Dengan arus keluar bersih sebesar US$1,10 triliun, mengapa ETF spot Ethereum berkinerja buruk?

Original article by: Tom Carreras, Benjamin Schiller

Terjemahan asli: BitpushNews Mary Liu

For many investors, the performance of spot Ethereum (ETH) exchange-traded funds (ETFs) has been disappointing.

While spot bitcoin ETFs have handled nearly $19 billion in inflows in 10 months, the Ethereum ETF, which began trading in July, has failed to draw the same interest.

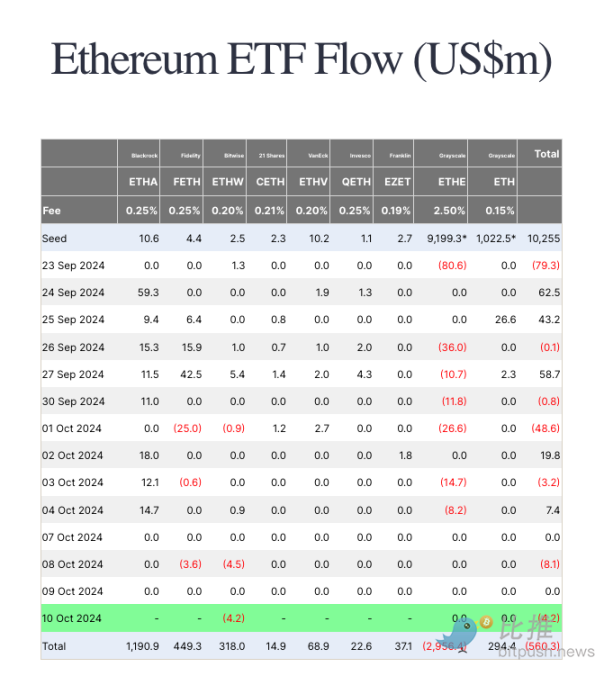

To make matters worse, Grayscale’s ETHE, which existed as the Ethereum Trust before converting to an ETF, has seen a large number of redemptions, which have not been offset by demand from other similar funds.

This means that spot Ethereum ETFs have seen net outflows of $556 million since launch. This week alone, these products have seen net outflows of $8 million, according to Farside.

So why is the Ethereum ETF performing so differently? There could be several reasons.

Fund inflow background

First, it’s important to note that the Ethereum ETF has not performed well compared to the Bitcoin ETF, which has broken so many records and is arguably the most successful ETF of all time.

For example, the ETFs, IBIT and FBTC, issued by BlackRock and Fidelity, raised $4.2 billion and $3.5 billion respectively in the first 30 days after listing, breaking the record set by another BlackRock fund, Climate Conscious, which raised $2.2 billion in its first month after listing (August 2023).

Nate Geraci, president of The ETF Store, said that while the Ethereum ETF failed to set off a blockbuster, three of the funds still rank among the 25 best-performing ETFs this year.

BlackRock’s ETHE, Fidelity’s FBTC, and Bitwise’s ETHW have attracted nearly $1 billion, $367 million, and $239 million in assets, respectively—not bad for funds that are only two and a half months old.

“A spot ether ETF will never be able to challenge a spot bitcoin ETF in terms of inflows,” Geraci told CoinDesk.

“If you look at the underlying spot market, Ethereum’s market cap is about a quarter of Bitcoin’s market cap. That should be a reasonable proxy for the long-term demand for a spot Ethereum ETF relative to a spot Bitcoin ETF.”

The problem is that the massive outflows from Grayscale’s ETHE masked the performance of these funds.

ETHE was established as a trust in 2017, and for regulatory reasons, it was originally designed in a way that did not allow investors to redeem their ETF shares – the funds were trapped in the product. This changed on July 23, when Grayscale received approval to convert its trust into a formal ETF.

At the time of the conversion, ETHE had about $1 billion in assets, and while some of these assets were transferred by Grayscale itself to its other fund, the Ethereum Mini ETF, ETHE has suffered nearly $3 billion in outflows.

Notably, Grayscale’s Bitcoin ETF – GBTC – has also experienced the same, having handled over $20 billion in outflows since its conversion in January. However, the outperformance of BlackRock and Fidelity’s spot Bitcoin ETFs has more than offset GBTC’s losses.

Lack of staking income

One big difference between Bitcoin and Ethereum is that investors can stake Ethereum — essentially locking it up in the Ethereum network to earn a yield paid out in Ethereum.

However, Ethereum ETFs in their current form do not allow investors to participate in staking. Therefore, holding Ethereum through an ETF means missing out on that yield (currently around 3.5%) and paying a management fee of 0.15% to 2.5% to the issuer.

While some traditional investors don’t mind giving up yield in exchange for the convenience and security of an ETF, it makes sense for crypto-native investors to look for alternative ways to hold Ethereum.

“If you’re a competent fund manager who has a basic understanding of the crypto market and is managing someone’s money, why would you buy an Ethereum ETF right now?” Adam Morgan McCarthy, an analyst at crypto data firm Kaiko Research, told CoinDesk.

“You can pay for exposure to ETH (the underlying asset is custodied at Coinbase), or buy the underlying asset yourself and stake it with the same provider to earn a certain yield,” McCarthy said.

Pasaring Dilemma

Another hurdle facing an Ethereum ETF is that some investors may have difficulty understanding Ethereum’s core use case as it attempts to take a leading position in several different areas of cryptocurrency.

There is a hard cap on the issuance of Bitcoin: the issuance of Bitcoin will never exceed 21 million. This makes it relatively easy for investors to view it as digital gold and a potential tool to hedge against inflation.

Explaining why a decentralized, open-source smart contract platform is important — and, more importantly, why ETH will continue to increase in value — is another matter entirely.

“One of the challenges an Ethereum ETF faces in breaking into the 60/40 baby boomer world is distilling its purpose/value into something easily digestible,” Bloomberg Intelligence ETF analyst Eric Balchunas wrote in May.

McCarthy agreed, telling CoinDesk: “The concept of ETH is more complex than other cryptocurrencies and is not well suited to being explained in a single sentence.”

It’s therefore necessary that crypto index fund Bitwise recently launched an educational advertising campaign highlighting Ethereum’s technological advantages.

“As investors learn more about stablecoins, decentralized finance, tokenization, prediction markets, and the many other applications powered by ethereum, they will enthusiastically embrace both technologies and U.S.-listed ethereum ETPs,” Grayscale head of research Zach Pandl told CoinDesk.

Poor cost performance

In fact, ETH itself has not performed very well compared to BTC this year.

The second-largest cryptocurrency by market cap is up just 4% since Jan. 1, while BTC has gained 42% and continues to hover near its 2021 all-time high.

Brian Rudick, head of research at cryptocurrency trading firm GSR, told CoinDesk: “One factor behind the success of bitcoin ETFs is investor risk-taking and fear of missing out, and these ETFs are still largely driven by retail investors, which was itself driven by BTC’s 65% rally at the ETF launch and 33% subsequent rally.”

Rudick added: “The price of ETH has fallen 30% since the ETF was launched, which has greatly dampened retail enthusiasm for buying these funds, and people have a mediocre evaluation of Ethereum, with some considering it to be between Bitcoin (the best monetary asset) and Solana (the best high-performance smart contract blockchain).”

Valuations are not attractive

Finally, traditional investors may simply not find ETH’s valuation attractive at these levels.

With a market cap of around $290 billion, ETH is already valued higher than any bank in the world, second only to JPMorgan Chase and Bank of America, which have market caps of $608 billion and $311 billion, respectively.

While this may seem like an apples-and-oranges comparison, Quinn Thompson, founder of crypto hedge fund Lekker Capital, told CoinDesk that ETH’s valuation is also high compared to tech stocks.

Quinn Thompson wrote in September that ETH’s valuation “is now worse than other assets because no valuation framework can justify its price. Either the price must fall or a new generally accepted asset valuation framework needs to emerge.”

This article is sourced from the internet: With a net outflow of US$556 million, why did the Ethereum spot ETF perform poorly?

Original | Odaily Planet Daily ( @OdailyChina ) Author: Golem ( @web3_golem ) The two hottest narrative directions of the Bitcoin ecosystem in 2024 are expanding Bitcoin’s programmability and staking to earn interest. Bitcoin’s scalability solutions are still in the stage of flourishing and exploring, but the “big king” and “small king” have already been distinguished in the narrative of staking to earn interest. Babylon has become the mainstream in the Bitcoin staking interest narrative by virtue of its features such as self-custody of user assets, sharing Bitcoin security for PoS chains and obtaining staking income. In the first phase of staking on the mainnet launched by Babylon on August 22, the upper limit of 1,000 BTC was reached in just 7 blocks, and the network gas fee soared to…