As SUI reaches a new high, let’s talk about the differences between the three major Move public chains from a user’s per

Penulis asli: Alex Liu, Foresight News

On November 14, SUI rose above 3.5 USDT, and the currency price hit a new historical high; Bitwise will launch Aptos Staking ETP on the Swiss Stock Menukarkan; the Movement mainnet will be launched soon… In addition to EVM, Solana, and BTC, a vibrant new ecosystem is emerging, and the Move public chain is gradually gaining momentum.

Sui, Aptos and Movement are often discussed together because they are all public chain platforms that support Move language smart contracts, the so-called Move public chain. Sui and Aptos are Layer 1 public chains, and most of the team members are from Facebook (now Meta)s blockchain projects Diem/Libra (Move language was born during this stage), which were forced to be terminated due to regulatory pressure. Both have successfully raised hundreds of millions of dollars and have been launched on the main network, ranking among the top in market value; and Movement is a Layer 2 built on Ethereum, aiming to bring the Move language into the ETH ecosystem. Movement has raised tens of millions of dollars in financing and is currently in the test network stage.

Although all of them are “Move public chains”, the differences between them are far greater than most people imagine. The author holds SUI and APT and is deeply involved in both ecosystems. At a time when Move Chains are gradually gaining momentum, I hope this article can provide readers with some information that they may not have noticed, to help everyone research and judge.

A brief discussion on technical differences

This article mainly starts from a non-technical perspective, but also briefly discusses the technical differences between the chains. DWF Ventures, a well-known market maker research department, recently published a comparative analysis of the three chains, in which it listed incorrect facts in terms of technology. Even institutions are like this, which shows that there is still a lot of room for improvement in everyones technical understanding of the Move public chain.

The architectures of Aptos and Sui are quite special. Strictly speaking, they cannot even be considered a blockchain, but a directed acyclic graph (DAG, a special data structure) composed of checkpoints, while Movement is consistent with a regular chain, consisting of blocks and a linear chain. Another well-known project that also adopts the DAG architecture is Kaspa (KAS), a new favorite of PoW miners, which claims to revive the original concept of Bitcoin. DWF Ventures mistakenly regarded Aptos as a linear chain in the above picture – Aptos was indeed a linear chain when it was first launched, but later changed to DAG.

Transaction relations in DAG

Differences beyond architecture include consensus mechanisms, different implementations of parallel transactions, etc.

The consensus of Sui and Aptos are both based on DAGs BFT (Byzantine Fault Tolerance), but the specific mechanisms such as Leader selection are different, while Movement uses the Snowman consensus of the Avalanche protocol. Different consensus mechanisms bring different TTF (transaction confirmation time). Currently, Suis Mysticeti consensus is the fastest and can be confirmed within 0.5 seconds. Aptos will be upgraded to RAPTR consensus later, and its performance is also worth looking forward to.

For parallel transactions, Aptos and Movement both use the Block-STM parallel engine, which is an optimistic parallelization mechanism that assumes that all transactions can be processed in parallel and re-executes transactions if errors are encountered. Sui uses a state access method to classify, sort, and confirm that transactions are conflict-free before execution.

Although both use the Move language, the Move language has evolved into two variants: Sui Move and Aptos Move. Movement is theoretically compatible, but in fact it mainly supports Aptos Move.

User Experience

(Movement is still in the testnet stage, and this article does not discuss the actual experience.)

Speed, cost

For high-performance public chains, speed and cheapness are the core competitiveness. In actual use, the speed difference is almost imperceptible, and the interaction is almost completed instantly.

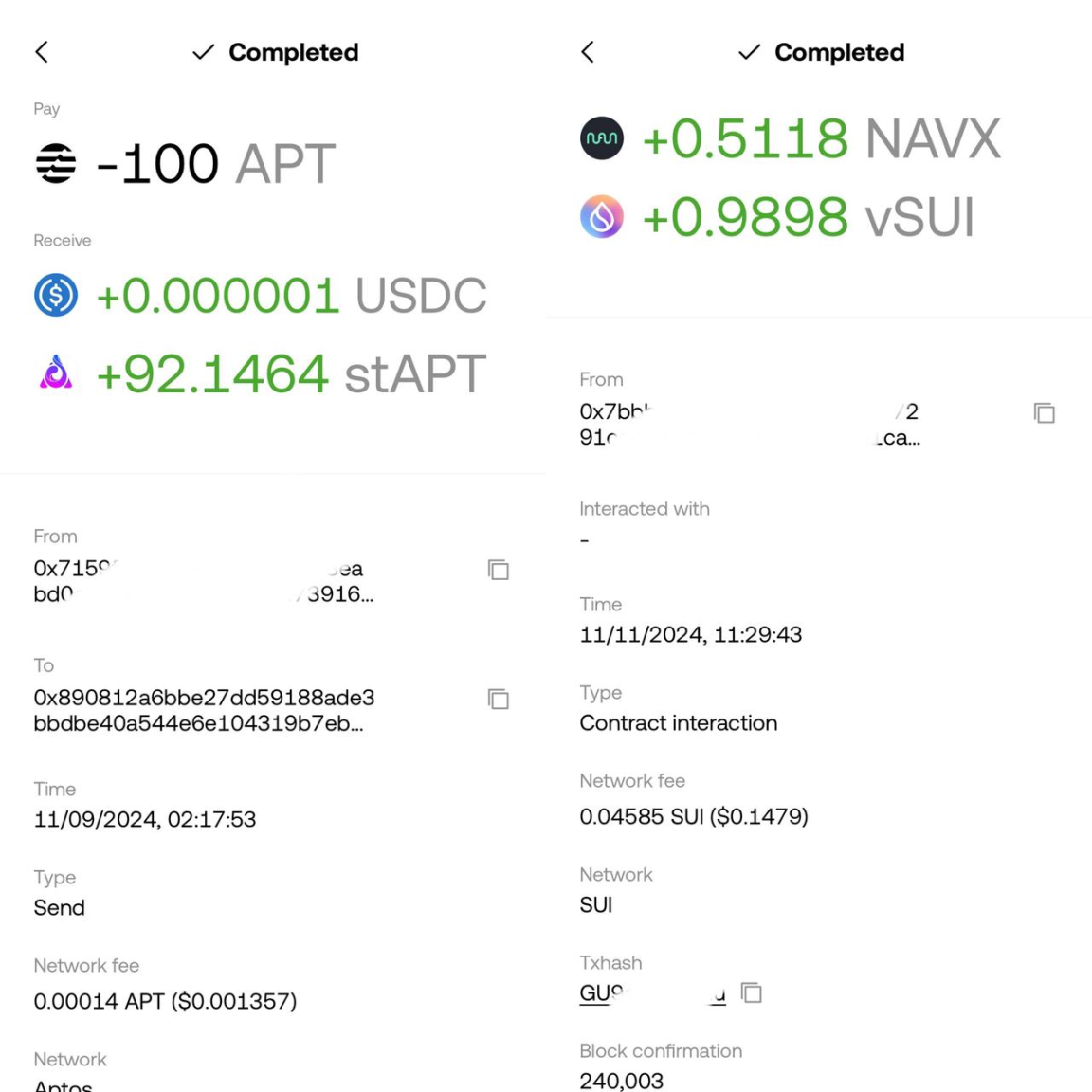

In terms of fees, all types of interactions on Aptos have negligible fees, while Sui has higher gas costs when executing certain transactions (as shown below, it costs $0.14 in fees to claim rewards on Navi). High gas fees are also related to the quality of contract code, but it is clear that the overall cost of Aptos is more controllable.

stabilitas

Stability is also an important consideration – no one wants to use a blockchain that often crashes for high-frequency financial activities. Sui has never crashed since its launch, and has successfully withstood the test of huge transactions of inscriptions and runes. But Aptos stopped producing blocks for a short period of time in October last year.

Hardware wallet adaptation

I store a large amount of tokens in a hardware wallet. During use, I found that:

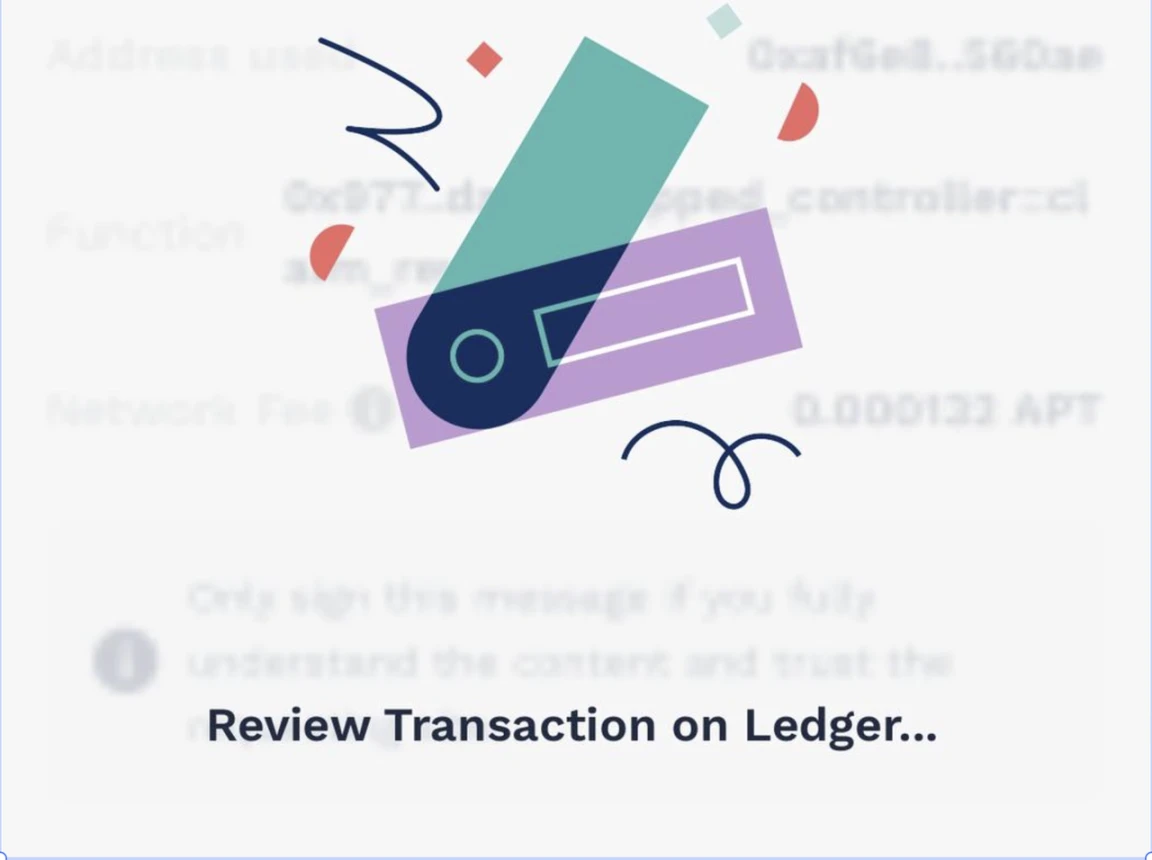

Suis Ledger adaptation is very poor. In the early days, every time you open the App, you need to reset the blind signing option, and the frequency of software updates and maintenance is very low. At the same time, all mainstream mobile wallets of Sui do not support hardware wallets!

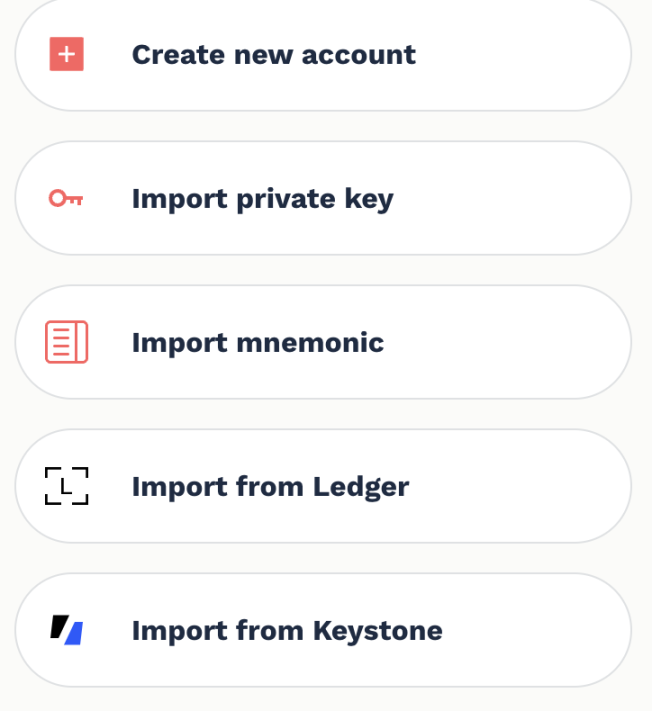

Unlike Aptos, Ledger has good adaptation and maintenance frequency. The Petra wallet launched by the official team not only supports multiple hardware wallets, but also has exclusive animations for signatures – the attention to details makes people like it very much.

When it comes to wallet experience, I think the official Petra wallet from Aptos is better than the official Sui Wallet from Sui (from the perspective of balance change simulation, multi-account switching, etc.)

Observation of the wallet experience also leads to a conclusion: Sui does not seem to care about Crypto Native users and has not invested a lot of resources to meet our needs, while Aptos has brought me a better experience. So what kind of users does Sui care more about? I think it is obsessed with the narrative of Mass Adoption and incremental users, and mainly promotes the creation of Sui wallets through social accounts such as Google, Twitch, and Facebook. The focus is on introducing Web2 users to expand the pie, rather than competing for existing kripto users.

Is this a good or bad consideration? It is actually difficult to judge. Solana first captured the existing Crypto Native users, and then gradually moved towards Mass Adoption. Judging from the results, it was very successful.

Team Tone

From the perspective of the tech-savvy crowd, Sui does have more innovations, while Aptos has some copycat qualities:

At the beginning, Aptos was based on the code foundation of the Diem project, which was an address model and a chain. Sui later launched the mainnet. Although it was also from the Diem team, it redesigned many key components and proposed a new solution: Sui is an object-centric DAG. Aptos later changed to an object model and DAG.

Sui first gave token incentives to ecological DeFi projects to attract TVL, and TVL successfully increased significantly. Aptos later also began to subsidize ecological projects with tokens.

The PoW gameplay on the PoS chain first appeared on Solana. After the imitation platform appeared on Sui, Aptos officials began to promote related imitation platforms in its own ecosystem.

Sui developer Mysten Labs has used the same logo for 2 years as shown above, and Aptos Labs recently launched its latest logo:

This may not be called similarity… Lets call it the CP feeling between the official opponents.

Another team tone is called pattern. The Aptos test network gave a large airdrop, which was the first pot of gold for many people, while Suis test network did not have an airdrop, but instead drew token subscription quotas in the community.

The most prominent feature of the Movement team is their strong ability to manage the community and create Hype for their projects. Before the mainnet was launched, the crypto community believed that they would be the next big thing.

Research, Engineering

Sui developer Mysten Labs has excellent academic research results, and recently 5 articles have been accepted by ACM CCS, the top conference in the computer industry. Speaking of engineering capabilities, in addition to the Sui public chain that everyone has seen, they have also launched a decentralized storage protocol based on Sui, Walrus, and are preparing to access the SCION network standard. In addition, Sui is also preparing to send transactions via radio waves without a network.

Sui founder and CEO won the ACM Software System Award in 2012 for his contribution to LLVM

Aptos Labs research and engineering capabilities are also top-notch in the industry. A simple example is that the Block-STM parallel engine from Aptos has been integrated and adopted by many large projects such as Starknet, Polygon, Monad, and Movement.

It is undeniable that the comprehensive accumulation of the Movement team is weaker than the above two teams. But in todays meme super cycle, the vibe of the project may be more important than the fundamentals.

Ecology and community

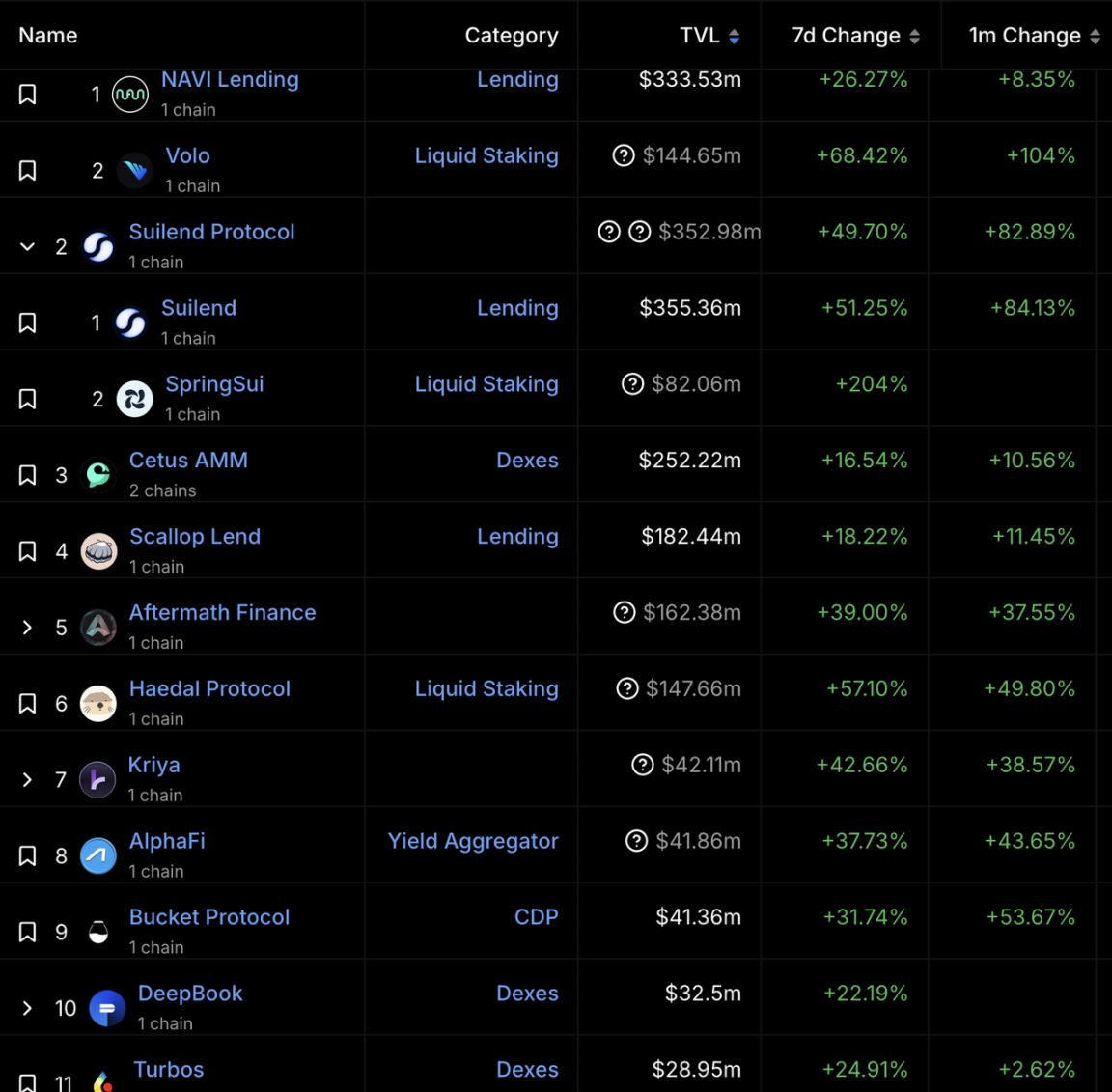

Sui ecological project, source: DefiLlama

Objectively speaking, the current Sui ecosystem has better project richness and development status than the Aptos ecosystem, and the TVL of DeFi is also higher. Aptos TVL has grown significantly recently, but the source is relatively homogeneous, mainly receiving grants from the foundation to have lending protocols with APT token incentives. Earlier this year, I also experienced a situation where I was the only one speaking in a Discord of an Aptos ecosystem project, and I asked the team questions in English for 3 or 4 days without a reply.

Aptos ecological project, source: DefiLlama

The Sui community is more active than Aptos as a whole (perhaps due to the strong price of the coin), and it seems that the slogan of No tetesan udara, No Community has failed. The Movement community is a cult comparable to Monad, and the gmove seen everywhere gives this project, which has not yet issued a coin, a leading mindshare.

It is also worth mentioning that Sui and Aptos seem to be old enemies and often go against each other in the selection of ecological cooperation projects. The mainstream cross-chain bridge of Sui ecology is Wormhole, and Aptos will definitely not choose the same one, but cooperate with LayerZero. Sui network introduced the native stablecoin USDC, and the first native stablecoin launched by Aptos was indeed USDT.

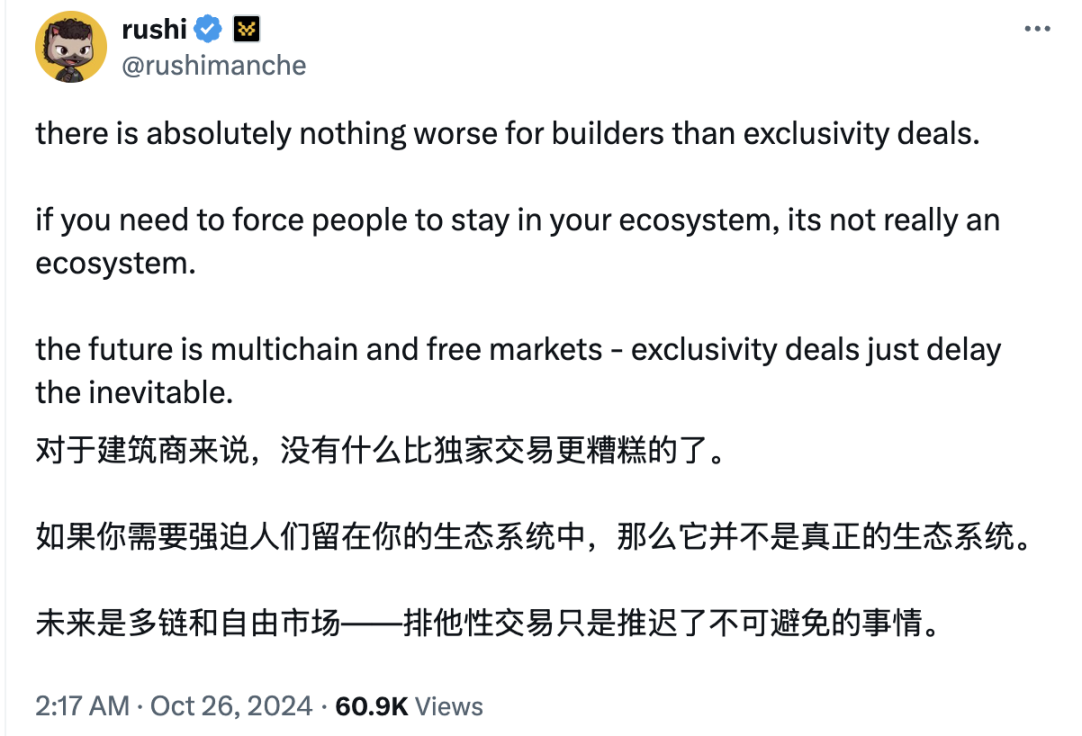

Aptos and Sui also have different attitudes towards Movement. Aptos is more open and has expressed its welcome to Movement to expand the Move language ecosystem. Almost all Aptos ecosystem projects I have used are ready to be launched on the Movement mainnet; Sui is relatively more closed. Lianchuang once said that L2 is meaningless, and most ecosystem projects are only built on the Sui chain.

Movement Lianchuang once published an article on X criticizing the exclusive agreement, which seemed to have a hidden meaning.

Although Movement is still in the testnet stage, it already has over 60 apps and tens of millions of active addresses, and its ecological effect cannot be underestimated.

Common issues

Currently, the Move ecosystem does not have a big wealth effect on retail investors. Although there are token subsidies from the foundation, the interest subsidies are mined and sold by high-net-worth whales, and retail investors are unlikely to be interested in more than 10% interest. There is a lack of wealth creation stories such as Solanas JTO airdrop and Bonk meme coin.

Specifically, Aptos is more likely to solve this problem because most projects in the ecosystem have not yet issued tokens. Recommended reading: Gold Rush Manual | Airdrops + High-yield Opportunities Not to Be Missed on Aptos

Sui’s third-party ecological projects have successively issued tokens, but the airdrop ratio is not high. What’s more, Navi, the largest lending protocol on Sui (now surpassed by Suilend, which is preparing for an airdrop in December), launched a points ranking in January this year, announcing that points will play a key role in the “upcoming” token airdrop after issuing tokens – but the project has not had an airdrop since issuing tokens in February, and it has come to nothing.

The tokens launched by Sui developers own projects (Deepbook, Sui NS) all follow the model of widely airdropping to the community and raising the price of the currency. For example, because the ecological project is not strong, they have to personally improve the wealth-creating effect of Sui chain.

Specifically speaking of the Meme wealth-creating effect, both sides still need to work hard. SUI’s FDV (fully released market value) and circulating market value are about 1/3 and 1/10 of SOL respectively, while the largest Meme market value on Sui is only 1/20 of that on Solana, and the largest Meme GUI on Aptos is only 1/100 of the market value of WIF.

Although there are various problems, in the long run, the future of the Move public chain is bright. Recommended reading: Why do developers bet on the Move public chain?

This article is sourced from the internet: As SUI reaches a new high, let’s talk about the differences between the three major Move public chains from a user’s perspective

Related: Safe investment starts here: DeFi staking fraud prevention guide

Hash ( SHA1 ) of this article: 14f211363c25423b3eb2472ade8865dc95a14513 Code: PandaLY Anti-Fraud Guide No.001 I believe that friends who follow us at Lianyuan Technology must have a certain understanding of DeFi. Indeed, in some cases, participating in the staking of DeFi platforms, especially the common USDT staking, can indeed bring lucrative returns. However, along with opportunities come various scams. Many criminals take advantage of investors lack of understanding of blockchain technology and project details to design a series of traps. A common method is to attract you to pledge investment on unknown DeFi platforms under the banner of higher yield than xxx platform, and these platforms often use the return rate far exceeding that of traditional DeFi platforms or exchanges as bait. When they have defrauded enough funds, they will run…