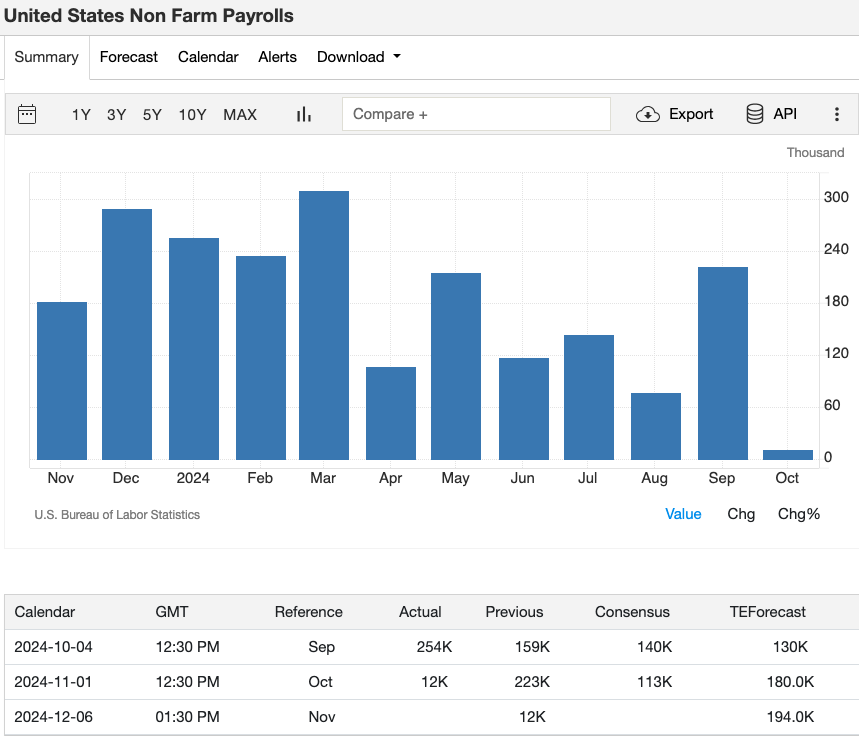

4. Non-farm payrolls report and unemployment rate (US)

Release date: Friday, December 6 Why its important: Non-farm payrolls and unemployment rate are important indicators of the health of the U.S. job market and have a direct impact on the Feds policy direction and market risk appetite.

Image source: Trading Economics

Impact on the crypto market:

-

Positive: If non-farm payrolls growth is lower than expected and the unemployment rate rises, it may increase market expectations that the Federal Reserve will adopt an accommodative stance, which is good for Bitcoin Dan Ethereum .

-

Negative: If the data is strong or the unemployment rate falls, investors may worry about rising inflationary pressures and reduce their interest in high-risk crypto assets.

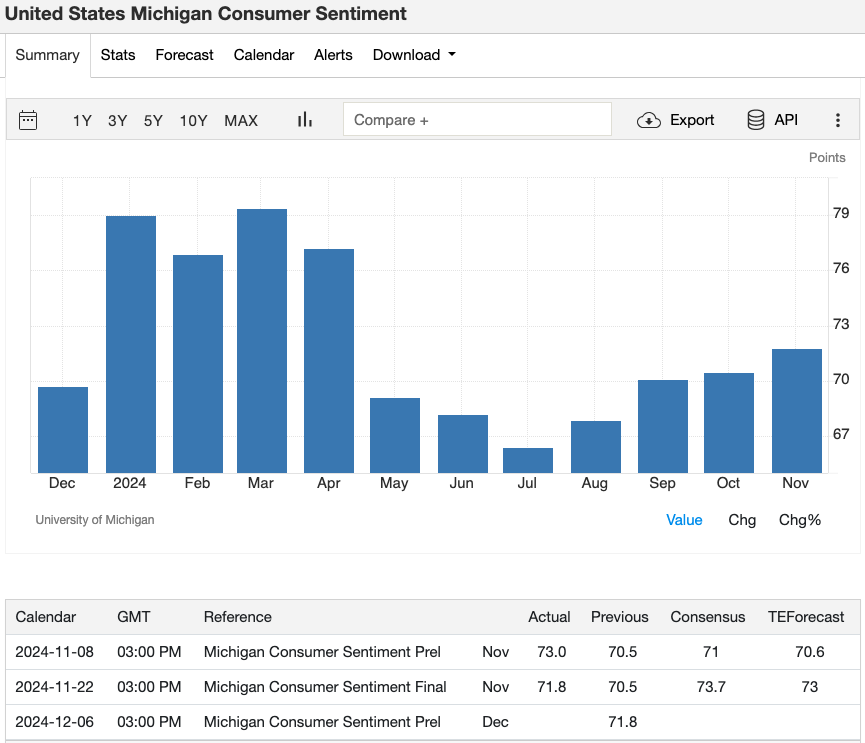

5. University of Michigan Consumer Confidence Index (US)

Release date: Friday, December 6 Why its important: This index measures US consumers confidence in the future economy and reflects retail consumption trends and the markets risk appetite.

Image source: Trading Economics

Impact on the crypto market:

Other indicators to watch

Caixin Manufacturing PMI (China)

Release date: Monday, December 2 Why it matters: As a barometer of Chinas manufacturing industry, positive data may boost global market risk appetite, which will indirectly benefit the altcoin market.

Image source: Trading Economics

GDP Growth Rate (Australia)

Release date: Wednesday, December 4 Why it matters: If Australias economic growth exceeds expectations, it could boost cryptocurrency trading activity during the Asian session.

Image source: Trading Economics

Afterword

This week’s economic calendar clearly demonstrates the profound impact of the macro economy on the cryptocurrency market. From consumer confidence to inflation data to job market performance, these key indicators not only affect market sentiment, but also have a direct impact on liquidity and investment direction.

What traders need to focus on

1. Dealing with market volatility:

-

Keep an eye on high-impact events like the PCE report and non-farm payrolls, which can trigger wild moves in the crypto markets.

2. Pay attention to changes in liquidity:

-

Economic data will directly influence the policy direction of the Federal Reserve, thereby affecting market liquidity, which is crucial to the performance of Bitcoin, Ethereum and other crypto assets.

3. Diversification strategy:

-

Use stablecoins to hedge risks while exploring altcoin opportunities in emerging fields such as DeFi , blockchain games, and NFT .

4. Focus on fundamentals:

-

Prioritize cryptocurrencies with long-term value, such as Bitcoin , Ethereum , and Layer-2 scaling solutions.

Events to watch next week

Upcoming key economic data, including the ISM Manufacturing PMI, JOLTS Job Openings, and the Non-Farm Payrolls report, will provide clearer signals on the economic trend at the end of the year. These data are important for both short-term traders and long-term investors as they will directly affect the performance of the crypto market in December.

Are you ready for market volatility?

Are you ready for market volatility? Join XT.COM, the worlds first social trading platform, and get real-time crypto market data, powerful trading tools and exclusive market insights. Register now to seize the opportunity and turn market volatility into investment returns!

About XT.COM

Founded in 2018, XT.COM currently has more than 7.8 million registered users, more than 1 million monthly active users, and more than 40 million user traffic within the ecosystem. We are a comprehensive trading platform that supports 800+ high-quality currencies and 1,000+ trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading products such as spot trading , leveraged trading , Dan contract trading . XT.COM also has a safe and reliable NFT trading platform . We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

This article is sourced from the internet: Understand the economic pulse and seize the opportunity of the crypto market with XT: Weekly calendar

Original author: Haotian (X: @tmel0211 ) Putting aside the neutrality of the core members of the Ethereum Foundation serving as consultants to @eigenlayer, in terms of its technical value, Eigenlayer is really too important to the future development of Ethereum in the long run. In order to avoid everyone falling into the emotional misjudgment of hating the whole thing, I would like to share some of my personal understandings for reference: 1) Many people are aware of the value of Lido to the Ethereum ecosystem. It manages a group of Validators, lowers the high threshold of 32 ETH required for users to participate in the node, and avoids complex node system maintenance. At the same time, stETH can re-release liquidity to avoid asset lock-in. In general, Lido increases the total…