ZKasino openly misappropriated customer assets for profit, is there any hope for a refund?

Latest Developments

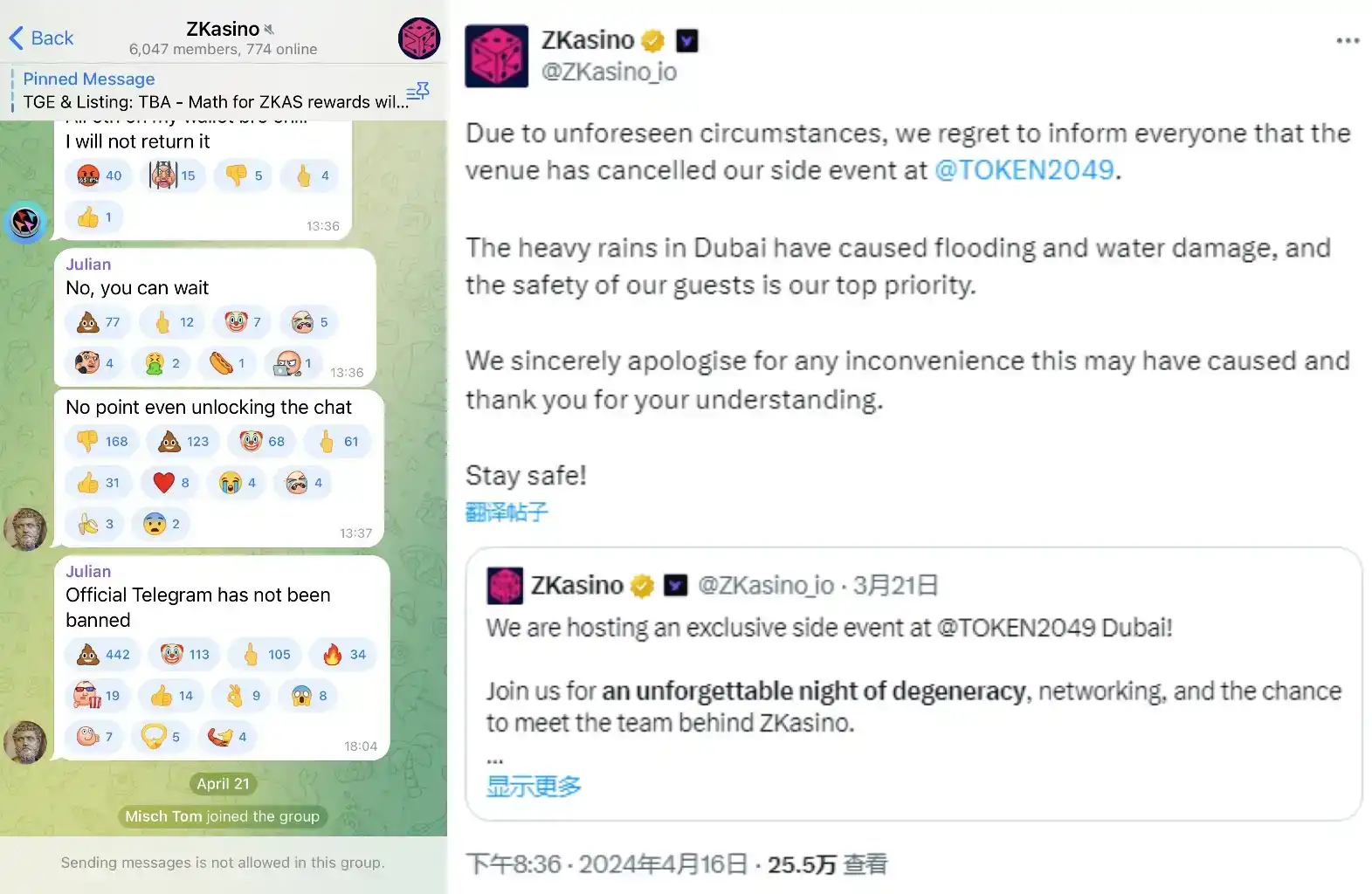

In April this year, ZKasino, a decentralized betting platform of ZK Ecosystem, was caught in a runaway storm: tampering with the website event introduction, refusing to return the ETH pledged by users to participate in the event, closing Telegram speaking rights, canceling the offline meeting in Dubai, and arbitrarily transferring user funds to Lido for staking… Many users suspected that ZKasino had soft rugged. On May 28, ZKasino officially responded that it had started a 2-step bridge return process, and bridgers could register and return their ETH at a 1:1 ratio. In the next few days, it will collect registration data, release a new announcement as soon as possible, and provide data for public verification.

However, as of August 14, the decentralized entertainment platform ZKasino, which had previously run away, had not yet refunded the funds raised by investors, and the funds raised by investors were still in the original two addresses.

On November 23, according to monitoring by on-chain data analyst Ember, the ZKasino address began to divert funds prepared to be returned to users to leverage long ETH on the chain. They deposited 5,270 ETH into Aave as collateral to borrow 11.589 million DAI, and then added 3,500 ETH.

On November 28, the ZKasino project continued to lend 9.36 million DAI to buy 2,603 ETH. After depositing 10,535 ETH of users into Aave as margin, it has lent a total of 53.77 million DAI to buy 15,645 ETH to leverage long ETH. The average price of this part of ETH bought through leverage is 3,437 US dollars. With the sharp rise of ETH, the ZKasino project has made a floating profit of 3.22 million US dollars by misappropriating users ETH as margin leverage long operations.

Judging from the on-chain data, ZKasino is not unable to repay, but openly chooses to profit from user assets. Every step of ZKasinos operation is exploiting the trust and assets of users, which completely deviates from the original intention of decentralization and transparency. The ZKasino project uses user funds to make floating profits in high-risk operations, but turns a deaf ear to the issue of returning user funds, which is undoubtedly a secondary harm to the victims.

The whole story of ZKasino incident

Back on April 19, many community users found that after the ZKasino staking activity ended, ETH refunds were delayed. Later, through the Wayback Machine, ZKasino deleted the sentence Ethereum will be returned and can be bridged back on the Bridge funds page on its official website on April 18, causing users to panic and question whether it was deliberately taking the money and running away. Users who participated in the staking activity flocked to the ZKasino official Twitter account to question, and Telegram also became a rights protection position, but it didnt take long for ZKasino team members to close Telegrams speaking rights.

On April 20, the MEXC trading platform, which originally planned to launch ZKasino (ZKAS) on the same day, announced that the launch and withdrawal of ZKAS will be postponed, and the recharge of ZKAS will be temporarily suspended. MEXC staff responded to the question of ZKasinos runaway and said, We are just one of the investors. The projects behavior has nothing to do with us. As an investor, we are also victims.

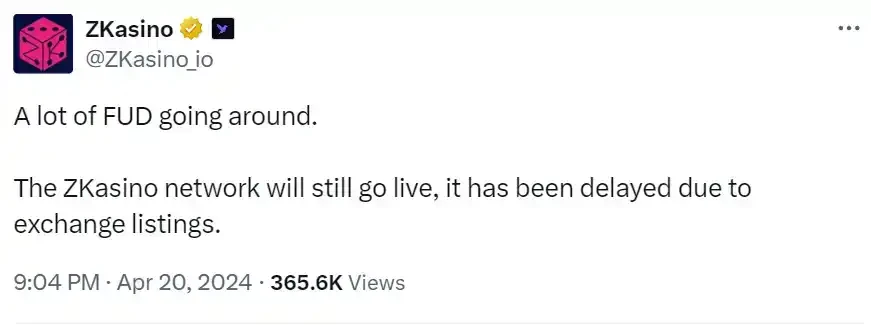

Perhaps due to pressure from many parties, ZKasino finally made a brief response: There are currently a lot of FUD rumors. The ZKasino network will continue to go online, which was previously delayed due to exchange listing.

However, users are not satisfied with this simple response. When will the refund be given?, Is it a soft run? and Why was the refund description on the main network changed? have become the main contradictions at the moment.

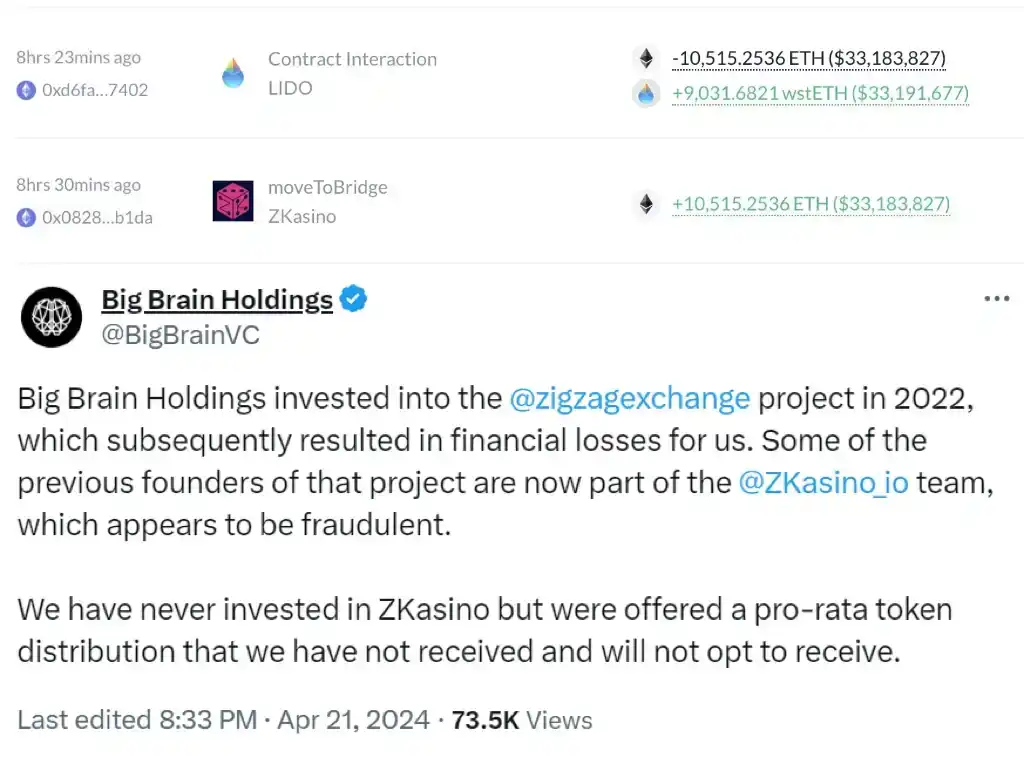

On April 21, according to the monitoring of on-chain analyst Yu Jin, ZKasino transferred 10,515 ETH that users deposited into ZKasino through bridging to a multi-signature address, and then deposited it into Lido. These ETH were deposited into ZKasino through bridging by users for mining, but the ZKasino project team modified the official website description and forcibly exchanged the ETH deposited by users for its platform tokens.

On April 22, Big Brain Holdings, which was previously disclosed as one of the investment institutions of ZKasino, issued a statement to refute the rumors and denied participating in the financing of ZKasino.

So far, users’ concerns seem to be being “realized” step by step. Some users also found that as early as March 16, Kedar, the founder of Ethereum Layer 2 ecological DEX project ZigZag, had warned that there seemed to be problems with ZKasino. In Kadar’s tweet, he mentioned that most of ZKasino’s income was fake, and users should be cautious in participating in their ICO activities.

At present, ZKasino’s latest tweet only announced the next plan of the project: “All ZKasino games will be moved to the new chain – and will also remain on Arbitrum and Polygon. Native DEX and stablecoins will be launched soon. The first batch of ZKAS was distributed to bridgers.”

However, there was no congratulations or celebration in the tweet replies, only users repeatedly asked: When will the refund be issued?

Crypto VC, KOLs opinions and suggestions

As a star project on ZK, many KOLs participated in and recommended the project in the early stage of its launch. Now that such negative events have occurred, these KOLs have naturally become the target of public criticism. In the field of Crypto, how to avoid pitfalls, and who should be held responsible when problems occur in the project? ABCDE Capital co-founder Du Jun, kripto KOL 0x Satoshis, @0x killthewolf and others expressed their opinions, which are summarized by BlockBeats as follows:

ABCDE co-founder Du Jun (@DujunX):

Regarding the project party running away, seeing that everyone is holding the investment institutions and KOLs accountable, I think it makes sense but is a bit absurd.

In the crypto field, 95% of investment institutions are actually disadvantaged groups, licking the project parties for quotas, licking the platform for currency, and licking LP for money. They are complete bootlickers.

These institutions have nothing to do with the first few rounds of good projects, let alone DD the project team. You should be thankful if you can send money to the address. KOLs seem to be strong and some projects even have KOL rounds, but they are actually at the bottom of the food chain and have no say. If KOLs do not receive money to shout orders, it is difficult to hold them accountable at the legal level, and they can only be morally condemned. Looking around, only the top exchanges are at the top of the food chain, and other roles are just soy sauce.

The project owner ran away, and everyone turned to investment institutions and KOLs for rights protection. Institutions and KOLs also invested real money, so who should they turn to for rights protection? In the jungle society of Crypro, we must pay for our investment results and keep learning, so that we can earn more and live longer.

Finally, I strongly condemn the runaway project owners and the KOLs who support these runaway projects. I hope that the unscrupulous projects will be punished by law and their coins will be refunded as soon as possible, so that everyone’s wallets will be safe.

Crypto art creator Niq (@niqislucky) replied:

Admit it: most staking projects are just like transferring money to a multi-signature address. Unless the team is well-known, VC brand endorsement is almost the entire trust basis for retail investors. KOL? Responsible for dissemination, or even taking the blame.

VCs are weak only when compared to each other. If you can’t get in when the gods are organizing a meeting, you are a novice. Even if you are a novice, retail investors still have too much information and funds to deal with. We are not on the same level, so who can empathize with me when I write this? Retail investors only think these are crocodile tears…

Crypto KOL 0x Satoshis (@0x Satoshis):

In view of the soft run of Zkasino, I have reviewed all the staking projects today, except for ATOM+OSMO+TIA+DYM staking

The projects currently participating in the pledge are:

1) swell+eigenlayer+renzo+puffer (total 20 E)

2) blast initially invested 25 E, now only 6 E remains, and the points inflation is serious

3) lista 5000+U

4) Merlin pledged Runestone

5) Bouncebit: Less than 10,000 U

Next, I will withdraw the principal from time to time, or reduce the position to a reasonable position (the so-called reasonable means returning to zero, which is acceptable). I always feel that the risk of nesting doll staking is very high now. One dollar is pledged once in each project ABCDE, and the TVL becomes 5 dollars, but the market is still only 1 dollar. What if the money runs away in the middle, or there is a hacker attack, the risk is continuous, so I should withdraw part of it while there is still liquidity.

I would like to emphasize again that you should not believe in KOLs’ orders, including a newbie like me. Just study the content shared by others carefully. As for whether to invest in the end, you must decide for yourself. Investment is our own business. KOLs provide us with content and information to assist us in decision-making.

It is recommended for novices to participate in fewer staking projects. Capital is the most important thing. Experienced investors should control their positions and try to get a critical hit at a low cost.

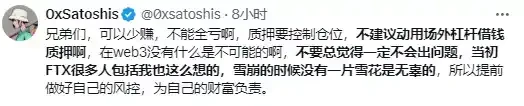

Brothers, you can earn less, but you cant lose everything. You need to control your positions when staking. It is not recommended to use off-site leverage to borrow money for staking. Nothing is impossible in web3. Dont always think that there will be no problems. Many people including me at FTX thought so at the beginning. No snowflake is innocent during an avalanche, so do your own risk control in advance and be responsible for your own wealth.

Finally: All the projects I participated in in this article are just my own review, which does not constitute investment advice, and I am currently reducing my position. Please make your own judgment, DYOR!

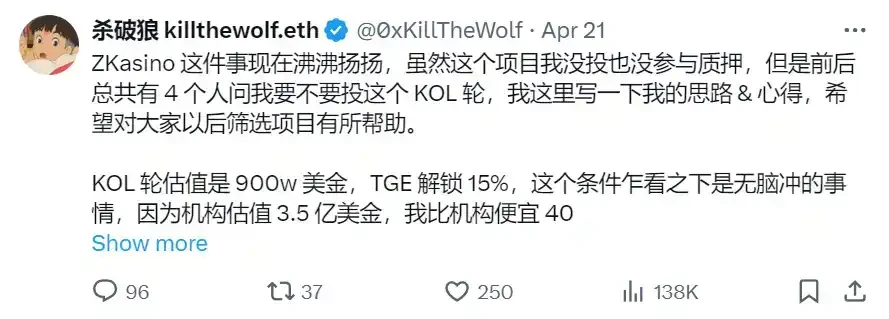

Crypto KOL killthewolf.eth (@0xkillthewolf):

The ZKasino issue is a hot topic right now. Although I did not invest in this project nor participate in staking, a total of 4 people asked me whether I wanted to invest in this KOL round. I will write down my thoughts and experiences here, hoping that it will be helpful for everyone to screen projects in the future.

The KOL round valuation is 9 million US dollars, and TGE unlocks 15%. At first glance, this condition is a no-brainer, because the institutional valuation is 350 million US dollars, and I am 40 times cheaper than the institution. As for TGE only unlocking 15%, in fact, I only need 60 million US dollars of FDV to make a profit at the opening, and the institution has already given a valuation of 350 million US dollars.

The two main reasons why I didnt participate in the end were:

First, why is it valued at 350 million? Ethena, which was recently listed on Binance, was valued at 300 million, Puffer Finance was valued at 200 million, and how can ZKasino, a gambling platform, be valued at 350 million? Because of this valuation number, I am skeptical about this round of financing.

Second, the project owner claimed a revenue of 8 million yuan. Although everyone agrees that this number is somewhat exaggerated, I still checked the addresses of the top 20 users in terms of gambling amount on the platform, and they were all suspected to be small addresses of the project owner who were inflating the volume.

Third, the founder’s character is questionable. Previously, their official account used a bloody video of a murder case as a joke for marketing, which caused a lot of controversy at the time. @zachxbt also exposed the various things this person had done: https://x.com/zachxbt/status/1731025316204745113

So from my perspective, the valuation of this project was fake, the revenue was fake, the character was bad, and there was no conscience, so in the end I did not participate, and luckily I avoided a big pit.

This article is sourced from the internet: ZKasino openly misappropriated customer assets for profit, is there any hope for a refund?

Related: The King of Cycle-Crossing Meme: How was DOGE created?

Original | Odaily Planet Daily ( @OdailyChina ) Author: Wenser ( @wenser 2010 ) After the Trump effect swept the cryptocurrency market and drove the price of BTC close to $90,000, the Musk effect also came roaring. As the former Godfather of DOGE, the most driven is naturally the No. 1 Meme Coin – DOGE. According to data from the Coingecko website , DOGEs market value skyrocketed in just two days, quickly surpassing XRP and USDC, and currently ranks sixth in the cryptocurrency market value with a market value of over $63 billion. Odaily Planet Daily will briefly analyze and explain the recent trend of DOGE and the future development direction of Memecoin in this article for readers reference. “The First Meme Coin”: The King of Meme Coins Across Four…