Jika seorang pembuat pasar memegang token, apakah itu berarti ia berpartisipasi dalam pembuatan pasar?

Original author: Aunt Ai (X: @ai_ 9684 xtpa )

I saw the news this morning that Wintermute becomes the third largest holder of $GOAT, holding 1% of the total supply of tokens. But just as airdropping tokens to Vitalik Buterin is a publicity stunt, airdropping tokens to market makers is nothing new.

So here comes the question:

– How to determine whether market makers are truly involved?

– Typical examples of market making

– Examples used only as promotional material

1/ Take GOAT as an example

1. Falsification: It is true that 10 million GOAT are held and the contract address is correct; do not underestimate this step, as many issuers promote market makers under the name of the same token.

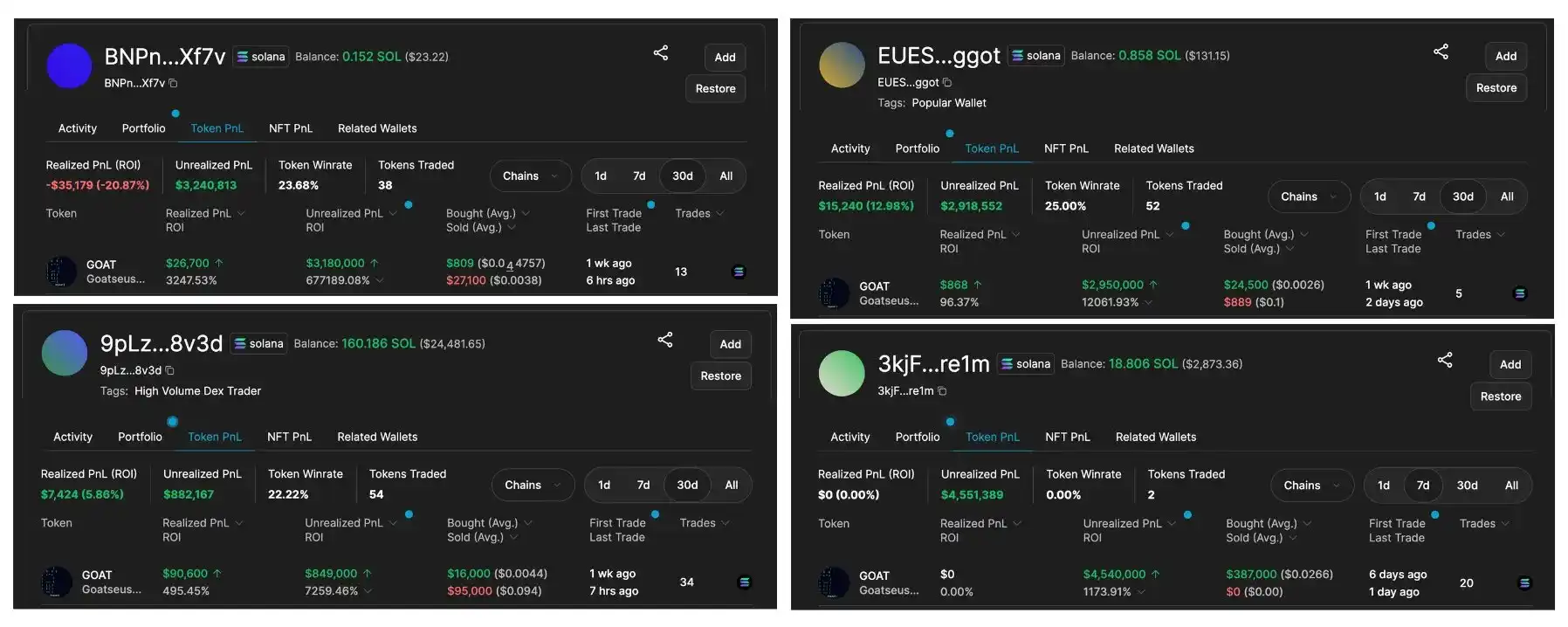

2. Identify the source of funds: Tracing back, it was found that four addresses transferred millions of tokens to 7 GNPT….snUM 1, and all of them were early-stage addresses with extremely high returns, with a cumulative profit of 11.63 million US dollars!

Four early entry addresses for depositing coins to Wintermute:

-

3kjF7ZXfMYo1dqxFNE7WVtQ38zZSciptu1deWYibre1m (the source buying address of CAnS 7…JZT 86)

-

BNPntzDuH7EofLrHGA7gjbeNvJQbEvvrGrCPCTCNXf7v

-

9pLzvD3s5g7nWbMbURPvYQgHp4piosoVLrxiEgr58v3d

-

EUES49UdAkevnREj5YShNXpWjX5DN44uCJQo7yfaggot

3. Check the market makers operation: After receiving the token, it did two things. First, it transferred 1 token to Wintermute 1 and immediately transferred it back. This is an obvious confirmation address action. Second, all tokens were distributed to the Wintermute 3 address after two transfers.

Seeing this, it is basically certain that Wintermute is actively participating in GOAT market making. As for whether it is OTC coin buying/instructed by the project party or a spontaneous behavior, it is unknown.

4. Stay tuned: Ultimately, it depends on whether Wintermute 3 frequently conducts GOAT transactions. If so, it can be confirmed.

2/ Typical examples of market making

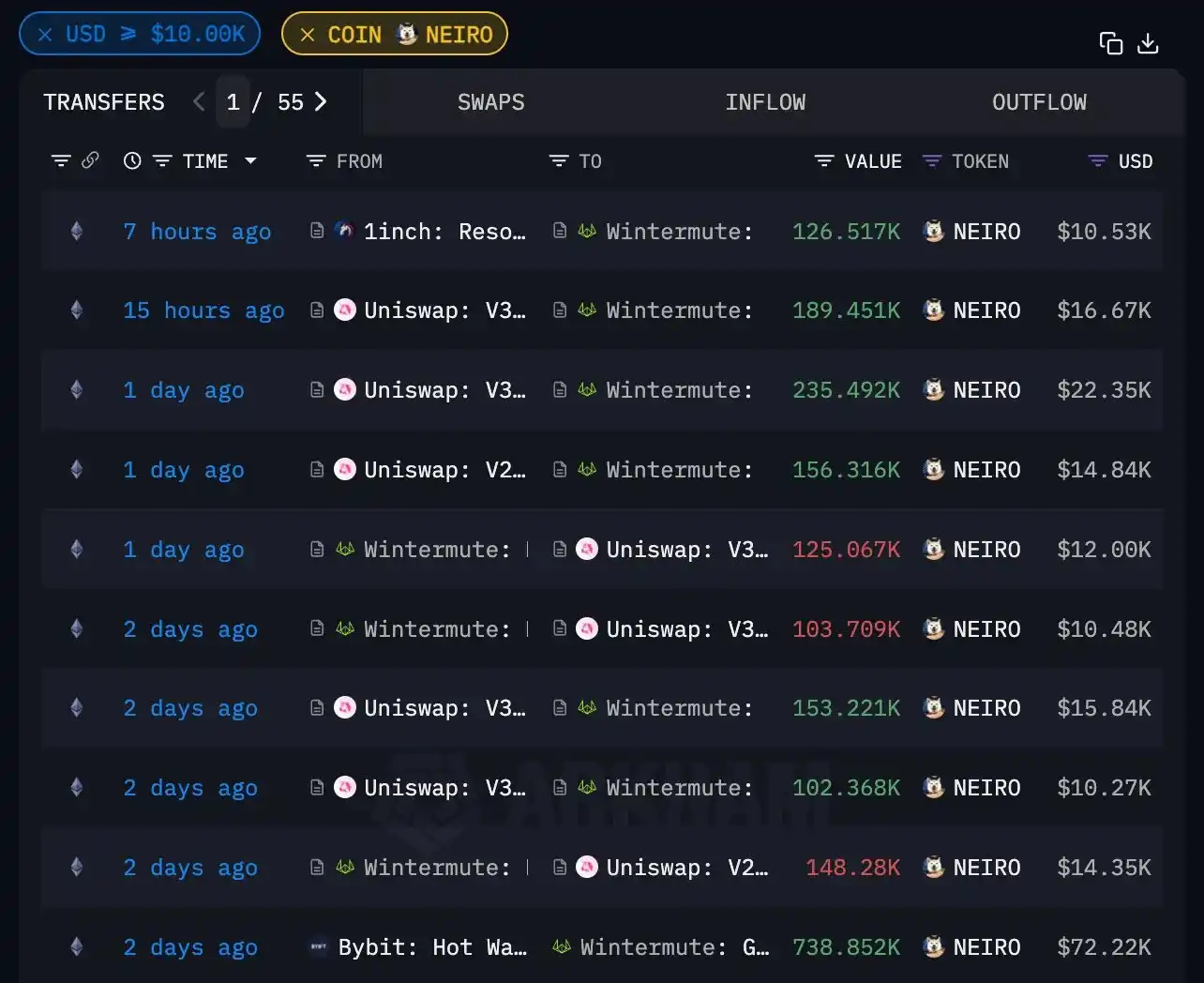

Wintermute participated in market making of capitalized $NEIRO: it once held 4.35% of the total supply of tokens and was once the largest holder. After receiving the tokens, it actively maintained frequent transactions with major exchanges and DEXs.

3/ Typical example of a product that is used only as a promotional tool

This type generally has several characteristics:

-

Direct airdrop by project owner/DEV

-

Usually airdropped to market makers and well-known founders in the kriptocurrency circle, such as Vitalik Buterin and Sun Ge.

-

The market maker does not take any action after receiving it (V God may sell it directly)

-

The community has made a high-profile announcement that a certain institution has participated in market making

As for pulling down and stepping down, I won’t give actual examples here. You can check these characteristics yourself.

This article is sourced from the internet: If a market maker holds tokens, does that mean he is participating in market making?

Terkait: Kembali ke pertumbuhan yang didorong: Bagaimana koin VC dapat lolos dari dilema narasi?

Penulis asli: Loki, BeWater Venture Studio TL;DR Inti dari keruntuhan mata uang VC adalah investasi berlebihan dan penilaian yang tidak rasional di pasar primer selama siklus ini, yang memungkinkan VC dan proyek yang seharusnya dihilangkan untuk bertahan hidup, mengumpulkan dana, dan muncul di pasar sekunder dengan penilaian yang tidak masuk akal. Dengan tidak adanya arus kas masuk eksternal, tingkat involusi di pasar kripto meningkat ke tingkat yang ekstrem dan telah membentuk struktur kelas seperti piramida. Keuntungan setiap level berasal dari eksploitasi level di bawahnya dan penarikan likuiditas dari pasar. Proses ini akan menyebabkan meningkatnya ketidakpercayaan di level berikutnya, membuat involusi semakin serius. Selain VC, ada sejumlah besar level yang lebih tinggi…